Retail sales are an economic indicator that measures consumer demand for finished products.

This indicator is a very important data set as it is a key monthly event of financial market movement.

Retail sales are reported every month by the U.S. Census Bureau and indicate the direction of the economy. It acts as a fundamental economic barometer and whether there are inflationary pressures.

Retail sales are measured by durable and non-durable goods purchased over a defined period of time.

The sales considered in the report are derived from 13 types of retailers, from food services to retail stores.

As a broad economic indicator, the retail sales report is one of the most timely reports because it provides data that is only a few weeks old.

An accurate measure of retail sales is vital to assessing the economic health of the U.S., because consumer spending accounts for two-thirds of gross domestic product.

Retail sales are affected by seasonality. Typically, the holiday season is believed to have the highest level of sales.

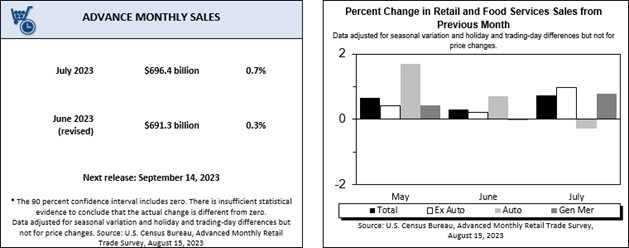

Retail sales are reported monthly in the U.S.

The report, which is published in the middle of each month, shows the total number of sales in the measured period, usually the previous month, and the percentage change from the last report.

As the main macroeconomic indicator, retail sales values typically trigger movements in equity markets.

Higher sales are good news for shareholders of retail companies because they mean higher earnings.

Bondholders, on the other hand, are quite ambivalent about this metric. A booming economy is good for everyone, but lower retail sales numbers and a shrinking economy would translate into lower inflation. This can cause investors to increase investment in bonds, eventually driving up the prices of those bonds.