We are currently facing a scenario of rising interest rates in response to an increase in the annual inflation rate to levels of 7.5% in the US and more than 6% in Europe, which are highs over the last 40 years.

Many investors pose the question of what to do in this scenario.

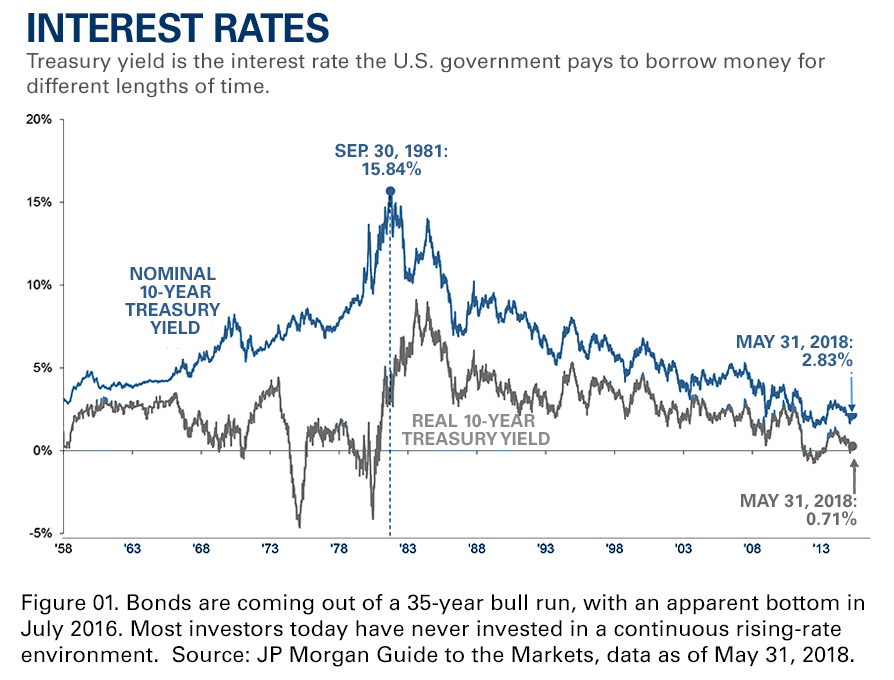

It is possible that this issue has gained greater concern because most investors do not know or have experienced periods of interest rate hikes.

This article analyzes how the various assets behave and analyzes what investors can do to overcome this situation.

The answer to the question of the sensitivity of the various assets or investments to rising interest rates and inflation is not as direct as one thinks.

It depends a lot on the circumstances in which it occurs.

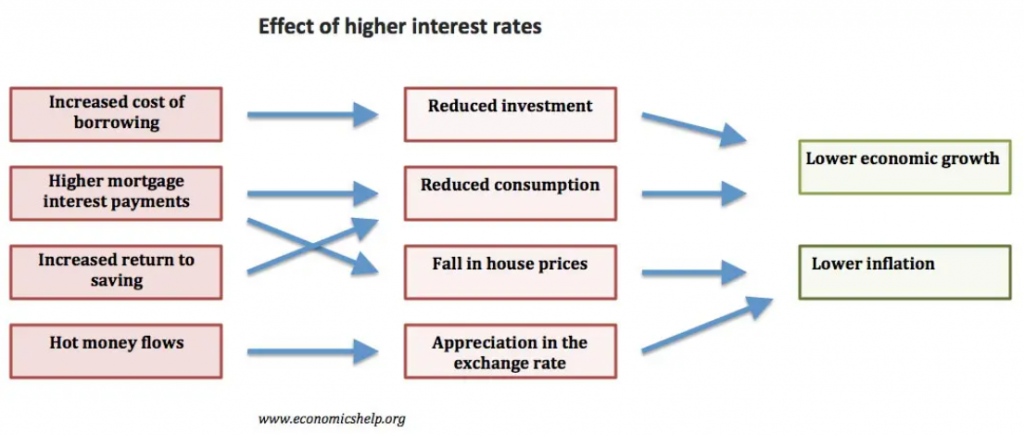

In economic terms, the increase in interest increases the burden on households, businesses and governments, retracting investment, consumption (aggregate demand) and therefore GDP.

Moderate inflation (between 2% and 4%) is overall positive, but very high and uncontrolled inflation is strongly negative.

Therefore, the combination of the effects of the two variables – inflation and rising interest rates – does not help.

Rising inflation and interest rates are usually associated.

However, they may have contradictory effects on some assets.

For example, in the case of real estate, rising inflation is positive while rising interest rates are negative, as it increases the cost of home benefits, decreases demand and prices.

In these situations, the dynamics of the movements of the two variables is important, as is the evolution of real interest rates.

On the other hand, the unpredictability, magnitude and speed of variables is very important.

For example, if inflation is moderate and interest rate increases are gradual, stock markets in general perform well (although there are sectors and companies benefited and others harmed).

But if inflation goes rampant and spirals, it will have adverse effects on economic growth and stock markets.

Furthermore, the context in which interest rates and inflation rise is also decisive.

There are many context factors that influence the development of the situation and the final outcome.

From the outend, the levels of economic growth and employment, the other conditions of monetary policy and fiscal policy matter.

Financial conditions in general and the levels of indebtedness of households, companies and governments are equally relevant.

The multiples of the markets are very important.

Exogenous risks (energy and raw material prices in general, geopolitical climate, etc.) also have an influence.

The expectations of agents also play a decisive role.

To that extent, we must be careful when we look at some of the studies carried out, particularly in view of the more global context in which they were made.

This issue is all the more important because some studies cover periods of great instability – depressions, wars, oil crises, technological bubbles, GFC (“subprime”), etc. – which except for the recent oil and other commodities spike linked to the Ukraine war have nothing to do with the current situation.

We can conclude that in the assessment of each situation, economic and financial theory is more robust, and empirical evidence is more subject to those biases.

Deep down, we can’t lose sight of the fact that every case is a case.

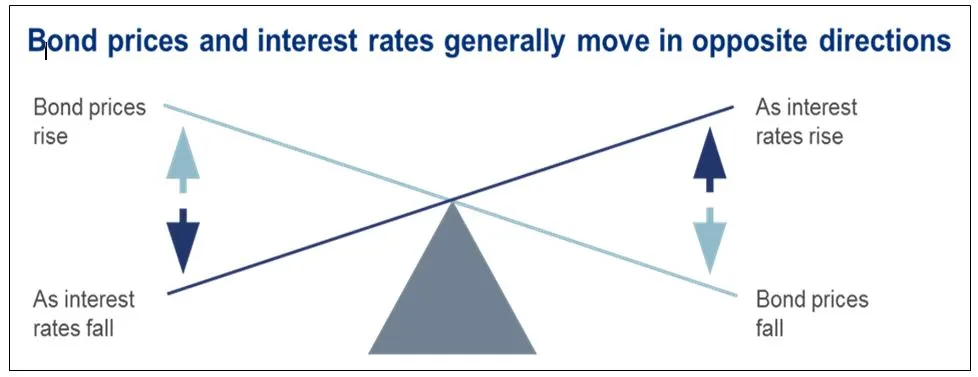

The investments most affected by the interest rate increase are bonds (mostly at a fixed rate)

Bonds are the assets most affected by rising interest rates in an inflationary context.

With most fixed-rate bonds, the increase in interest rates causes a loss of value from bonds issued, as investors demand higher rates.

This situation is more impactful in the current context, since the starting base is very low and the expected increase is considerable.

Official interest rates are expected to rise from 0.25% to between 1% and 2% in 2022, and to more than 3% in 2023.

This increase will be transmitted to interest rates on longer-term bonds.

In addition, this increase will be accompanied by a programme for the sale of assets by the FED, composed mainly of treasury bonds, but also mortgage and corporate bonds.

Furthermore, spreads or credit risk margins are also at historically very low levels, due to the high demand for income in recent years, and it should be admitted that they will tend to revert to the average in a context of rising interest rates.

It should be noted that there is a segment of bonds that benefits from inflation, which are the bonds indexed to inflation.

The interest rates on these bonds are determined by inflation so the income paid is all the higher as inflation.

To this extent, in inflationary periods, demand for these bonds increases and their prices rise.

The investments most benefited by rising interest rates and inflation are equities, although with major divergences at sectoral level

There are several asset classes that traditionally benefit from inflation, including gold, commodities, real estate, inflation-indexed bonds that we saw earlier, and stocks in general.

Gold acts as a refuge and reserve of value especially in periods of high inflation.

Commodity prices react almost immediately to rising prices.

Real estate has a positive reaction in early signs of inflation and rising interest rates, when households anticipate home buying by hiring fixed-rate loans at lower levels than in the future.

However, at a later stage, when interest rates are high, credit applications, demand for homes and price for them decrease.

We have seen the reason for inflation-indexed bonds benefiting from inflation.

As for the stock market, the relationship is not evident for two reasons. On the one hand, moderate inflation and rising interest rates act in opposite directions. But in a scenario of high inflation and rising interest rates the effect is clearly negative.

Generally speaking, if inflation is moderate the effects on stock markets are positive, as companies have the ability to pass on price increases, increase revenues and profits.

However, if inflation is too high there is economic downturn and the effects will become very negative.

Charlie Munger, Warren Buffett’s partner at Berkshire Hathaway, believes that inflation is the biggest threat to stock markets after nuclear war, and could even destroy empires and nations.

As examples, it recalls the periods of hyperinflation of the fall of the Roman Empire, Hitler’s Germany and many Latin American countries.

With regard to rising interest rates, the effects on the stock market are overall negative, although there are exceptions, such as the financial sector, which benefits.

In financial terms, the increase in interest increases the rate of return required by investors, which decreases the price of stocks. Shareholers have economic rights over future profits and the higher the cost of money the lower the current value of those profits.

In addition, it increases the risk premium of the equities, which also lowers prices.

Additionally, the opportunity cost of holding stocks relative to bonds increases, causing a rotation of investments from the stocks to bonds, which also puts pressure on the prices of those.

But not all sectors and companies are hit in the same way by the combined rise in interest rates and moderate inflation.

The financial sector is favoured because interest rates on loans are faster revised than deposits, increasing financial margin and profits.

Companies capable of impacting price increases on consumers are favoured (so-called pricing power companies benefit from inflation, which mitigates the effect of interest.

Companies with high operational leverage, i.e. where fixed assets (factories, land and equipment) are important, are also benefited by inflation because they increase prices and there is a high percentage of fixed costs.

The most indebted companies are hit harder by rising interest rates than those with less debt.

Value companies, which quote at lower multiples and with more stable cash-flows, are also less impacted by rising interest rates than growth companies, which quote to higher multiples and whose value is more dependent on the growth of future cash-flows.

https://www.morningstar.com/articles/999388/the-best-value-funds

https://www.spglobal.com/spdji/en/indices/equity/sp-500-value/#overview

Smaller-cap companies are more affected than larger companies by increased volatility and market risk premiums.

In essence, so-called quality, large and global companies with stable revenues and cash flows, low-indebted and valued at fair multiples are better protected from rising interest rates and inflation.

In this category, we may include Apple, Google, Microsoft, Amazon, Berkshire Hathaway, UnitedHealth, Johnson and Johnson, Walmart, Adobe, Coca-Cola, Procter and Gamble, Pfizer, Disney, Exxon, as well as banks such as JP Morgan, Bank of America, and other similar companies.

On the contrary, the most vulnerable stocks are those of growth companies, with current cash-flows lows and which quote at high multiples. So it’s not surprising that the ark innovation fund companies managed by Cathie Wood have been hit hard.

Empirical evidence on stocks and bonds

In an article focused on the relationship between economic cycles and investments, we saw that the stock markets behave well in the 4 phases of the cycles except in recessions.

In another article, in which we addressed the relationship between interest rates and inflation and financial markets, we saw that interest rates did not have a significant correlation with the long-term returns of the stock markets (the main determinants are the valuation multiples).

We also saw that official interest rate hikes did not have a negative influence on short-term returns in the stock markets. And that only high and uncontrolled inflation and deflation are negative for stocks.

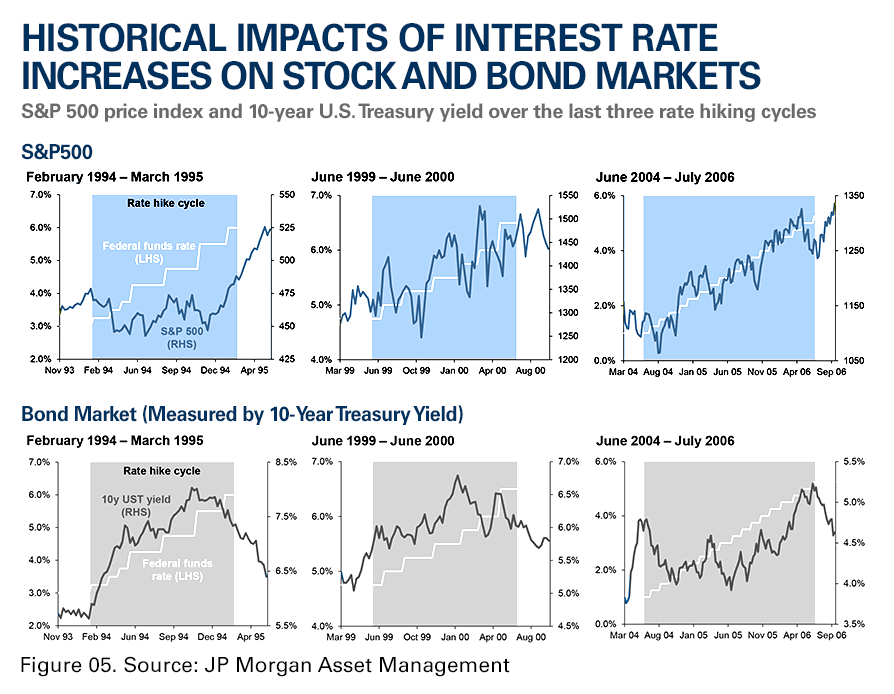

A study by JP Morgan Asset Management shows the reaction of bond and stocks markets to the three most recent periods of official interest rate hikes (since 1994):

The first half of the chart indicates a positive relationship between the interest rate hike and the stock market.

In the second half, it shows a negative relationship between the rise in official interest rates and bonds, by the direct transmission to the interest rates of 10-year bonds and considering the inverse relationship between these rates and the prices of bonds.

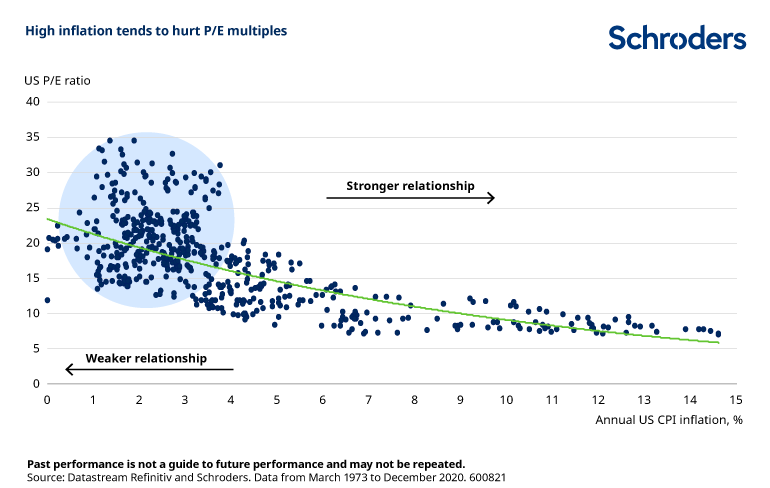

The following graph from a study by Schroders with data from 1973 to 2020 shows the relationship between inflation and multiples of equity markets:

It is concluded that for moderate inflation rate values, up to 4% per year, there is no relationship with the valuation multiples. Inflation only harms the valuation multiples if it subsists above 5% per year.

In relation to the stock market, there are sectors and companies that benefit from inflation and others that are harmed

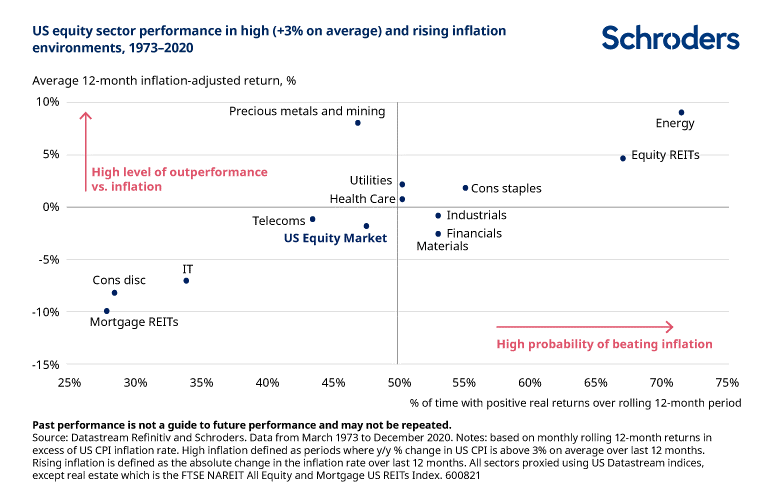

This study also analyzed the performance between the various sectors of the stock market and inflationary contexts:

In a context of inflation, the sectors with the best performance are energy, real estate with own equity, consumer staples, industry and finance, the worst performing being mortgage real estate and discretionary consumption.

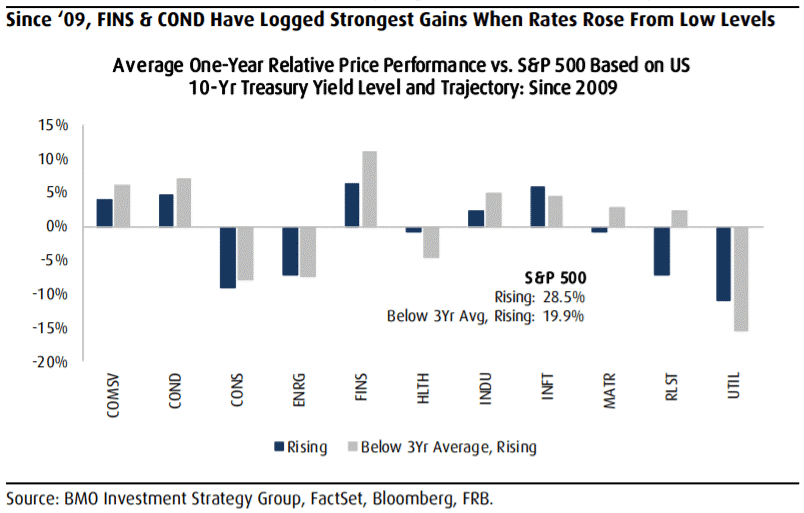

According to a BMO study, the sector performance of the stock market since 2009 in different periods of interest rate rise from low values was as follows:

In periods of rising interest rates from low levels, the best performing sectors in the following year were financial and discretionary consumption.

Evidence from the beginning of 2021 to date proves that the stock market has evolved as expected

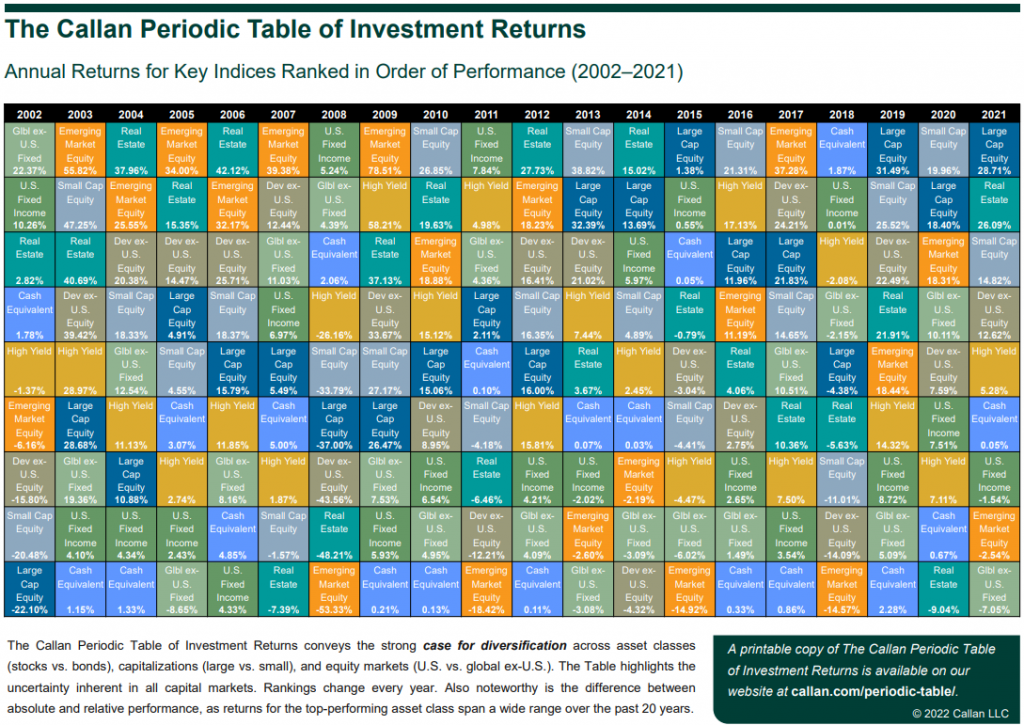

Callan’s periodic table of annual returns highlights the behavior of the various assets last year, with inflation rising:

Bonds performed negatively. On the contrary, stocks and real estate have performed very positively.

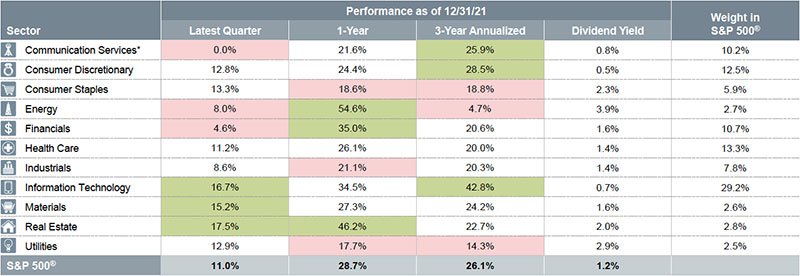

Fidelity showed the sectoral behavior of the U.S. stock market in 2021 as follows:

In a very favorable year for the stock market, the best performing sectors were real estate, finance and energy, while the worst were industry, consumer goods and public services.

The question that arises in the present is how we should act

In principle, we must stay on course and not make major changes.

The correct preparation of the personal financial plan ensures that our asset allocation and investment execution is best suited to all phases of the economic cycle and circumstances.

These moments of market volatility are conducive to us updating the plan. If nothing has changed, the allocation should remain.

Although it is difficult to maintain the course and the temptation to change is great, we should not do so.

It is very difficult to improve our return and risk trade-off by making changes to the allocation at each stage of the cycle.

In addition to running the risk of failing to adjust, there is also a risk that we will err in the moments of doing so.

That’s why we shouldn’t make big changes to our allocation.

However, we can make minor corrections or adaptations to each scenario.

In this context, we can replace part of the investments in fixed-rate bonds with inflation-indexed bonds.

In stocks we can increase the weight of the value and quality stocks.

Don´t fight the FED works both ways. The FED put has expired.

Fighting inflation is the FED (and other central banks) priority.

It will be a long and difficult task because inflation is running high and central banks tightening don’t solve supply shocks and only affect aggregate demand.

Too many unknows are piling up for the short, medium, and long term.

What will be the shape of the new era that is forging up?

There is a growing concern for energy dependence, food prices, water security, climate change, health threats, etc.

There are background trends that change the economy and market dynamics like ageing in western countries and world population growth centred in emerging Asia and African countries.

What will be the structural changes coming from the new economic international order of deglobalisation?

How are investors and managers reacting and adapting to the end of the 40 year long bond bull market?