PMI data is compiled by S&P Global for more than 40 economies worldwide.

The monthly data is derived from surveys of top executives of private sector companies and is available by subscription only.

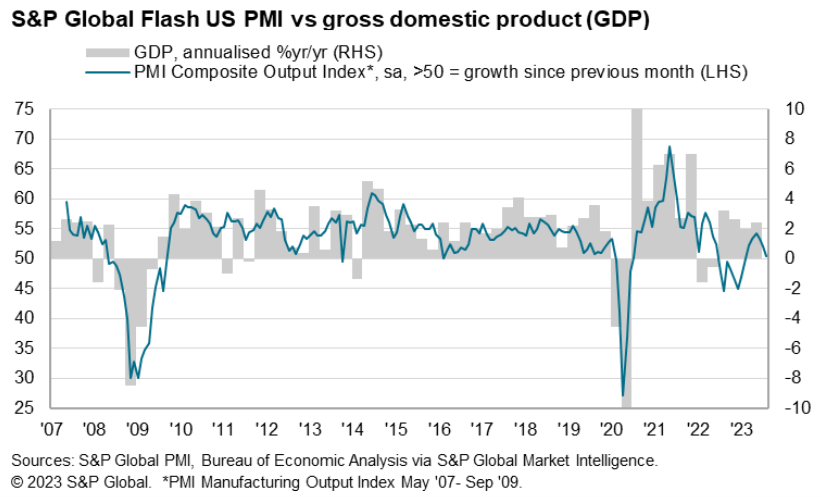

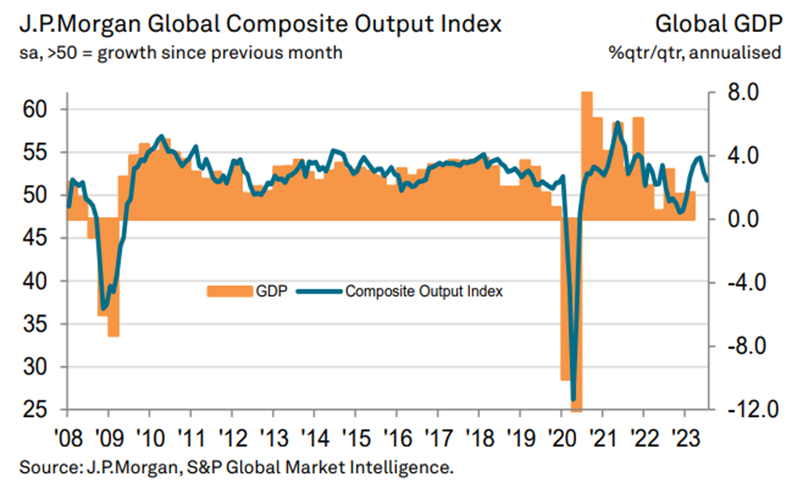

The PMI dataset presents a global number, which indicates the overall health of an economy, and sub-indices, which provide information on other important economic factors such as GDP, inflation, exports, capacity utilization, employment, and stocks.

PMI data is used by financial professionals to understand the direction of economies and markets and to uncover opportunities.

Because PMI data is released months before comparable official data, PMI surveys rank among the world’s busiest economic data releases.

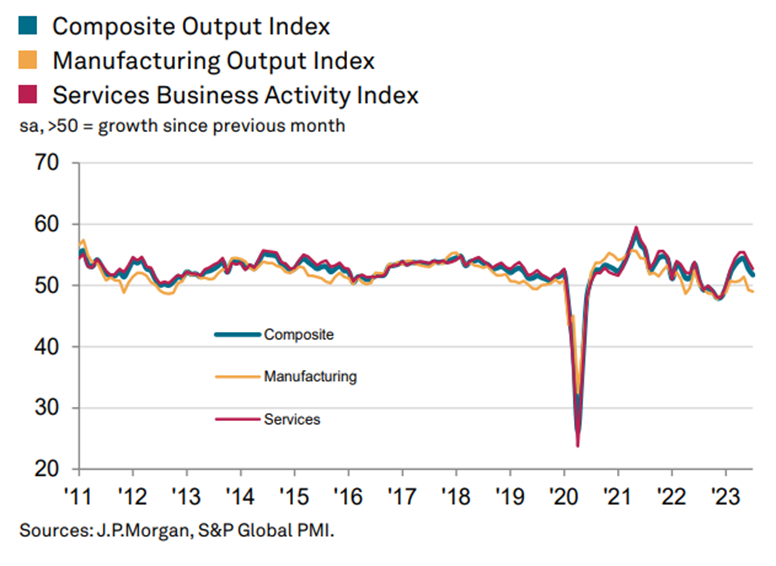

The Purchasing Managers’ Index™ (PMI) is a survey-based indicator of business conditions, which includes individual measures (‘sub-indices’) ™ of business output, new orders, employment, costs, sales prices, exports, purchasing activity, supplier performance, order accumulation and inputs and finished product inventories.

Global PMI™ indices are the leading economic indicators compiled by S&P Global and are widely used by economists and financial market analysts due to their ability to provide timely information on changing world business conditions.

Also known as the Global Purchasing Managers Index™, the Global PMI™ is derived from responses to monthly questionnaires sent to companies in the industry and services sectors in more than 40 countries, totaling about 28,000 companies.

These countries account for 89% of the world’s gross domestic product (GDP).

Global manufacturing and services PMI data are calculated by weighting the indices by country together using the weights of GDP (annual value added) of domestic manufacturing and services.

The global composite PMI data is then calculated by jointly weighting comparable global indices of industry and services using the global annual value added of industry and services.

The results of the industry PMI surveys are released on the first business day of each month, followed by services on the third business day.

A composite PMI is also published along with the services PMI, which is a GDP-weighted average of industry and services sector data.

Some countries also have construction PMI and economy-wide PMI, also released at the beginning of each month.

The reading of the Purchasing Managers’ Index can vary between 0 and 100.

If the index reading is above 50, it indicates an economic expansion. This means that the closer the reading is to 100, the greater the degree of positive economic growth.

A reading below 50 indicates an economic contraction, with readings closer to 0 indicating a greater degree of contraction.

A reading of 50 indicates that there has been no change in the economic environment.

Access: https://www.pmi.spglobal.com/public/release/pressreleases

https://www.pmi.spglobal.com/Public/Home/PressRelease/3271b887e7634ea9bd6845578aa62a3bhttps://www.pmi.spglobal.com/Public/Home/PressRelease/3bfc5a90d9d2416a8f6709f78f90d014