The track record of the impacts of geopolitical risks on financial markets

The economic and financial impacts of the Ukraine war

#1 The impact on world GDP growth

#2 The impact on oil, natural gas and commodity prices

#3 The impact on inflation

#4 The impact on international trade

#5 The impact on capital movements

The first studies: Bloomberg Economics

Russia’s invasion of Ukraine began on February 24 has been slashing stock markets and changing financial market conditions.

The developed world reacted in unison by imposing sanctions on Russia to isolate it economically and financially (in addition to political and social).

There are several effects that this war has on the financial markets.

The stock markets of developed countries have fallen by 10% in recent days, more sharply in Europe than in the rest of the world. The Russian lost 30% until it was closed for more than a week, and the ruble depreciated by the same amount.

The price of oil rose from $80 to above $110. The prices of the remaining goods also increased, especially those of agricultural products.

Interest rates on 10-year U.S. treasuries reversed their upward trajectory and fell from 2% to 1.70%. Investors now estimate that the FED will act more moderately on rising interest rates in the context of the instability brought by the war.

In this article we analyze the effect of increasing geopolitical risks in stock markets according to some of the most recent studies on the subject.

It is not intended to make predictions because in these circumstances there is no predictability.

Just show what happened in the past and what is at stake in the present to help form opinions of what may happen in the future.

We know well that there are no two geopolitical risks alike. Not even two wars alike. And even if they were the same, the results would necessarily be different because there are other conditions of context, economic and other, that change the situations. But history has value.

The track record of the impacts of geopolitical risks on financial markets

We start with the background of the history of the impact of geopolitical risks on financial markets, presenting two recent studies on the subject, one prepared by Schroders in 2019 and others by LPL Research in 2020.

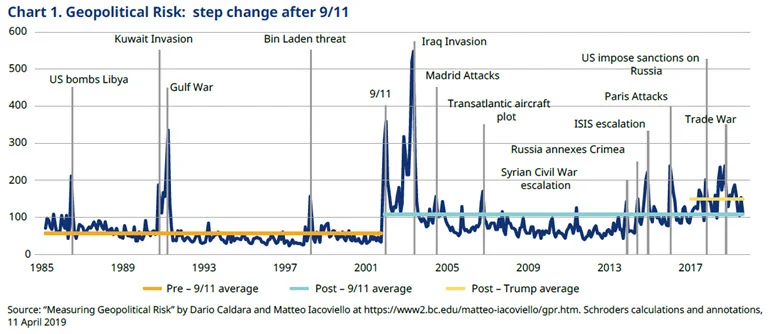

The Schroders study begins by presenting the evolution of the geopolitical risk index since 1985:

It shows that the average value of this index has increased since the 9/11 attacks and that two conflicts with Russia were among the most recent risks to this war.

The following link contains more developed and current information about this index:

https://www.matteoiacoviello.com/gpr.htm

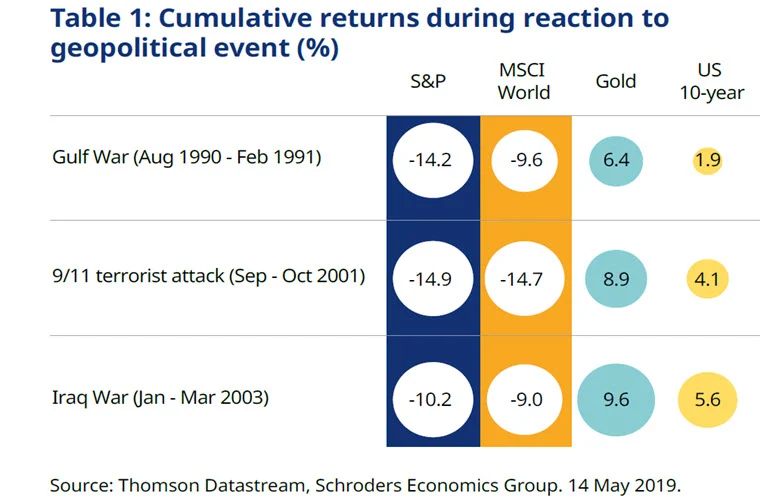

The following table shows the profitability of financial markets during risk events:

Gold and U.S. treasury bonds act as assets of refuge, showing positive returns. Stock markets fell between 10% and 15% at these three events.

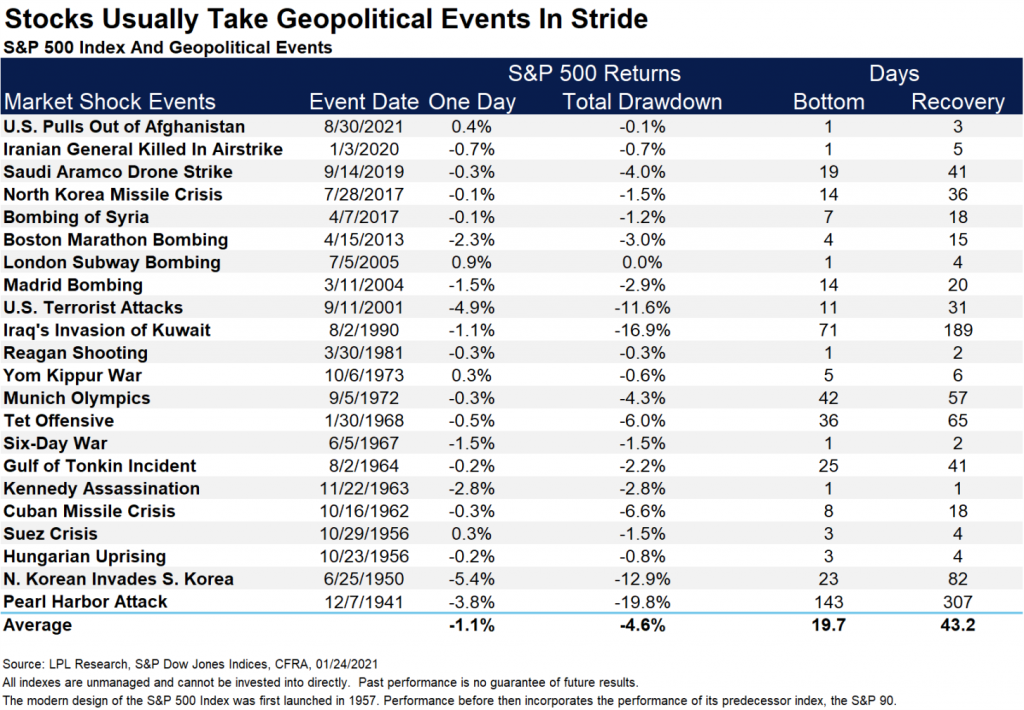

The LPL Research study shows the impact on the S&P 500 of the major political risks that have occurred since the 1941 Attack on Pearl Harbour:

The biggest drop in the S&P 500 occurred in precisely 1941, of -19.8%, followed by the 16.9% invasion of Kuwait in 1990 and the terrorist tower attacks of 11.6%.

The study also shows the duration of falls and the recovery time of markets. In the first case the fall lasted 143 days and the recovery only happened after 307 days. In the second case, the fall lasted 71 days and recovery required 189 days. In the third case, everything was faster, with 11 days of fall and 31 days for recovery.

In this last study what is evident is that both the depth of the fall and the recovery time of the market are very different depending on the nature of the event.

It is easy to observe that the longer the event and the greater the resources expenditures or capacity destruction, the greater and longer the impact on stock markets. So wars are obviously also the worst geopolitical risk to stock markets.

The economic and financial impacts of the Ukraine war

This war is actually very different from the more recent ones.

First because it’s a war in Europe. There are certainly few who predicted that Europe would have a war in our day after memories of what happened in the two previous great wars and with all the civilizational advances since then.

Secondly, because it’s a war unleashed by Russia, a superpower. Once again, it reminds us of the two previous wars.

Third because it had an immediate reaction, economic and not belligerent. The whole developed world has taken a stand alongside Ukraine, from Europe, the USA, Japan and Australia. China seems to have adopted a neutral position. Only countries that are political and economically dependent on Russia and very undeveloped have stood by them, such as Belarus, Syria, Venezuela, etc.

The developed world has imposed economic sanctions, freezing Russian assets, preventing financial movements and isolating Russia from trade and world capital markets. Many global companies have announced the decision to disinvest from Russia, including oil companies BP, Shell and ENI with major economic interests in the country.

Fourth, the outcome is not yet envisaged.

Putin is firmly in power until 2036, and has built his rhetoric of unity between Russia and eastern European countries that he firmly believes in experts.

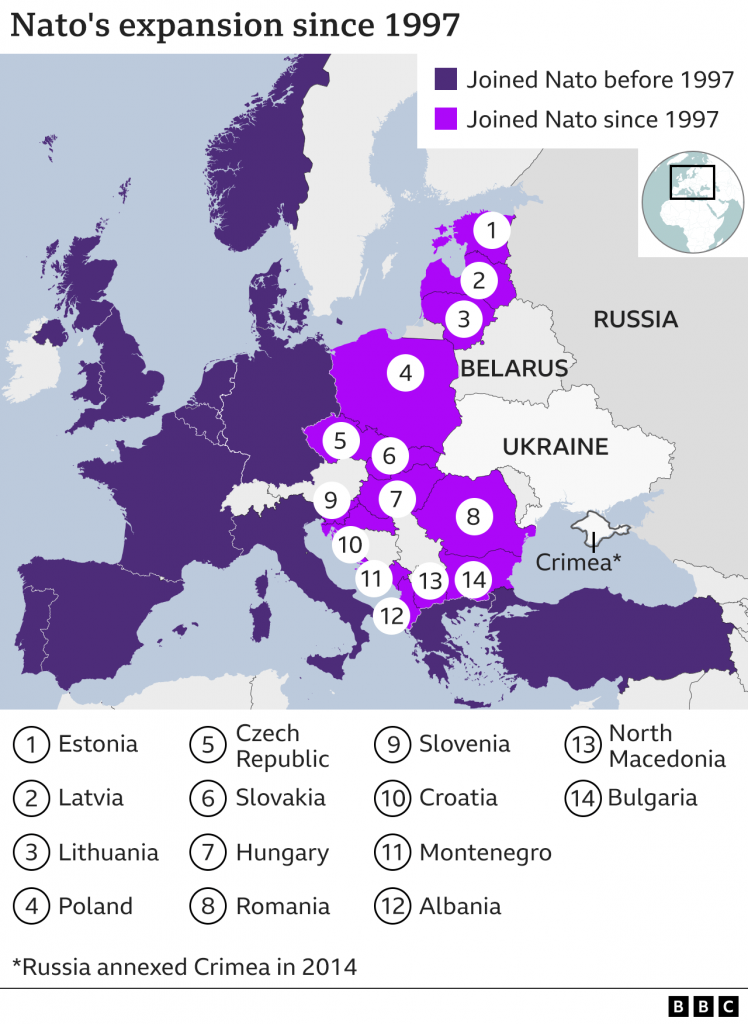

Putin demands that Nato withdraw its military forces and infrastructure from the countries that joined after 1997 and that Ukraine not join Nato.

The developed world recognizes Ukraine’s sovereignty and democracy, strongly condemns Russian aggression and Nato will not budge in defense of its allies.

There is clearly the emergence of a new international political order that has not been seen since the times of the Cold War.

This war may also trigger a new economic order in terms of trade and capital movements.

And we must not forget that the trade war between the US and China is still ongoing.

#1 The impact on world GDP growth

A study published by the Financial Times estimates the following effect on world GDP:

The Eurozone and the UK will be the hardest hit regions with a predicted gdp reduction of around 0.4% per year over the next 3 years. The effect in the U.S. will be half and worldwide of about 0.25% per year.

#2 The impact on oil, natural gas and commodity prices

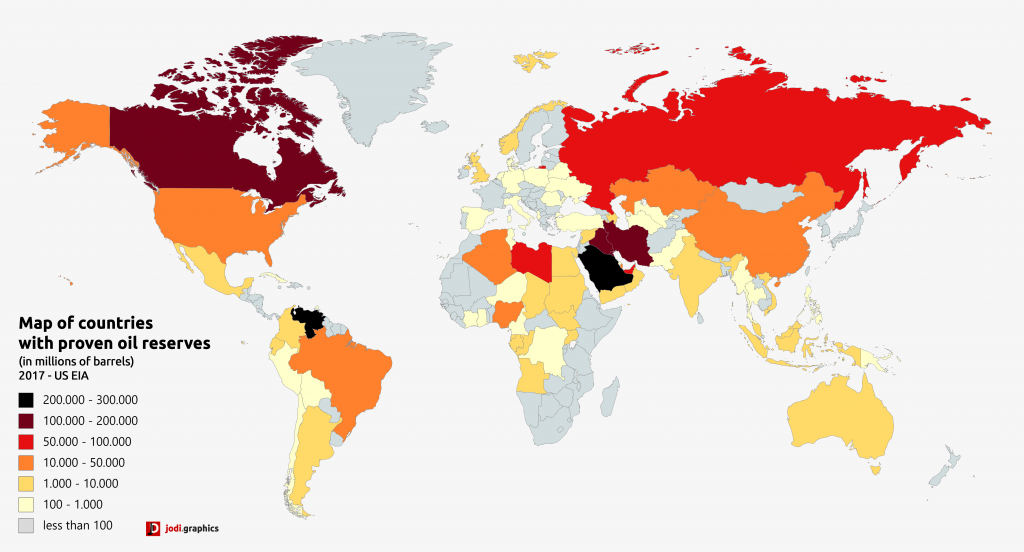

Russia is the world’s second largest oil producer and the largest producer of natural gas, being the largest supplier in Europe and especially Germany.

Despite this dependence, Germany has already announced that it was abandoning the Nord Stream 2 consortium of the Russia-related pipeline, which is the alternative to the pipeline passing through Ukraine.

Oil prices have had the following evolution:

In recent years, Russia and Saudi Arabia have controlled OPEC+ decisions, and are primarily responsible for managing quotas and prices especially since the pandemic.

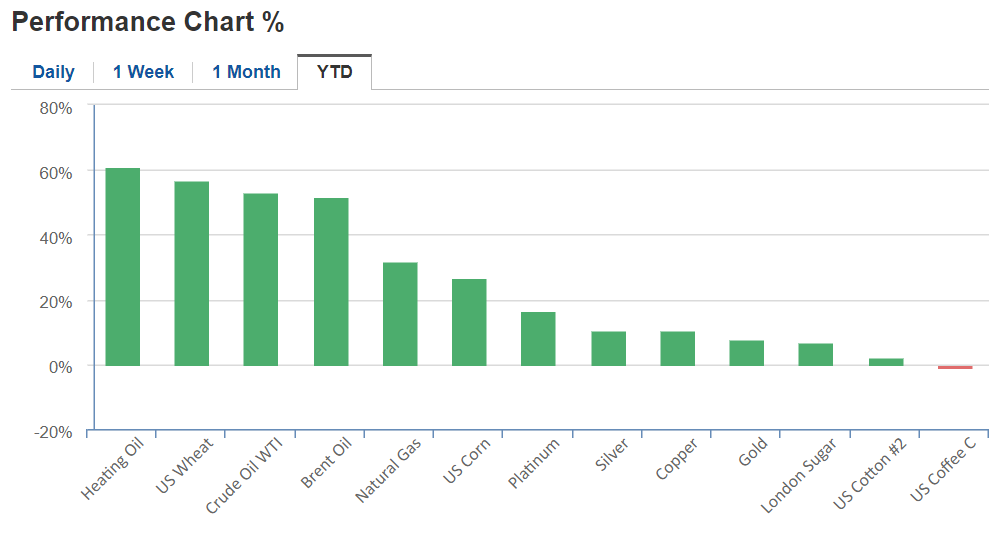

The rise in prices of other goods, especially agricultural products, has also been significant:

Source: Commodities Price Index performance, Investing, March, 4th, 2022

Ukraine and Russia are jointly considered the breadbasket of the world, with a combined share in cereal exports of about 25%.

#3 The impact on inflation

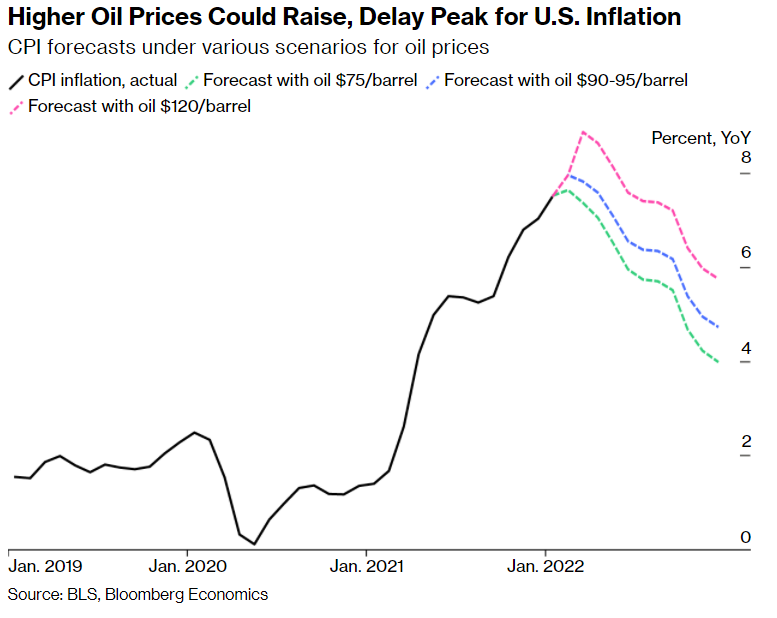

The war has further raised concerns about the high inflation that has been felt all over the world.

The increase in energy prices, other goods and the worsening supply chain shortages that this war brings to international trade will accentuate inflationary pressures.

#4 The impact on international trade

In the following link we have a graphical view of the main exports and imports of goods and services from Russia, as well as the countries of destination and origin:

https://oec.world/en/profile/country/rus

Russia’s main trading partners are China and Europe, exporting energy products and importing durable consumer equipment and goods.

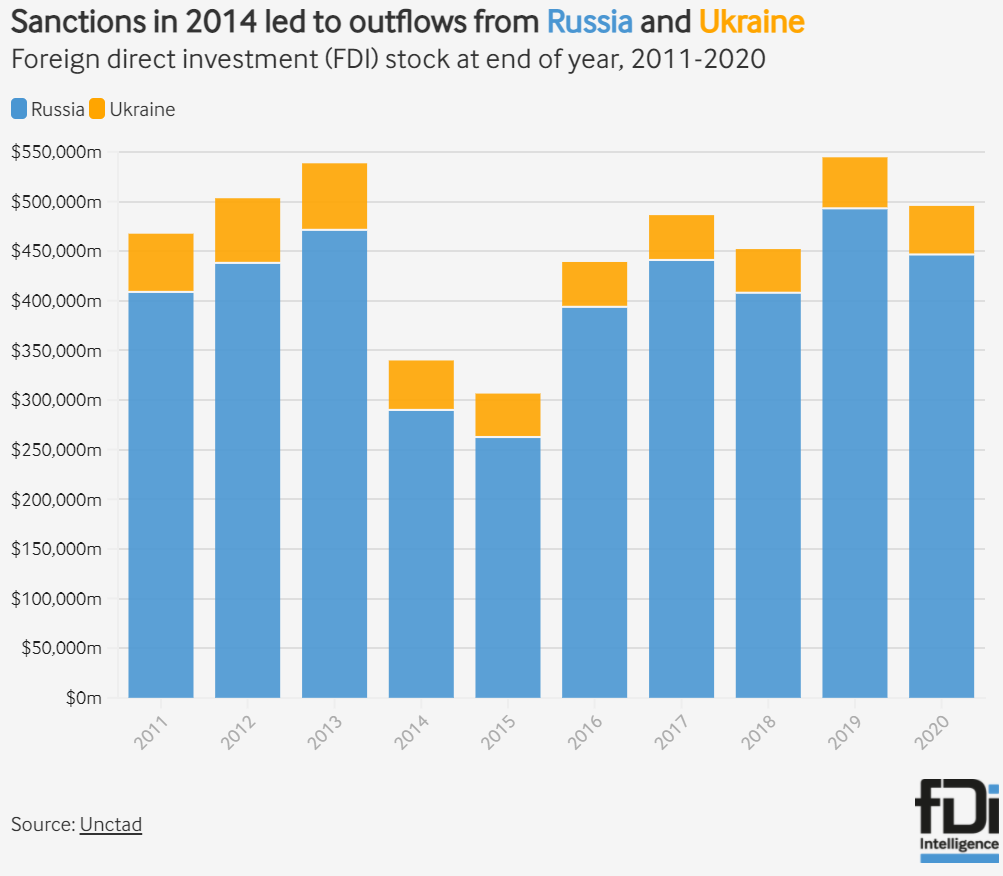

#5 The impact on capital movements

Russian foreign direct investment reached more than US$450 billion in 2020:

This figure will be significantly reduced as it did when Crimea was taken in 2014 and considering the decisions already taken by many companies in developed countries.

The first studies: Bloomberg Economics

Bloomberg Economics published a few days ago one of the first studies on the economic and financial impacts of the war.

It begins by highlighting the increase in inflation associated with rising oil prices.

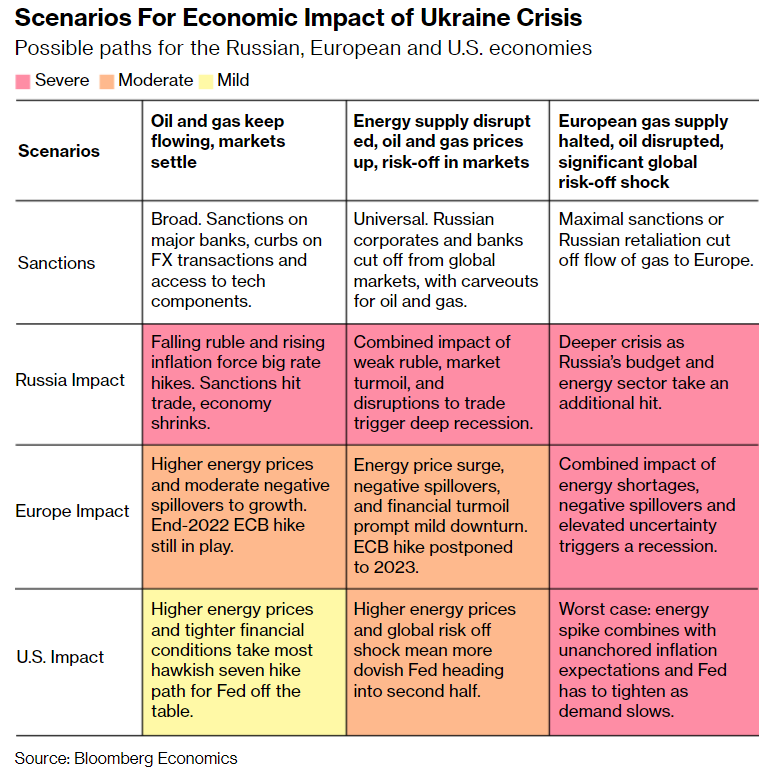

Next it builds 3 scenarios for the development of this moderate, mild and severe crisis:

In the moderate scenario, the picture is basically the current one, there is a drop in oil supply, rising fuel prices and a correction of stock markets.

In the mild scenario, the context improves slightly, energy supplies continue and the stock markets continue their previous trajectory.

In the severe scenario of maximising sanctions and a supply of supply by Russia, there is an interruption in energy supply and a crisis in the stock markets.

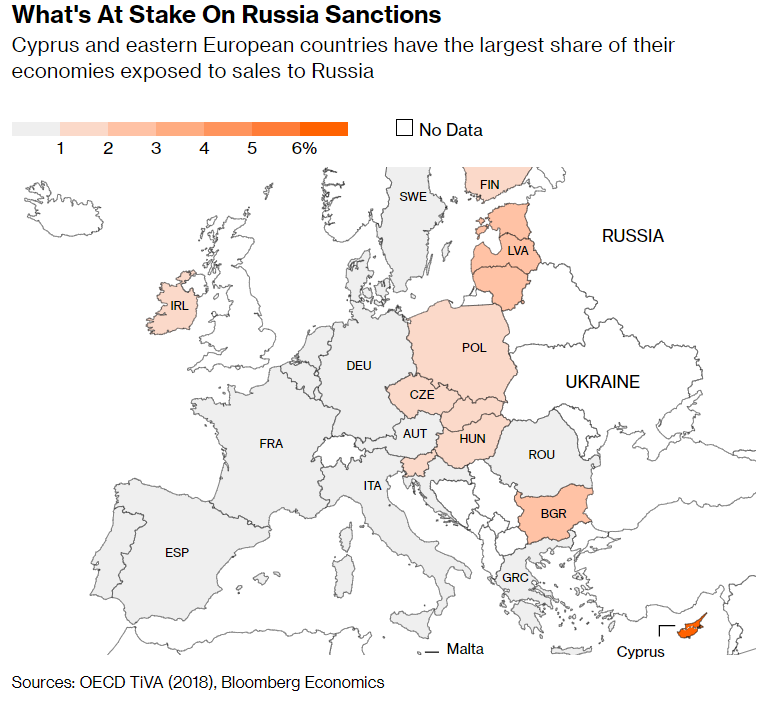

In the event that Russia retaliates against economic sanctions, the countries most affected will be Cyprus and the economies of Eastern Europe:

What can we do under these circumstances?

Nothing, again absolutely nothing.

Having properly made our personal financial plan, we have the allocation of assets and made investments that are the most correct and suitable for all situations. What we have to do is stay the course.

We insist that it is not worth trying or even thinking about adjusting to market times because it is not possible.

It is also in these circumstances that the value and importance of diversification is once again revealed, that is, to have an investment portfolio ready for these shocks.