Inflation falling around the world, at an uneven pace, phases of economic growth differentiated by regions, and vigilant authorities with different actions.

Long-term interest rates rise slightly, assuming that the reduction in inflation will be more prolonged than expected.

Stock markets rise and appreciate 25% from October lows, S&P 500 breaks the 4,100-point barrier pushed by big tech companies and the start of the AI revolution.

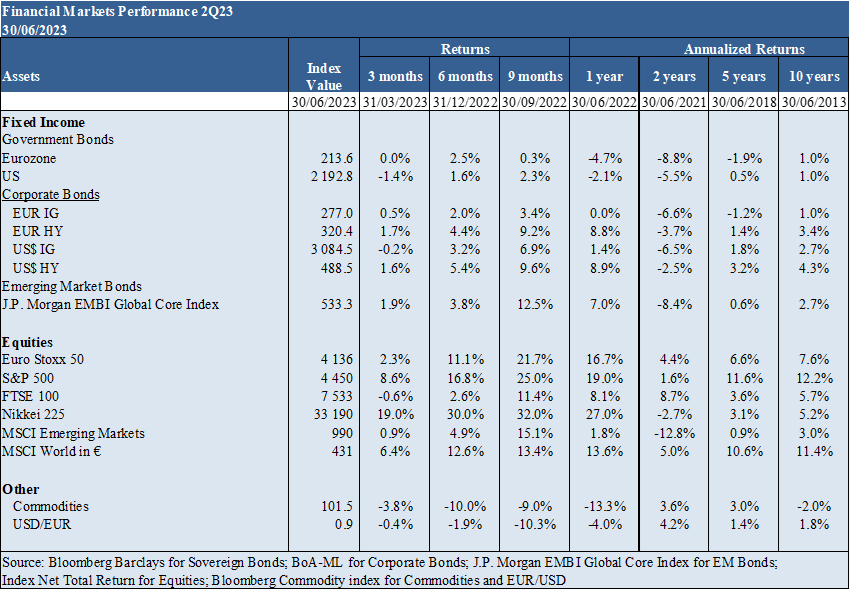

Markets Performance 2Q23: Equity markets continue to rise led by the big tech and stocks associated with the AI revolution, and extending recently to most companies. Long-term interest rates resume climb due to the rigidity of inflation

Macro Context: Desynchronisation of global economic growth and inflation. Inflation falling in developed countries at an uneven pace, proving to be more rigid than expected. Slowing economic growth in China with problems in real estate and youth employment and threats of deflation also in Japan, with the yen at lows

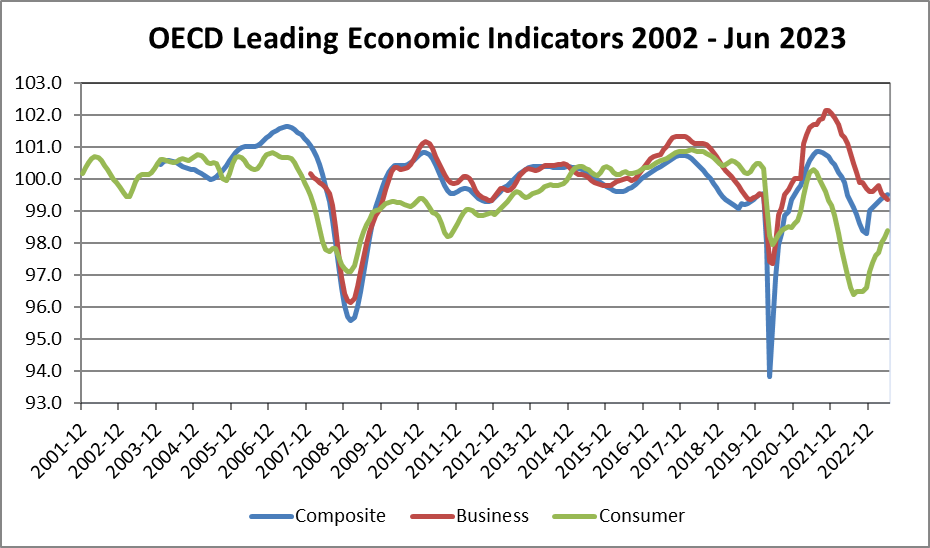

Micro Context: Key instantaneous and advanced economic indicators stabilise worldwide

Economic policies:Central banks remain vigilant about inflation developments, with the Fed on pause, while ECB and BdI continue to hike official interest rates, and Japan and China lower rates

Equity markets: Equity markets continue to rise globally, with the S&P 500 breaking the 4,100-point barrier driven by big tech and AI stocks, and an increase in depth over the past month. Nikkei 225 at 30-year highs and Hang Seng at weak developments

Bond markets: Bonds in developed countries suffer from rising long-term interest rates near 15-year highs, but credit spreads remain at historically low levels

Key opportunities: Less uncertainty, lower oil and other commodity prices, and U.S. job and growth resilience

Main risks: Possibility of economic recession in Europe, threat of housing crisis in some countries (e.g. UK, Sweden and China), and emergence of more risks from the financial excesses of the recent past

Long-term interest rates at the high levels of the last 15 years in Western countries favor investments in bonds, especially in the US, UK and Europe, and the decrease in economic uncertainty improves the prospects for investing in shares of quality companies with lasting competitive advantages

Performance of the financial markets 2Q23

Equity markets continue to rise led by big tech and the stocks associated with the AI revolution, recently extending to most companies. Long-term interest rates resume high due to rigid inflation

Equity and bond markets rebound with falling inflation, an improving outlook for global economic growth and the nearing end of rising U.S. interest rates.

The Q1 earnings presentation season proved to be very positive, especially for large technology companies and those linked to artificial intelligence.

The S&P 500 rose 9% and broke the 4,100-point barrier higher, gaining 16% for the year and 25% from last October’s lows, with valuations very concentrated in those companies.

The Nikkei 225 hit 30-year highs, advancing 30% this year, driven by accommodative economic policy and weakness in the Japanese yen.

The Eurostoxx 50 and 600 also recorded interesting appreciation.

Rising long-term interest rates in Western countries due to the persistence of inflation impact on bonds.

Bitcoin appreciated by 10% in the quarter and 80% in the year.

Macroeconomic context

Desynchronisation of global economic growth and inflation. Inflation falling in developed countries at an uneven pace, proving to be more rigid than expected. Slowing economic growth in China with disruptions in some sectors and threats of deflation in Japan, with the yen at lows

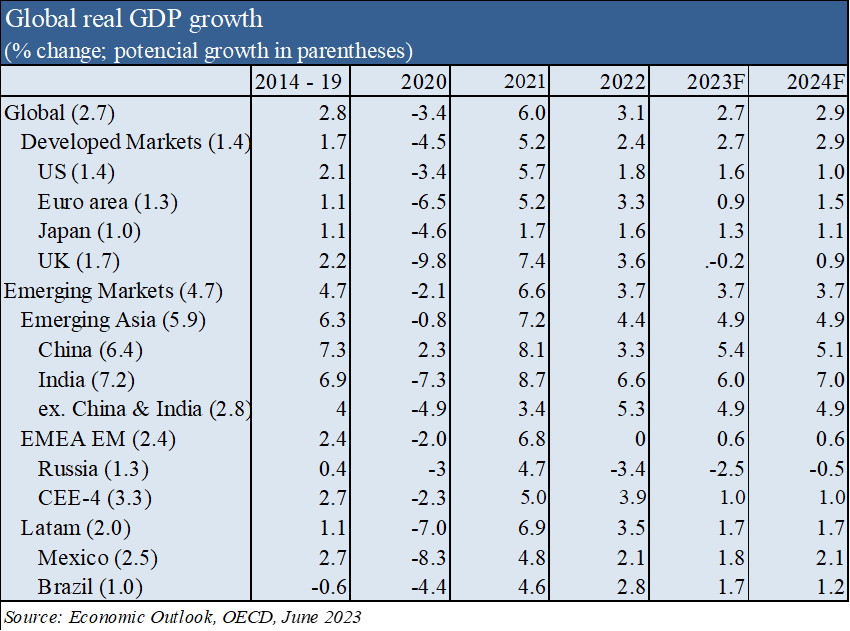

Improved global economic growth forecasts to 2.6% in 2023 and 2.9% in 2024, and with 1.5% and 0.9% in the US, 0.8% and 1.5% in the Eurozone, and 5.3% and 4.9% in China in 2022 and 2023 respectively, due to the lower impact on incomes of lower inflation.

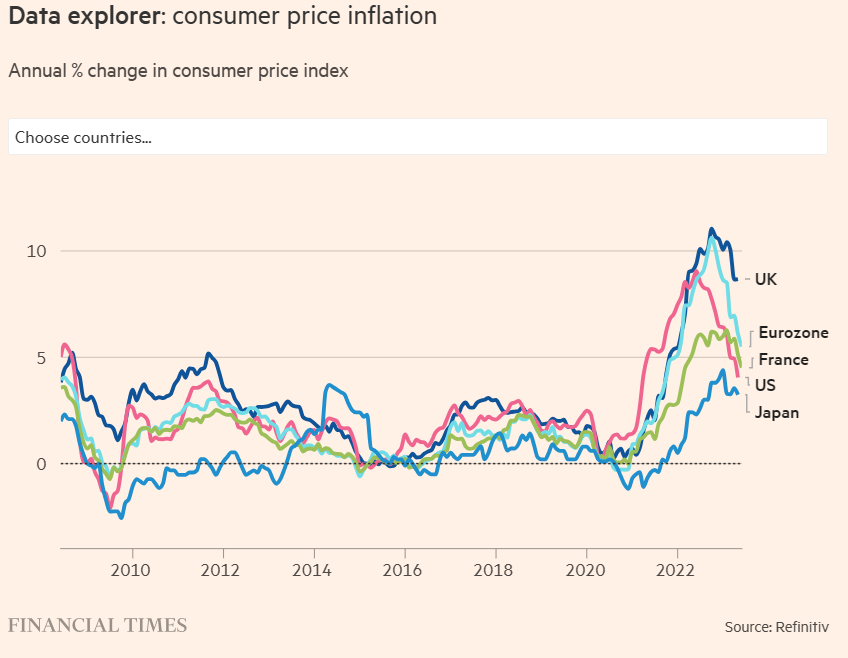

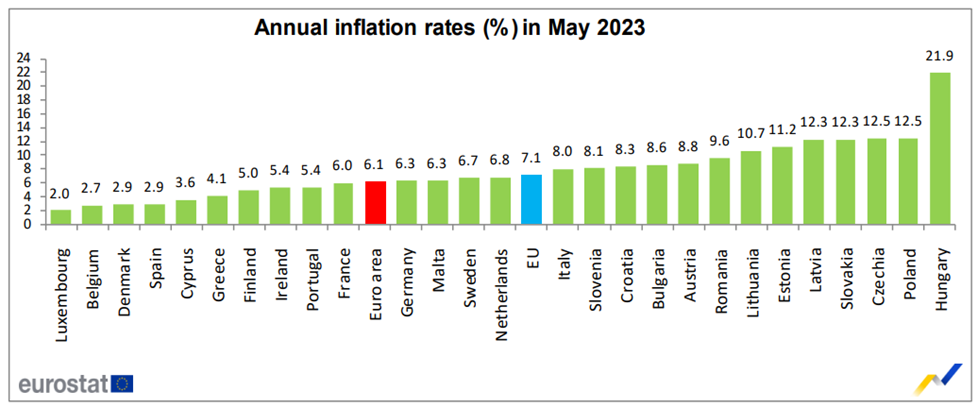

Inflation continues to fall gradually in developed countries by reducing the price of energy and other goods.

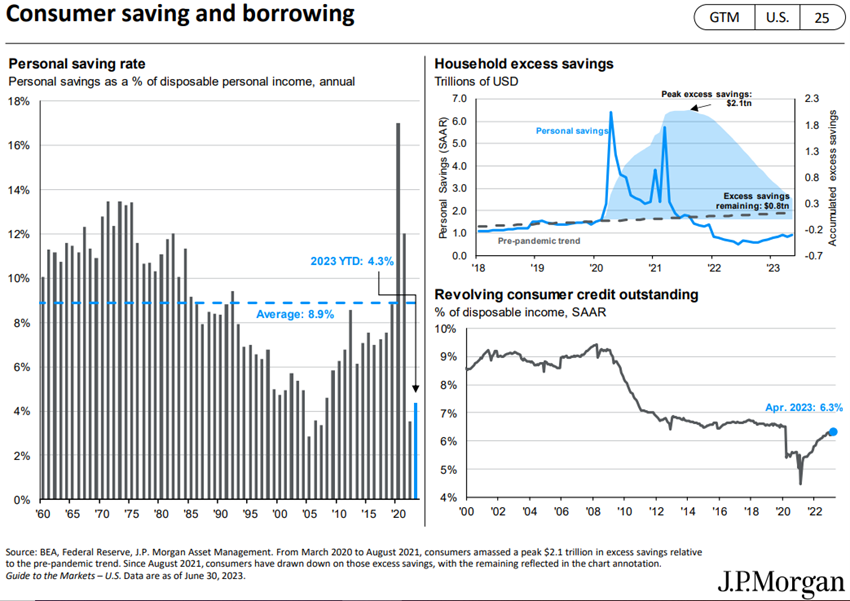

However, core inflation remains high and tighter than expected by the authorities due to service prices, high margins in some sectors and labour market pressure.

According to the OECD, inflation is projected to decline from 8.1% in 2022 to 4.5% in 2024 in advanced countries, with core inflation at 4.0% in 2023 and 2.5% in 2024.

China shows problems and weaknesses in the real estate sector and with youth unemployment.

Micro-economic context

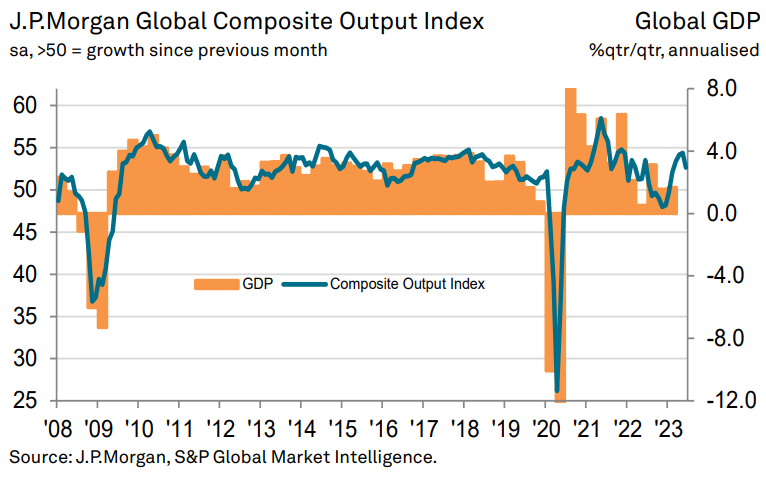

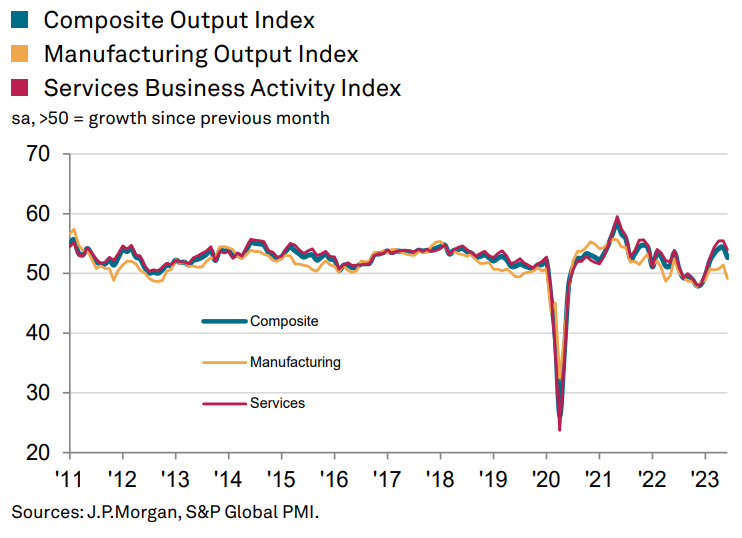

Key leading and advanced economic indicators improve worldwide

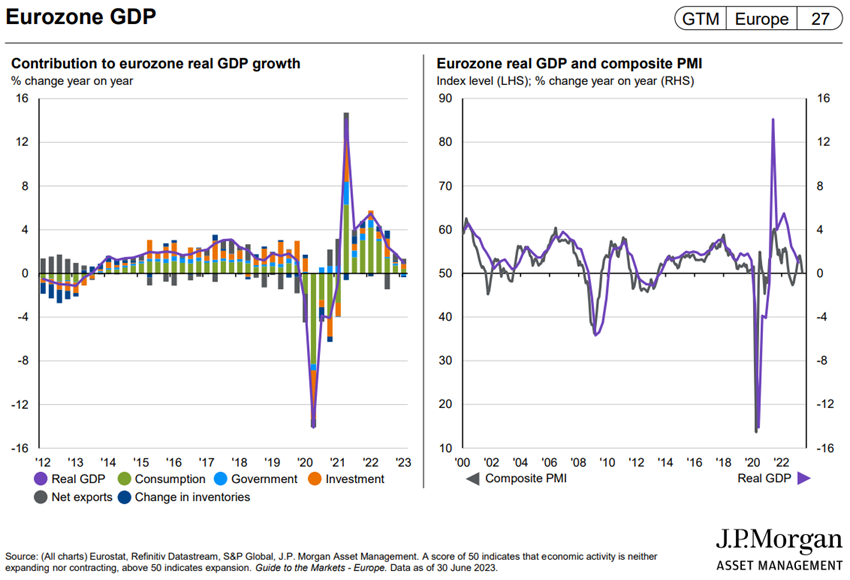

The June PMI surveys indicated a slowdown in services growth and a contraction in manufacturing.

The J.P. Morgan Global Composite Output Index recorded 52.7 in June, falling from an 18-month high of 54.4 May to a 4-month low.

The expansion continues to be driven by the services sector, albeit the lowest rate, while manufacturing contracted for the first time since January.

Of the 14 countries analyzed, 12 had improved economic activity in June, with the exceptions being Italy and France.

Final producer and input prices are at their lowest level in 2.5 years.

The unemployment rate in the U.S. is at 3.7%, levels very close to the lows.

Business and consumer confidence in OECD countries has improved.

Economic policies

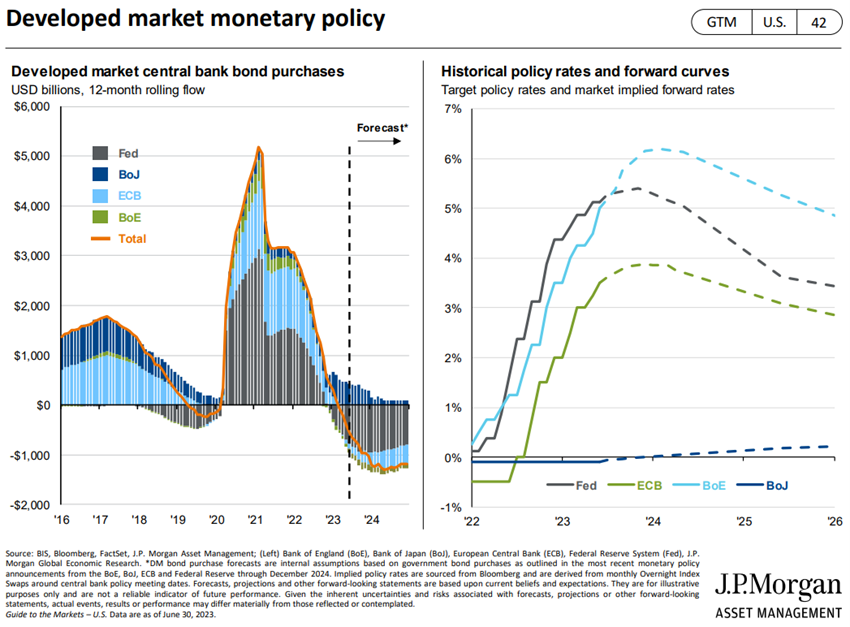

Central banks in Western countries remain vigilant about inflation developments, with the Fed on pause, while the ECB and BdI continue to hike official interest rates

The central banks of Western countries remain vigilant to the decline in inflation, which is proving to be more rigid than expected.

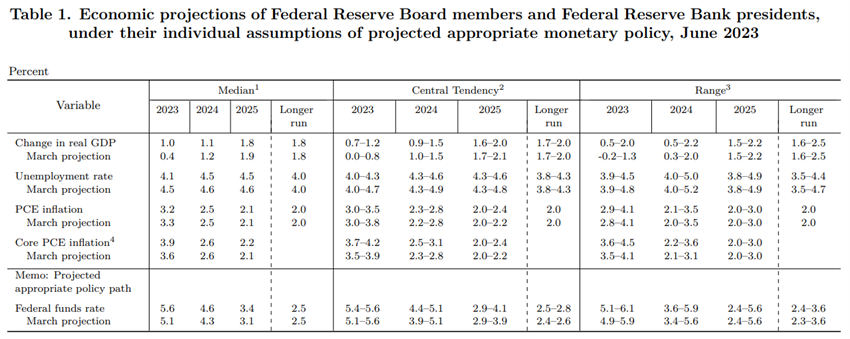

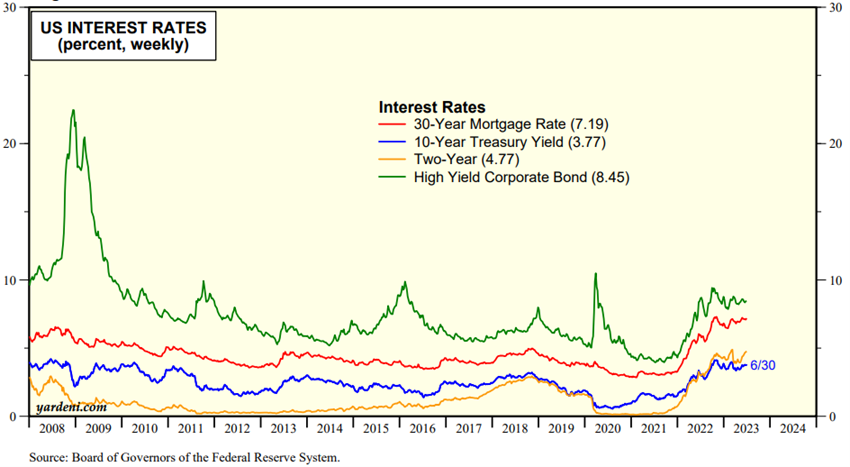

The Fed took the first break in the cycle of hikes and kept the official interest rate in June, setting it at 5%-5.25%, but anticipated the need for two more hikes for this year.

The Fed’s projections point to raising this rate to 5.6% at the end of 2023, 4.6% in 2024, 3.4% in 2025, and 2.5% in the longer term. It admits that unemployment could reach 4.1%, down from 4.5% in March.

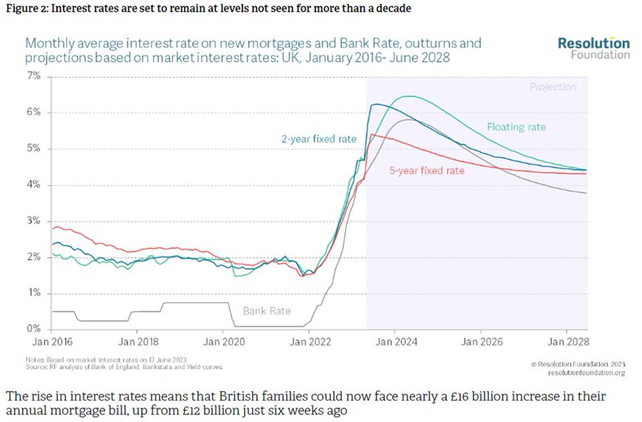

The Bank of England raised the official interest rate to 5.0%.

The ECB increased the refinancing rate to 4%. It forecasts inflation of 5.4% in 2023, 3.0% in 2024 and 2.3% in 2025.

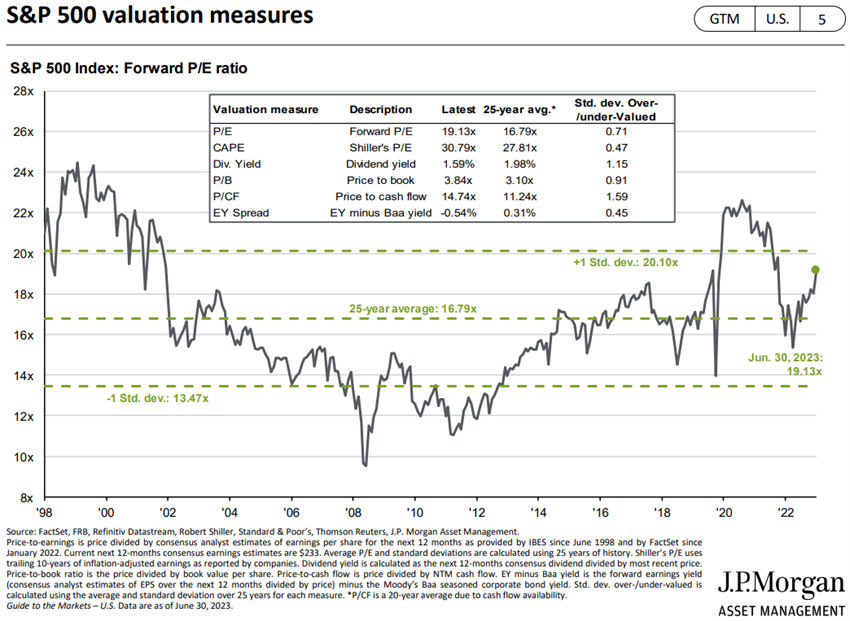

Equity markets valuation

Equity markets continue to rally globally, with the S&P 500 breaking the 4,100-point barrier driven by big tech and AI stocks, and an increase in depth over the past month. Nikkei 225 at 30-year highs and Hang Seng at weak developments

Equity markets rose nearly 10 percent in the quarter, the third straight up, recovering 25 percent from October lows.

S&P 500 breaks the 4,100-point barrier, mainly driven by big tech and artificial intelligence companies and with little depth.

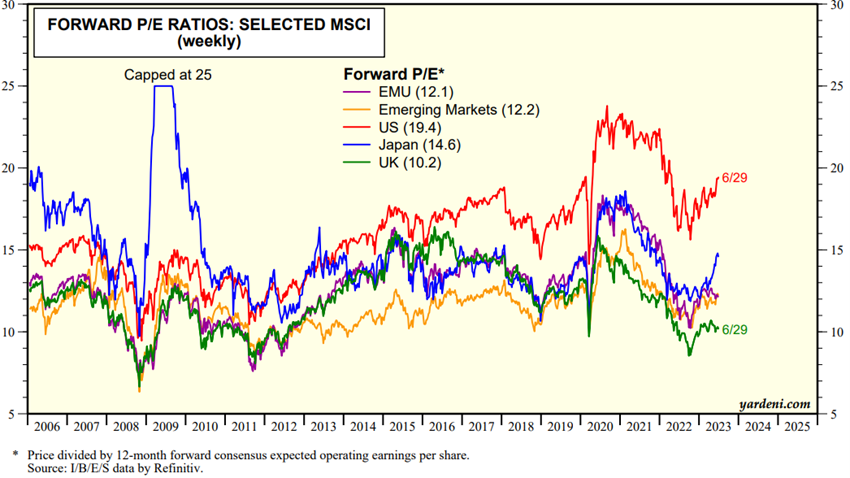

The 19.4x forward PER for the US is above the long-term average, dropping to 18x without FAANGM or MegaCaps.

PERs for the remaining regions rose to 12.1x in the Eurozone, 14.6x in Japan, 10.2x in the UK and 12.2x in emerging markets, all below the historical average.

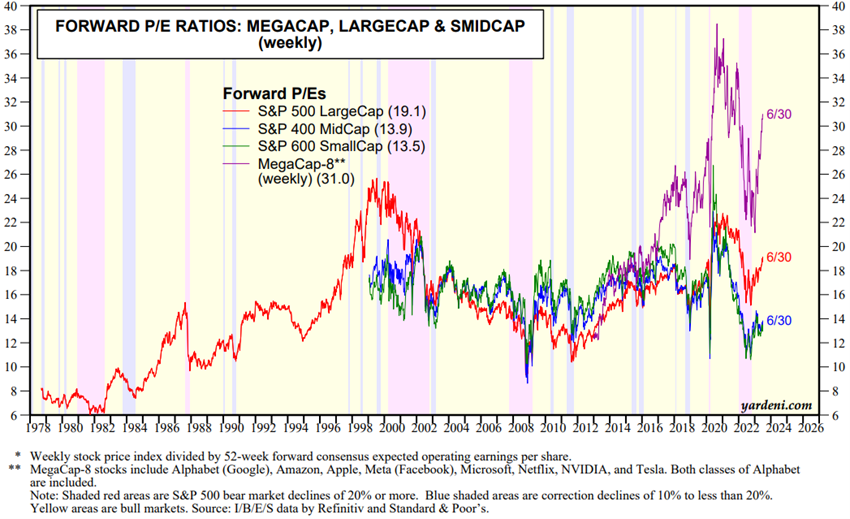

The PER of mid- and small-cap U.S. stocks is at 13.9x to 13.5x, respectively, below the long-term average.

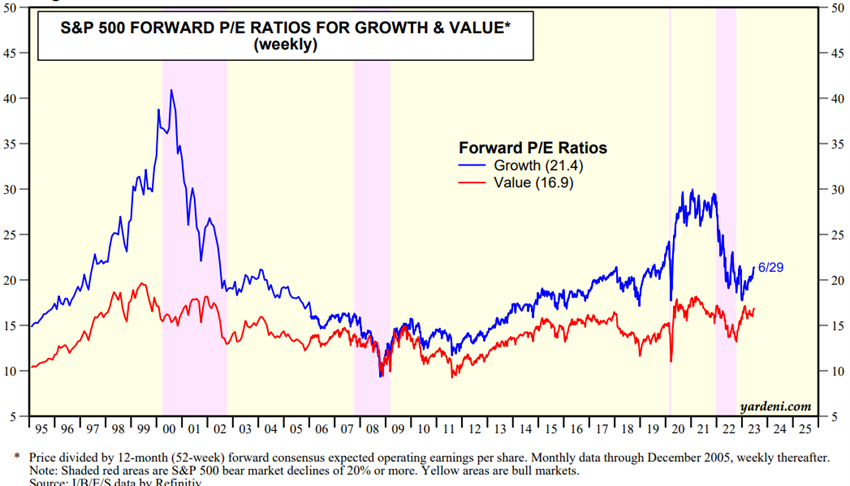

The PER of U.S. growth stocks is at 21.4x and value at 16.9x, respectively.

Source: Global Index Briefing: MSCI Forward P/ES, Yardeni Research, July, 5, 2023

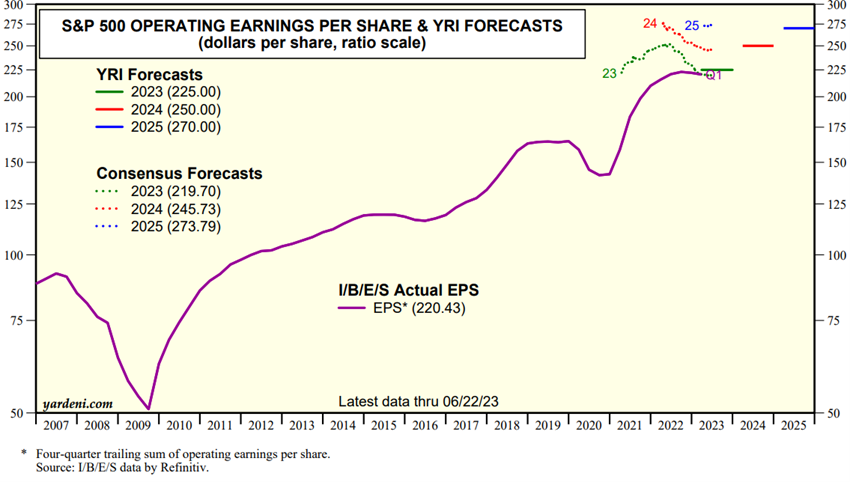

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, June, 26, 2023

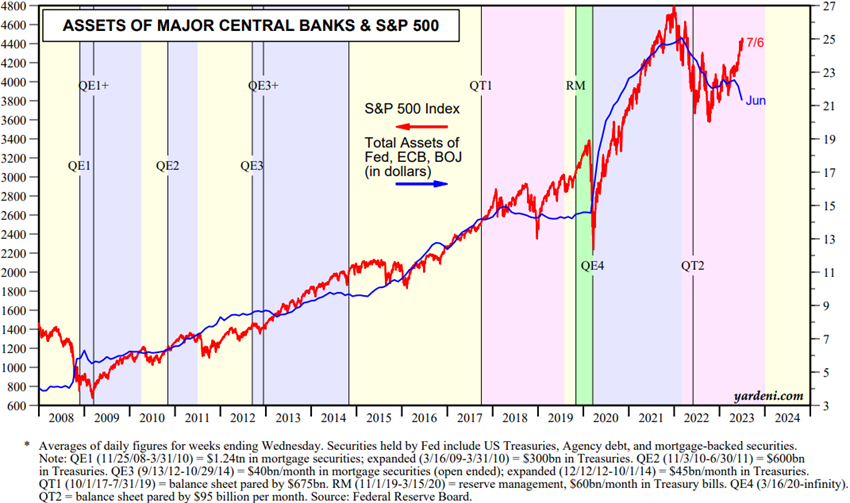

Source: Major Central Bank Total Assets, Yardeni Research, July, 6, 2023

Source: Stock Market Briefing: Selected P/E Ratios, Yardeni Research, July, 6, 2023

Source: Stock Market Briefing: Selected P/E Ratios, Yardeni Research, July, 6, 2023

Bond markets valuation

Bonds in developed countries suffer from rising long-term interest rates near 15-year highs, but credit spreads remain at historically low levels

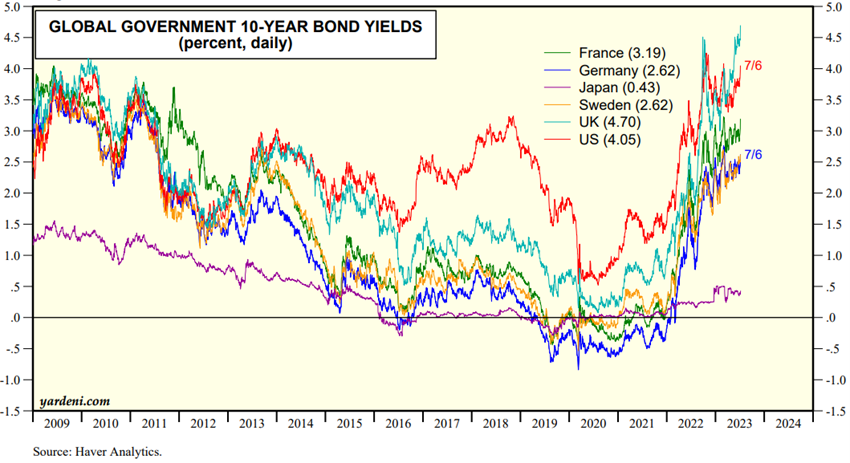

Long-term risk-free interest rates rose in the United States, the United Kingdom and the eurozone due to rigid inflation, devaluing bonds.

Interest rates on U.S. 10-year Treasuries rose from 3.3% in April to the current 4.05% (and the 2-year from 3.8% to 4.77%), and remained in the largest European countries, being close to 15-year highs.

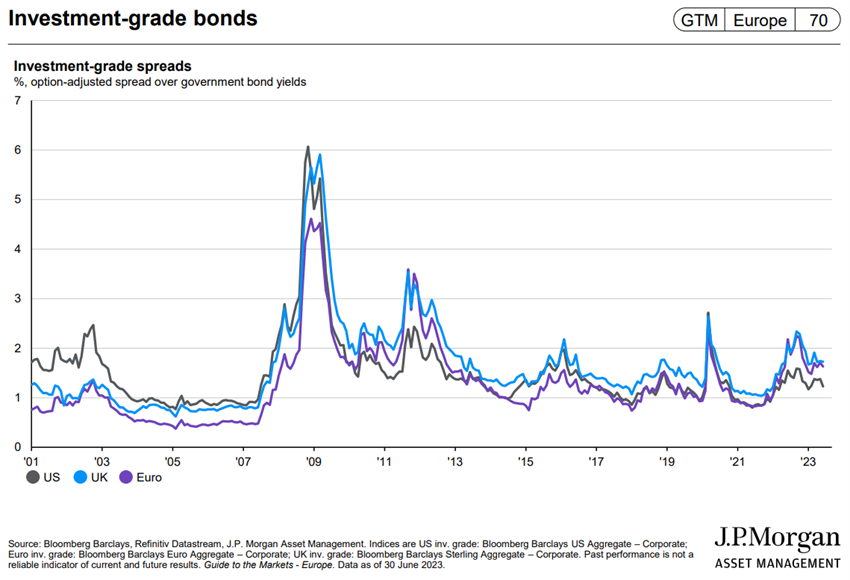

Credit spreads were flat after Q1 hikes associated with the banking crises in the U.S. and Europe.

U.S. and European investment-grade bonds trade at interesting levels in the medium and long term.

The less liquid segments of the credit market remain vulnerable.

Source: Market Briefing: Global Interest Rates, Yardeni Research, July, 7, 2023

Source: Market Briefing: US Bond Yields, Yardeni Research, July, 7, 2023

Main opportunities

Less uncertainty, lower oil and other commodity prices, and resilience of U.S. jobs and growth

The eventuality of a negotiated term in the war in Ukraine, with low probability, would obviously be a very positive surprise factor for the markets.

Main risks

Possibility of economic recession in Europe, threat of housing crisis in some countries (e.g. UK, Sweden and China), and emergence of more risks from the financial excesses of the recent past

High inflation may persist longer than anticipated, causing a loss of disposable income and a decrease in economic growth, or recession, at least in Europe.

The UK still has very high inflation and interest rates are very high, increasing the cost of living and household spending on mortgages

Financial markets show vulnerabilities associated with the financial excesses committed in the recent past of cheap money and which, from one moment to the next, can turn into risks of significant impact.

Recent examples are many, such as bank failures in the US and Europe.