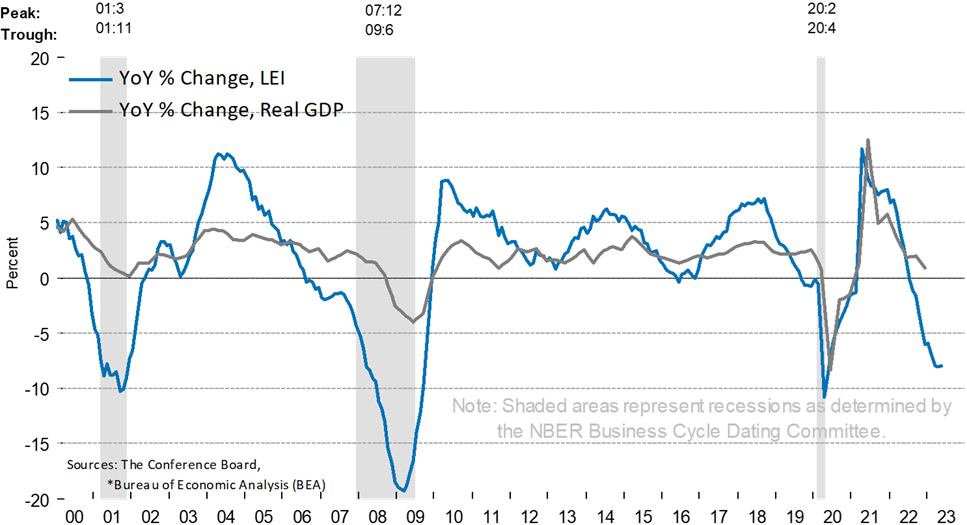

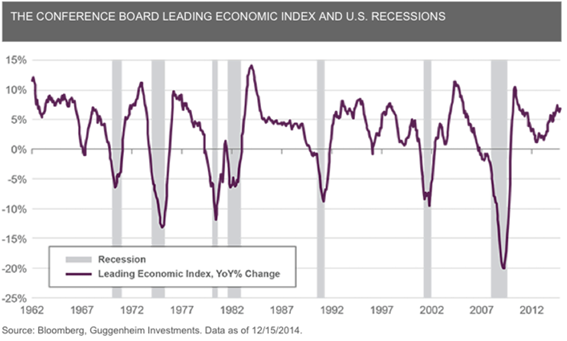

The Leading Economic Index provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term.

The Coincident Economic Index provides an indication of the current state of the economy.

The main, coincident and lagged economic indices are essentially averages composed of several individual indicators of anticipation, coincidence or mismatch.

They are built to summarize and reveal common inflection point patterns in economic data more clearly and convincingly than any individual component, primarily because they smooth out some of the volatility of the individual components.

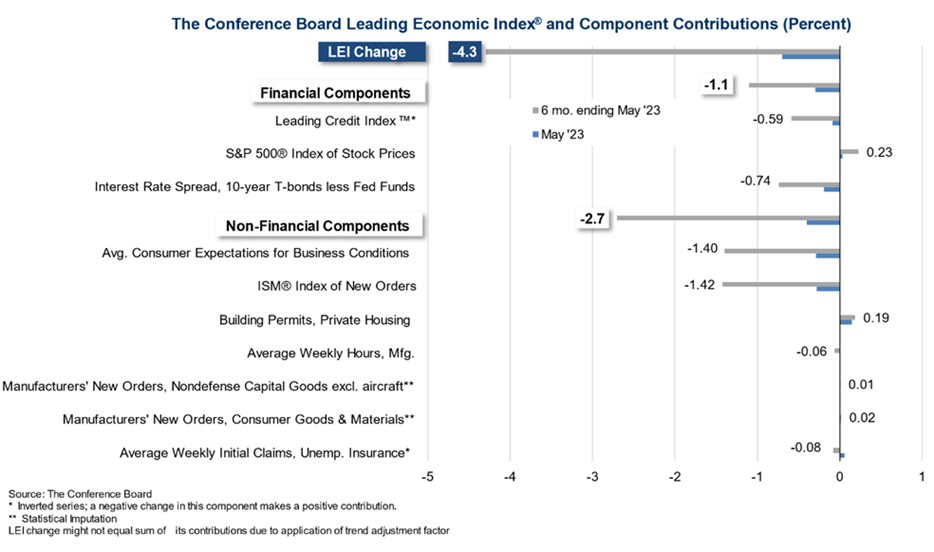

The ten components of the Conference Board Leading Economic Index for the U.S. include the average weekly manufacturing hours, the weekly average of initial claims for unemployment benefits, new orders, consumer goods and materials from manufacturers, the ISM index of new orders, new orders from manufacturers, non-defense capital goods, excluding aircraft orders, permits to build new private housing units, stock prices, 500 common shares, the leading credit ratio, the spread between the interest rate on 10-year Treasury bonds and the Fed interest rate, average consumer expectations regarding trading conditions.

Access:

http://www.conference-board.org/data/bcicountry.cfm?cid=1

https://www.conference-board.org/topics/business-cycle-indicators/