Investing is a medium and long-term process. To succeed it should endure asset class diversification according to the investment objective time horizon and the investor profile

We need to invest in financial assets – stocks and bonds – to accomplish goals, knowing that the higher the rates of return, the greater the risk

Investing in financial assets is a medium-and long-term process that to succeed requires knowing how financial assets work and who we are as investors

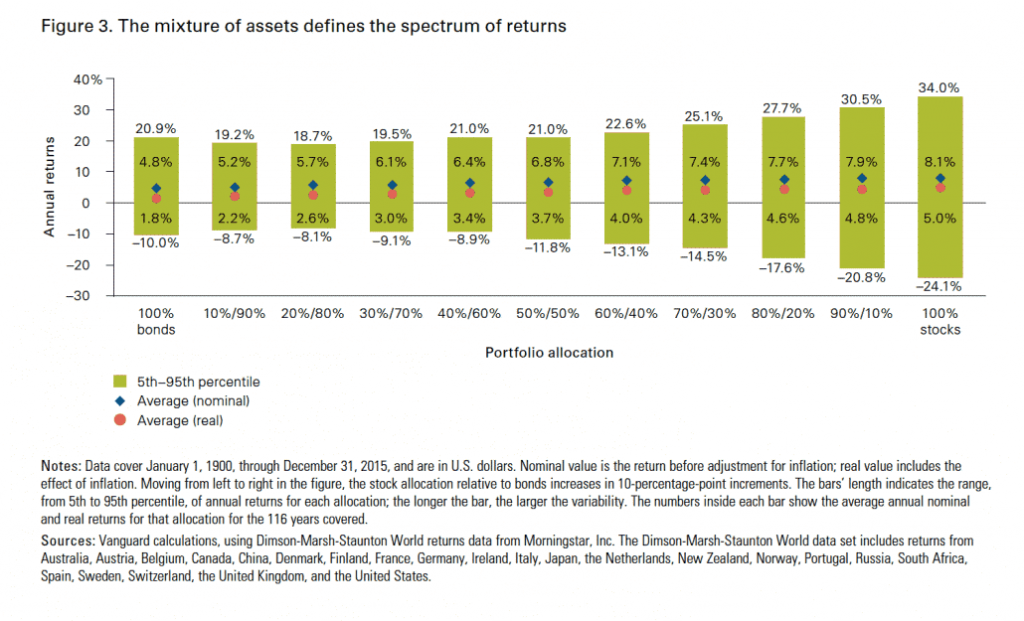

The allocation of investments between stocks and bonds classes should be adequate to our individual situation and determines the is the major determinant of the investment performance with more than 90%

To succeed we need to be patient, rational, decided to stay on course and avoid the excessive markets noise

Who are we as investors: the 2 dimensions of the personal risk profile: risk capacity and risk tolerance

The right asset classes’ allocation should be guided by the investment time horizon and the investor risk profile, which results from investor’ financial capacity and risk tolerance

We need to invest in financial assets – stocks and bonds – to accomplish goals, knowing that the higher the rates of return, the greater the risk

When we think of wealth management, it is essential to realize what is at stake. We need to invest in financial assets because we need their profitability to achieve the financial goals we want. The work income earned is not sufficient and the savings do not yield enough. The two main financial assets are stocks and bonds. Investment in stocks has a higher return, but greater risk.

We have to choose where we want to place ourselves in a line that starts at low risk, virtually zero or negative rates of return in real terms, and ends at high risk, potentially high profits, as well as eventual losses. In other words, what is our balance between return and risk?

Investing in financial assets is a medium-and long-term process that to succeed requires knowing how financial assets work and who we are as investors

In the process of investing well it is essential to know who or how we are as investors. We are not all alike; or rather, we’re all different. For investments to be well made we must believe, trust and fully assume the responsibilities and consequences of the process and the decisions we have made.

Investments in financial market assets are volatile. There are times in which things will be going positively and others where they may be evolving negatively. That is, there are times when investments and our wealth grows in value, and others in which investments may incur some devaluations and the wealth declines. To know how to live well these moments, when things go up, but especially when things go down, we must learn how and who we are as investors.

In other words, we must know how we would feel and be tempted to act if we faced these situations.

Why? Because the process of investing successfully in financial assets is a medium-and long-term process, which requires us to stay on course, regardless of the circumstances and the markets noise. If we do not invest for the medium and long-term it is not possible to obtain higher returns because we have not achieved the discipline necessary to manage the risk and fluctuation markets events. If that is not the case, it is worthless to invest in financial assets and it is best to stay with the savings and time deposits returns.

The key to the success of wealth and investment management lies in two main aspects:

1) Knowledge and experience of financial assets and the functioning of financial markets;

2) Know yourself in terms of investor profile.

https://www.streamfinancial.com.au/wp-content/uploads/2020/05/real-investment-advice.pdf

https://wealthwatchadvisors.com/wp-content/uploads/2020/03/QAIB_PremiumEdition2020_WWA.pdf

The allocation of investments between stocks and bonds classes should be adequate to our individual situation and determines the is the major determinant of the investment performance with more than 90%

We make investments for satisfaction and happiness, and not concerns or anxieties. Realizing how they work is fundamental to deciding well, to take responsibility, to be confident that we are on the right track and to maintain the medium and long-term course independently of markets short-term fluctuations.

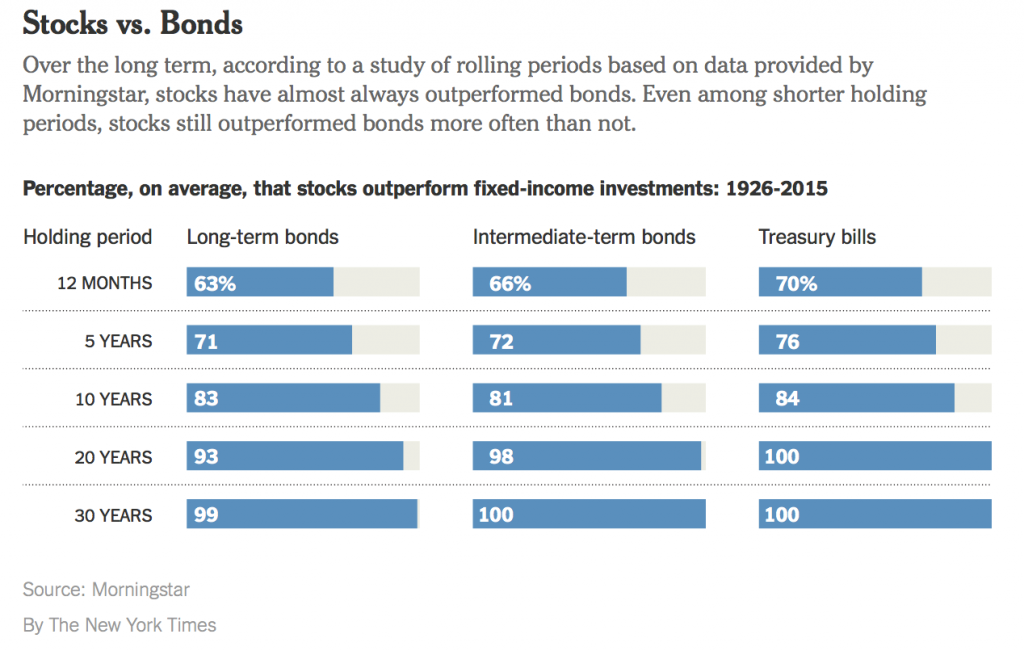

We all want the greatest rates of return provided by investments in stocks and even bonds.

We aim to get the historical average nominal returns of 10.1% per year in stocks or 5.7% per year in bonds. We prefer the historical average real rates of return, after taxes and inflation, of 5.1% per year in stocks to 0.6% per year in bonds.

But have we managed to get through any crisis or stress situations in the markets facing hefty investment devaluations?

At what point of this scale of annual average rates of return do we want to be, exchanging risk for return?

We know that the longer the time horizon of our investments, it will be easier to face temporary losses of capital because in the long term stocks are unbeatable.

To succeed we need to be patient, rational, decided to stay on course and avoid the excessive markets noise

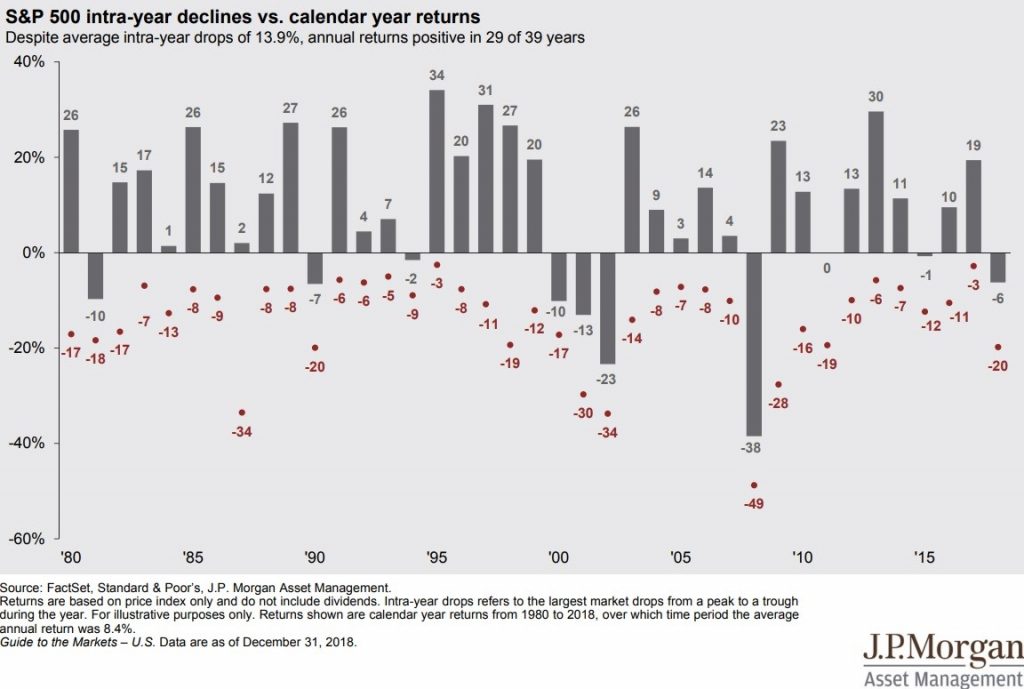

The following chart shows that despite the positive returns of the S&P 500 in 29 of the last 39 years, there were average intra-year losses of 13.9% that certainly caused many investors to give up on their investments, due to excessive concern or anxiety. If this happened, the annual average gain would have disappeared.

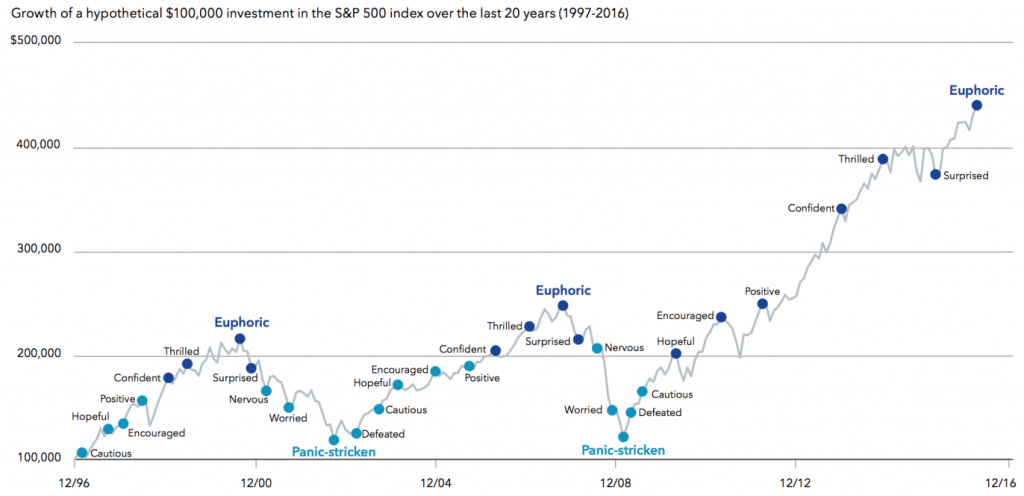

These anxiety reactions, but also of overconfidence, generators of panic or euphoria, are natural behavioural bias to which we are all subject and that are well illustrated in this graph whose line reflects the evolution of the S&P Index 500 between 1996 and 2016:

Source: Blackrock

As Benjamin Graham well said: “The investor’s chief problem – and even his worst enemy – is likely to be himself.”

Who are we as investors: the 2 dimensions of the personal risk profile: risk capacity and risk tolerance

The risk-taking decision of investments in financial assets begins by evaluating the level of risk required to achieve the desired financial objective, according to the known behaviour of financial assets.

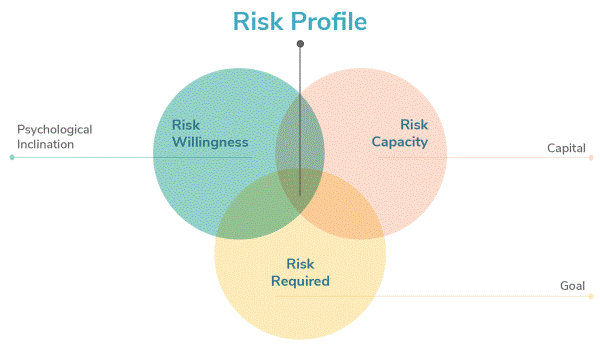

Then there are 2 dimensions to assess the personal risk profile: The financial capacity for risk taking (our wealth, net-worth or capital) and our risk tolerance or risk willingness to assume (the psychological inclinations).

It is very important to understand well what each one means and how we must combine them to define our risk profile.

The risk-taking capacity has to do with our present and future financial situation and the foreseen needs the funds. It is a rational, objective and quantifiable dimension. The more money we have, the greater our ability to withstand market devaluations. The longer we have to mobilize the invested funds, the better we can face and go through the moments of devaluation.

On the other hand, risk tolerance has to do with the way we react to risk. It’s an essentially emotional and sentiment dimension. When we have adverse scenarios or situations before us, how do we behave? Are we very anxious or worried people, balanced or moderate, or adventurous or risky?

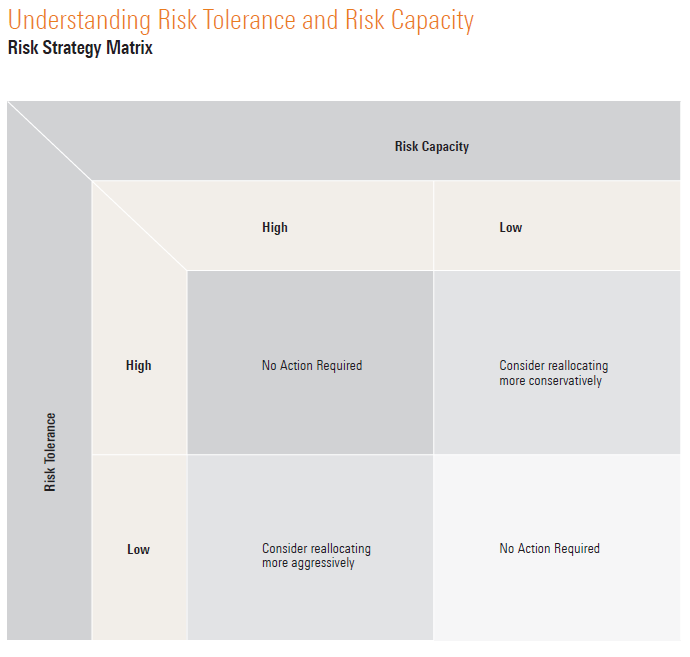

In each one of us, these two dimensions can be in sync or not. On the one hand, we have the declared and assumed behaviors and attitudes, rationalized and subjective, and on the other, the effective, real and objective ones. If they are in sync, we don’t need to adjust our behavior. If they are not in sync, we must correct them, adopting a more conservative profile.

Source: Fundamentals for Investors, 2018, Morningstar

The right asset classes’ allocation should be guided by the investment time horizon and the investor risk profile, which results from the investor’ financial capacity and risk tolerance

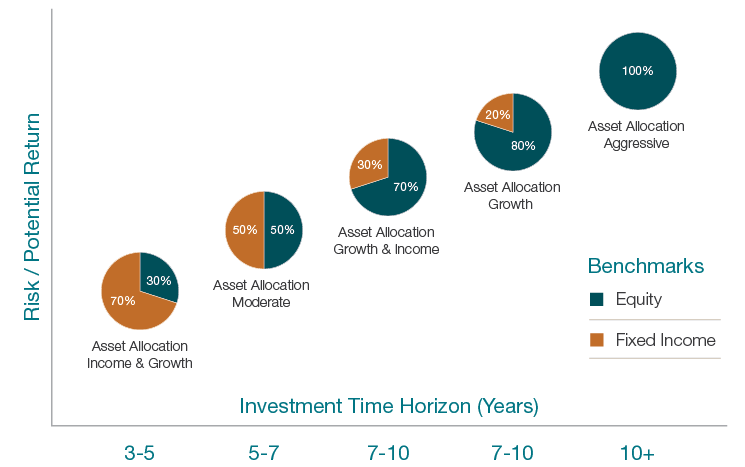

We conclude that it is appropriate to diversify adequately to make investments according to our time horizon and investor profile (capacity and risk tolerance).

The following chart presents a standard central allocation between stocks and bonds in these two dimensions, time horizon and investor profile:

We see that asset allocation is the result of a matrix combination of the investment time horizon (number of years to reach the objective target and number of years to use capital after that) and the various investor risk profiles.

The time horizon and risk profile – capacity and tolerance – vary this central allocation to fewer or more stocks (i.e. less or more risk and less or more expected profitability) depending on the two dimensions. We will be much more conservative if we have less time and are more intolerant and we will be more daring if we have a longer time and are capable of willing to take risk.