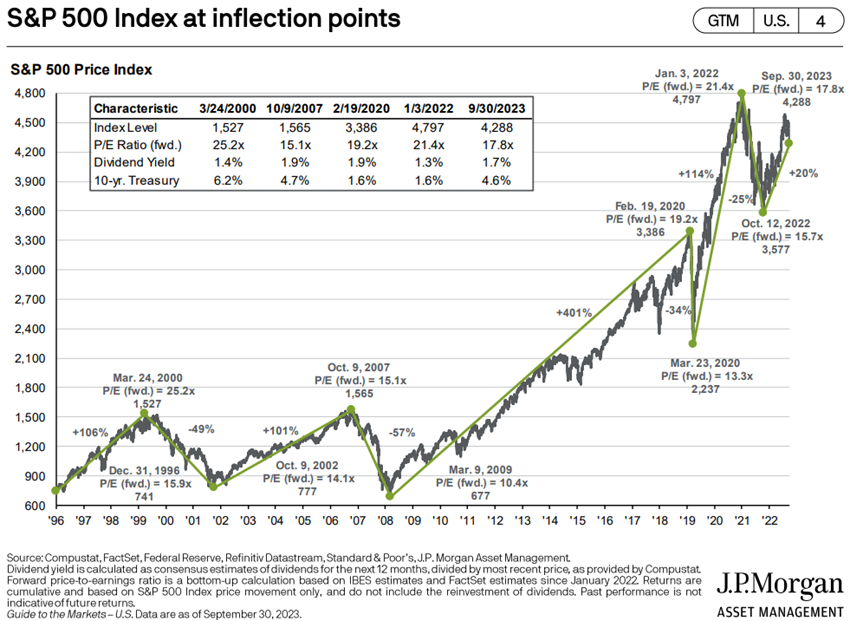

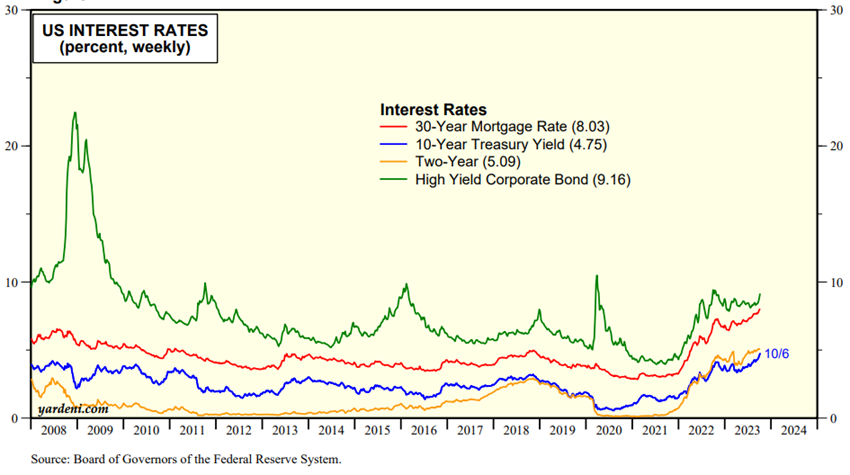

The continued rise in the 10-year interest rate in the US, currently above 4.5%, the highest in the last 15 years, has been behind the correction in the stock markets, and the question arises as to how far it can go.

It is considered that above 5% could already have a significant effect on the markets. Recently, Jamie Dimon, Chairman and CEO of JP Morgan, admitted the risk and the possibility of a rise to 7%, which would have a major impact on the markets.

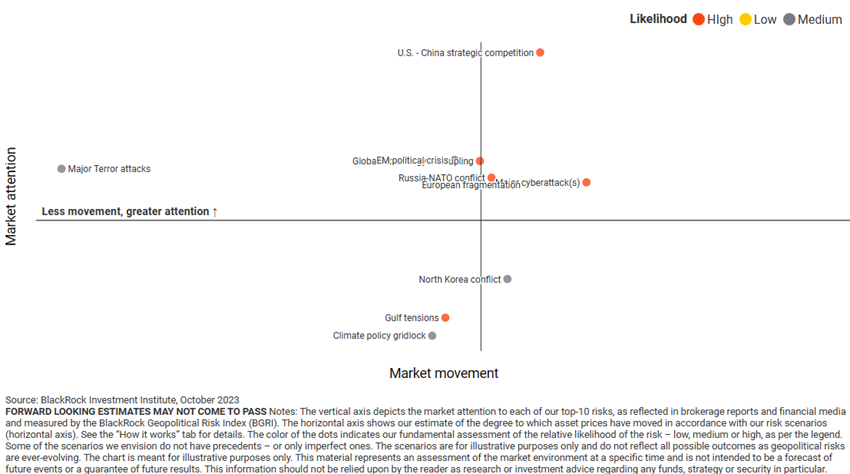

The factors that condition this movement of interest rates are of an economic, financial and political nature (including geopolitical): cost of financing the high public deficit (currently at 7%), public debt ratio of 120%, possibility of government shutdown, rating stability, still high and rigid inflation, war in Ukraine, oil prices and growing fragmentation of international trade.

In recent days, Israel’s conflict has emerged in response to the Hamas terrorist attack, which increases global instability and also aggravates the risks of inflation and interest rates.

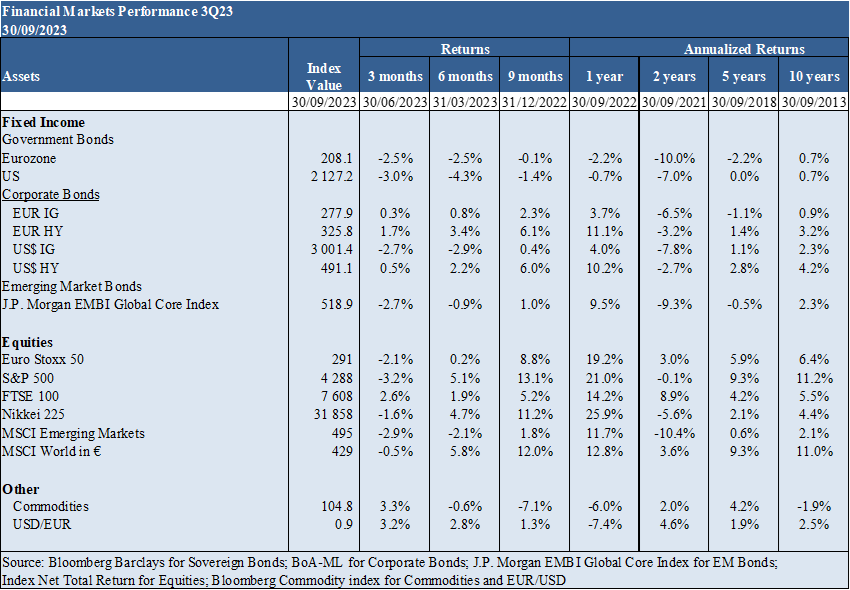

3Q23 Markets Performance : Equity and bond markets in a sideways movement and without a defined direction, in a typical period of illiquidity.

Macro Context: Low levels of global economic growth. Tighter-than-expected inflation makes further declines more difficult. Economic growth in China is lower than expected, with high youth unemployment, problems in the real estate sector and in enveloped savings products. Dollar remains strong.

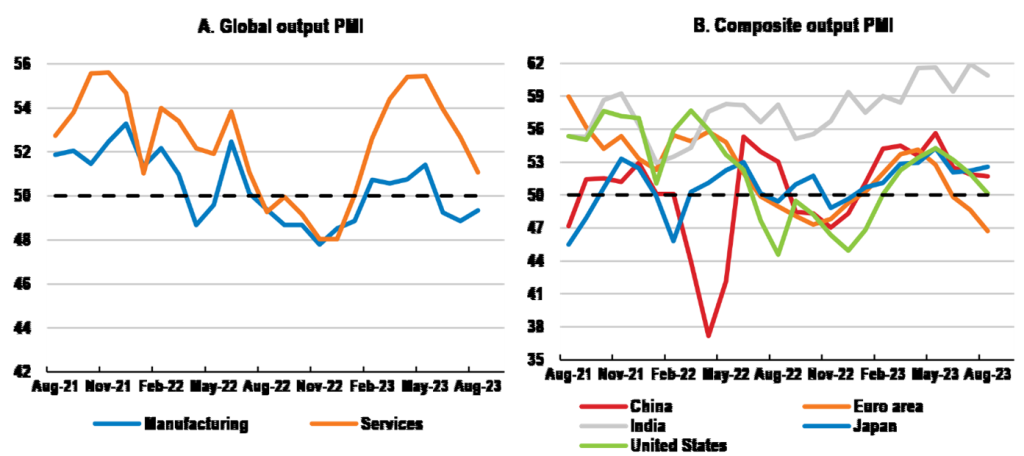

Micro Context : Leading instantaneous and advanced economic indicators stabilize at low levels around the world.

Economic policies: Central banks in the U.S. and Europe will keep interest rates high for a long time.

Stock markets: The US stock market is at an impasse, after the rally of the US “mega caps” in the first half of the year, without much follow-up from the other capitalizations, and awaiting indications of the earnings season that is now beginning.

Bond markets : Long-term government bond yields in the U.S. and Europe are at 15-year highs, with credit spreads remaining at historically low levels.

Key opportunities: Negotiated term of the war in Ukraine, with very low probability.

Main risks : Possibility of economic downturn in Europe due to high energy costs and high interest rates, aggravated by increased global economic fragmentation. China’s slowdown. Sudden conflict instability in Israel.

Long-term interest rates at 15-year highs in Western countries favor bond investments, especially in the US, UK and Europe, and decreased economic uncertainty improves the prospects for investing in stocks of quality companies with lasting competitive advantages.

Financial market performance 3Q23: Equity and bond markets in a sideways movement and without a defined direction, in a typical period of low liquidity.

Directionless equity and bond markets in a quarter of low volumes and with long-term interest rates at 15-year highs

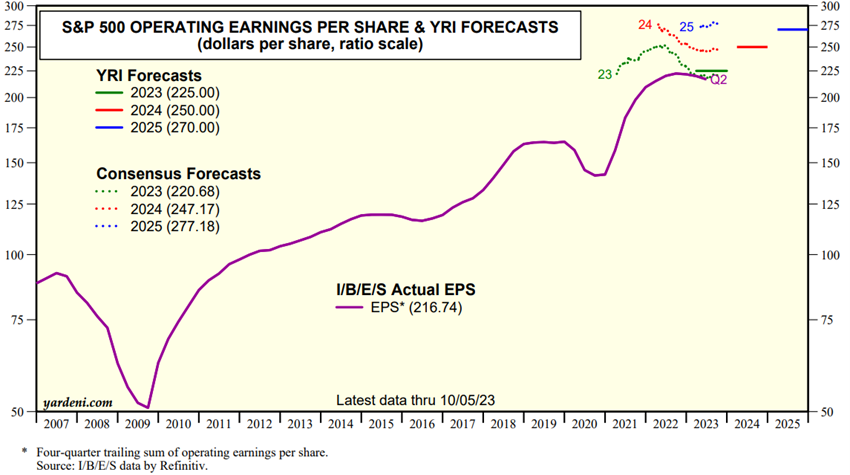

The Q2 earnings season was subdued, following the Q1 rally of large technology companies and those linked to artificial intelligence.

All major stock indexes fell slightly.

Bitcoin also suffered slight losses.

Macroeconomic context: Low levels of global economic growth. Tighter-than-expected inflation makes further declines more difficult. Economic growth in China is lower than expected, with high youth unemployment, problems in the real estate sector and in enveloped savings products. Dollar remains strong.

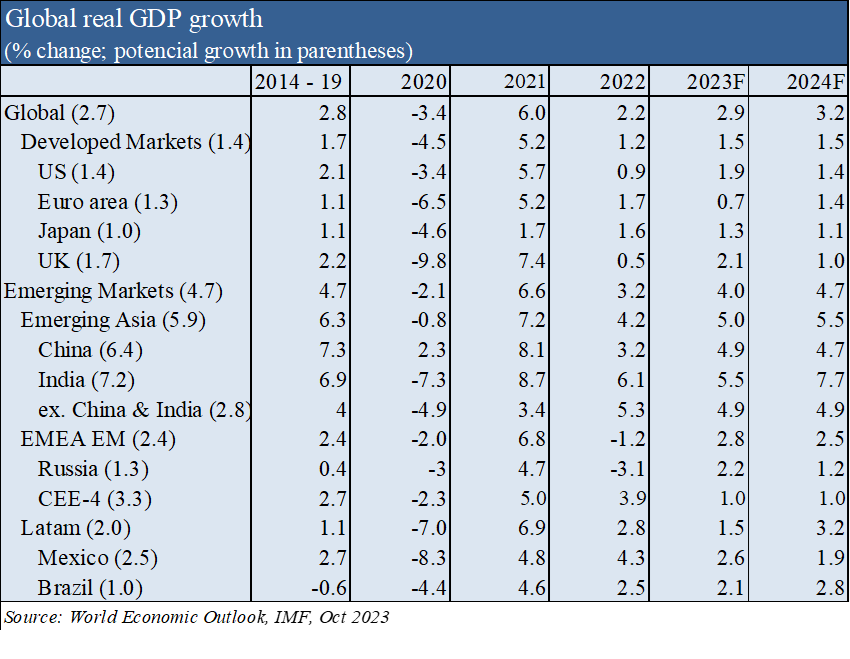

Global economic growth forecasts are maintained to 3.0% in 2023 and 2.9% in 2024, with 1.9% and 1.4% in the US, 0.7% and 1.4% in the Eurozone, 4.9% and 4.7% in China, respectively, below the long-term average.

The Eurozone narrowly missed out on a technical recession in the first half of the year, and this scenario is increasingly likely to come to fruition in the short term. However, the central question is not the possibility of a recession, but rather whether the depth of it will be as low as expected, since unemployment is at historically very low levels and companies are well capitalized.

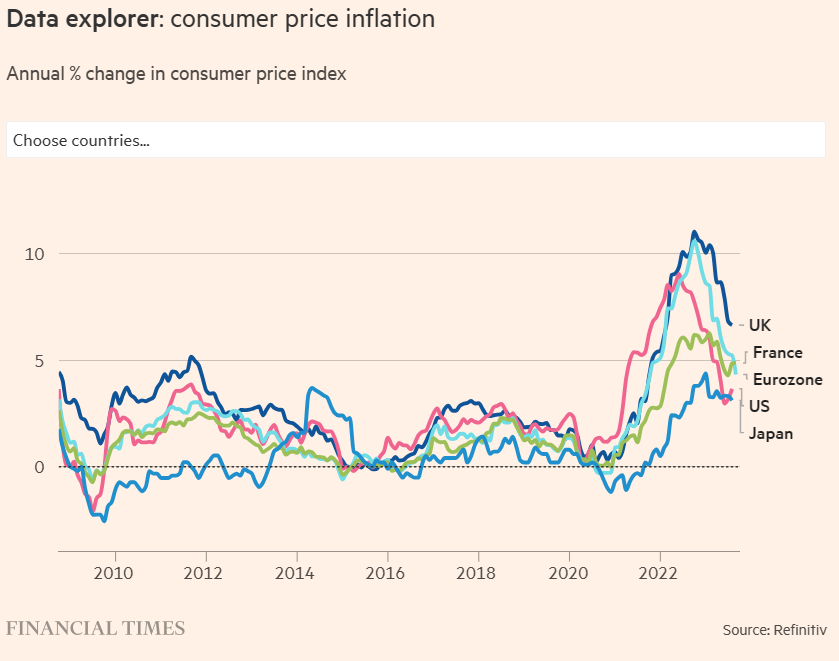

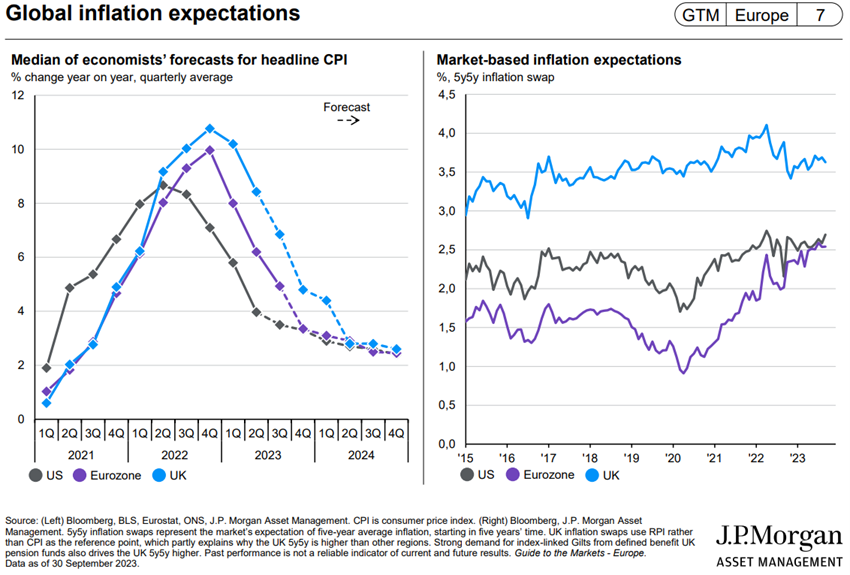

The downward path of core inflation in the US and Europe was halted in the quarter due to increases in energy and services prices, high margins in some sectors and pressure on the labour market.

Core inflation remains high, at 3.7% in the U.S. and around 5% in Europe, and stickier than expected by policymakers.

According to the IMF, headline inflation is expected to decline from 9.2% in 2022 to 5.3% in 2023 and 4.8% in 2024.

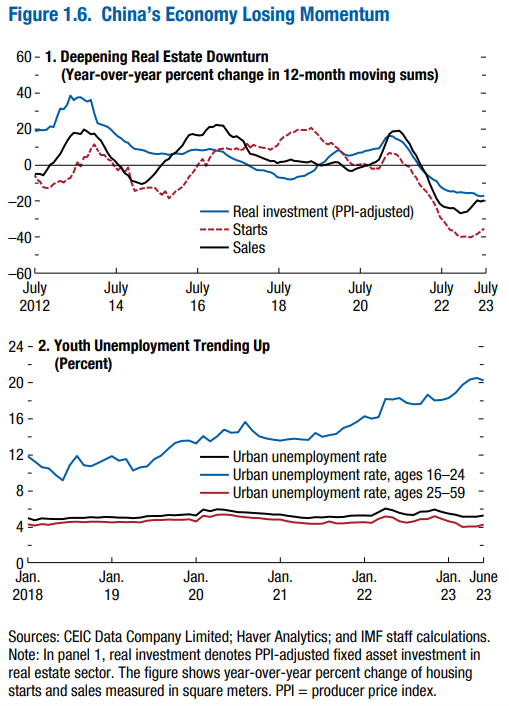

China is at a crossroads, with growth below 5% and lower than predicted by the authorities, and a far cry from the average of 9% per year over the past four decades.

In addition, it has high youth unemployment, and a worsening risk of two important sources of wealth, the real estate sector (fall in property prices and solvency of large companies) and the financial sector (losses in bank loans and failures in the repayment of enveloped savings products).

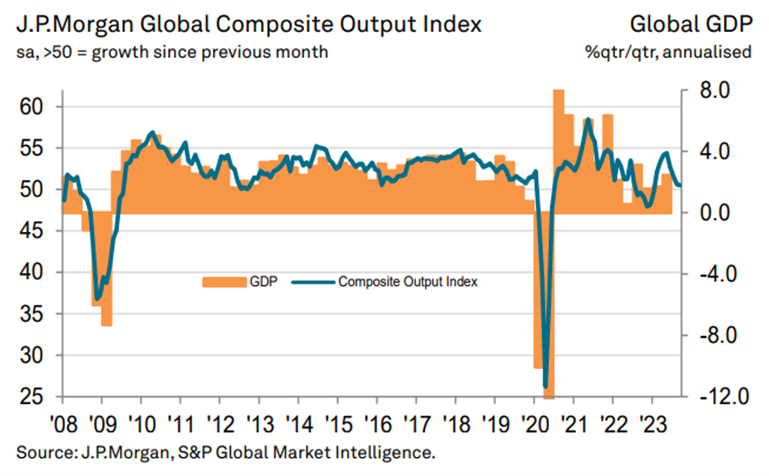

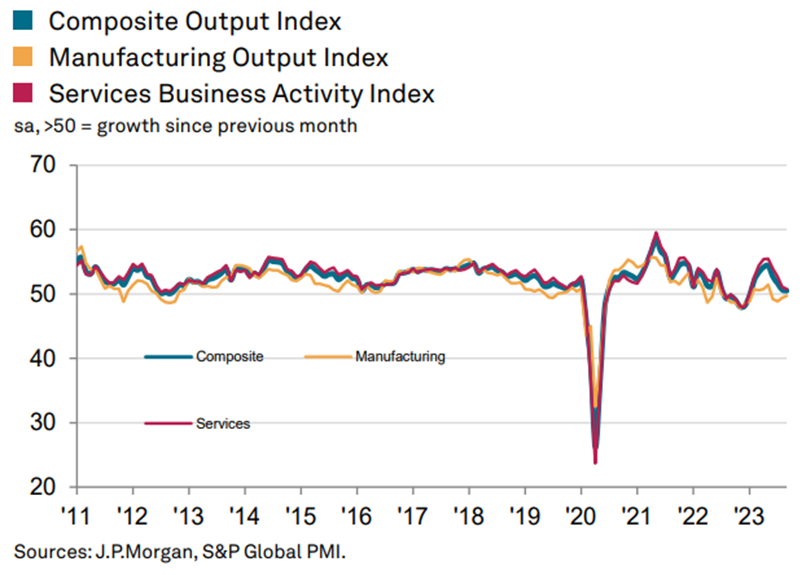

Microeconomic context: Leading snapshot and leading economic indicators stabilise at low levels worldwide.

Industrial production remained the main drag on global economic growth, contracting for the fourth consecutive month.

The global services sector also slowed in September to its lowest level in eight months.

8 of the 13 countries that make up the global PMI showed expansion, including Russia, Japan, China and the US.

The weakness was largely concentrated in the euro area, where output fell for the fourth consecutive month, notably Germany, France and Italy. The United Kingdom and Brazil also saw declines.

The unemployment rate in the U.S. is at 3.8%, levels close to the lows.

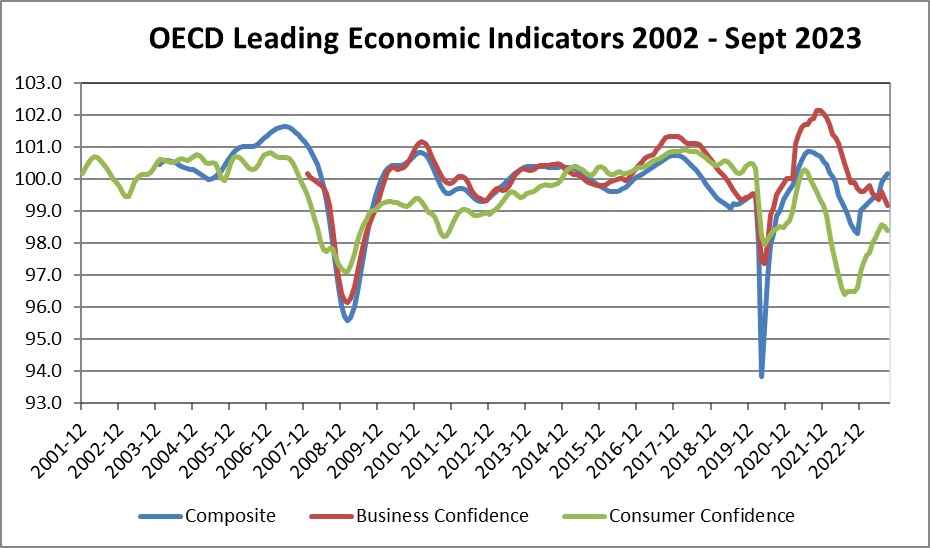

Business and consumer confidence in OECD countries has improved.

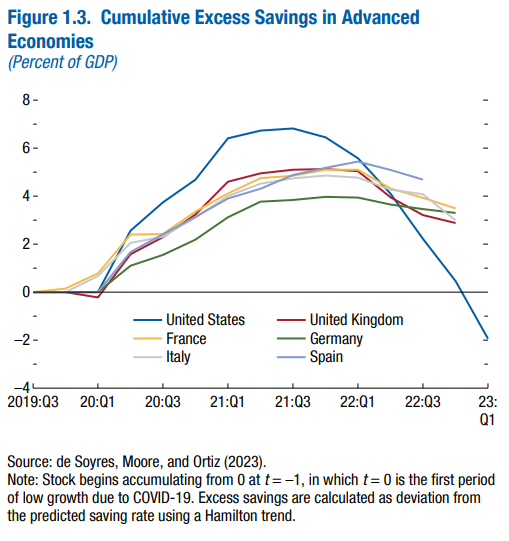

U.S. businesses and households show financial strength and resilience.

The excess savings generated in the pandemic are still underpinning households’ resilience to the crisis of the rising cost of living in advanced economies.

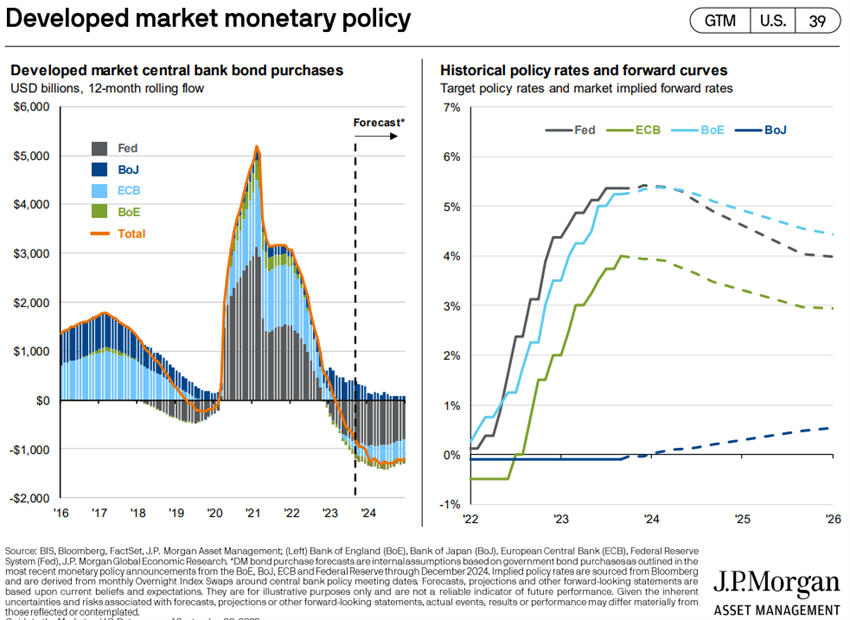

Economic policies: Central banks in the U.S. and Europe will keep interest rates high for a long time.

The central banks of the US and Europe say they will keep official interest rates at a high level for an extended period, due to the greater difficulties in continuing the path of the decline in inflation from current levels to the 2% target.

The Fed kept the official interest rate unchanged in September, setting it at 5.25%%-5,5%

The FED projections point to a rise in this rate to 5.6% at the end of 2023, 5.1% in 2024, 3.9% in 2025, and 2.9% in 2026. It admits that unemployment could reach 4.1%, down from 4.5% in March.

The Bank of England kept the official interest rate at 5.25%.

The ECB raised the refinancing rate to 4.5%. It forecasts inflation of 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025.

Assessment of stock markets: The US stock market is at an impasse, after the rally of US “mega caps” in the first half of the year, with no follow-up of the remaining capitalizations, and awaiting indications of the earnings season that is now beginning.

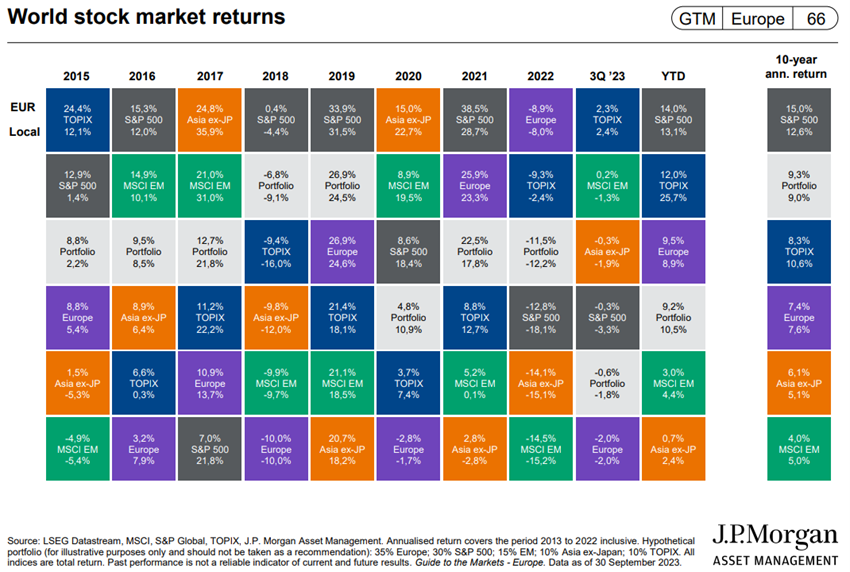

Equity markets fell in Q3 after rallying in the first 6 months of the year due to rising interest rates.

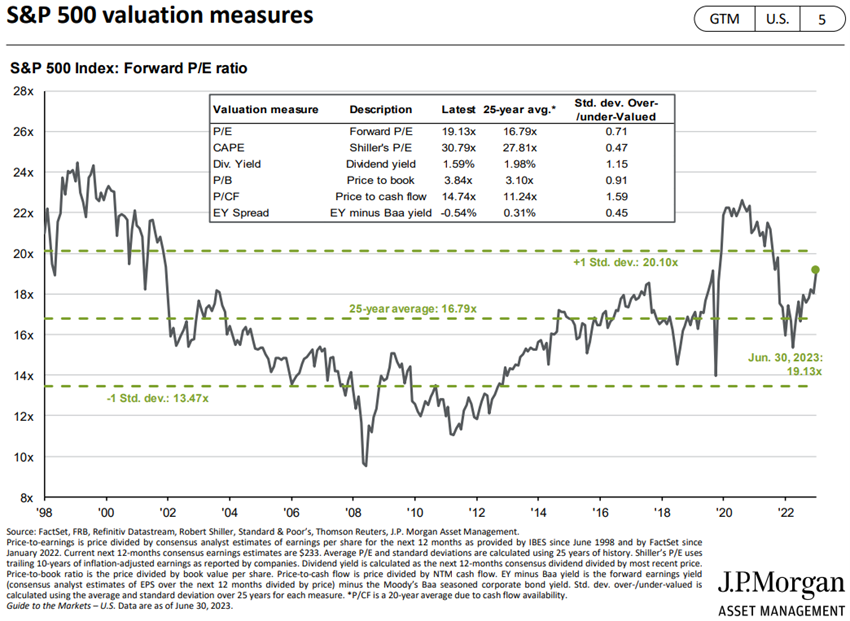

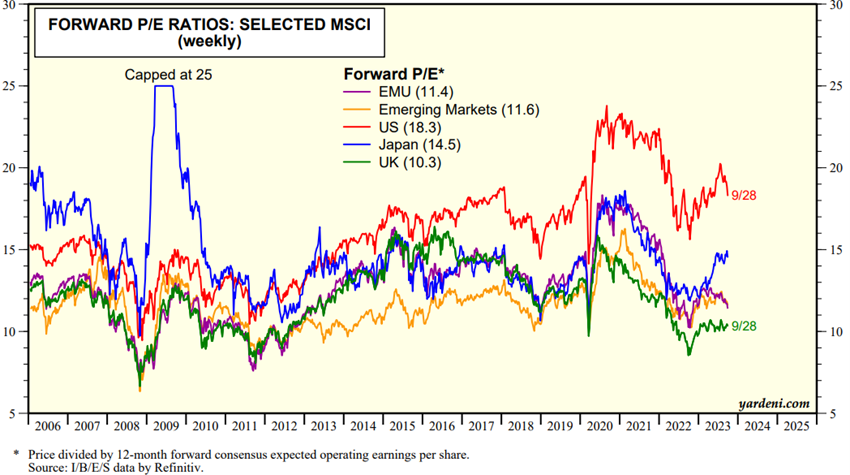

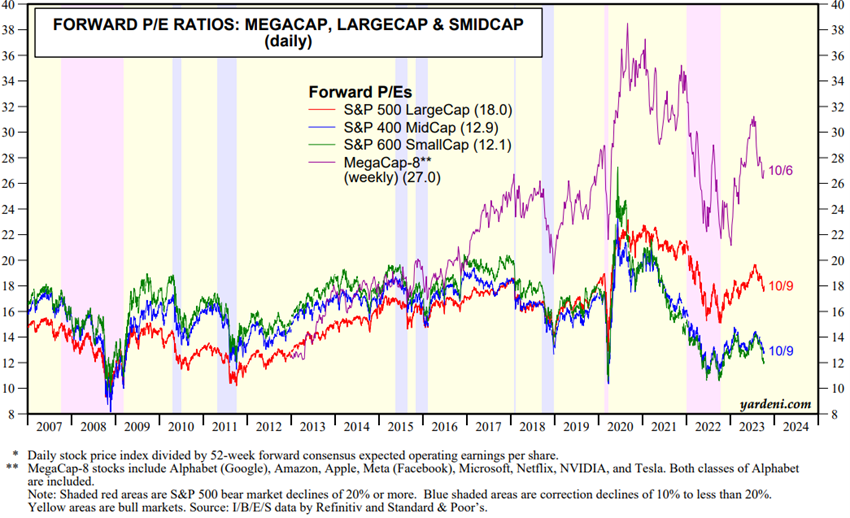

The 18.3x forward PER for the U.S. is above the long-term average, falling to 16x without the FAANGM or MegaCaps.

The PER of the remaining regions declined slightly to 11.4x in the Eurozone, 14.5x in Japan, 10.3x in the UK and 11.6x in emerging markets, all of which are below the historical average.

The PER of mid-cap and small-cap US stocks is at 12.9x and 12.1x, respectively, below the long-term average.

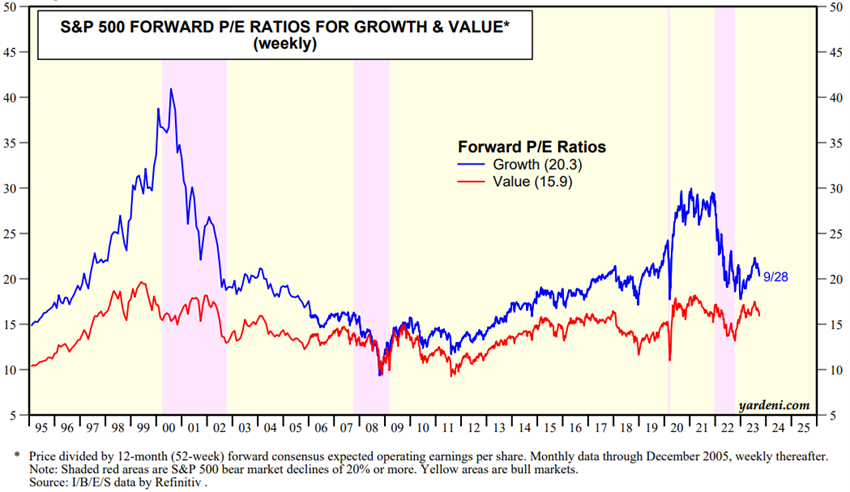

The PER of growth U.S. stocks is at 20.3x and that of value stocks is at 15.9x.

U.S. markets with no defined meaning, in the process of managers and investors adjusting to higher interest rates for longer, in a context of financial robustness and resilience of households and companies, and high concentration of indices (weight of 30% of the largest capitalizations in the S&P 500).

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, Oct 4, 2023

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, October, 9, 2023

Source : Stock Market Briefing: Selected P/E Ratios , Yardeni Research, October, 9, 2023

Source: Stock Market Briefing: Selected P/E Ratios, Yardeni Research, October, 9, 2023

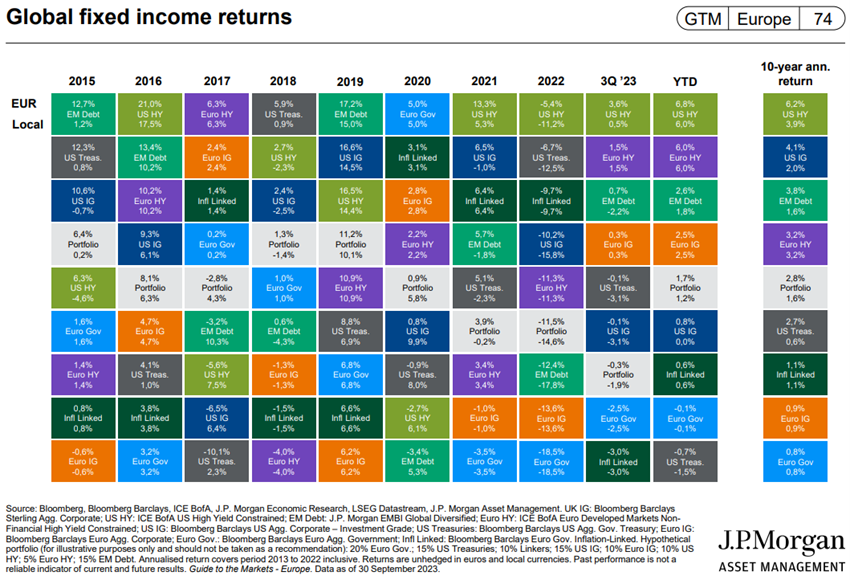

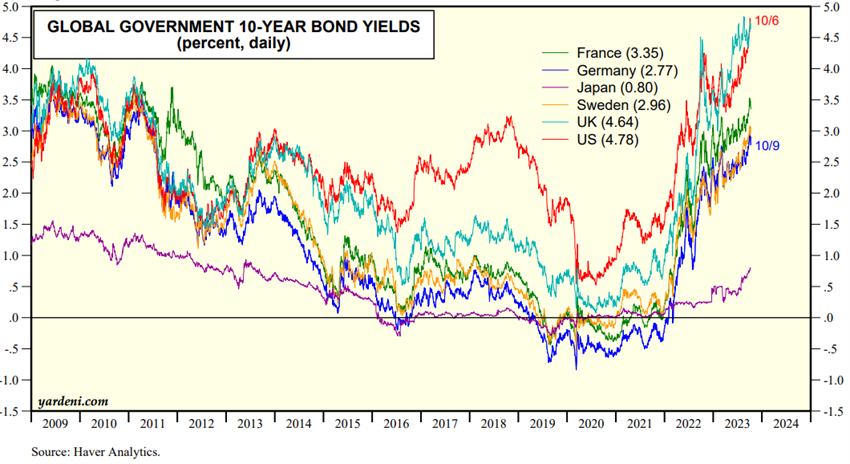

Bond market assessment: Long-term government bond yields in the U.S. and Europe are at 15-year highs and credit spreads remain at historically low levels.

Long-term risk-free interest rates continued to rise in the United States, the United Kingdom and the euro area, reaching new 15-year highs, causing slight devaluations in bond investments.

Interest rates on 10-year US treasury bonds rose from 3.3% in April to 4.5% today (and 2-year bonds from 3.8% to 5.5%), and also increased in the largest European countries (2.8% in Germany, 3.3% in France and 4.3% in the UK).

Interest rates on 30-year U.S. government debt are at 4.7%, the highest since 2007.

Credit spreads in the U.S. and Europe remained stable.

U.S. and European investment-grade bonds trade at interesting levels in the medium and long term.

The less liquid segments of the credit market remain vulnerable.

Source: Market Briefing: Global Interest Rates, Yardeni Research, October, 9, 2023

Source: Market Briefing: US Bond Yields, Yardeni Research, October, 7, 2023

Key opportunities: Negotiated term of the war in Ukraine, with very low probability.

Main risks: Possibility of economic recession in Europe due to high energy costs and high interest rates, aggravated by increased global economic fragmentation. China’s slowdown. Sudden conflict instability in Israel.

Increased likelihood of recession in Europe in the short term, due to high inflation, high interest rates, the prolongation of the war in Ukraine, and the determination of monetary authorities to keep interest rates high for a longer period.

Slowdown in economic growth in China due to problems in the real estate sector.

There is a possibility of an inflationary spiral through rising wages in the US, given the pressure on the labour market.

The constant threats of a shutdown in the U.S., with increasing political polarization in anticipation of next year’s elections, in the context of a deficit of 7% and a public debt-to-GDP ratio of 120%, increase the likelihood of a revision of the credit rating of the U.S. economy.

The main geopolitical risks are the strategic competition between the US and China and the possible NATO-Russia conflict.

Israel’s sudden conflict stemming from the Hamas terrorist attack has developments that are still uncertain, but they are a new factor of instability.

The strong dollar increases emerging market risks.