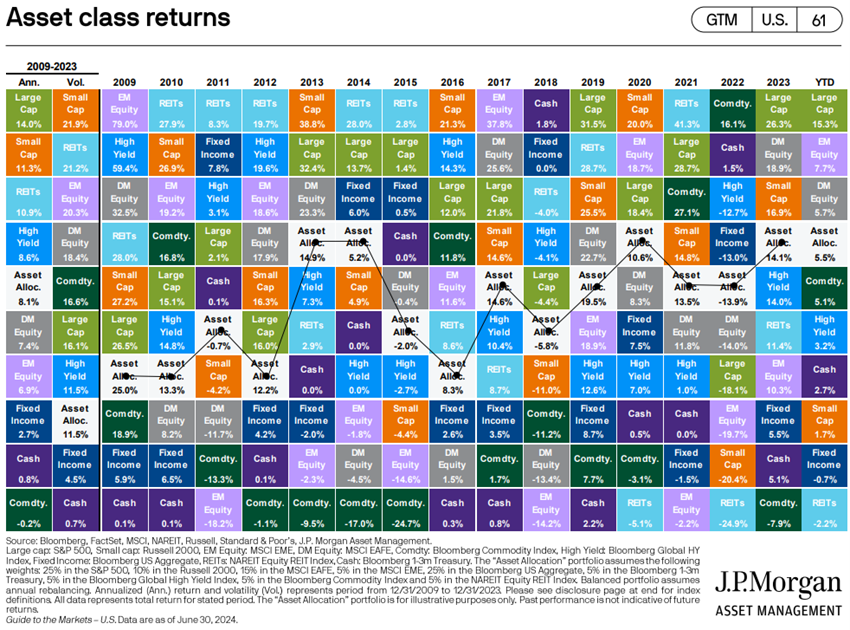

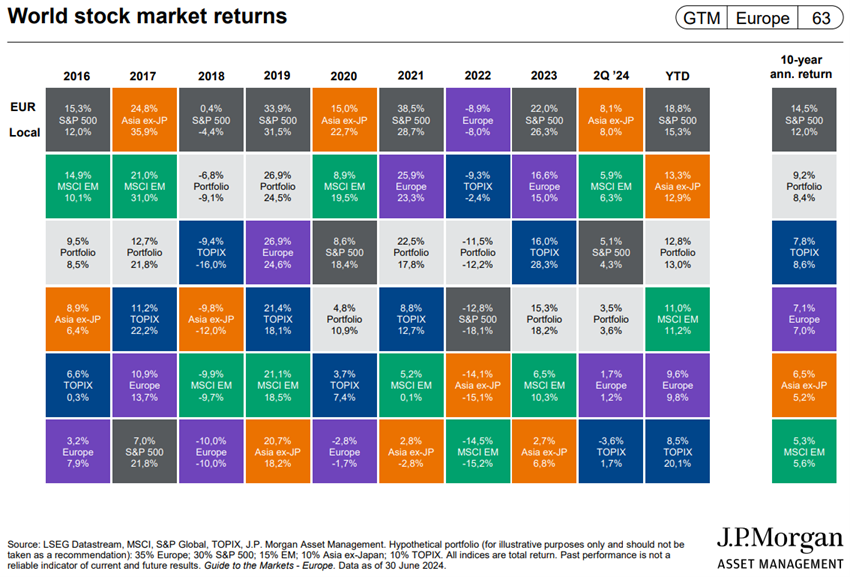

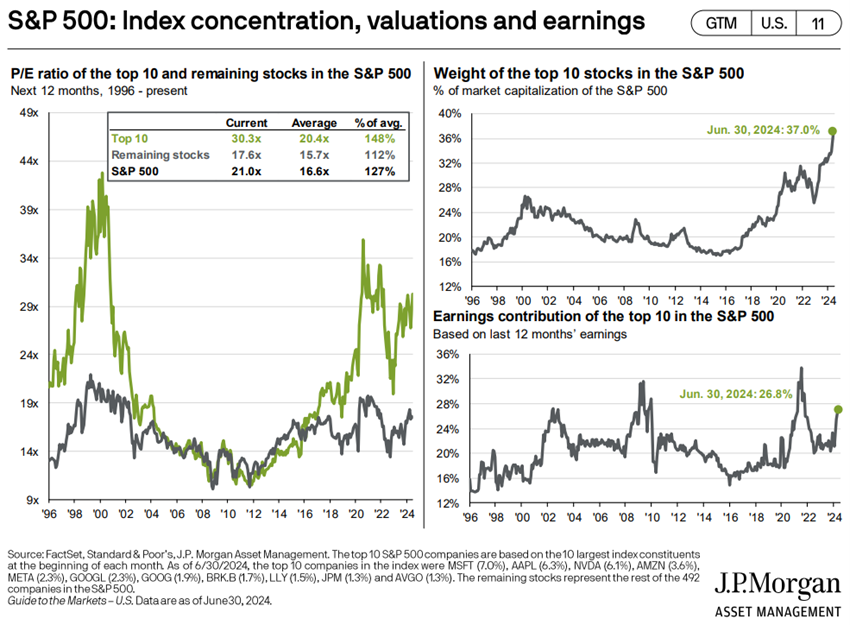

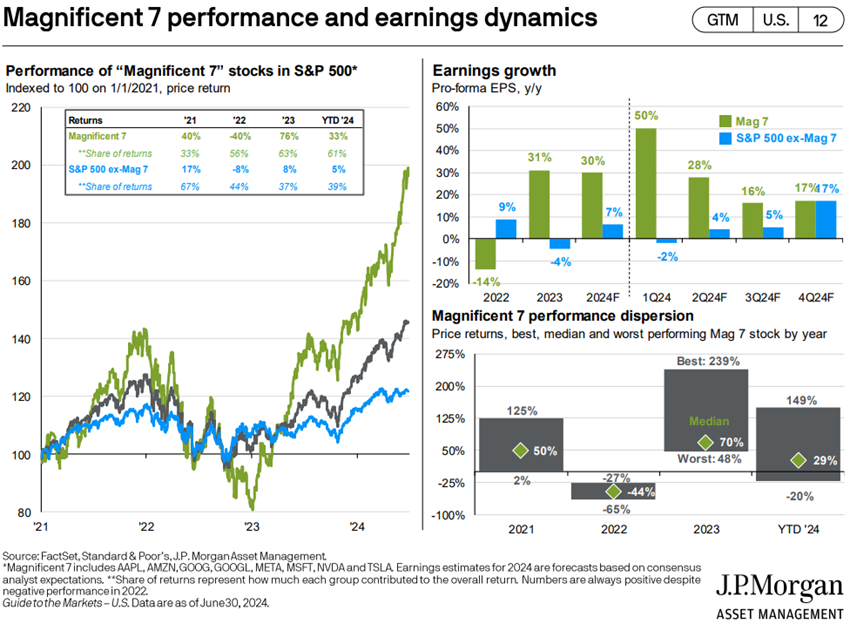

The S&P 500 continues to hit highs, in a cycle that started at the end of 2022, concentrated in the magnificent 7. The remaining developed stock markets have been left behind and China does not solve its problems.

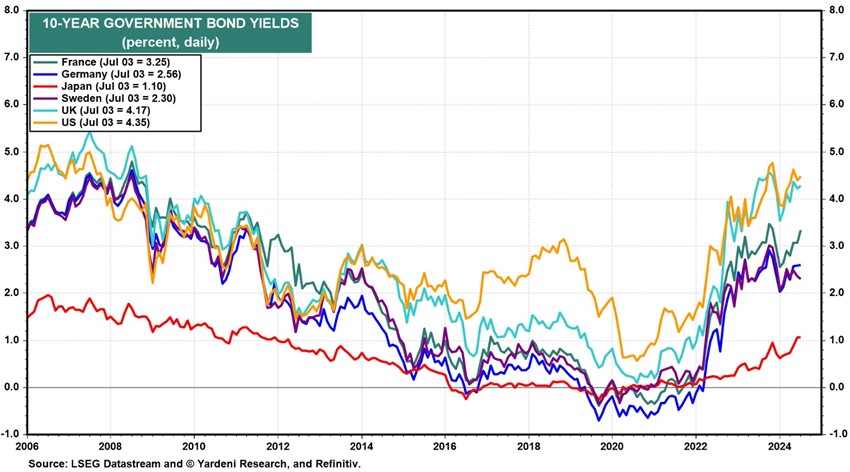

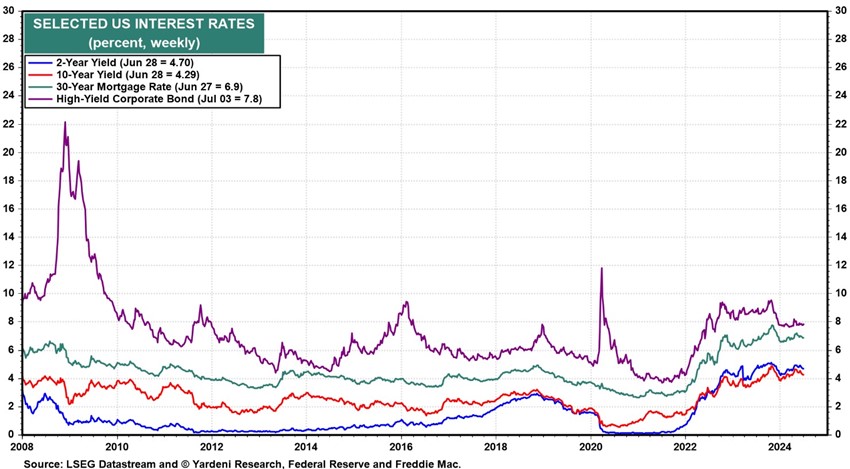

Bonds in the U.S. and Europe followed interest rate volatility in the first half of the year, dictated by instability in inflation.

Good macro support in the US (lower inflation with resilient growth and employment) reinforces the growth of earnings, enabling a broader stock market appreciation.

Geopolitical uncertainty is accentuated with the prolongation of the war in Ukraine, the conflict in the Gaza Strip, the results of the European (and French) elections, and the approach of the US elections.

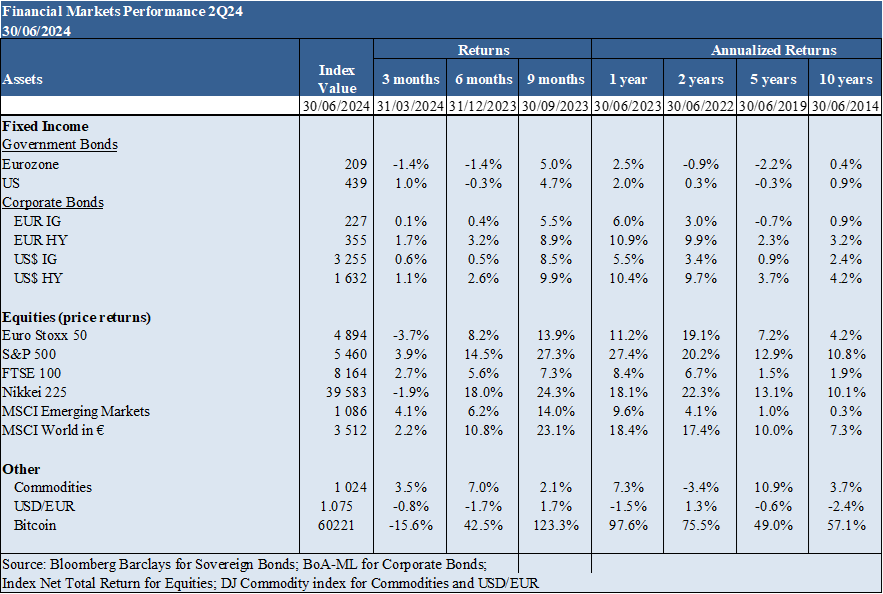

Performance 2Q24 Markets: The S&P 500 advanced 14.5% in the half, reaching maximum levels, taking off from European and Japanese stock markets. Long-term treasury bond interest rates in the US and Europe follow the instability of inflation evolution, impacting bond performance.

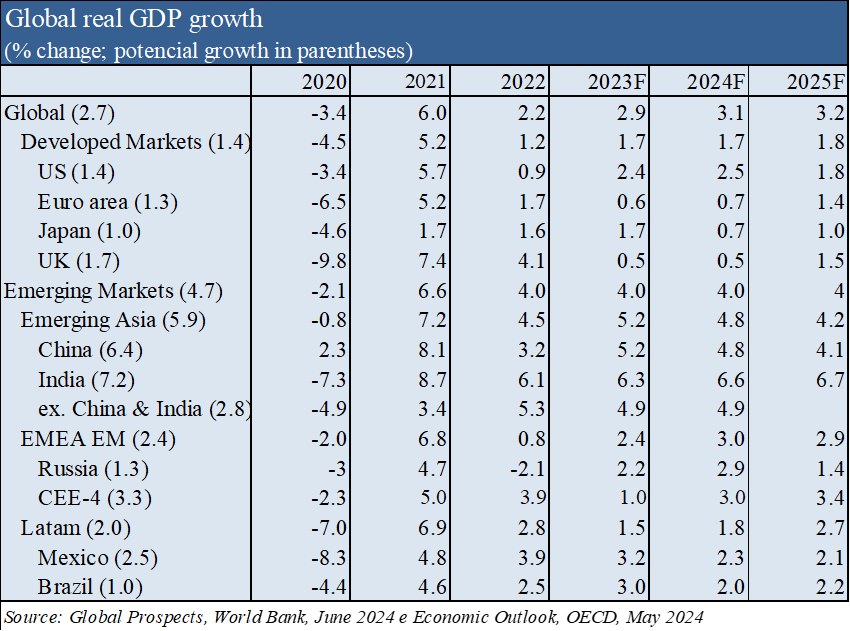

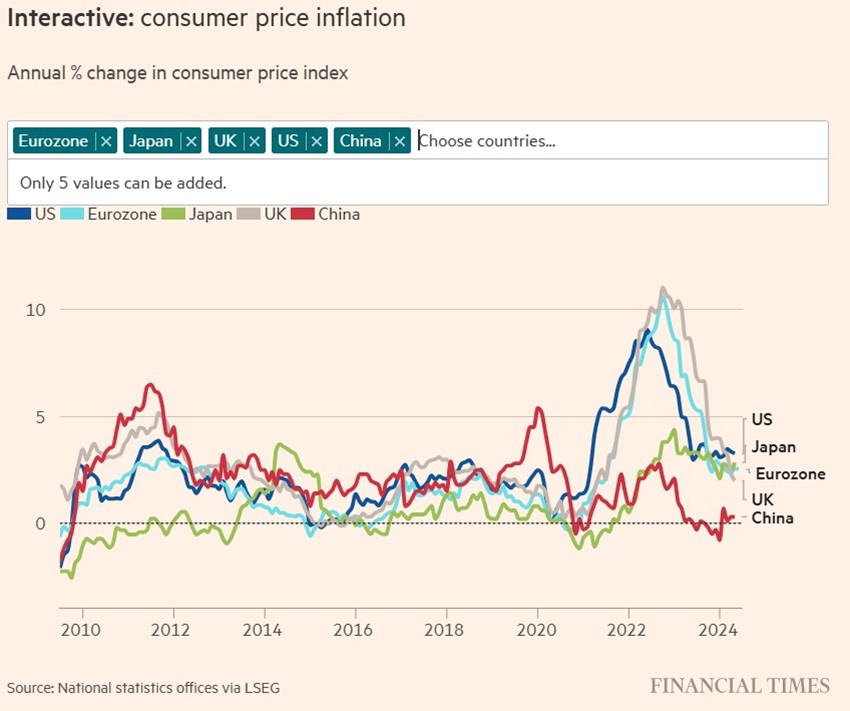

Macro Context: Overall economic growth levels are below average. The US continues to surprise on the positive side, Europe remains practically stagnant, and China continues to fail to solve the problems. Inflation in the US and Europe seems to be receding again, after a first quarter of slight increase.

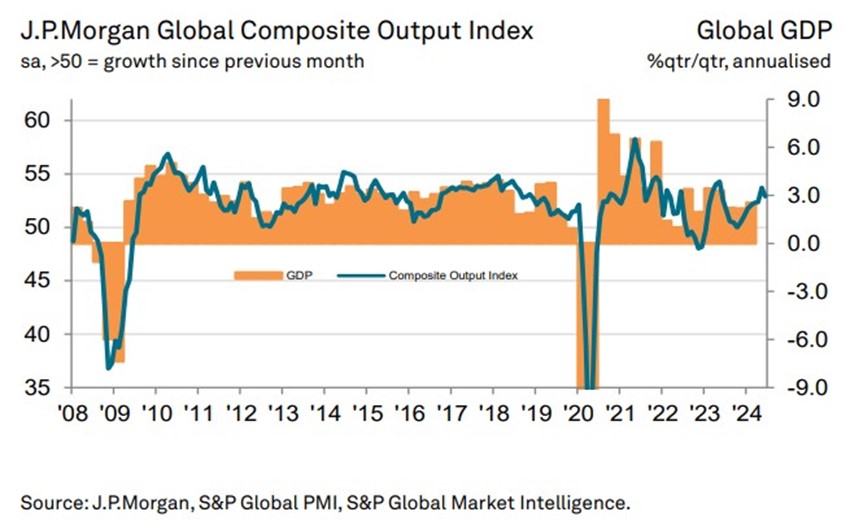

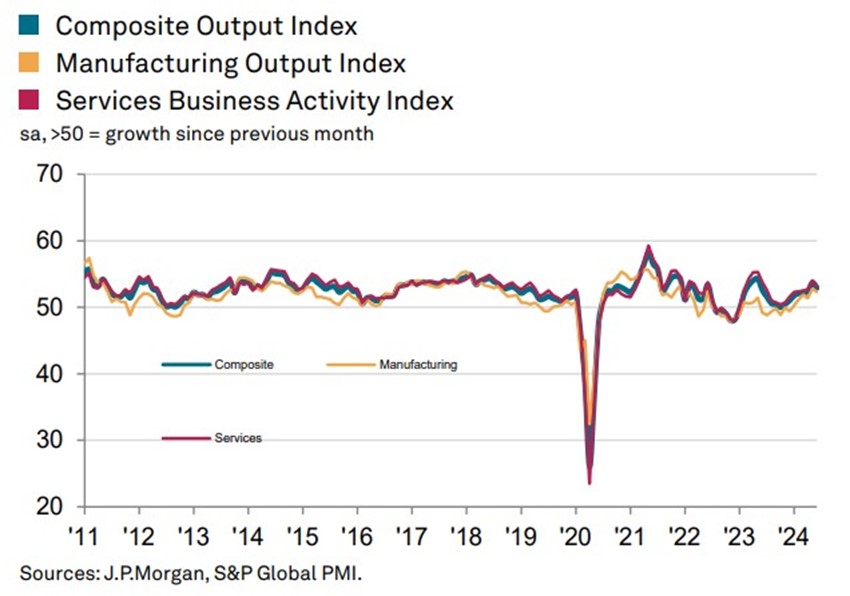

Micro Context: Leading instantaneous and leading economic indicators are at solid levels almost everywhere in the world.

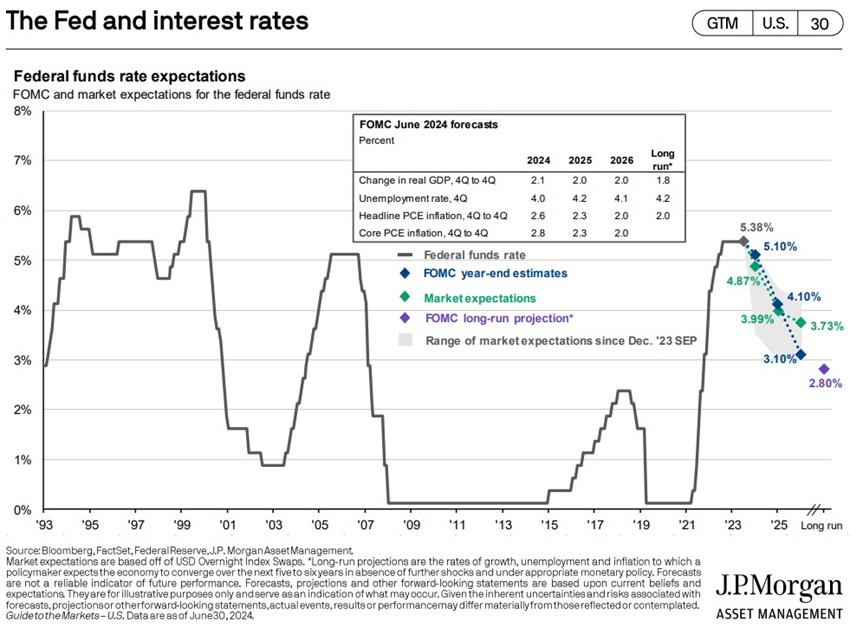

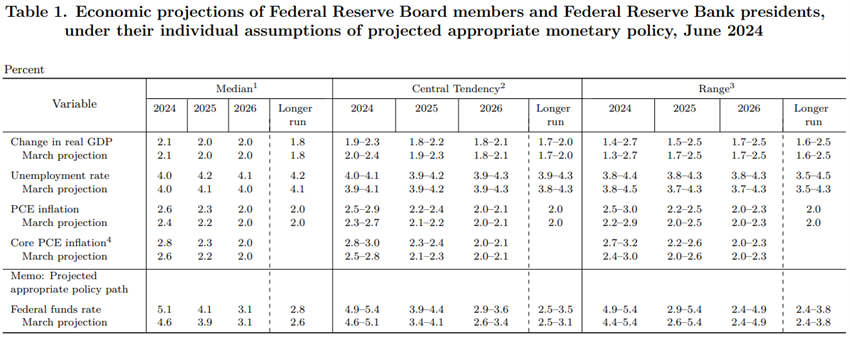

Economic policies: The ECB cut official rates in June by 0.25%, while the US admits 1 to 2 cuts only for the end of the year.

Stock markets: US stock market at maximum levels, mainly due to the performance of mega capitalizations. The Japanese and Eurozone markets did not progress and lagged behind.

Bond markets: US and European medium- and long-term bonds with good ratings will benefit from the reduction in official interest rates in line with the decline in inflation. Credit spreads remain at historically low levels.

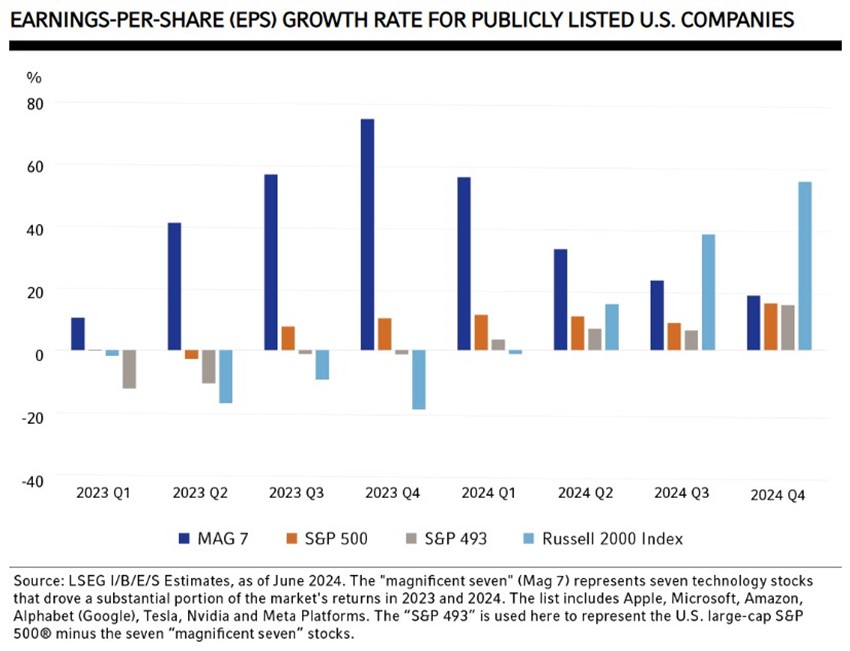

Key opportunities: Continued good growth and employment, accompanied by lower inflation in the US, resulting in increased earnings per share across more companies and sectors.

Main risks: Spread of the Israel-Palestine conflict to Iran and the Middle East region. European (and French) election results.

Falling inflation and long-term interest rates in Western countries favor investments in equities, as well as bonds, especially in the US, where growth has been less affected.

Financial markets performance 2Q24: S&P 500 advanced 14.5% in the half, reaching maximum levels, taking off from the European and Japanese stock markets. Long-term treasury bond interest rates in the US and Europe follow the instability of inflation evolution, impacting bond performance.

The S&P 500 reaches new highs, and once again, takes off from the rest of the stock markets, driven by mega-caps and with high concentration.

Bond markets in Western countries follow the instability of interest rate and inflation movements.

Bitcoin depreciated to $60 thousand dollars.

Macroeconomic context: Overall economic growth levels are below average. The US continues to surprise on the positive side, Europe remains practically stagnant, and China continues to fail to solve the problems. Inflation in the US and Europe seems to be receding again, after a first quarter of slight increase.

Stabilization of global economic growth forecasts to 3.2% in 2024 and 2025, with 2.5% and 1.8% in the US, 0.7% and 1.4% in the Eurozone, 4.8% and 4.1% in China, respectively, but below the long-term average.

The US continues to beat economic growth estimates, while Europe maintains weak growth.

Inflation in the US fell again to 3.3% in May.

The estimate of inflation in the euro area in June is 2.5%.

China has not yet resolved the economic and financial problems of recent years.

In essence, global growth remains stable, having slowed for three consecutive years.

Inflation has been reduced to the lowest level in the last three years.

Financial conditions have improved.

In short, the world economy seems to be in the final stages for a soft landing.

Microeconomic context: Leading instantaneous and leading economic indicators are at solid levels almost everywhere in the world

J.P. Morgan’s global composite PMI production index stood at 52.9 in June, versus 53.9 in May, signaling expansion in eight consecutive months, in industry and services, closing the semester with solid levels.

Of the 14 countries with available data from the manufacturing and services PMI, 11 recorded expansions in June.

The unemployment rate in the US is at 4.0%, levels close to the lows.

Economic policies: The ECB cut official rates in June by 0.25%, while the US admits 1-2 cuts only for the end of the year

The ECB cut official interest rates by 0.25% in June, while the US Fed and the Bank of England kept them unchanged.

The Fed’s projections point to the decision of this rate from the current 5.25% to 5.1% in 2024, 4.1% in 2025, and 3.1% in 2026. The Fed lowered its projections for its preferred measure of inflation – the private consumption price index (PCE) – to 2.6% in 2024, 2.3% in 2025 and 2% in 2026.

The ECB lowered the refinancing rate to 4.25%. It forecasts inflation of 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026.

The Bank of England kept the official interest rate at 5.25%.

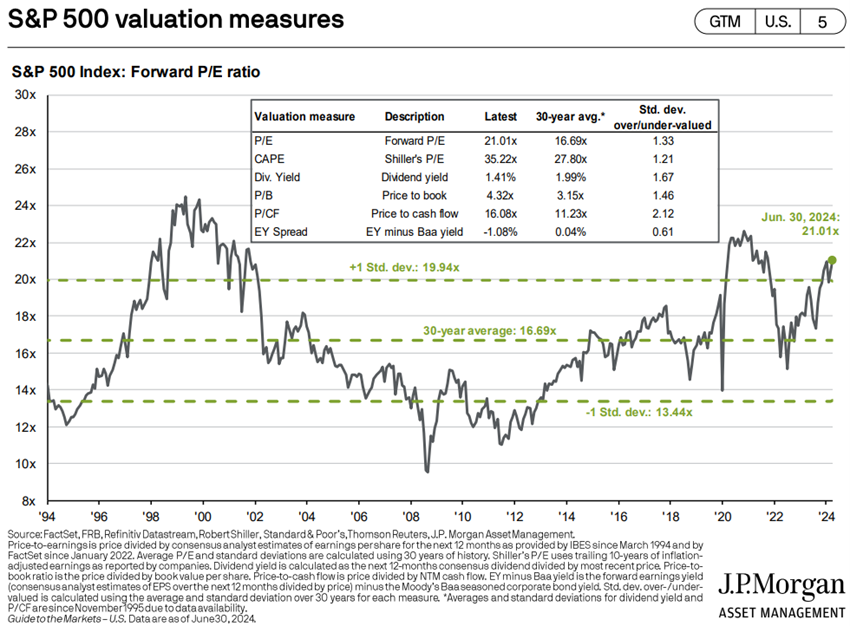

Assessment of the stock markets: US stock market at maximum levels, mainly due to the performance of mega capitalizations. The Japanese and Eurozone markets did not progress and lagged behind.

The US stock market is at peak levels, with the S&P 500 closing the first half of 2024 with a gain of 14.5%, driven and very concentrated in mega-caps.

The other stock markets retreated a little in the quarter.

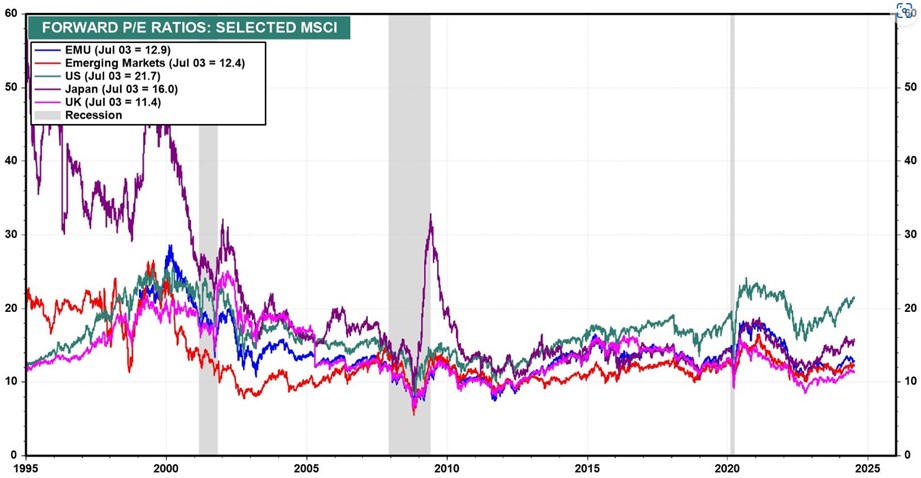

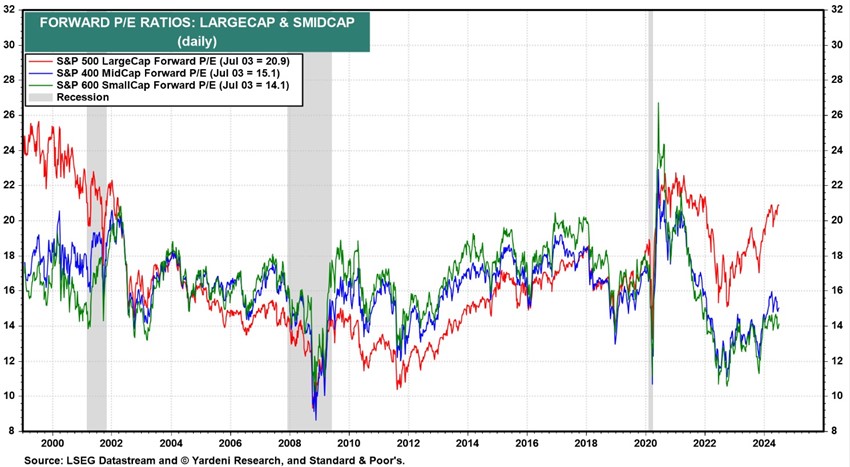

The 21.7x forward PER for the US is above the long-term average, dropping to 17.0x without the 8 MegaCaps.

Japan’s PER of 16.0x is also above average.

The PER of the other regions fell slightly to 12.9x in the Eurozone, 11.4x in the UK and 12.4x in emerging markets, all below the historical average.

The PER of mid-cap and small-cap U.S. stocks are both at 15.1x to 14.1x, below the long-term average.

The PER of U.S. growth stocks is at 28.2x and that of value stocks is at 15.8x.

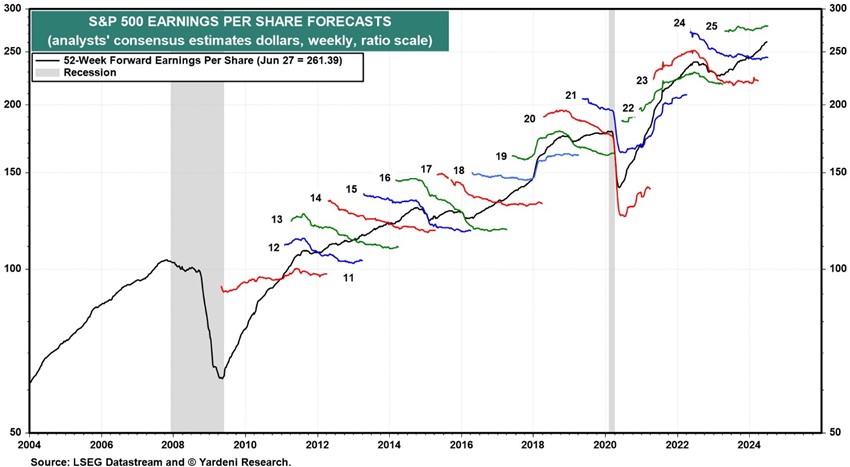

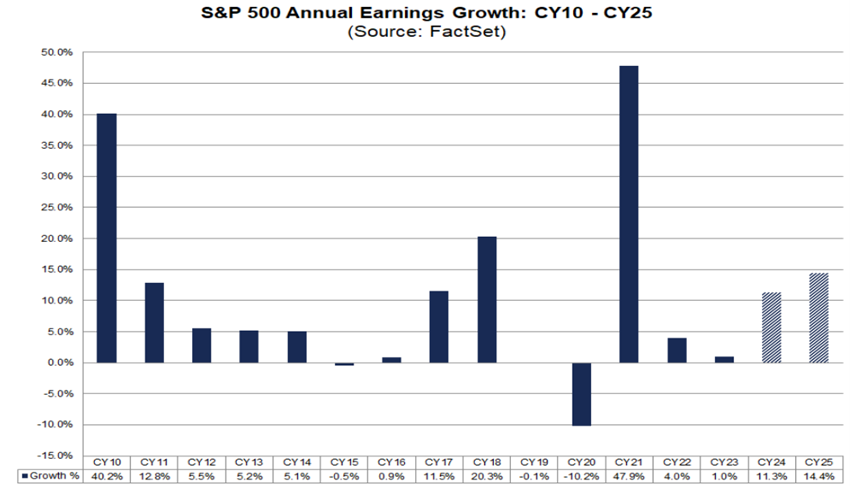

Analysts predict earnings growth for S&P companies of 11.3% in 2024 and 14.4% in 2025.

The North American market continues to be attractive despite high valuation multiples due to the growth in annual results.

Europe has weak growth and greater geopolitical risk, due to the war in Ukraine and the elections in France and England, while China struggles with the exhaustion of the development model, which benefits India as one of the main bets of emerging markets.

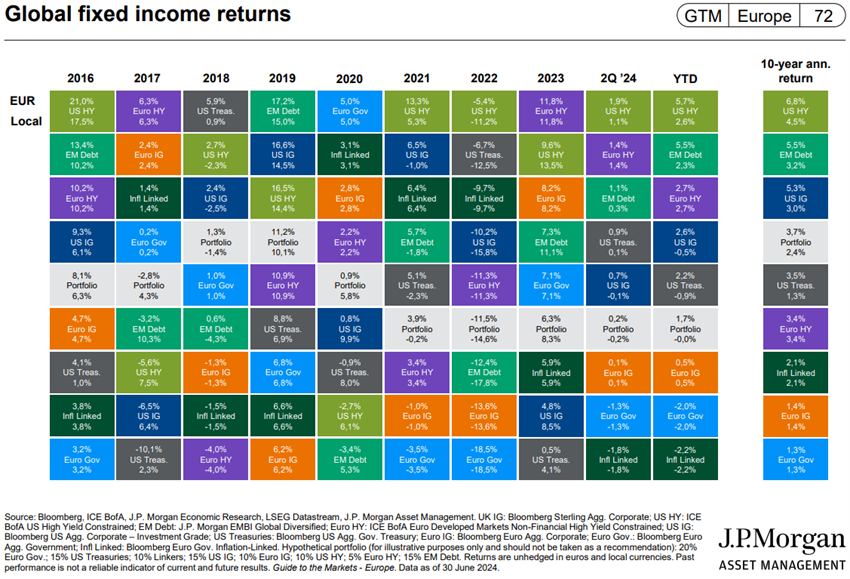

Bond market assessment: US and European medium- and long-term bonds with good ratings will benefit from the reduction in official interest rates in line with the decline in inflation. Credit spreads remain at historically low levels

Long-term risk-free interest rates have risen 0.5% in the United States and 0.4% in the Eurozone since November, impacting bond performance.

Credit spreads in the U.S. and Europe remained stable.

The reduction of official interest rates by the Fed and the ECB, in line with inflation, will have a positive impact on bonds.

With long interest rates well above the average of the last 15 years, and the downward trend in these rates, investment quality bonds trade at interesting levels in the medium and long term, especially in the US.

Main opportunities: Maintenance of good levels of growth and employment, accompanied by a decline in inflation in the US, resulting in an increase in earnings per share, generalized to more companies and sectors.

In the US, the decline in inflation and long interest rates, while maintaining solid levels of economic growth and employment, will lead to more broad-based growth in corporate earnings per share and a rotation of assets from liquidity to equities, with the consequent broader appreciation of the US market.

Ending the war in Ukraine would decrease geopolitical risks and the risk premium of financial markets, increasing equity and bond valuations, especially in Europe.

Main risks: Spread of the Israel-Palestine conflict to the Middle East region. European (and French) election results.

The conflict in the Gaza Strip could spread to neighbouring countries such as Lebanon and Iran.

The results of the European and French elections, with a major swing to the far right, increase the uncertainty of economic and financial policies.

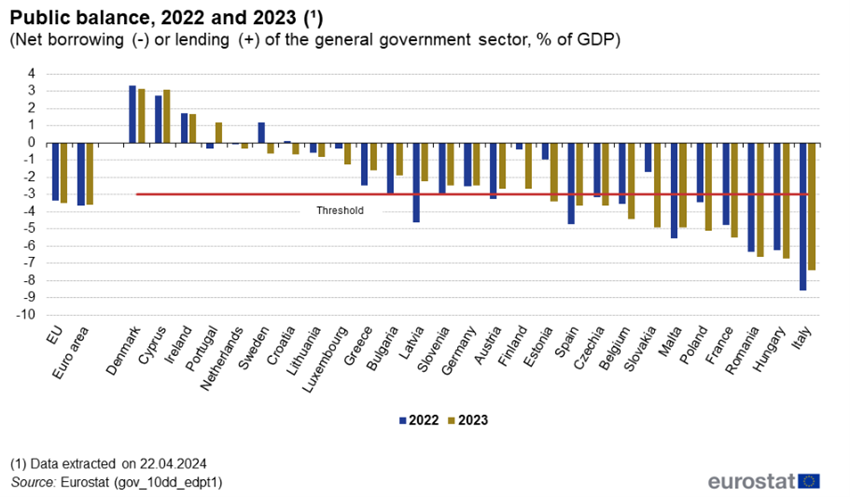

The public finances of the US and some European countries have worsened, which will worsen if there is an extension of high interest rates.