The best performing stocks of the S&P 500 in the last 30 years

The best US performing stocks in the last 10 and 20 years

The best US performing stocks of all time

Are there patterns in these companies or secular grpwth or vintage stocks?

The challenge of investing in these stocks is much greater than it seems at first glance. It is not enough to identify companies, which is already very difficult, but it is also necessary to have the courage to maintain investment for many years

The stocks with the highest potential in the next 20 to 30 years

S&P 500 stock returns since 1926 to date have been 9.5% per year, and in the last decade, between 2010 and 2020, were slightly higher and around 13.6%.

These returns are quite good, but there are of course actions that do better.

This is what we will discuss in this article because small returns differences are large capital appreciation differences over many years.

The best S&P 500 performing stocks in the last 30 years

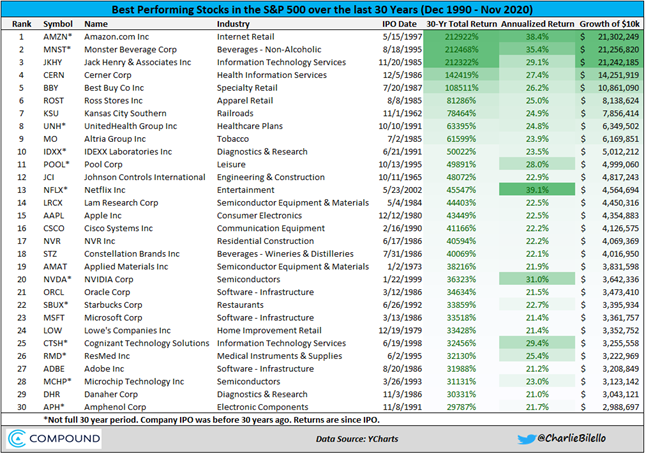

The following table shows the best performing S&P 500’s stocks in 30 years between December 1990 and November 2020 and the initial investment appreciation of $10,000 in each of these companies (assigning asterisk those that were the subject of initial subscription offer during the period):

There are 30 companies in 30 years, in which – it is important not to forget – three crises followed, the technology bubble in 1999-2000, the subprime in 2007-08 and the pandeminin in 2020.

In the worst case, Amphenol’s investment of $10,000 would have resulted in nearly $3 million over 30 years, corresponding to an average annual profitability of 21.7%.

In the best case, Amazon, this investment would now be worth $21.3 million, providing an average annual profitability of 38.4%.

By the way, the same $10,000 investment in the S&P 500 index companies would have provided an average annual return of 9.87%, resulting in capital of $168,000.

The gains would be at least 17.8 times more than those provided by the average profitability of the index.

Some names are well known to everyone, and little surprise. Amazon, Netflix, Apple, Microsoft, Starbucks, UnitedHealth, Cisco, Nvidia and Oracle are listed.

Others are less well known, such as Monster Beverage, Jack Henry, Cerner, or even wonder, such as Best Buy, Ross Stores, Kansas City Southern and Altria.

These are not technology or cutting-edge companies. They are companies in traditional sectors, consumer goods, rail transport and even tobacco. In fact, although there are many companies in the technology sector, there is a diversity of sectors represented.

We will now see companies that have valued themselves more in other periods.

The best US performing stocks in the last 10 and 20 years

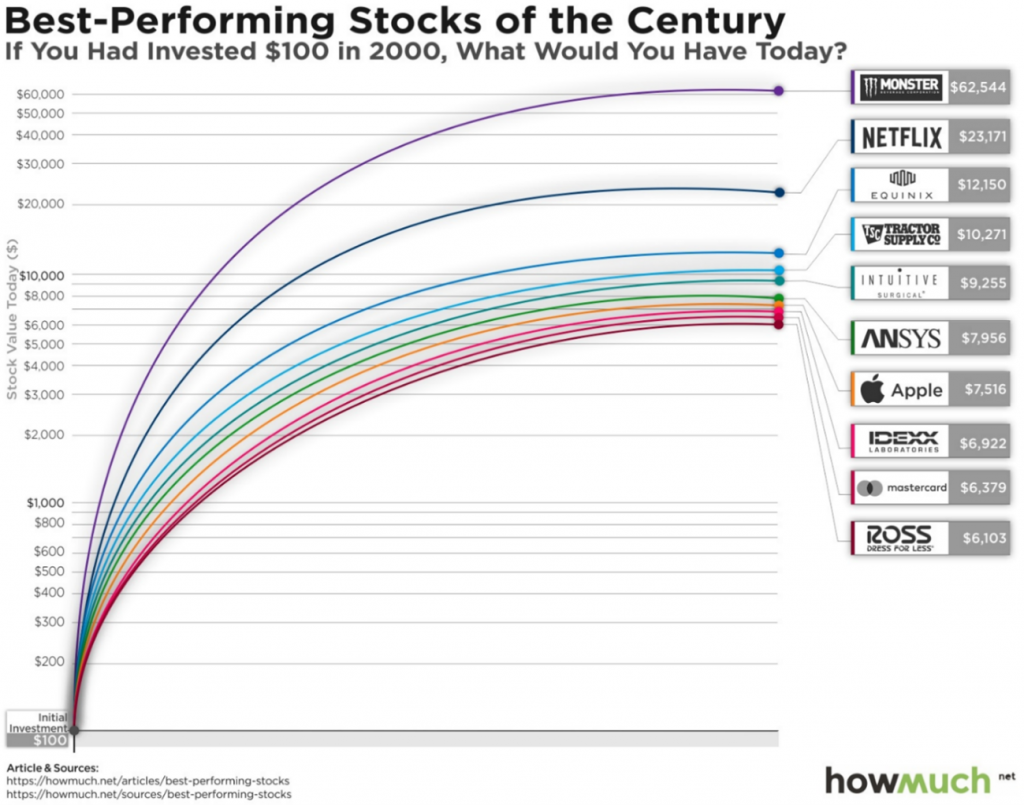

The following chart shows the 10 stocks that have been valued the most in the last 20 years:

Monster Beverages (Corona beer), Netflix, Equinix (), Contractor Supply(), Intuitive Sirurgical (), Ansys (), Apple, Idexx (), Mastercard and Ross Stores are part of this group. 5 or half of these companies were on the 30-year list.

An investment of only $100 would have resulted in capital between $6,100 and $62,000.

To compare with the figures above, from the example of the investment of 10 thousand dollars, we just multiply these values by 100, reaching between 601 thousand and 6.02 million dollars.

Companies are very diverse and from various sectors, such as technology, beverages, health, finance and retail.

Strange is the absence of companies such as Walmart, Exxon and Berkshire Hathaway, as well as some of the other FAANG, but this is due to the methodology itself. Some of these companies did not exist at the beginning of the century or their price was already over $100 by then.

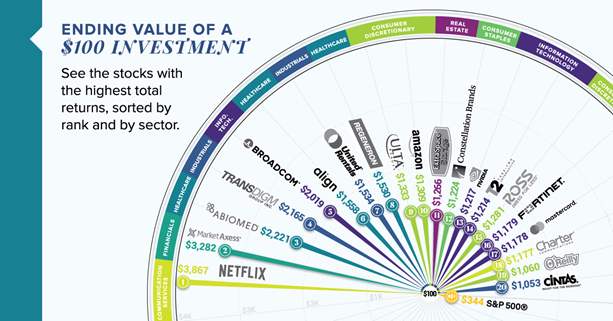

The following is a list of the 50 stocks of the S&P 1500 (which covers 90% of the U.S. stock market) that have appreciated the most in the last 10 years (between 2010 and 2019):

As we have seen, this decade has been very positive for the S&P with returns above 13% which would result in a cumulative appreciation of 3.6 times.

These 50 companies had an appreciation between almost 1,000% and 4,800%, multiplying the invested capital by 10 to 48 times.

The company that increased the most market capitalization was Amazon from $60Bn to $860Bn, but ranked only 27th.

The list is composed of companies from various sectors.

The decade has been very positive for technology companies such as Netflix, Broadcom and Nvidia, but also for food company Domino’s Pizza and Bond Trading MarketAxess.

The raw materials sector and in particular energy did not perform very positively in this period.

In a narrower list focused exclusively on the S&P 500 over the past 10 years, we have the stocks that have been valued most by each sector were:

In this set we have Netflix, Market Axess, Abiomed, Transdigm, Broadcom, Align Technologies, United Rentals, Regeneron, Ulta Beauty, Amazon, ExtraSpace, Constellation Brands, and Nvidia, among others.

Once again, some of these stocks also count from the list of the best stocks in the 20s and 30s.

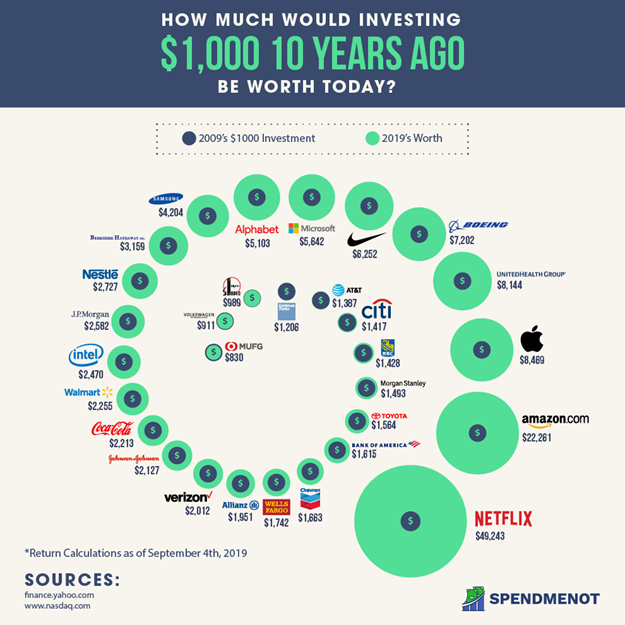

If we focus on some of the best-known companies, the valuation over the past 10 years has provided the following multiplication of $1,000 of invested capital:

The accumulated capital was $49k on Netflix, $22k on Amazon, $8k on Apple and UnitedHealth, $6k on Nike, Microsoft and Alphabet, etc.

The best US performing stocks of all time

Although we did not get an image we have a link to an article about the 50 companies that performed better over time (or created more wealth), giving an account of the value generated and the period in which this occurred:

https://www.kiplinger.com/slideshow/investing/t052-s001-the-50-best-stocks-of-all-time/index.html

The following companies are listed in descending order of value creation: Exxon Mobil (energy), Apple (tech), Microsoft (tech), GE (industrial), IBM (tech), Altria (tobacco) Johnson & Johnson (pharma), General Motors (autos), Chevron (energy), Wal-Mart (retail), Alphabet (tech), Berkshire Hathaway (financial), Procter and Gamble (consumer staples), Amazon (tech), Coca-Cola (beverages), Dupont (industrial), AT&T Corp (telcos), Merck (pharma), Wells Fargo (financial), Intel (tech), JP Morgan (financial), Home Depot (consumer discretionary), Pepsico (beverages), Oracle (tech), Mobil (energy), 3M (industrial), Walt Disney (media), Facebook (tech), Abbott Labs (pharma), Pfizer (pharma), MacDonald’s (food retail), United Health (health), ATT (telcos), Amoco (energy), Verizon, Texaco (energy), Brystol Myers-Squibb (pharma), Comcast (telcos), ConocoPhillips (energy), Warner Lambert (pharma), Boeing (transports), Amgen (biotech), Schlumberger (energy), Cisco (technology), Visa (financial) HP (technology), United Technologies (industrial), Union Pacific (transports), Sears (consumer discretionary) and Gilead Sciences (biotech).

Many of these companies have been at the top for many years.

Few of these companies have lost any flash in recent times, and Sears is perhaps the most obvious example.

We know that there are sectors that in the light of our day are over represented, such as the case of energy.

While it’s hard to find patterns on such a diverse list, it’s worth trying to find common factors or denominators.

In the following link there is an animated video of the evolution of the 10 best performing stocks of the S&P 500 index in the last 40 years, between 1980 and 2020:

https://www.aarp.org/money/investing/info-2021/most-valuable-stocks-by-the-decade.html

The best performing stocks in the last year

If we were to analyse the stocks that performed the most in the last year the list would be very different from the previous ones, which was influenced by many specific factors.

It was a year of energy, other raw materials and meme stocks.

This shows that analyzing shorter periods may not be very useful for detecting secular growth actions.

Are there patterns in these companies or vintage or secular growth stocks?

Combination this list with the previous we find some constants for these best performing stocks or also called admirable atocks. These are companies:

– Huge dimension;

– Operating in global markets;

– Generally speaking, of large consumption;

– Technology, pharmaceuticals, health and consumer staples as the most represented sectors;

– With lasting and sustainable competitive advantages, in some cases almost natural monopolies;

– With good profit margins and growth rates;

– And that they transact at reasonable or fair prices.

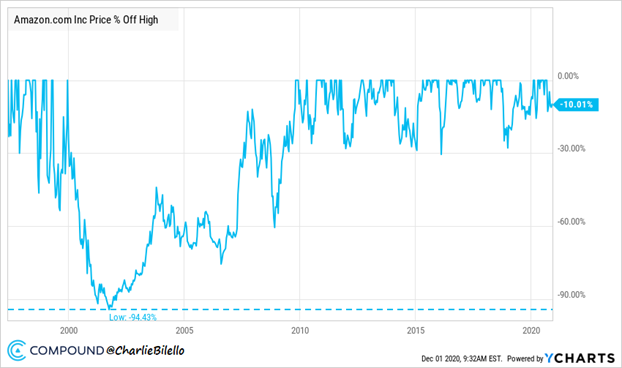

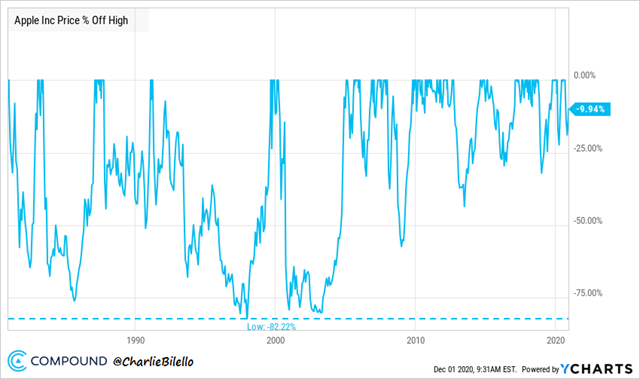

The following charts show the biggest fixes suffered by two of the best-known companies in the previous lists, Amazon and Apple:

In the tech bubble crisis, Amazon lost more than 94% of its value. How many of us would resist such losses? Since then, the corrections were more moderate and the final result is in sight.

In Apple’s case, the challenges are even greater, as they have been repeated several times. During the technological bubble, it lost 82% of its value, a situation similar to that which had already occurred in the previous years. However, Apple again lost more than 50% in the subprime crisis and almost another in 2014.

They are successive endurance tests, but the final gains appear.

The stocks with the highest potential in the next 20 to 30 years

In conclusion: No one knows for sure. This crystal ball doesn’t exist. It is up to each investor to search and find in the market the companies that it considers to be part of these lists in the future.