Are we as good as it looks, or can appearances be deceiving?

The first disturbing and alert signs emerge in the low penetration of savings products and in the way to face and financially prepare for retirement

More worrying is the almost lack of investment in financial assets, directly or indirectly via mutual funds or equivalent products, privileging low-return financial placements

But even more shocking, is to see the lack of investment in securities, with the implied loss of all the potential for wealth build up and accretion that is associated with them.

It’s a bad sign to see that those who invest in stocks and bonds do it directly instead of diversifying via mutual funds and equivalent investment products

There is a deficit of knowledge for investment in financial assets and securities

Some of the fears in investing in securities that can only result from lack of financial literacy

Only 26.6% of those investing in securities recognise that they do so to obtain higher income than bank deposits

The bank account manager and friends and family advices are the main factors of choice of investments in securities, with little direct personal intervention

Are we as good as it looks, or can appearances be deceiving?

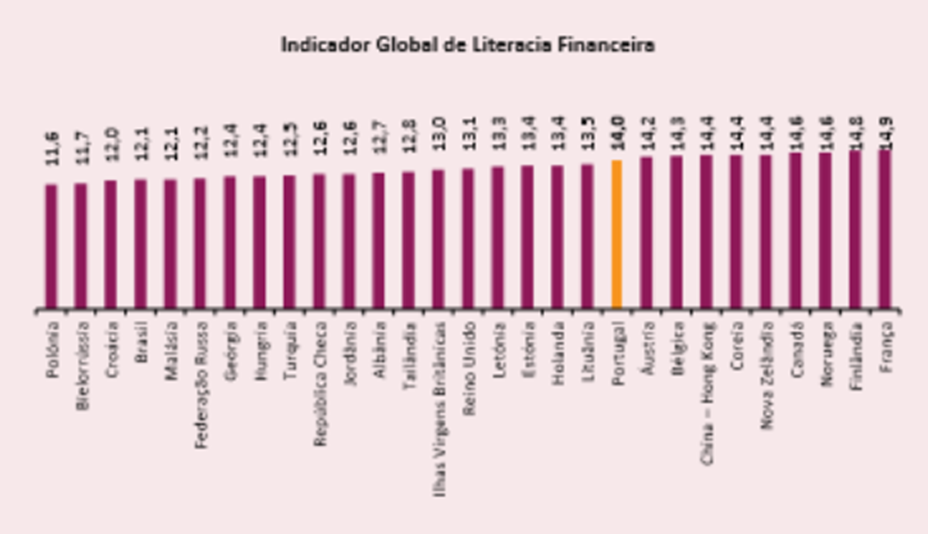

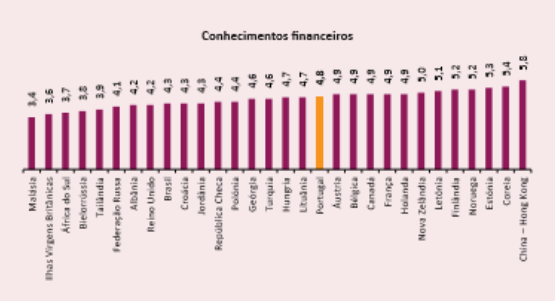

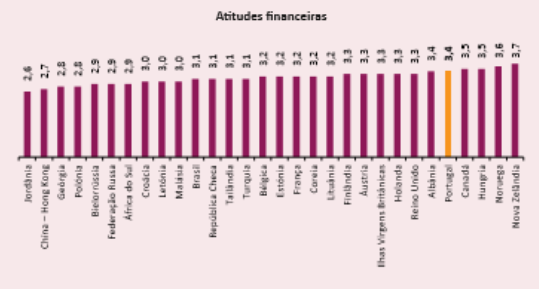

In the results of the latest surveys on financial literacy from 30 countries associated with INFE (International Network for Financial Education), of which 17 from the OECD, Portugal appears well placed in terms of a global indicator with 14 points in a total of 21 possible and not far from the first place, the France with 14.9 points.

This finding that there seems to be no relative weakness in financial literacy in Portugal also results in an assessment by each of its three main components – behaviours, knowledge and financial attitudes.

The first disturbing and alert signs emerge in the low penetration of savings products and in the way to face and financially prepare for retirement

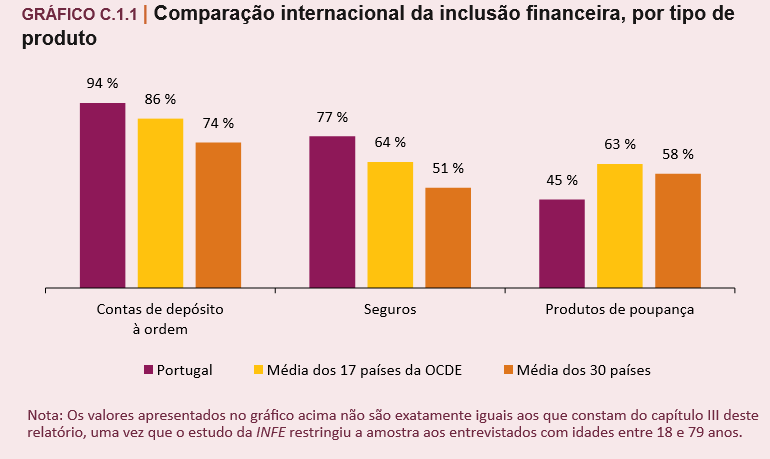

However, when we get a little bit more into it some signs emerge that not everything is as well as it seems. The first is given to us by comparing financial inclusion:

We stand well in terms of deposits and insurance accounts, but in terms of savings products we are 18 percentage points below from the other OECD countries and even behind the average of the 30 countries by 13 percentage points.

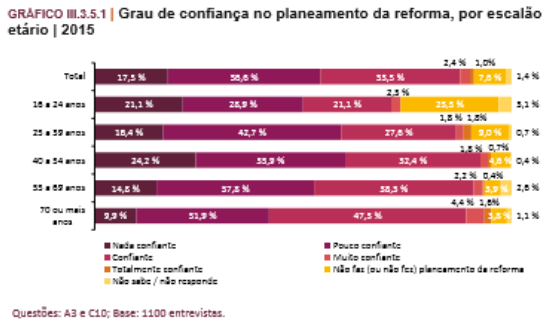

As we analyse what is happening with the planning and financing of retirement, the main financial objective, the signs are disturbing:

Most people are not confident about life in retirement, including those who are over 70 years old and mostly already retired. In the immediately preceding age bracket, between 55 and 69 years old, which covers those who are about to enter retirement and others who are already there, the majority says it is not ready.

This level of mistrust in retirement financial planning increases considerably for younger generations which is not surprising when we consider the financial pressure that population ageing has on the social security system.

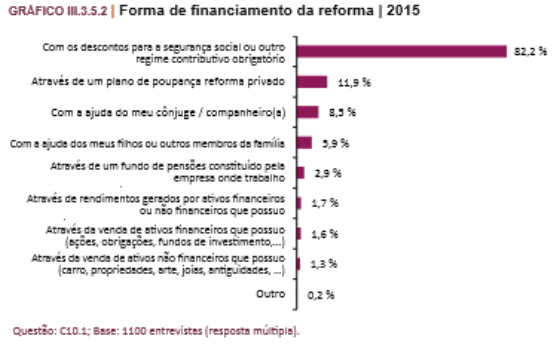

With regard to the retirement financing sources, 82.2% relies solely on social security or other mandatory contributory arrangements. In another article we have seen that retirement pensions paid for social security are very low, because the amounts paid are low and much lower than the wages and income reported for tax purposes.

Only 11.9% has a personal pensions plan, and only 2.9% have a private pension fund in the company in which they work.

More worrying is the almost lack of investment in financial assets, directly or indirectly via mutual funds or equivalent products, privileging low-return financial placements

When we analyse the answers given at the level of the composition of the financial wealth, the data goes from disturbing to worrying, if not even shocking:

Less than 10% of households have investments in financial assets, such as shares (4.1%), mutual funds (1.9%) and bonds (0.5%). It should be stressed that investment in mutual funds, an instrument of greater diversification than the rest, represents less than half of what is invested in stocks and little more than in bonds.

And even though 15% have savings plans for retirement, these are mostly low-yield savings accounts.

Looking at the financial products that people are contracting the situation does not improve. At the financial placements level, they mainly buy low-risk and low-yield products.

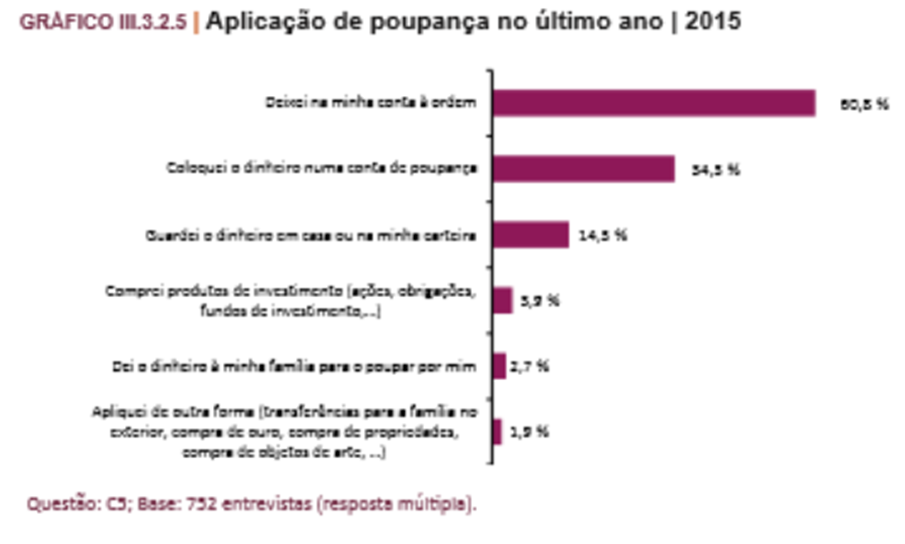

When questioned only about the savings applications made last year, most mentioned that they favoured sight deposits (50.5%), time deposits or savings accounts (34.5%) or simply saved them (14.5%). In either case, these financial placements have no income or have a very low yield.

Despite this, people claim that they have knowledge about financial assets, shares (91.9%), mutual funds (64.9%) and bonds (63.8%).

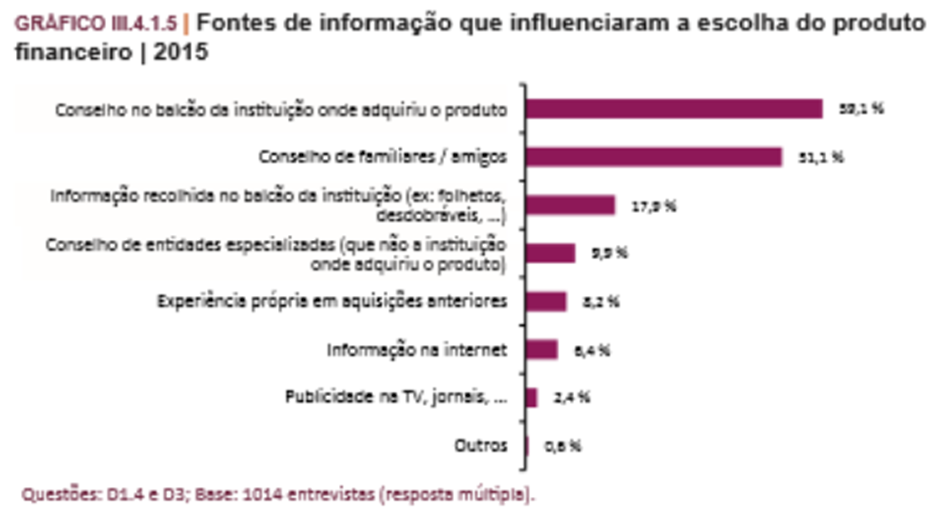

Concerning the sources of information influencing the choice of financial products:

People put a lot of trust in the advice of the bank manager (59.1%) and friends and family (51.1%) regarding the choice of the financial product, giving little importance to the analysis of the information (on paper or on the Internet) or to the advice of independent specialised entities.

But even more shocking, is to see the lack of investment in securities, with the implied loss of all the potential for wealth build up and accretion that is associated with them

When it comes to questions about investing in securities, the data becomes shocking:

A large majority of 89.9% of people have never held securities, either shares, bonds, mutual funds or equivalent investment products.

Only a minority of 4.4% of people currently hold securities.

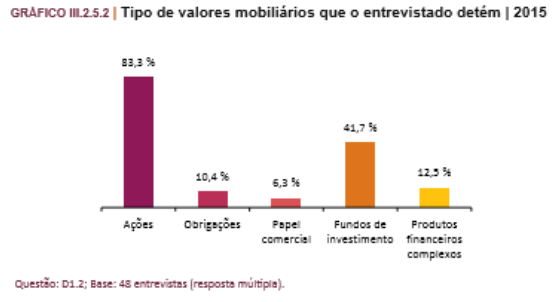

It’s a bad sign to see that those who invest in stocks and bonds do it directly instead of diversifying via mutual funds and equivalent investment products

Regarding the type of securities held:

It is a bad sign to see that 83.3% of investments are made directly in shares instead of through more diversified investment products, such as mutual funds and equivalent investment products.

It’s a good sign to know that 26.6% of the people who invest recognize they do it to achieve superior returns.

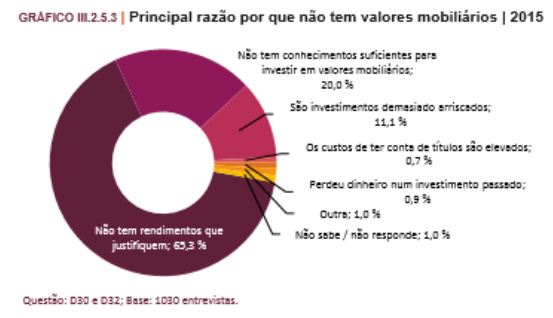

There is a deficit of knowledge for investment in financial assets and securities

The main reasons for not investing in securities are not having the income justifying it (65.3%), not having knowledge (20%) and consider them to be very risky investments (11.1%).

Although it is risky to question the validity of the lack of income because the income in Portugal is effectively low, in general, still the percentage seems exaggerated, even because there are investment products suitable for small amounts, which demand periodic and low-cost contributions.

However, the other reasons do not cease to be very significant because they are at the heart of lack of financial literacy.

Although there are 90% who have knowledge about securities, there are 20% who do not invest because they do not have enough knowledge to invest, which means that people know what it is, but not how to do it.

On the other hand, the 11.1% who point out the risk of not investing are too conservative people or who do not duly consider the correspondence between higher risk and greater profitability of these investments.

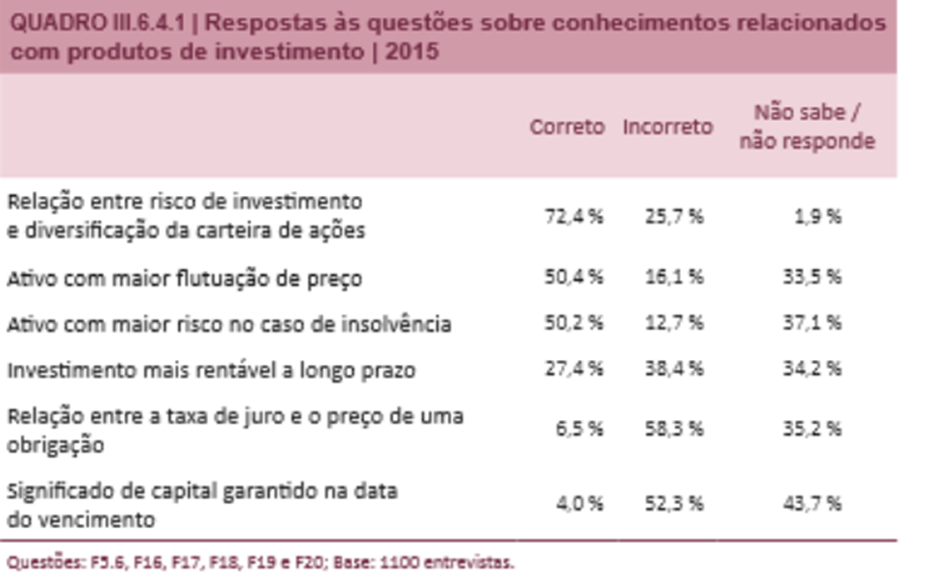

Answers to questions about knowledge in investment products were mixed:

Most people understand the value of diversification in managing the risk of investments in stocks, as well as the risks and volatilities of assets.

However, there are many people who are unaware of the most profitable long-term investment (therefore, and by a majority reason, are unaware of the comparative returns of the main financial assets and investments), and the inverse relationship between the price of a bond and the interest rate (possibly because they invest mainly in Portuguese treasury bonds, in which until recently the variable rate, the OTRV’s issues predominated).

Some of the fears in investing in securities that can only result from lack of financial literacy

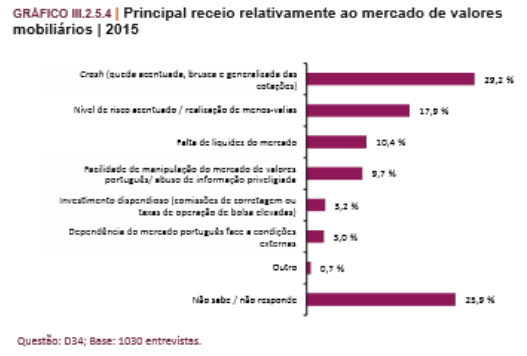

The main fears of investment in securities are:

The biggest fears of investing in securities are the associated risks and the possibility of loss, namely focused in the eventuality of a crash (29.2%) and the level of risk (17.9%).

Although we do not have this information it would be interesting to know to what extent people perceive the inverse relationship between the risks and returns of financial assets and investments, understand the reduction of risk through diversification of investments, and the dilution of risk associated with an increased investment timeframe.

Only 26.6% of those investing in securities recognise that they do so to obtain higher income than bank deposits

Regarding the reasons for investing in securities:

Only 26.6% of those people investing in securities acknowledge that they it to obtain a higher return than bank deposits, and 12.5% to earn more income and generate capital gains. The others most important reasons reside in the advice by account manager (21.9%), and in tax reasons (14.1%) linked to retirement products.

The bank account manager and friends and family advices are the main factors of choice of investments in securities, with little direct personal intervention

The investment choice in securities is driven by the following factors:

The bank account manager is the factor with the most weight, with 37.5%, followed by the advice of friends and family with 22.9%.