The phenomenon of recent increased participation of individual investors is a real democratisation of stock market investments for younger generations, more digital and avid for social media, being a striking and overall positive fact, although there are some “Ifs and Buts”

Individual or retail investors significantly increased their direct participation in the US stock market in 2020, from a market share of 20% to 35%, a move initiated with zero commissions in trading, and accelerated by realities of the pandemic – the opportunity and volatility of the market, remote work, the increase in disposable income and savings associated with economic stimulus to households, and the viral mobilization of social media

The latest indicators show that US individual investors have significantly increased their participation in the equity market last year:

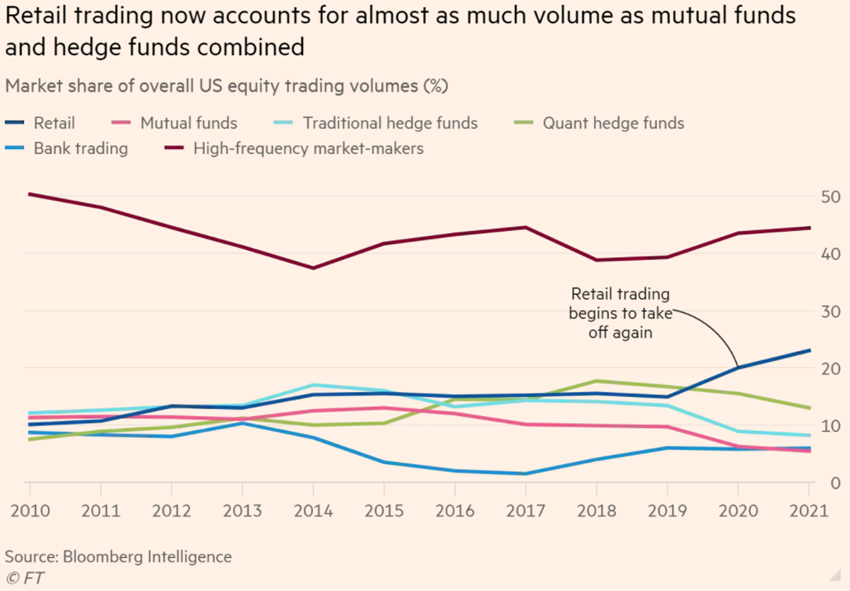

The share of retail investors increased from 15% in 2019 to the current 23%, representing a volume equal to the sum of the flows of mutual funds and hedge funds (if we exclude high frequency traders, individual investors represent more than 50% of the market).

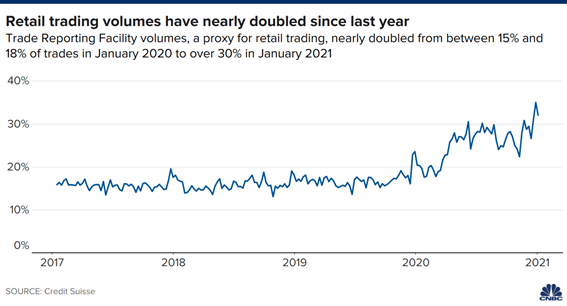

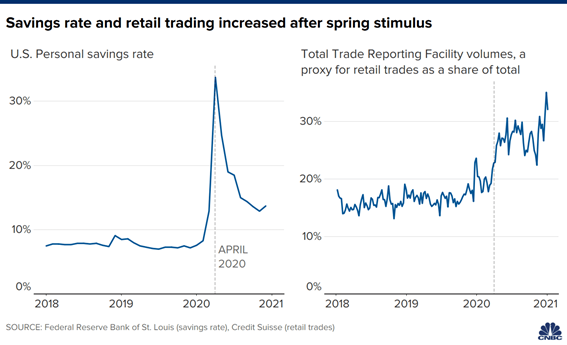

According to a study by Credit Suisse of analysis of volumes reported by the various retail trading platforms, either directly from exchanges or other trading systems, retail investors have increased their stake from 20% to 35% in the last year:

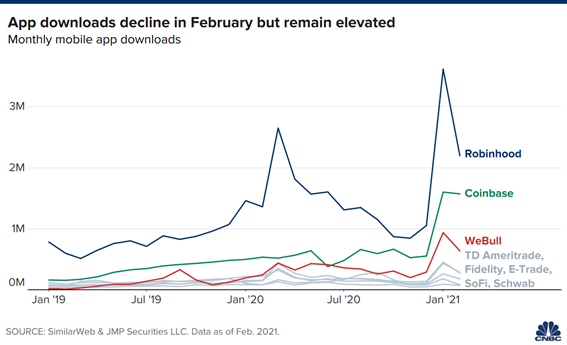

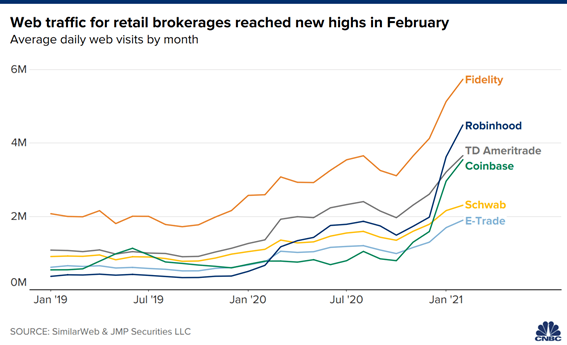

These actions have brought many new investors to the market, especially the generation Y or Millennials, but also the adjacent generations X and Z, more digital and social media driven age groups than the older generations (and who will soon inherit an immense fortune from their parents, Baby Boomers).

Then, the opportunity and market volatility brought by the pandemic created another wave for these new investors to the equity markets, sometimes for the first time.

Finally, work from home allowed greater availability for trading, economic support given to households increased levels of personal savings, and market driven social networking platforms such as Reddit (Wallstreetbets: https://www.reddit.com/r/wallstreetbets/) turned viral, have accelerated the boom in trading by individual investors.

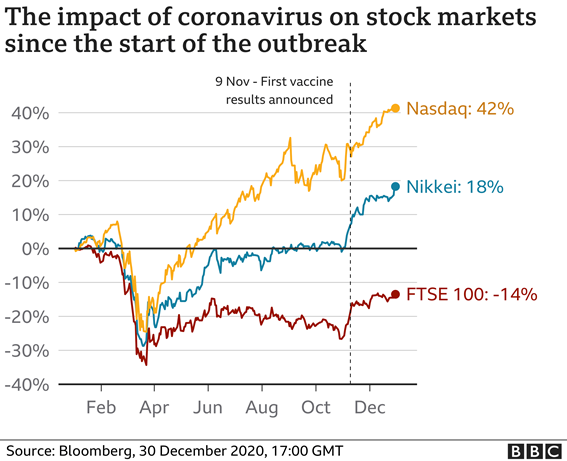

The pandemic had an influence from the outset with the market crisis in the spring and its rapid recovery with the rapid and strong action by monetary and fiscal policy authorities, which caught the attention of many new investors.

Remote work made many families had to be closed at home, having more availability to pay attention to the themes of financial markets, not least because they were prevented from occupying their free time with normal leisure and recreation activities, social, cultural and even sports activities.

And most households have had an increase in disposable income and savings by combining the generous financial support paid by the government to households and the lower spending on those activities.

Finally, people had more time to follow and communicate on social media, surging movements like Redditers that have activated individual investors’ investment for some stocks and other assets.

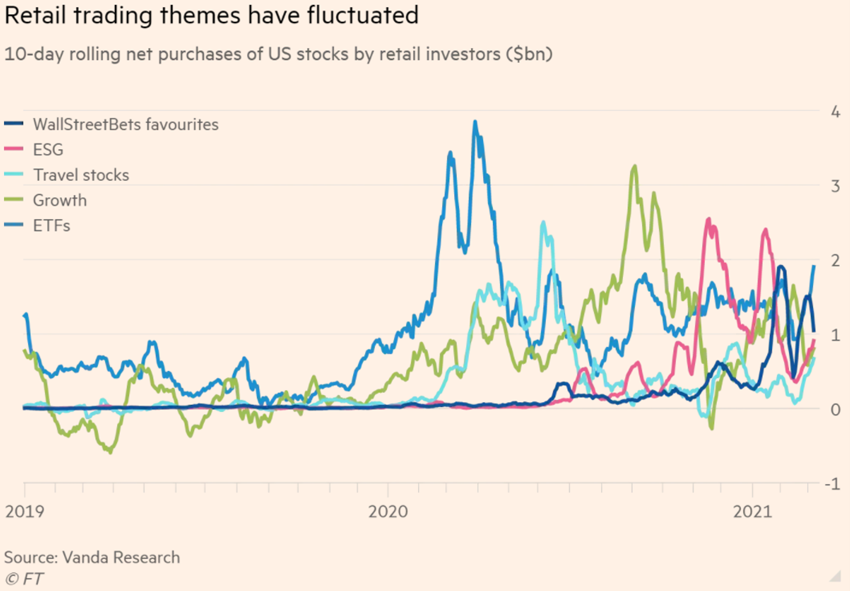

At first the most benefited actions were those of technology in general (the large FAAMNG), and those of remote work (Zoom, Peloton, etc.), those linked to the environment, green energy and ESG in general, such as renewables and electric cars, extending at a later stage to cryptocurrencies and short-squeeze stocks such as Gamestop and AMC.

All these forms of more active and intense trading, decision-making, and the very nature of the stocks and other assets are more appealing to a younger generation of investors.

These new individual investors trade more individual stocks, use greater financial leverage and are mobilized by social media

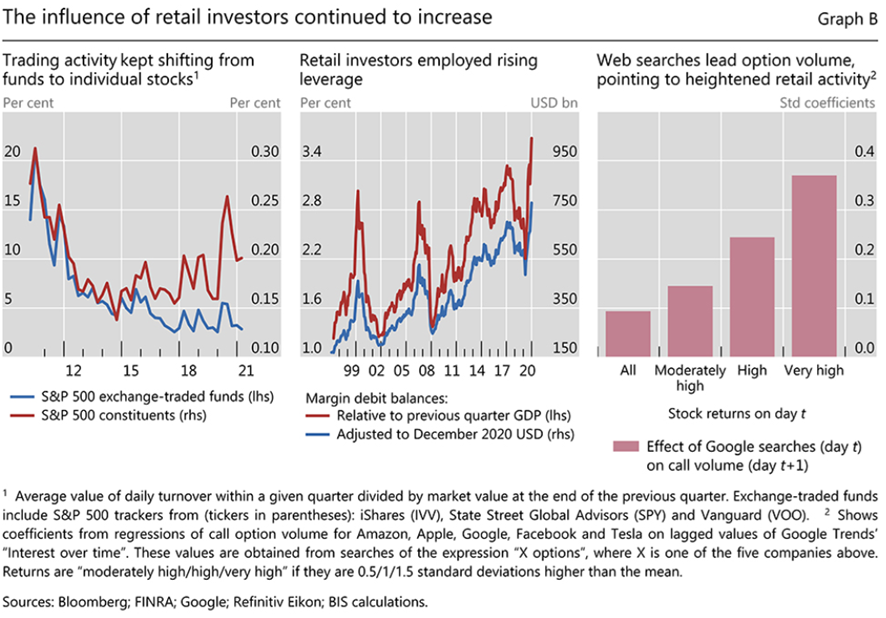

In its quarterly review, BIS published a very interesting article on the growing participation of individual investors in the US equity market, focusing on the information contained in the following chart:

The main conclusion is that there is undoubtedly a large increase in the participation of retail investors in the equity market.

In addition to increasing trading volumes, these investors use leverage, buy and sell options to speculate on individual companies, and rely on social media platforms to coordinate their investment strategies.

The growing activity of individual investors arose from patterns of stock trading volumes and stock price movements.

On the one hand, small investors often seem attracted by the nature of individual stocks, not by the benefits of index diversification, which can be explained by the large decrease in trading commissions, the very nature of higher index investment stability, the recent great market volatility, and the separation that these investors make between retirement and brokerage accounts.

In the United States, the risk-taking of individual investors has been channelled through brokerage accounts, the main tool they have for managing their non-retirement funds (which are in individual pension plans or accounts).

Brokerage accounts allow holders to take leverage in the form of collateralized securities loans in margin accounts. In December 2020, the amount of this debt stood at US$750 billion, the highest level recorded since 1997, both in inflation-adjusted terms and as a percentage of GDP.

In the search for exposure to stocks of individual companies, retail investors use financial options, especially call options, or positive, or long (put options, or short, or protection, are most used by institutional investors, especially managers of pension funds and hedge funds).

Call options only pay off when the price of the underlying shares rises (falls) beyond a predefined value, with gains potentially equivalent to multiples of the initial investment. In this sense, the options have incorporated a leverage that the debt account margin increases further.

Academic research has concluded that options trading tends to be unprofitable and for longer periods for small investors, notably due to their weak market timing.

Early 2021 reports suggest that the increase in call options trading volumes – both in small and large stocks – occurred due to the activity of retail investors:

In addition, retail investors are more likely to trade assets based on non-core information. During the tech boom of the late 1990s, for example, they sometimes responded to important news about certain companies, rushing to buy stocks of similar but distinct companies. Comparable patterns emerged in early 2021 – for example, when the value of a company (Single Advance) briefly increased fivefold while investors misinterpreted tweet by Elon Musk.

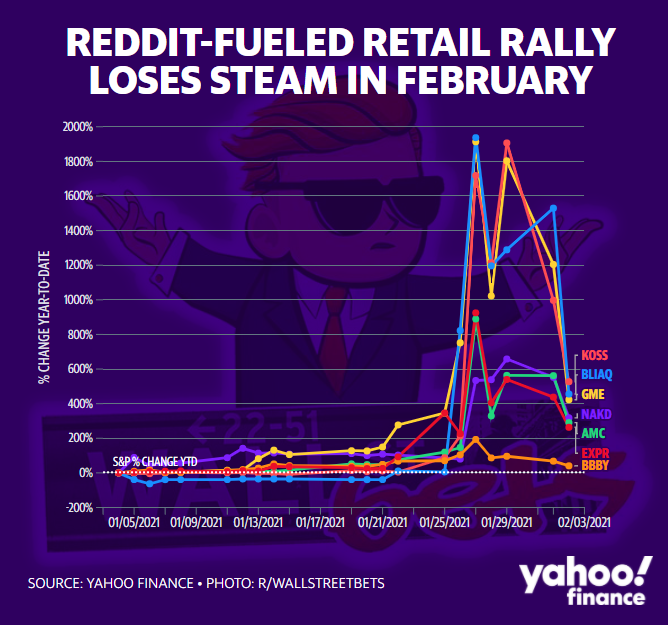

Prices of some stocks rose and fell as retail investors coordinated their trading in specific stocks via social media in January 2021.

Although online chat rooms were already a popular means of exchanging information in the late 1990s, the tripling of the number of US internet users and the rise of zero-commission brokers have since expanded the range of investors who can combine their efforts.

In a recent episode, individual investors forced sellers to close their short positions in struggling companies by buying their shares, as was the case with Gamestop and AMC.

These movements have made it clear that large-scale deliberate coordination between small individual investors is possible and that it can have substantial effects on prices.

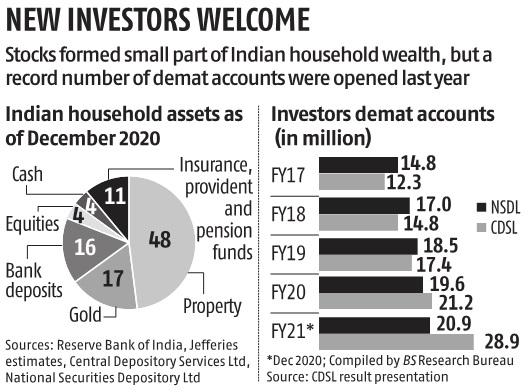

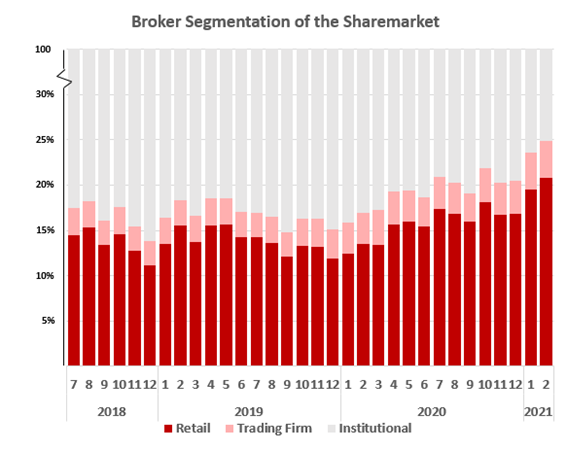

This phenomenon of democratization of investments goes far beyond the US, being of a global nature, as there are other very illustrative examples, such as the cases of India and Australia

Although without the same impact and under the same conditions, this phenomenon extended beyond the US, for example in India:

The same happened in the Australian stock market:

https://news.gallup.com/poll/1711/stock-market.aspx

https://www.ft.com/content/7a91e3ea-b9ec-4611-9a03-a8dd3b8bddb5