Advantages of CFD trading

Disadvantages of CFD trading

CFD transactions are very short-term

The largest CFD trading platforms on currency pairs are also the largest in foreign exchange trading, given the weight of those in the product range of CFDs

In a previous article we covered structured products, their characteristics and the different types of products, showing that it is a broad product family that covers products of very different degrees of complexity and risk.

In the second part of this articlewe have delved into the advantages and disadvantages of investing in structured products, in absolute terms and compared to traditional investment products, stocks and bonds, either directly or through investment funds.

Later, in another article, we analyzed the Contracts for Differences or CFD, one of the structured products of greater complexity and risk, due to its high degree of leverage, and which are highly sought after by speculative investors, but which also attract many ordinary investors.

In that article we developed their characteristics, we showed the high probability of losses, and that the regulation of the authorities has been increasingly deep in the countries in which they trade, and is even banned in others, such as the USA.

This article continues the previous one on CFDs, presenting the advantages and disadvantages of CFD trading.

It concludes that CFDs products should be used exclusively by experienced or qualified investors, and ordinary investors should refrain from and focus on traditional investment products such as stocks, bonds or investment funds.

Advantages of CFD trading

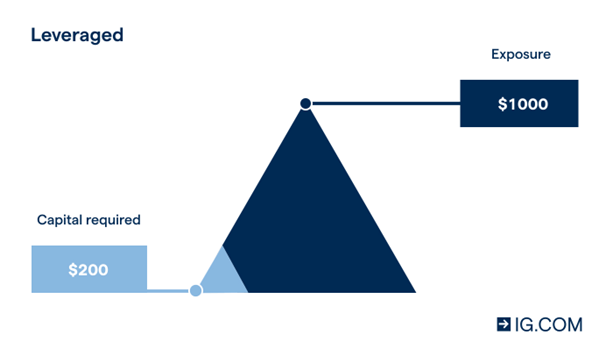

CFDs provide greater leverage than traditional investment products.

Standard leverage in the CFD market is subject to regulation.

Leverage was once 50:1 (2% margin), and is now between 30:1 (3% margin) and 2:1 (50% margin).

The lower the margin requirements, the lower the capital investment and the higher the potential returns, but also the losses for the investor.

CFDs can be traded on a single platform, where the largest brokers offer products on all the major markets in the world, allowing uninterrupted access.

CFD instruments can have short or short positions at any time without borrowing costs because it is not necessary for the investor to own the underlying asset. On the contrary, in traditional investments, many markets prohibit short or short positions.

CFD brokers offer the same variety of order types as traditional brokers, including limit, contingent, chained orders, etc.

Brokers make money by paying the spread and by charging commissions or fees by the investor.

The CFD market has no requirements for day trading, capital or trade numbers, unlike some markets for traditional products.

CFD brokers offer a variety of trading opportunities, including CFDs on stocks, indices, interest rates, foreign exchange and commodities.

Disadvantages of CFD trading

Leverage risks expose the investor to higher potential profits, but also to greater potential losses.

Although stop-loss limits are available, many investors do not trigger them, and even if they exist, if the movements are sudden and sharp, such as the suspension of trading, the position is closed at a more unfavorable price and the loss may be greater than expected.

This situation can occur during the session or between daily sessions.

Investors have to pay the spread on inflows and outflows, in addition to commissions and fees, which eliminates the potential to profit from small moves.

Until recently, the CFD industry was poorly regulated.

Counterparty risk, or the broker’s ability to comply in honoring commitments, depends on the broker’s financial capacity, reputation, and longevity.

CFD trading is very risky, fast and requires close monitoring. There are liquidity and margin maintenance risks that if not insured lead to the automatic closing of positions by the broker.

CFD transactions are very short-term

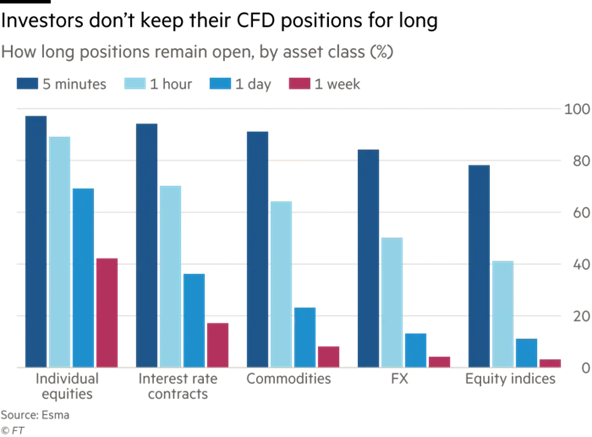

According to ESMA, the European regulatory agency, most CFD transactions are very short-term, less than a week:

Most CFD trades on stock indices, foreign exchanges, commodities and interest rates are intra-day, and many of them don’t even last 5 minutes or 1 hour.

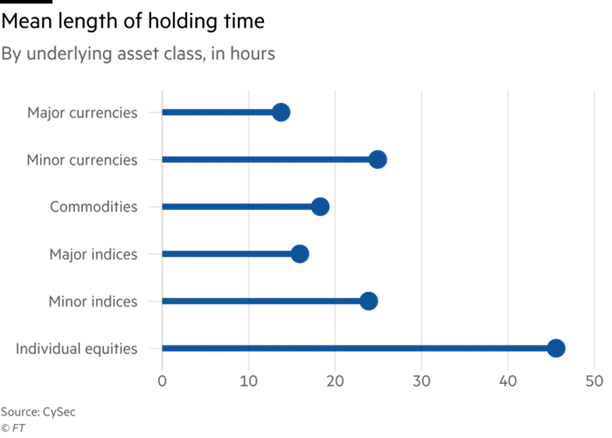

The average holding time of the CFD investment is measured in hours:

The average holding time of CFDs on major currency pairs is 14 hours or little more than a day, that of commodities is less than 20 hours, of the largest indices shareholders of 16 hours and that of individual shares of 45 hours, or about a week.

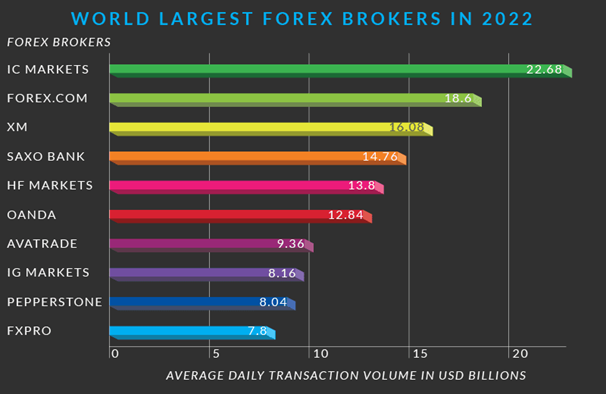

The largest CFD trading platforms on currency pairs are also the largest in foreign exchange trading, given the weight of those in the product range of CFDs

The largest CFD trading platforms are also the largest forex trading platforms:

The 5 largest forex trading platforms are IC Markets, Forex, XM, Saxobank and HF Markets.