#1 Core investment portfolio and satellite investment portfolio

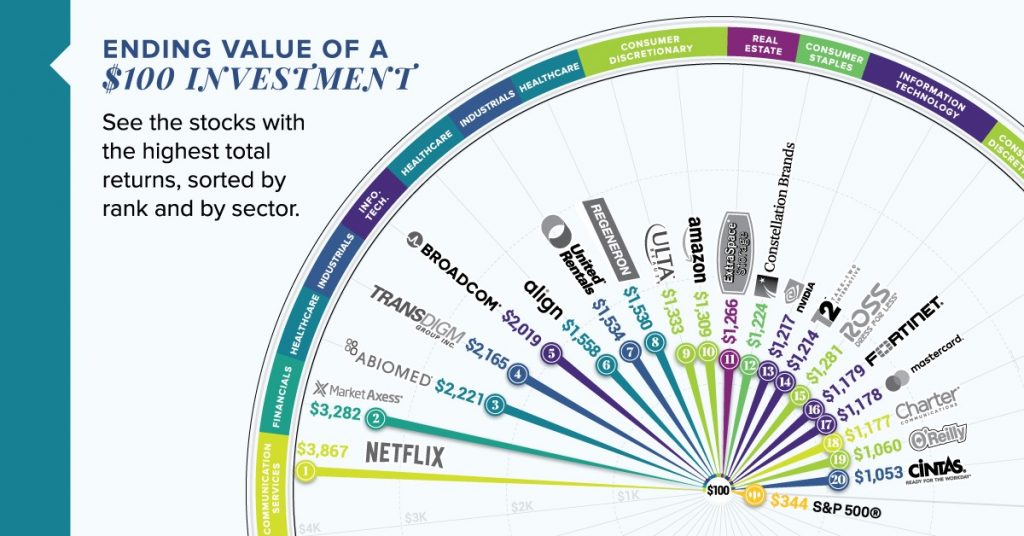

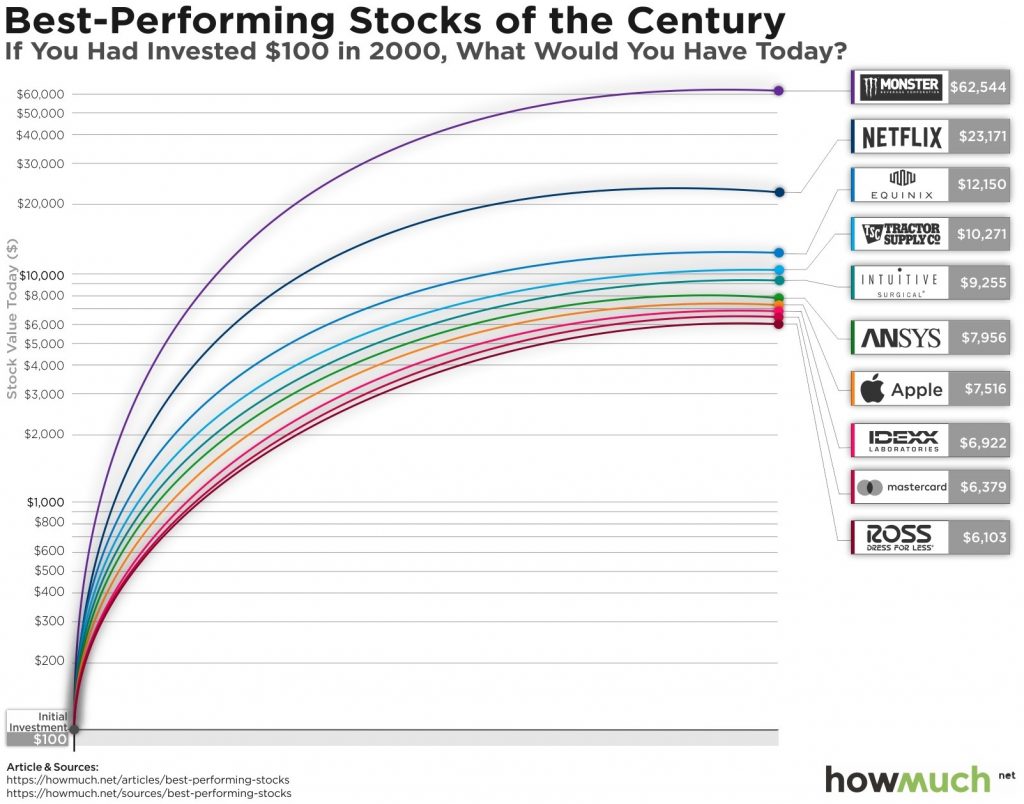

#2 Long-term investment and average annual profitability target of 1.5 to 2 times that of the stock market

#3 Percentage of financial assets in the satellite portfolio from 20% to 33%

#4 Breakdown of the satellite portfolio by individual investments in predefined lump sums or percentage weights

#5 Common sense helps to start defining the object of investments

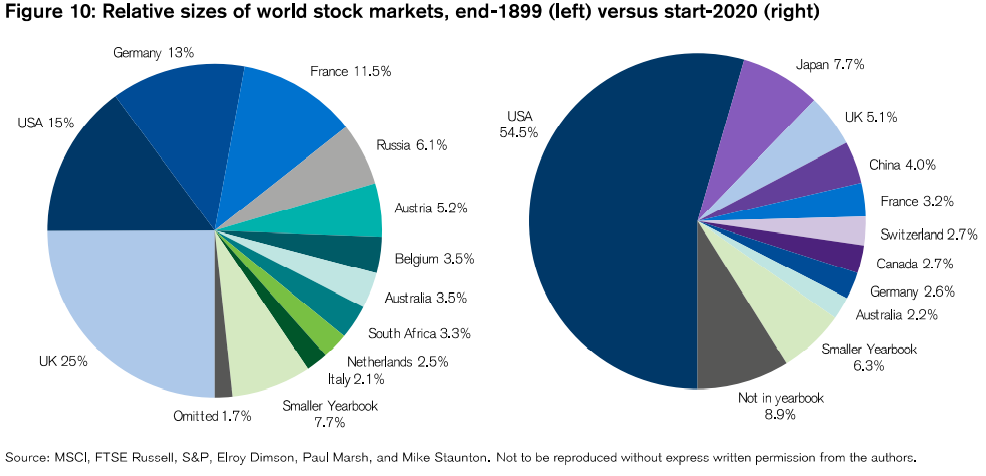

#6 Alignment to the weight of geographic markets allows you to fine-tune this object a little more

#7 The structure of capital markets in terms of stock market capitalization is also an element for tuning

#8 The usefulness of multiple stock listings in the market

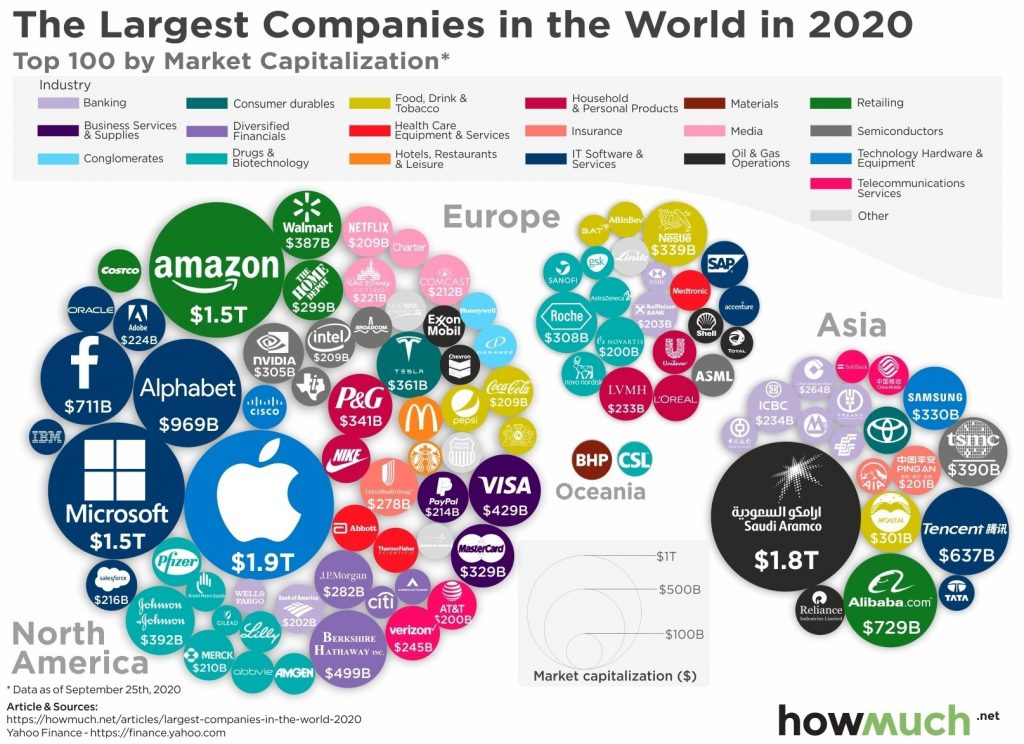

#9 Market size, activity sectors and global trends

#10 Focus on generating value through lasting and sustainable competitive advantages

#11 The importance of price below fair value and the safety margin

#12 The use of stock screens

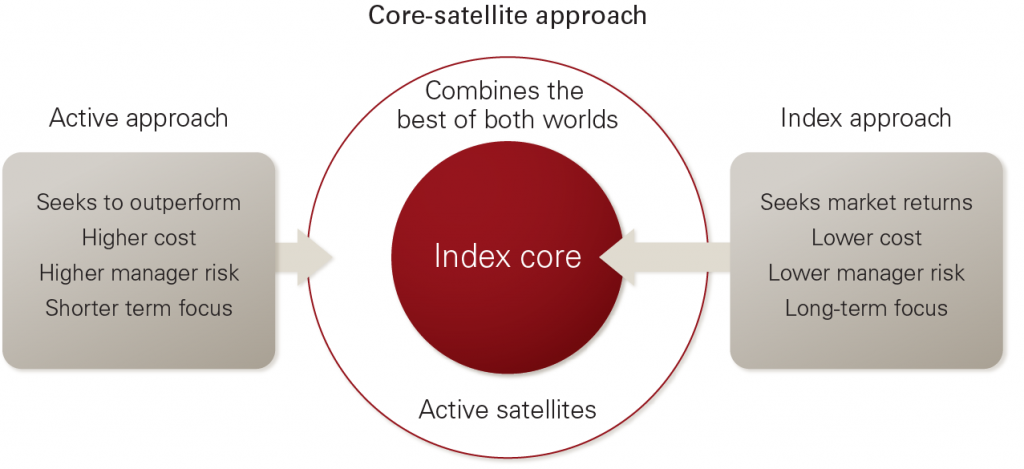

In a previous post we saw that it is worth complementing our core investment portfolio composed of indexed funds from the main global assets and markets with a portfolio of active management satellite investments, including direct investment in some stocks of high-performance companies in the medium and long term.

It’s so-called vintage actions or secular growth.

There are tens of thousands of stocks around the world to choose from. How to make the selection?

We can start with a blank sheet and write company names that tell us something.

Another option is to follow the lists or investment recommendations of market analysts of major investment banks and other large investment houses.

Another hypothesis is to listen to the opinions of the investment gurus of the main asset managers. We can know the opinion of both on the television channels CNBC or Bloomberg.

We also have the alternative of listening to the ideas and advice of friends and family who are more knowledgeable and specialized in these matters.

All this makes sense, and should be used, but to be less confused and more objective we can try to introduce some order.

Therefore, we will adopt an approach and a structured method for the selection of direct investment in individual stocks, realizing that for this exercise to be done well it must observe some rules and criteria.

#1 Core investment portfolio and satellite investment portfolio

The first one we have already mentioned, but it is never too much to repeat so that we do not forget.

These are secondary or complementary investments, as opposed to core or major ones. They don’t replace them, but they complement them.

Core investments should be those indexed to key, low-cost geographic assets and markets. Direct investment in stocks is a complement or a satellite of those indexed investments.

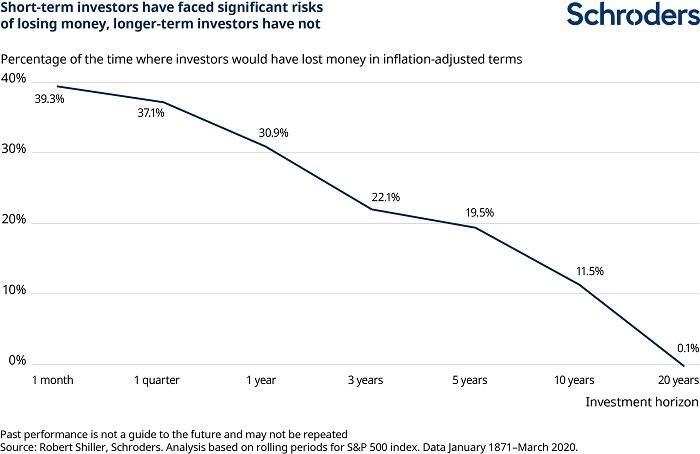

The direct investment in stocks that we advocate is very long-term, for periods of 20 to 30 years.

The common investor is considered to have neither the knowledge, nor qualifications nor the capacity to generate a higher return on more speculative investments.

Moreover, if a short-term horizon were admitted, the risk of securities selection would be added to the risk of choosing the market investment time, which proved to have poor results for the individual investor and even for professionals.

With regard to profitability, the target must be ambitious, not only to compensate for the risk of diversification but also to help to have discretion in the choice of investments.

In the previous article we saw the returns that some of the best stocks have provided in recent decades.

Thus, the average target annual returns of each investment should be 15% to 20% per year, i.e. 1.5 to 2 times that of the market in general.

In a previous article we saw that investing in a stock with 20% annual returns is equal to investing in 13 stocks with returns of 10% (or market average) for 30 years.

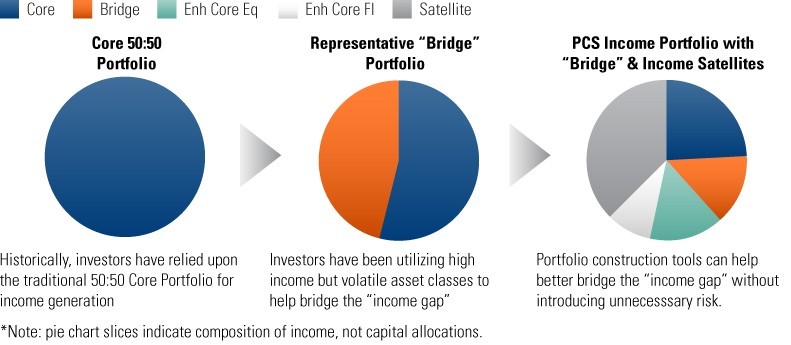

#3 Percentage of financial assets in the satellite portfolio from 20% to 33%

As a corollary of this rule, it is necessary to define what percentage of the assets to be affected by it, which depends on each person.

This percentage depends on the knowledge, experience, capacity and availability of each person to carry out the active management of investments.

In any case, we consider that this supplementary or satellite investment should not exceed 20% to 33% of the assets invested.

The next question is how we should split this amount.

Investments will logically be more concentrated, even to extract their benefits. However, there must be some diversification to increase the chances of success.

The possibilities of distribution are many. From investing a predefined lump sum in each company, for example $1,000, to establishing that between 10 and 20 individual investments will be made, each representing between 5% and 10% of the portfolio.

#5 Common sense helps to start defining the object of investments

The following is the aspect of where to invest, that is, which universe of targeted investments.

Next, to choose individual stocks we have to observe the following 3 principles of common sense.

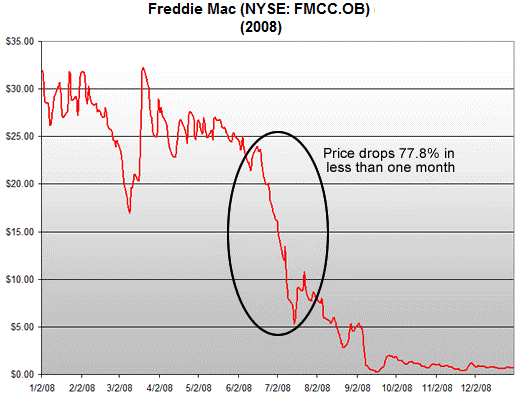

First, we avoid stocks with great volatility. We never invest in low unit value stocks, so-called “penny stocks”, stocks with sharp losses or falling knives, or stocks with sharp appreciation or chasing stocks.

Second, we invest in companies that we perceive and have a lasting competitive advantage.

Third, we determine the value of the stock and buy the shares with some margin of safety

In the next articles we will see how we can analyze the competitive advantages and discuss the main methods of evaluating stocks.

#6 Alignment to the weight of geographic markets allows you to fine-tune this object a little more

It is also useful to have a geographical focus. For the investor in general, who has no knowledge advantage in relation to the stocks of his hpme country, it is best to adopt the criterion of the weight of the world stockmarket.

The US has a weight of more than 60%, Japan 10%, the Eurozone 15%, and everything else 15%. In this logic, the US must have a representation in investments of 6:10, and so on.

It makes perfect sense that the US has a predominant weight, even higher than its weight in global indices. Besides being the largest market in the world, the US is the most efficient, the one with the most information and the one with the largest number of companies with the largest capitalization in the world and the highest growth in valuations.

Investment in stocks of large, medium or low-cap companies has associated varying degrees of risk.

The choice of the capitalization grid should be balanced for two reasons.

On the one hand, since this investment is not very diversified, it is considered that one should try to avoid very small capitalizations, for example less than $1Bn. Moreover, in general, the smaller the company, the less information there is on it and the more difficult it is to do the analysis.

On the other hand, it is also difficult to predict that mega capitalisations will deliver the higher long-term returns that we aim for

Preferably they should be companies that have positive earnings and strong growth.

In the following links we obtain synthetic information about a a a stocks that are part of the main global stock index, the S&P 500:

https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

https://fknol.com/list/market-cap-sp-500-index-companies.php

#8 The usefulness of multiple stock listings in the market

The stock lists of the market can be another element of the set-up of the universe.

These lists are useful not to be followed blindly, but rather because they contain relevant information in themselves. They are companies that are the subject of news and commentary, therefore, are in the target of information from market investors, either because they have already valued themselves or because their potential can be high. What is needed is for the investor to form and have a critical spirit towards them.

We have lists of the S&P 500 stocks that have been the most valued in the last year, 3 years, 5, 10, 20 and 30 years, or since its inception. We also have lists of the recommendations of financial analysts, gurus, managers, family and friends. All this information arrives daily through personal contacts, or is accessible by internet or television.

In other articles we will see some of these lists of stocks

#9 Market size, activity sectors and global trends

Companies must act or be able to operate in large markets so that their growth can expand with market growth and the company can benefit from economies of scale. Thus, companies should preferably have a global scale.

Not all sectors of activity offer the same valuation possibilities. For example, companies in the technology sector are more attractive at first than companies in the raw materials or building materials industries.

Global trends are also important. Demographics by old aging and generational wealth transfer, climate change and transport, mobility, digitisation and communication, health sciences, leisure and well-being are factors that alter markets, create new markets and are the subject of unceasing innovation with new business projects.

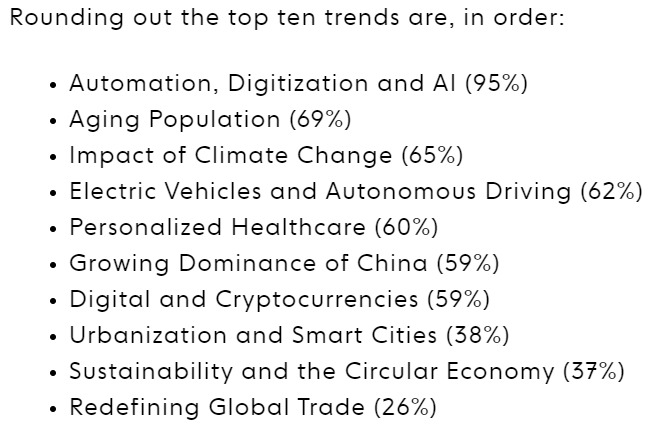

In a survey conducted in 2020, the world’s leading professional asset managers indicated the following 10 major global trends relevant to investment:

#10 Focus on generating value through lasting and sustainable competitive advantages

‘It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price’ – Warren Buffett

The focus on choosing companies should be the selection of businesses with lasting and sustainable competitive advantages.

In a subsequent article, we will present the aspects that are the main determinants of sustainable competitive advantages.

#11 The importance of price below fair value and the safety margin

Long ago, Ben Graham taught me that – Price is what you pay; value is what you get. Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. – Warren Buffett, 2008 letter to the Berkshire Hathaway’s shareholders

‘The three most important words in investing are margin of safety’ – Warren Buffett

Competitive advantages are necessary conditions, but they are not enough.

In the same way that it is not worth buying companies without advantages at a low price it also makes no sense to invest in companies with competitive advantages, but at an excessive price.

The price should take as reference the fair value of the company in the value of the acquisition and with some margin of security. That is why it is necessary to master the basic criteria for evaluating companies.

This will also be examined in a following article in which we will address business valuation issues.

If we have time and want to go further we can use the available market information screens applications, some of which are free.

One of the entities is Morningstar and its public information for Apple is as follows:

We’ll present these apps in a next article.

https://www.morningstar.com/stocks/xnas/aapl/quote

In summary, we have a total of 12 rules or steps to select individual actions.