Who can invest in high-yield bonds?

The core and satellite strategy in investing in high-yield bonds

How to evaluate investment in high-yield bonds

How to invest in high-yield bonds?

In the first part of these articles we saw what “high-yield” bonds are and their historical performance.

In the second part we looked at the size and growth of the market, its valuation cycles and the advantages and drawbacks of investing in high-yield bonds.

Having said that, in this third part we are in a position to address what the investment in these bonds is for and how this asset subclass can be invested.

Who can invest in high-yield bonds?

High-yield bonds have an asymmetric nature of risk, in that the potential for price appreciation is often limited by the fact that they are typically repaid to the pair at maturity (or earlier if requested by the issuer).

In the meantime and over the life of the bonds, defaults can trigger significant capital losses and wipe out higher coupon gains, resulting in a disproportionate impact on the downside.

In the previous articles that “high-yield” bonds are a hybrid between stocks and bonds, with a performance profile more similar to stocks, having a little less profitability and less risk (lower volatility and drawdowns).

We have also seen that their performance is very much determined by the economic and credit cycles.

In fact, defaults are an integral part of investing in this asset subclass, as the following chart shows when comparing developments in implied returns and default rates:

To that extent, investments in high-yield bonds are generally considered better suited to investors who are aggressive or in search of higher yields and willing to take on higher levels of risk in exchange for potentially higher returns.

On the other hand, conservative investors, who prioritize capital preservation and have a lower risk tolerance, prefer more stable, lower-risk investments.

In addition, investors in high-yield bonds should have more developed knowledge and experience in financial investments, and preferably specialized in credit markets.

Basically, we believe that non-conservative investors can maintain a long-term allocation to the asset class of high-yield bonds, with the aim of taking advantage of their attractive yield over time, if they are supported by this risk management capability.

The core and satellite strategy in investing in high-yield bonds

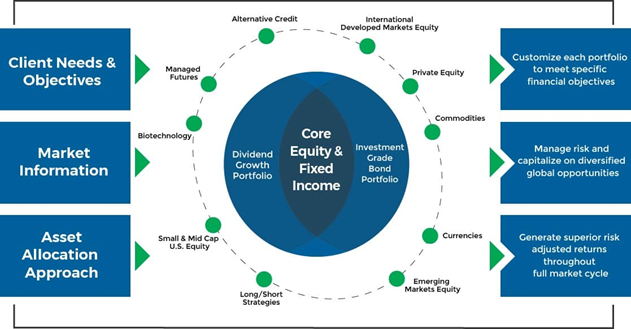

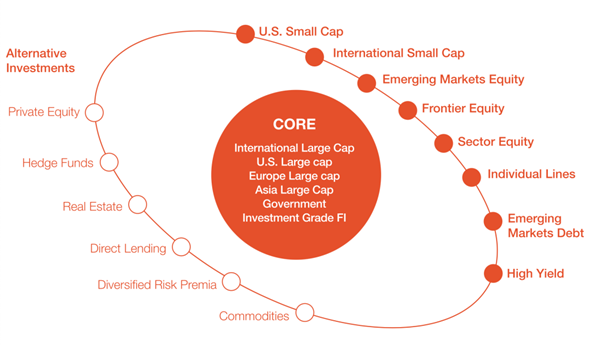

High-yield bonds should integrate the satellite component into an investment portfolio built on the core and satellite strategy we saw in a previous article.

The core component of the investment portfolio serves to bring stability and mitigate risk, and the way to achieve this is through diversification and disciplined investing.

For good diversification, the core portfolio should contain a combination of asset classes (both stocks and bonds) from various sectors and geographies, and including ETFs that track major indices such as the S&P 500, as well as globally diversified investment funds.

The satellite component of a person’s portfolio is invested in sectors or themes that can potentially outperform in the short and medium term, which may consist of sector-specific stocks, bonds, ETFs or investment funds and/or even options and futures.

Regular investment in a diversified nuclear portfolio reduces long-term costs and eliminates the temptation to give in to emotions.

In addition, having positions in your satellite portfolios allows you to take advantage of market opportunities in the short term and still have the possibility to outperform the market.

The “core” component of the core portfolio gives stability, and the satellite brings opportunity.

In this investment we must resist the temptations that the market sometimes puts at us.

Until recently, when we lived in a time of very low interest rates for a prolonged period, many investors, in search of more yield, could not resist the temptation to increase their exposure to these securities.

Similarly, a short time later, at the end of last year, many of these same investors sold everything they invested in high-yield bonds in the face of the devaluations recorded.

Usually, these attitudes of trying to chase the market do not work. Most often, the consequence is losses. This is not to say that investors should not make adjustments to the portfolio. However, these adjustments should not be drastic or profound, but rather small and gradual.

How to evaluate the investment in high-yield bonds?

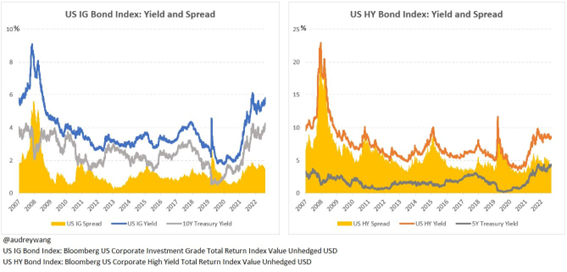

In mid-August, the implied rate of return on investing in investment-grade U.S. bonds was 5.8 percentile, which puts it in the 91 percentile. The spread was 160 bps, at the 77% percentile.

The implied rate of return on high-yield bonds was 8.7%, at the 79% percentile since 2008. The spread was 430 bps, which historically is the 34% percentile.

For reference rates, the implied yields on 5- and 10-year government bonds were at 4.3% and 4.2%, respectively, both in the 100% percentile, the highest level since 2008.

This means that investing in government bonds and investment-grade corporate bonds provide interesting returns, while high-yield bonds are not pricing in a significant recession risk.

The assessment of investment conditions in high-yield bonds includes historically comparing the implied rates of return and the foreseeable prevailing and foreseeable probabilities of default.

The economic environment in terms of growth and interest rates, the structure and distribution of bond ratings, the maturity profile, the degree of leverage and the weight of debt service charges are other factors to consider.

How to invest in high-yield bonds?

Recognizing that defaults are an inherent part of the asset class, the purpose of investing in high-yield bonds is not necessarily to completely avoid the risk of default.

Instead, the goal is to understand and measure the key sources of risk and then look for an appropriate level of compensation through a return (or spread) on the risk-free rate to offset that risk.

Investors should seek to manage the risks of high-yield bonds by diversifying their holdings among issuers, industries and regions, and by carefully monitoring the financial health of each issuer.

If they are not able to do so individually, there is the option of working with an expert investment advisor with experience in bottom-up credit analysis and a strong track record of selecting long-term securities.

Considering the risk of default, collective investment in a diversified set of these bonds is more appropriate than investment in individual securities.

Thus, diversified investment funds specialized in high-yield bonds, whether actively managed, liabilities or indexed, should be preferred.

The existing offer in the market is large and varied, as all the world’s large management companies have funds in this asset category, which are traded in various geographies.

In the following link we find some of the main funds traded in the USA:

https://www.morningstar.com/high-yield-bond-funds

In the Tools folder we will publish information about some of the largest “high-yield” funds for American and European investors.