Worldwide financial literacy studies show scores slightly above 50%, with lack of knowledge, behaviors and mostly attitudes

According to the latest study on financial literacy, OECD countries achieve results between 50% and 65%. Portugal ranks slightly above average and the main difficulties focus on the field of concepts of income capitalization and diversification, on the low rate of lack of setting of objectives and long-term planning and lack of information to decide on investments

Allianz’s study for Europe detects flaws in the concepts of diversification, calculation of expected values, and risk and returns

In the U.S., people know about loans and savings but understand less about diversification, insurance and investments

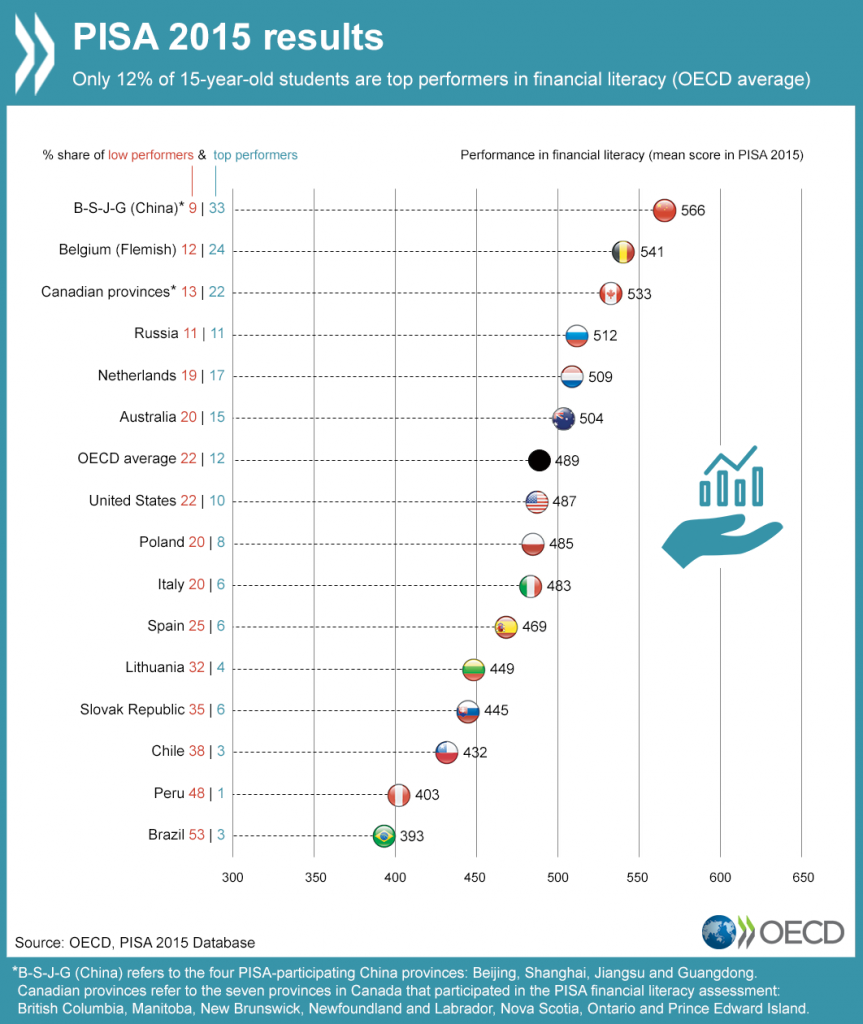

According to the latest PISA study that assesses the financial literacy of young people in the world, only 12% perform higher and the best results are achieved in countries with the best global education, particularly in mathematics

According to the latest study on financial literacy, OECD countries achieve results between 50% and 65%

Portugal ranks slightly above average and the main difficulties focus on the field of concepts of income capitalization and diversification, on the low rate of lack of setting of objectives and long-term planning and lack of information to decide on investments

Financial literacy is a key enabler in personal finances, asset management and investments.

Every year many studies are done on this subject. Some of its conclusions are subject to public debate and enter the political agenda of the various countries.

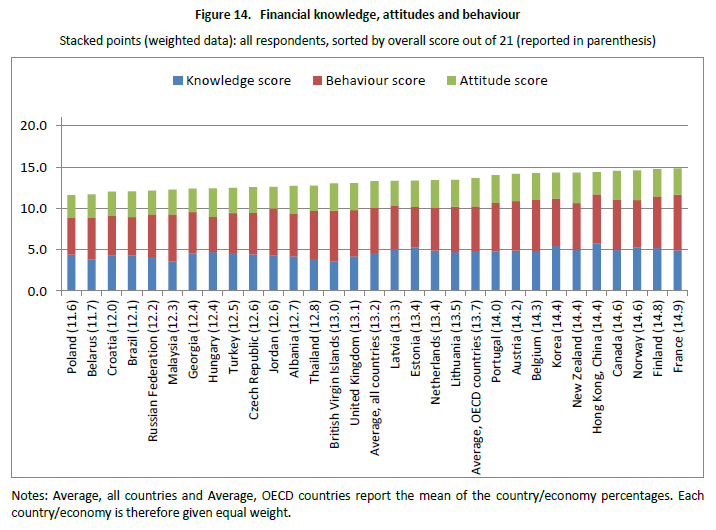

One of the most reference studies is the one carried out periodically by the OECD. This study assesses financial literacy in 3 dimensions through several relevant issues focused on each one:

- Financial Knowledge (8), comprising questions about the time value of money, interest paid in loans, calculation of interest, compounding of income, simple and compound interest, profitability and risk, inflation and diversification;

- Financial Behaviors (3), covering questions about household budgeting, decision making of purchasing goods and services, payment of expenses, savings, indebtedness, definition of medium and long-term objectives and investment decision making;

- Financial Attitudes (4), including the way one faces money and planning the future.

A score is given that is the result of a weighted average in which financial knowledge has a maximum of 9 points, followed by financial behaviours with 7 points and attitudes with 5 points, for a maximum total of 21 points. The study had a participation of 51.650 respondents aged between 18 and 79 years.

The average score was 13.2 for all participating countries and 13.7 for the OECD countries. Portugal appears in the top half of the ranking, headed by France, Norway, Finland, Canada and China. In the tail, there are some emerging and very populous economies such as Poland, Russia, Malaysia and Brazil.

More important than the final score are the following intermediate conclusions:

- 56% of the total adult participants and 63% for OECD countries obtained the result considered to be at least 5 out of 7 in financial knowledge, with the most problematic areas being the effect of income compounding and the effect of diversification in the reduction of investment risk;

- 51% of all participating adults and 54% for OECD countries had the score considered to be at least 6 out of 9 in financial behavior, and the weaker subjects were the low level of savings and the lack of establishment of objectives in the medium and long term;

- 50% of the total number of participants and 55% for OECD countries achieved the minimum score in terms of financial attitudes, and the major deficits were the absence of medium and long-term planning and the lack of adequate information for investment decision-making, notably by not hearing more of an opinion and not using an independent financial adviser.

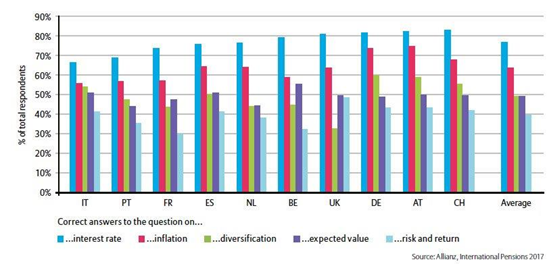

Allianz’s study for Europe detects flaws in the concepts of diversification, calculation of expected values, and risk and returns

A more recent study conducted in Europe by Allianz in 2017 reached the following results:

The differences are greater among the concepts than between countries. People understand reasonably well interest rate and inflation but have difficulties with diversification, expected value and profitability and risk.

This can be one of the reasons that puts more obstacles to investing in financial markets.

In the US, people know about loans and savings but understand less about diversification, insurance and investments

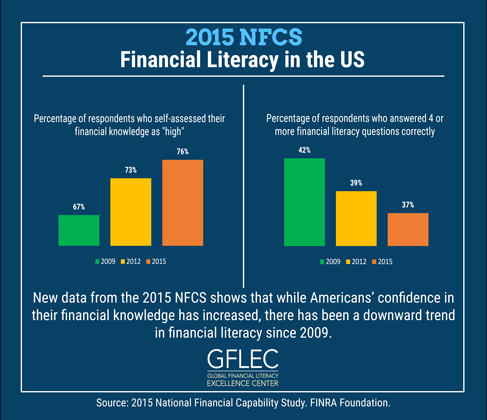

In relation to the USA, one of the main studies is FINRA, carried out every 3 years. There are only 5 questions about simple interest, interest and inflation, relationship between the evolution of interest and the price of bonds, cost of mortgage loans and diversification. The last published data relates to 2015, and more than 27.000 adults were surveyed:

In 2015, only 37% of the adults hit 4 of the 5 questions, a decrease compared to the 42% achieved six years earlier.

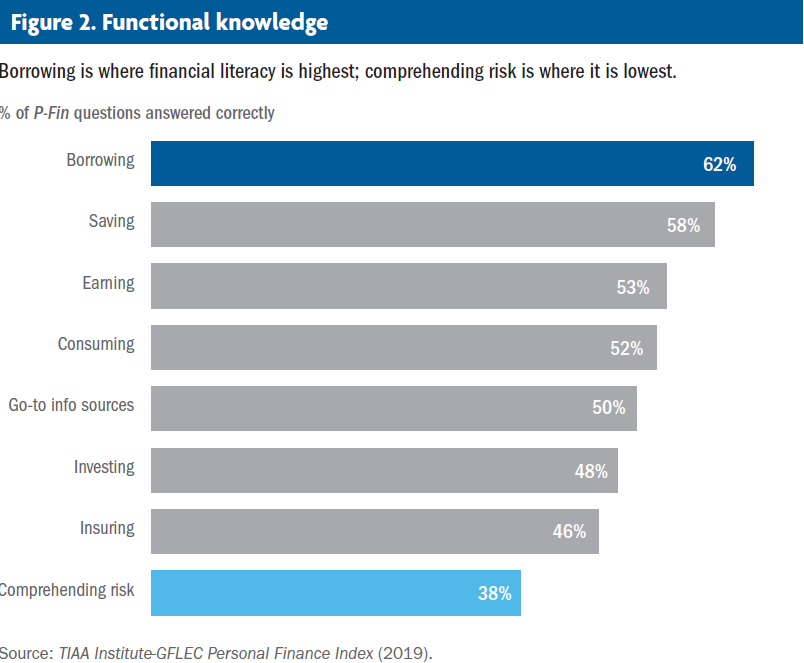

TIAA carries out a deeper study of financial literacy in the US every year, the latter being published in 2019 for a sample of 1.008 adult individuals:

The results show that most of the population knows about loans and savings issues but does not understand the matters of diversification, insurance and investments.

According to the latest PISA study that assesses the financial literacy of young people in the world, only 12% perform higher and the best results are achieved in countries with the best global education, particularly in mathematics

Another very interesting world study is that of PISA conducted in 2017 that assesses financial literacy in 15-year-old students in OECD countries, testing their experience with money:

In terms of the average of OECD countries, only 12% of 48.000 surveyed students had excellent performance.

The best results were obtained by China, Belgium and Canada, and the worst by Brazil, Peru and Chile.

The study also confirmed that there is a relationship between the results and the performance of students in reading and mathematics assessments, although 38% of the score is exclusively due to financial competencies.

On average, 64% of students already earn some money with a formal or informal activity, 59% receive an allowance, and 56% have a bank account, but two-thirds do not know how to manage their money and how to read a bank statement.