The democratization of equity markets is a positive global trend that has implications for the functioning of capital markets and asset management business

The democratization of equity market investments in US, or the emergence of a new wave of lower wealth and younger investors, has been boosted by the fall in transaction fees in 2019 and has accelerated with the combination of various pandemic effects from the second quarter of 2020

The introduction of zero commissions in retail trading initiated by Robinhood, and widespread by Charles Schwab and Fidelity in 2019, has piqued the interest of many new investors in the younger and lower wealth towards equity markets.

The pandemic has accelerated this interest by the investment opportunity associated with market volatility, increased disposable income and savings brought to households, greater willingness to invest in remote work, available digital means, and viral phenomena from social networks.

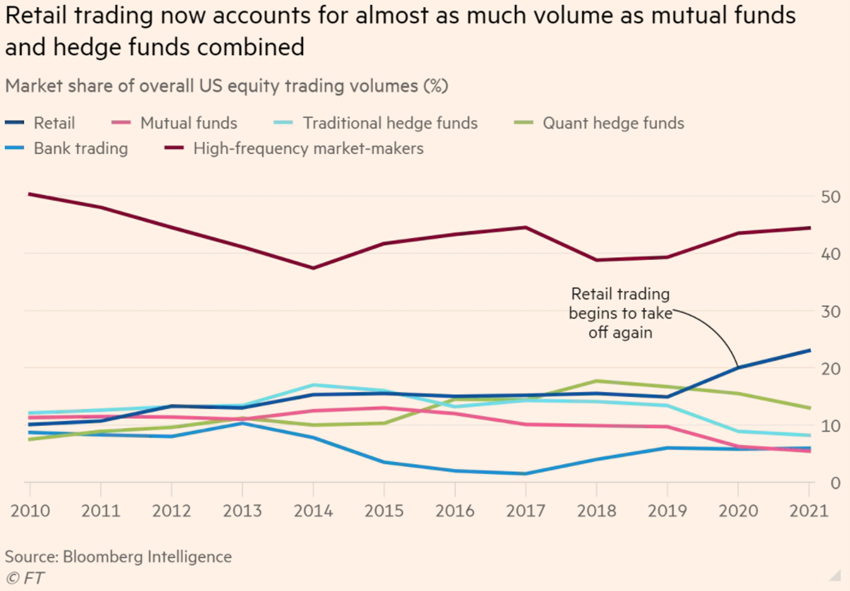

Retail investors have increased their weight in the market and already represent as much as the sum of stable and directional institutional investors in the market, traditional mutual funds and hedge funds:

If we exclude high-frequency market makers who have a weight of almost 50% – since they are not directional investors, but rather agents that foster market liquidity – retail investors account for more than 50% of the market.

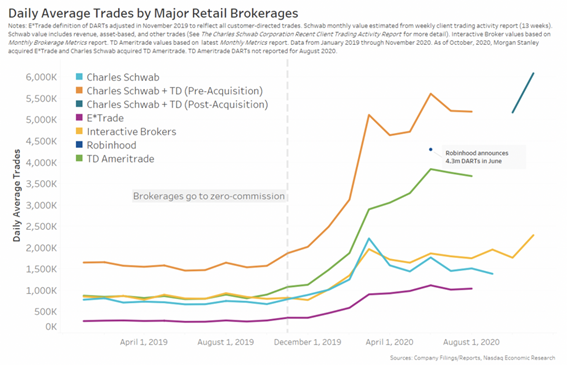

This phenomenon has been felt in the widespread increase in transaction volumes:

Daily trading volumes rose from about 6 billion shares between 2010 and 2019 to between 10 and 14 billion in 2020 (in terms of trading values growth would be even more pronounced since US stock markets are close to historic highs).

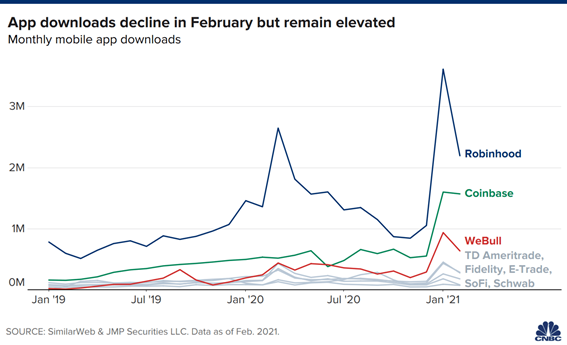

These investors have been essentially attracted to the new trading platforms in a digital environment:

The volume of app downloads has been higher on new platforms such as Robinhood, Coinbase (for cryptocurrency trading) and WeBull, while growth in Fidelity, Schwab, TD Ameritrade, SoFi, etc. is also observed.

New and younger retail investors are not just joining the new platforms.

Fidelity Investments added 4.1 million new accounts in the first quarter of 2021, an increase of nearly 160% compared to the first quarter of 2020, and of new customers, 1.6 million were opened by retail investors aged 35 and under, up more than 222% from a year earlier.

Online broker Charles Schwab added a record 3.2 million new customers in the first quarter of 2021, which compared with about 2.4 million new accounts added in the whole of 2020.

JMP Securities estimates that Robinhood added nearly 6 million customers in the first two months of 2021.

The volume of daily transactions has increased in all retail investor brokerage companies:

This number tripled or even quintupled mainly from the beginning of those pandemic effects in April 2020.

More than two-thirds of new online investors in the last 2 years are from the younger generations, aged up to 44 (and especially up to 35):

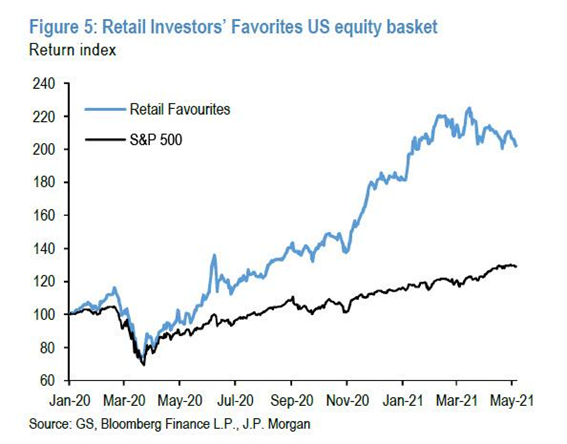

This move was accompanied by a very positive experience for new investors, which has strengthened their confidence in the stock market

In general, these investors have taken good advantage of the opportunity for market volatility created by the pandemic and have a significant appreciation of invested capital. This has been a very positive first experience, which strengthens their confidence in the market.

Since the March 2020 lows, and contrary to what is customary, retail investors have outdone either the market and hedge fund managers. And by a wide margin.

A basket of favourite retail investor stocks has gained +75% in 2020 and more than +100% since March lows, surpassing both the S&P 500 (+14% for the year) and the list of stocks preferred by hedge funds (+37% for the year).

This superior performance of individual investors compared to the index continued at the beginning of 2021, but has been regressing with the change in the market cycle, mainly due to the better performance of value versus growth strategies:

New investors tend to focus on modern themes, more technological, digital and ESG driven, move on social networks, trade low average values, in the very short term, and with great turnover

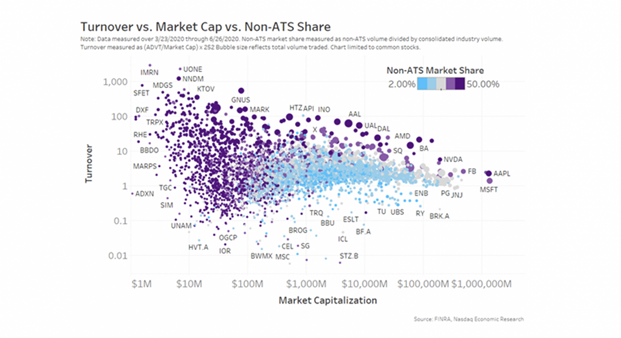

The following chart shows the activity of transactions carried out in the various stocks of the US market in the first half of 2020, highlighting in purple the most traded stocks by individual or retail investors (where the share of orders executed outside the regulated official markets, i.e. excluding Alternative Trading Systems, which include “dark pools”):

The chart shows the volume traded on the vertical axis, where the traded values of the companies are adjusted by their market capitalization, in order to allow the comparison of liquidity on an equivalent basis.

One thing that is difficult to see from the middle of this scattering of points is that the stocks of micro companies (on the left side of the chart) are, on average, much less liquid. As we said, purple indicates stocks that have a high proportion of retail activity. The retail concentration in micro companies makes sense, given that they are not in any of the major institutional indices.

Regarding large market capitalisation stocks, an active base of retail investors can significantly increase liquidity compared to stocks of companies of similar size (the high points are all purple).

We see that among the most traded large stocks by retail investors are technology (Microsoft, Apple, Facebook, Square, Nvidia) and airlines (Boeing, American, Delta and United Airlines). The weight of institutional investors is greater on Berkshire Hattaway and UBS stocks, for example.

For the shares of small companies most traded by retail investors we can find some of the so-called “penny stocks” (low unit price and very volatile stocks, from companies normally in financial difficulties and with negative earnings), such as Hertz, Remark and Genius Brands.

The investments of these new investors have their own digital or thematic footprint, tending to focus on growth stocks, large technology companies, electric mobility, remote work, cryptocurrencies, cannabis, etc., and more recently in companies with large short positions by some institutional investors (AMC, Gamestop), giving rise to a saga already dubbed David against Goliath.

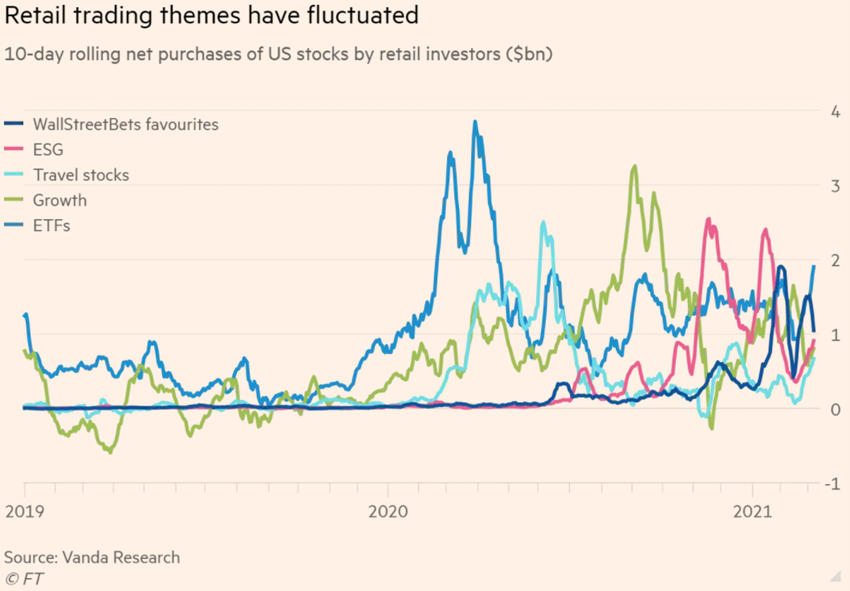

They are usually driven by movements on social networks that quickly go viral and work in waves:

The r/WallStreetBets forum on Reddit now has 9.4 million members — or “degenerates,” as they call themselves – growing five times since the beginning of the year, and more than 10 times since the beginning of 2020.

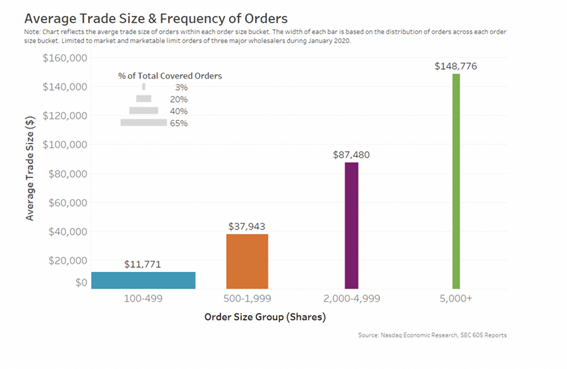

Most transactions of individual investors are small amounts, with the orders of these investors having an average value of $11,000:

More than 65% of orders are transactions with fewer than 500 shares, representing an average value of less than $12,000. Less than 3% of orders are transactions greater than 5,000 shares, which still represents average transactions of less than $150,000.

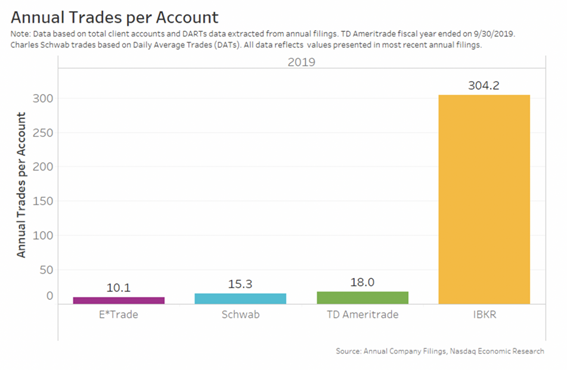

The number of annual transactions by individual investors is usually low, but increases significantly in the case of new investors and new brokerage platforms:

In many retail brokers, the average client trades once a month, but the data also shows that Interactive Broker customers are much more active with an annual average of 304 transactions (Robinhood does not disclose this data). A recent Vanguard study showed that its retail customer base traded even less: only about 20% of customers traded per year and even the most active quintile of customers averages only 13 transactions per year.

These trading platforms enable many of these investors to trade with margin accounts (invest on credit), trade options, invest in fractional stocks, trade cryptocurrencies, and more recently have access to some initial public offerings.

This phenomenon of taking Wall Street to Main Street is a globally positive trend, definitely putting into check the idea that equity investing is only for the richest, bringing generations of young people to the market, and allowing to generalize the improvement of the financial situation of households

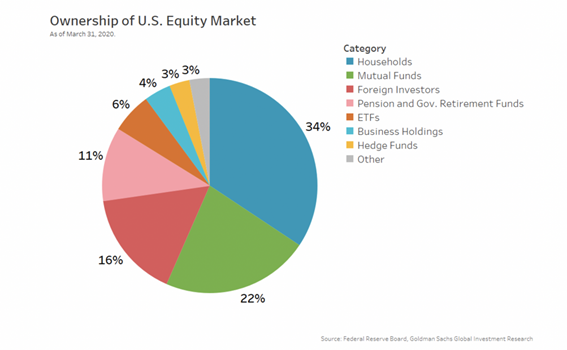

Retail investors hold 77% of the market capitalisation in total through stocks held directly, and indirectly, from mutual funds and pension funds (these three categories are “retail assets” as the funds are “aggregated” or collective vehicles of individual investors managed by professional investors).

It should be considered that many of the stocks directly held by individual investors are also “managed” by professionals such as registered investment advisors (RIA).

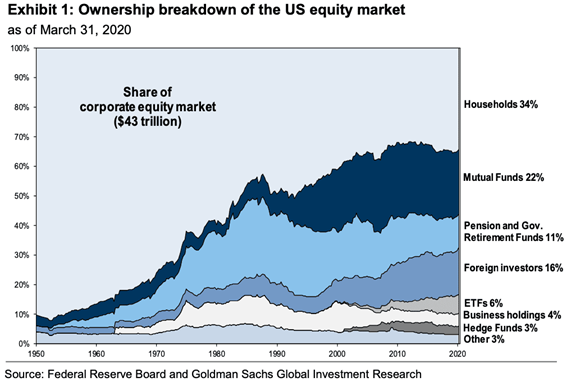

The following chart shows the evolution of the types of investors in the US stock market since 1950:

Since 1950, we had the professionalization of equity investment management and the development of social protection systems, with direct investments by households from 90% to less than 40%. In the last 15 years there has been some stabilization of the weight of these investments.

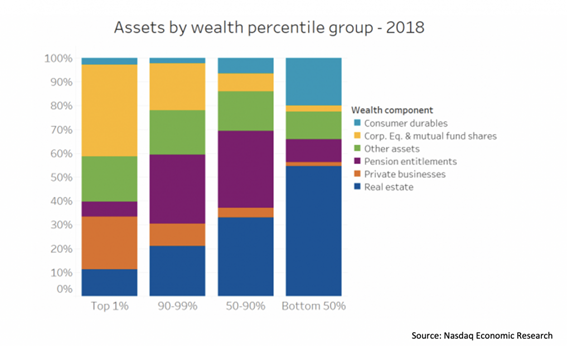

The data also show that stock ownership is concentrated in wealthy individuals:

In a study, Gallup concludes that by adding direct ownership of stocks, investment funds and pension funds (401ks), just under half of all households still have no exposure to the US stock market and the dividends and investment gains they provide. This undermines the long-term financial stability of low-income households.

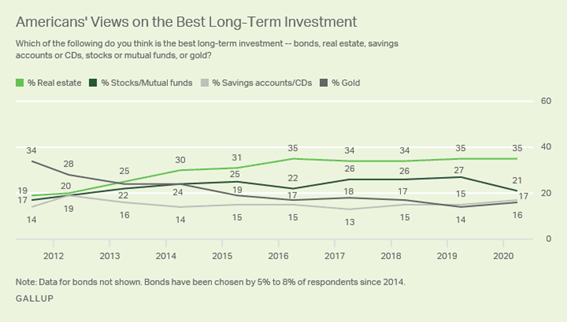

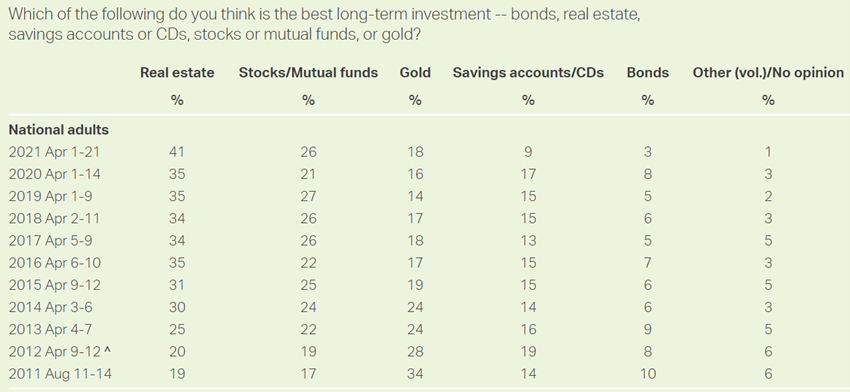

Gallup also concludes by the importance given by households to investment in the stock market in annual surveys:

Investment in stocks is considered the second best long-term investment made by households, only surpassed by investment in real estate, in most cases seen as buying home ownership.

In the latest survey, 26% of households consider that the best long-term investment is that of stocks, which will be skewed down to the extent that half of households have a home but do not invest in stocks.

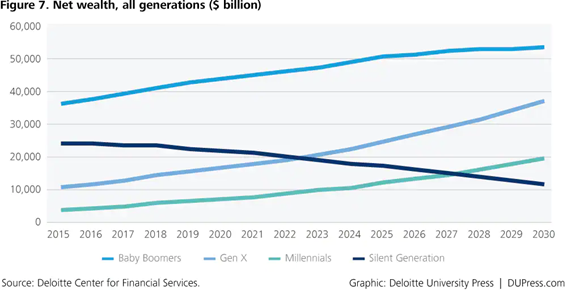

These new generations of investors, such as Generation X and Millenials or Y, will be the heirs to Baby Boomers fortunes in the short and medium term

This phenomenon of new investors from younger generations to the equity market has other implications beyond those we have seen earlier on its typology of investments.

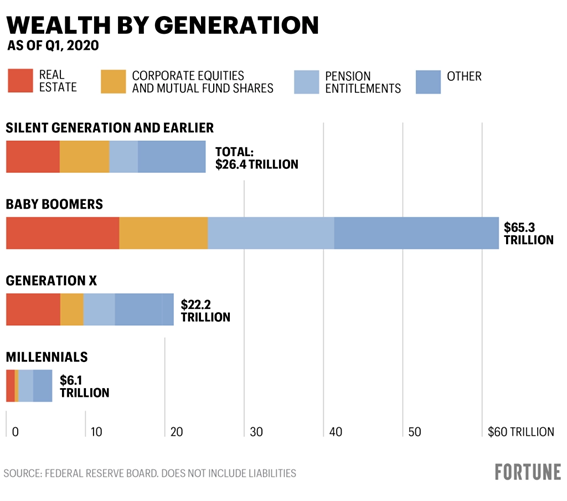

Today wealth is concentrated in the generation of Baby Boomers and even in previous generations, such as Silent Generation:

However, generation X and Y or the Millenials will inherit these fortunes in a few years’ time and will manage these assets:

https://news.gallup.com/poll/1711/stock-market.aspx

https://www.ft.com/content/7a91e3ea-b9ec-4611-9a03-a8dd3b8bddb5