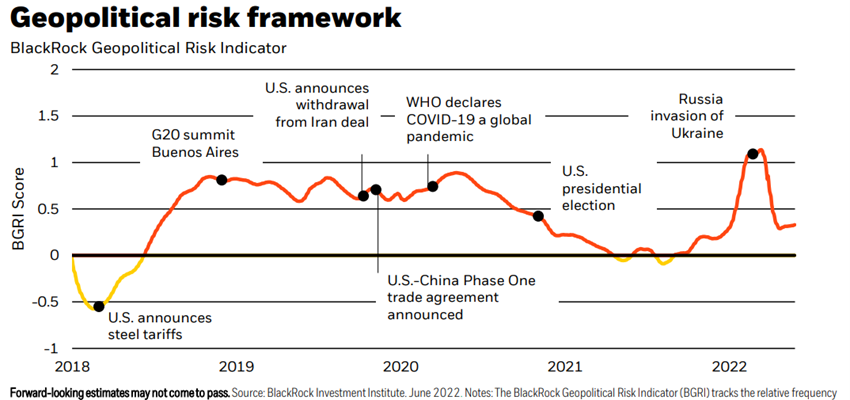

We are in the process of adjusting for inflation, rising interest rates, tightening, oil prices, war, a breakdown in the supply of agricultural goods, the breakdown of supply chains, lockdowns and covid, but above all, for a new monetary policy regime, and the start of a new international economic order

Executive summary

Performance 2Q22: Stock markets of developed countries in bear market with corrections of more than 20% and very volatile. Bond markets regress with long-term interest rate hike

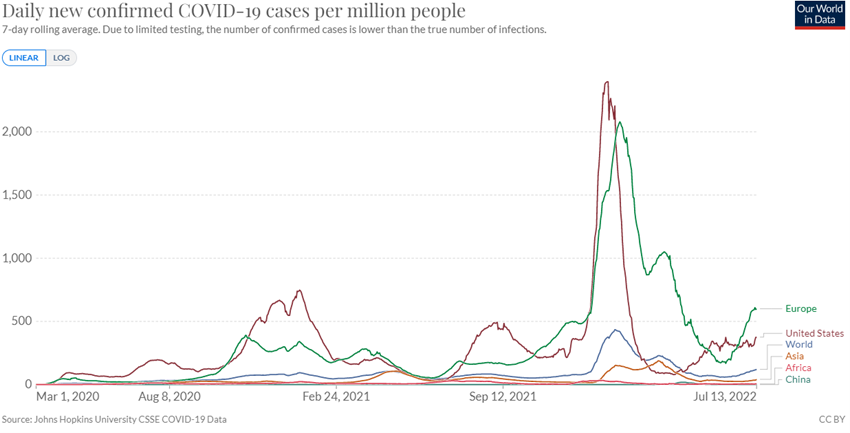

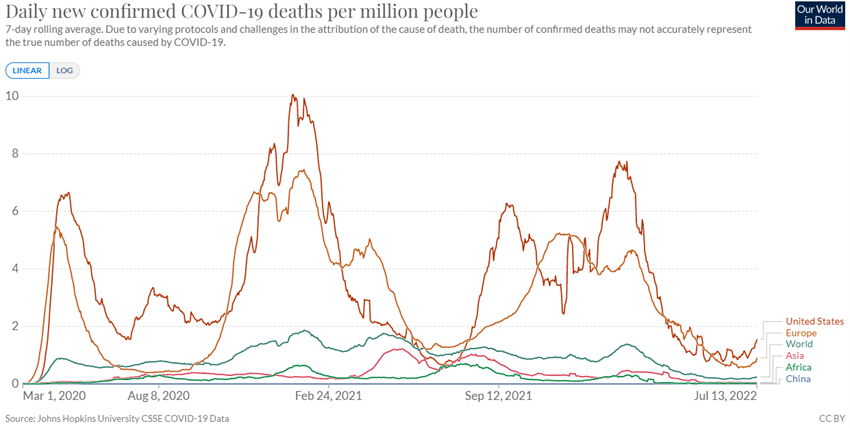

Status Covid-19: Transition to endemic state in most countries, despite outbreaks in China leading the government to successive lockdowns of major cities

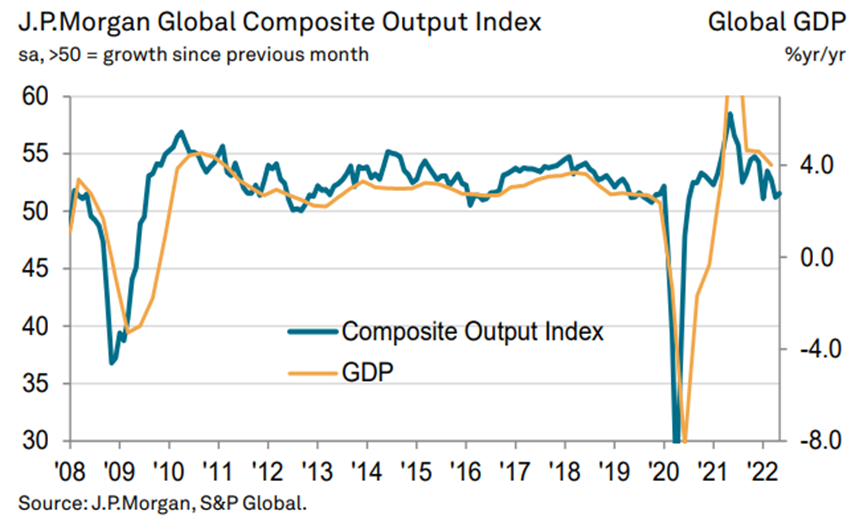

Macro Context: Strong slowdown in economic growth around the world, especially in Europe, due to rising interest rates and oil prices, and the prolongation of the war in Ukraine, and China, also due to successive lockdowns

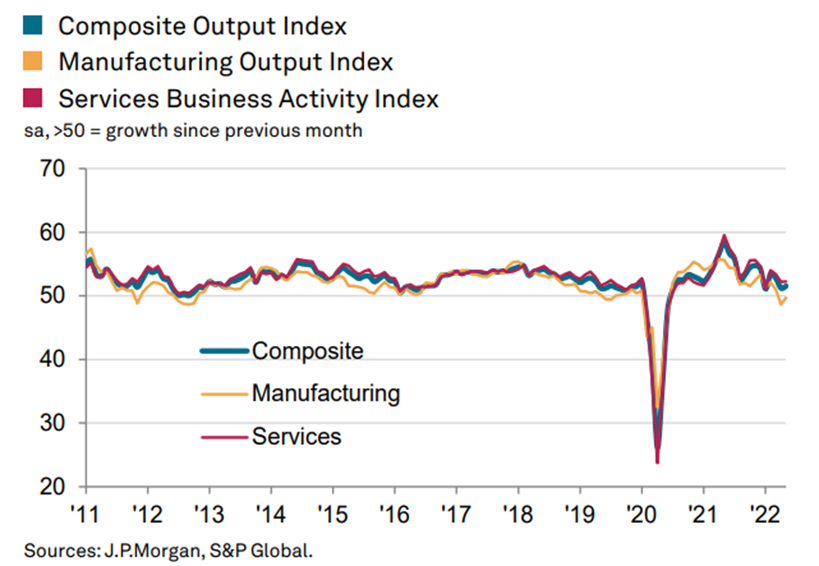

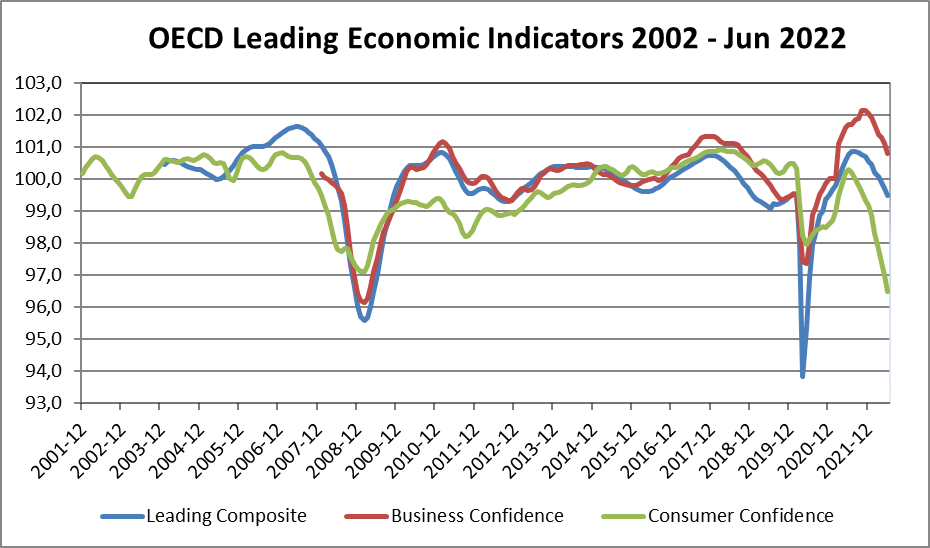

Micro Context: Key instantaneous and advanced economic indicators in decline

Economic policies: Central banks raise interest rates and remove excessive liquidity from the system, with the exception of Japan

Stock markets:Equities in bear market with declines of more than 20% in developed and larger emerging markets, with increased volatility as a result of economic and geopolitical risks

Bond markets: End of the long bonds bull market. Fixed income markets correct more than 10% by the rise in long-term interest rates, and some widening of sovereign and corporate debt credit spreads

Key opportunities: Mitigation of the economic impact associated with resilience of the financial capacity of households and businesses

Key risks: Increased likelihood of economic downturn in Europe and the US, compounded by Russia’s possible gas cut, and increased risk in the most vulnerable emerging economies

This transition phase of the cycle, with lower levels of economic growth and changes in monetary policies, favours equities investments driven by value and quality strategies versus growth investments. Additionally, fixed-rate bond investments in US treasury bonds are beginning to look interesting.

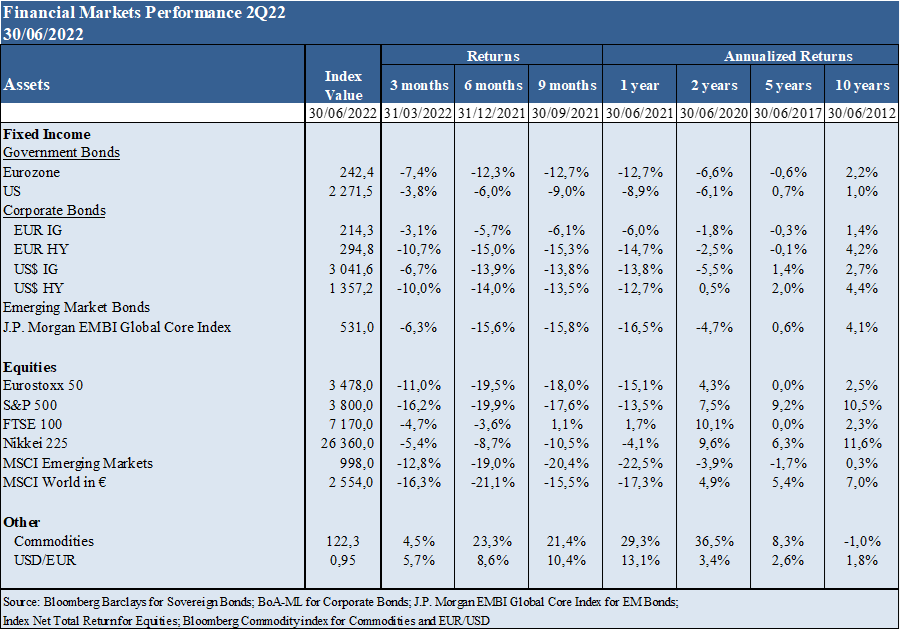

Performance of financial markets 2Q22

Stock markets in bear market developed countries with corrections of more than 20% and very volatile. Bond markets regress with long-term interest rate hike

Stock markets go into bear market with falls of more than 20% in developed countries and higher in emerging markets.

Bond markets also fell more than 10% in the US and the Eurozone due to the sharp rise in long-term treasury bond interest rates associated with changing monetary policy.

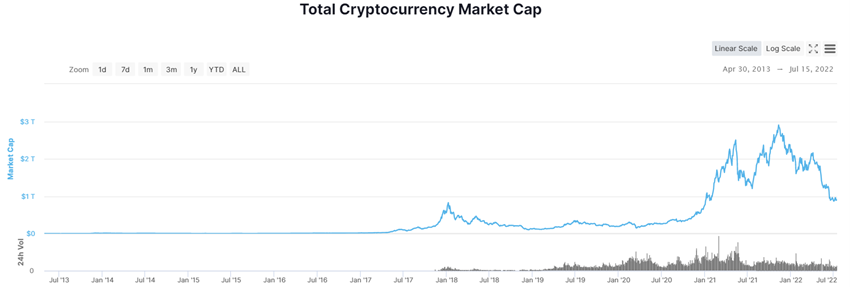

High devaluation of all cryptocurrencies, with total market capitalization falling below $1 billion after highs of $3 billion last November, causing bankruptcies of lender Celsius and hedge fund Three Arrows Capital.

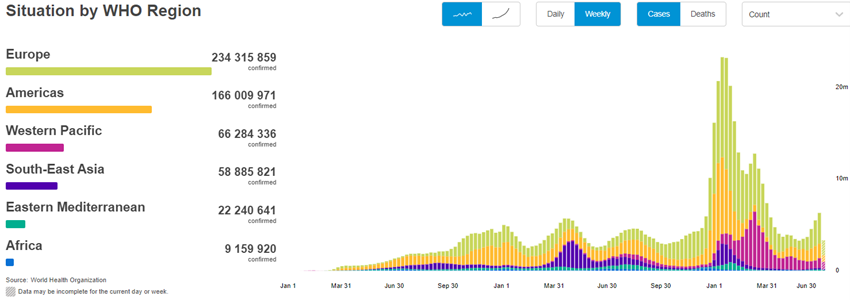

Covid-19 Status:

Transition to endemic in most countries, despite outbreaks in China leading the government to successive “lockdowns” of major cities

The Covid-19 virus has surpassed 557 million infected and 6.3 million dead.

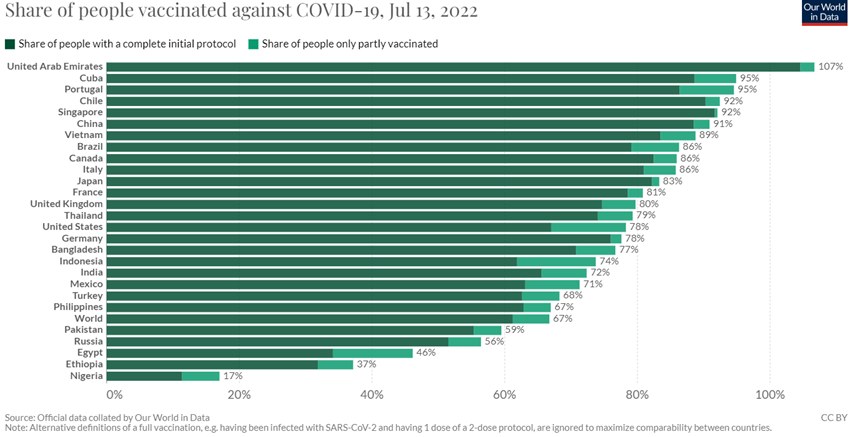

66.7% of people worldwide have already received a dose of the vaccine, but only 19.4% in the lowest income countries.

Mortality continues to decline due to high vaccination rates and more effective new treatments.

New outbreaks continue in China’s major cities, which maintain its policy of lockdowns.

Source: WHO, Jul, 15, 2022

Macroeconomic context

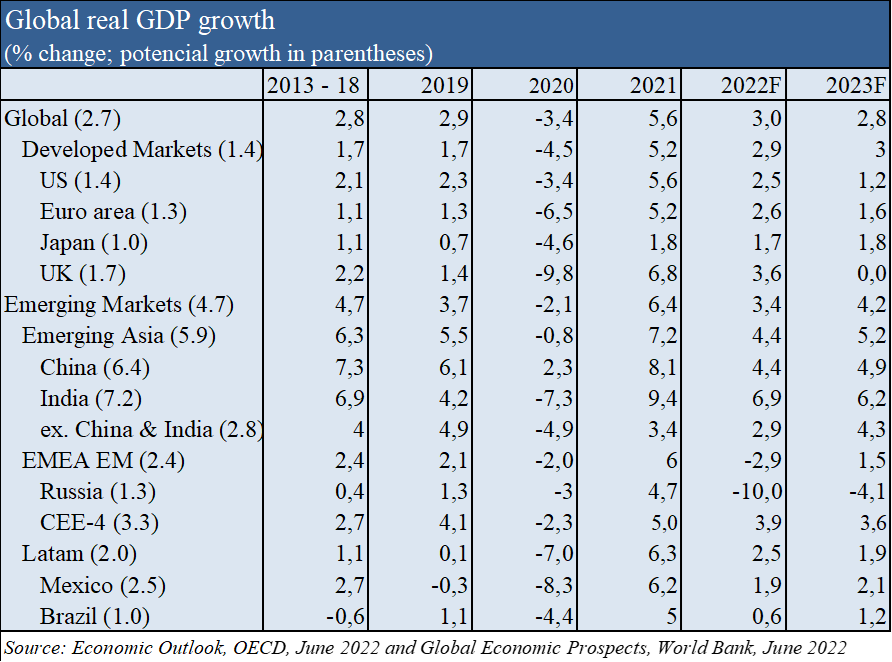

Downwards review of global economic growth forecasts to 2.8% in 2022 and 3.0% in 2023, and with 2.5% and 1.2% in the US, 2.6% and 1.6% in the Eurozone, and 4.4% and 4.9% in China in 2022 and 2023 respectively, due to the persistence of high inflation, rising interest rates, oil prices and war in Ukraine (OECD).

A continued slowdown in economic growth around the world is expected, with less impact on the US and greater impact on Europe due to the war.

Inflation remains at 40 years highs in developed countries, with figures of 9.1% in the US, 8.1% in the Eurozone, and 7.8% in the UK, but seems to show the first signs of starting to fall.

According to the IMF, inflation of 5.7% is expected in developed economies and 8.7% in emerging economies by the end of 2022.

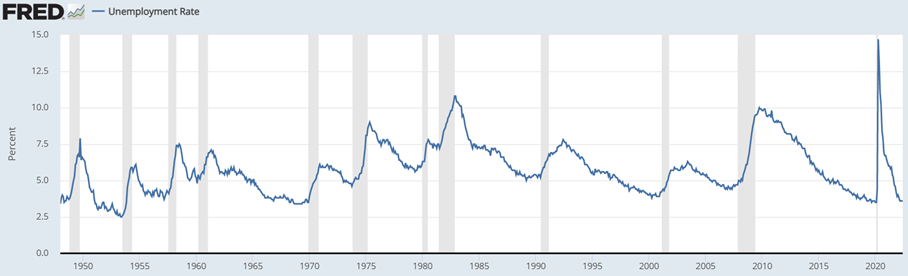

The impact of these negative factors will be lower than usual considering the good levels of wealth, income, employment and household savings in most developed countries.

Micro-economic context

Key leading and advanced economic indicators in decline

The manufacturing sector has fallen in the last two months and the services serctor has remained at a low level.

In May, only Russia and China contracted.

Inflationary pressures remain due to price increases in inputs and outputs.

The unemployment rate in the US remains at 3.6 %, level of full employment.

Business and consumer confidence in OECD countries continues to decline sharply.

Economic policies

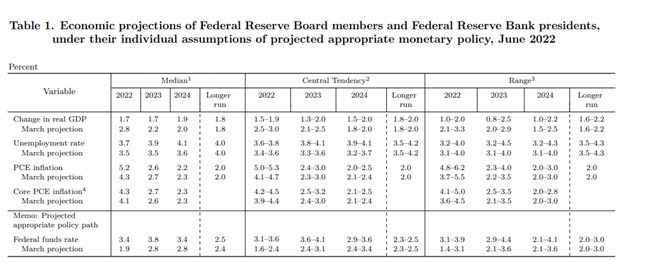

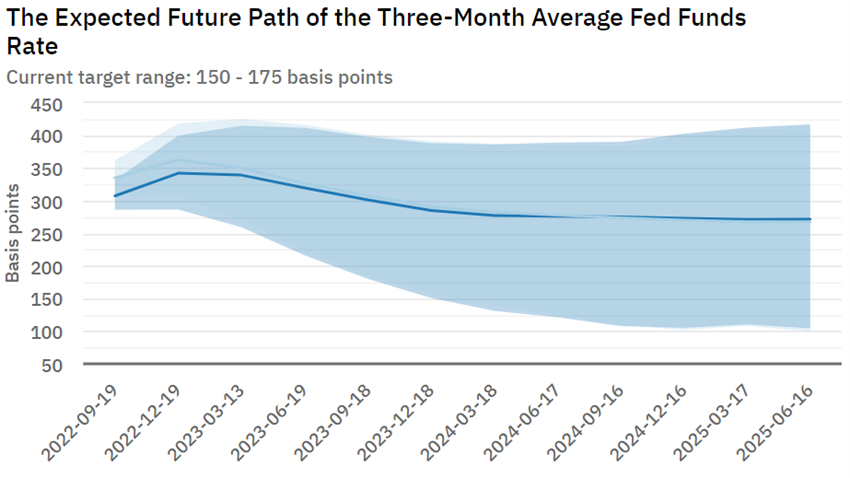

At the June meeting, the FED raised the official interest rate more pronouncedly by 0.75% to 1,5%-1,75%, admitting similar increases at upcoming monthly meetings to fight inflation.

The average FED rate forecast at the end of the year is 3.4%. In addition, it continues to withdraw liquidity from the economy.

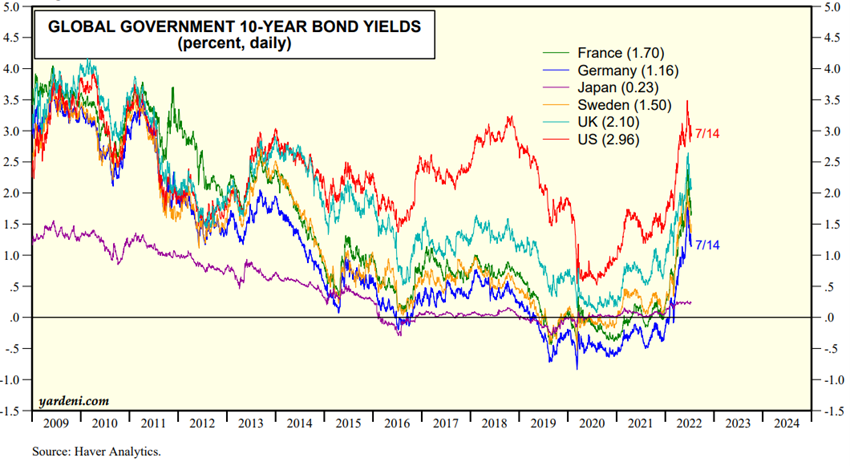

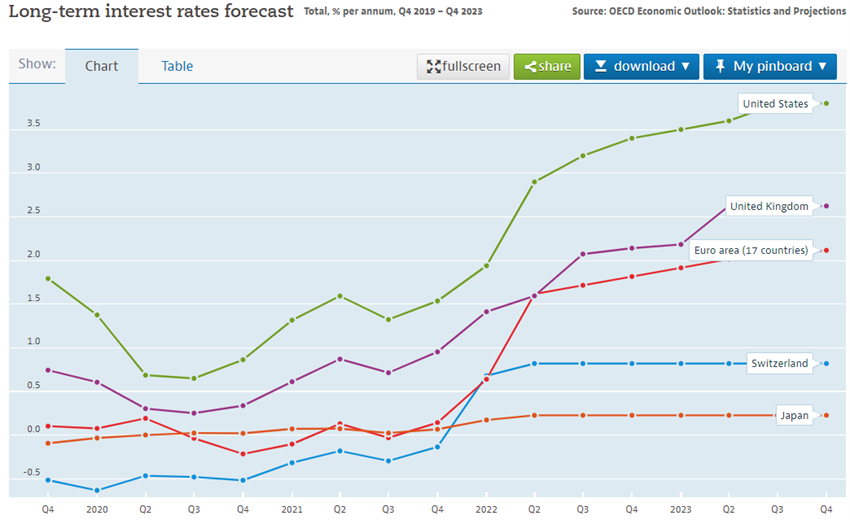

Interest rates on long-term bonds and mortgage loans rose immediately and sharply and are already above 2019.

The Bank of England has raised official interest rates to 1.25%.

The ECB decided to end the asset purchase programme on 1 July and announced its intention to make the first base rate hike by 0.25% at the July meeting.

The ECB held an emergency meeting in June to decide to act in the face of sharp rise in long-term interest rates in the most indebted countries, such as Italy, to avoid European fragmentation.

The dollar rose and trades almost at par to the euro.

After the sharp rise in the first six months of the year, interest rates on treasury bonds and mortgage lending in the U.S. are starting to stabilize.

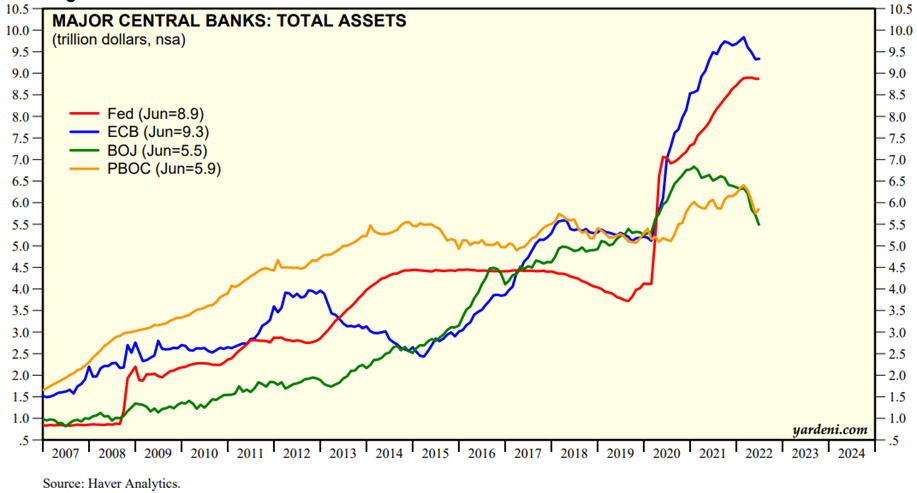

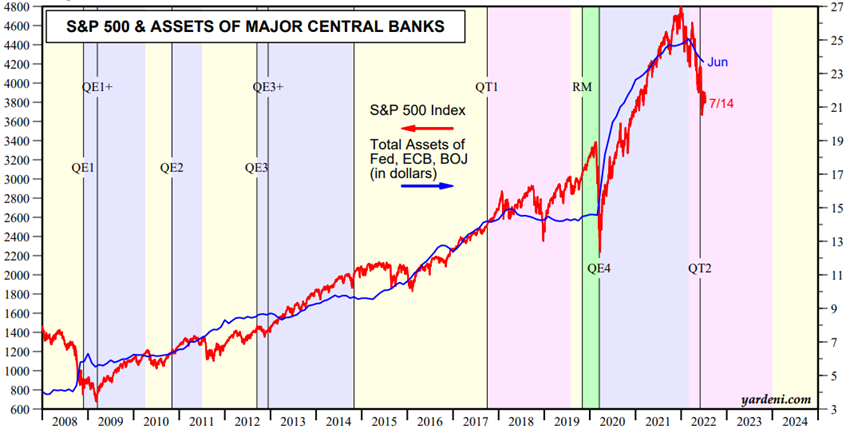

Source: Major Central Bank Total Assets, Yardeni Research, July, 13, 2022

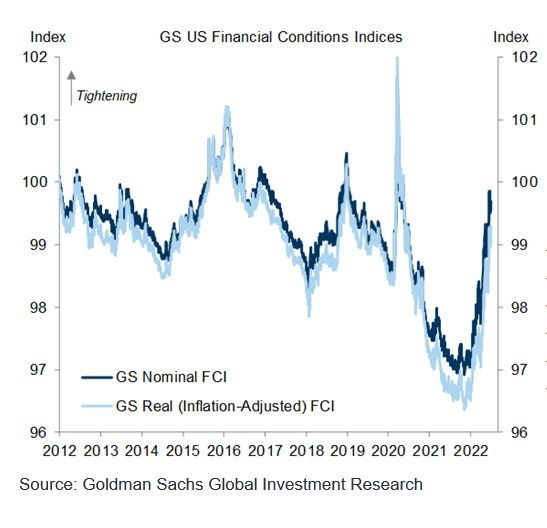

Financial conditions continue to worsen in developed countries and especially in emerging economies

Financial conditions worsened in the U.S. and Europe.

In emerging countries financial conditions have deteriorated much more in the countries of Eastern Europe and Africa (obviously in addition to Russia and Ukraine).

Sri Lanka has gone bankrupt, and there are more countries in major financial difficulties, such as Ghana, Ethiopia, Tunisia, Pakistan, South Africa, Argentina and Peru, due to high indebtedness and trade deficits, and the fall in foreign reserves.

Equity markets valuation

Stock markets in developed countries fell by more than 20% and went into bear market, with increased volatility.

Emerging stock markets have fallen more sharply.

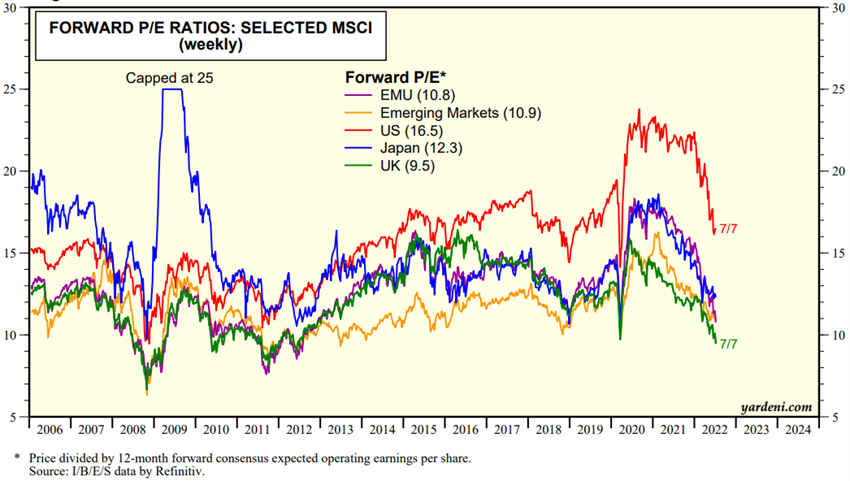

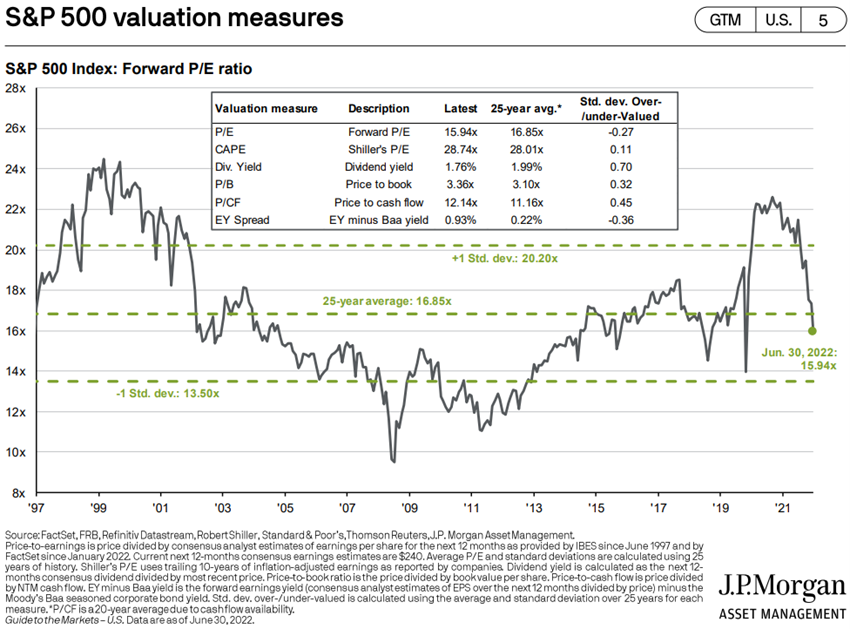

The valuation of the global stock market and in the various regions has fallen and is on the long-term average.

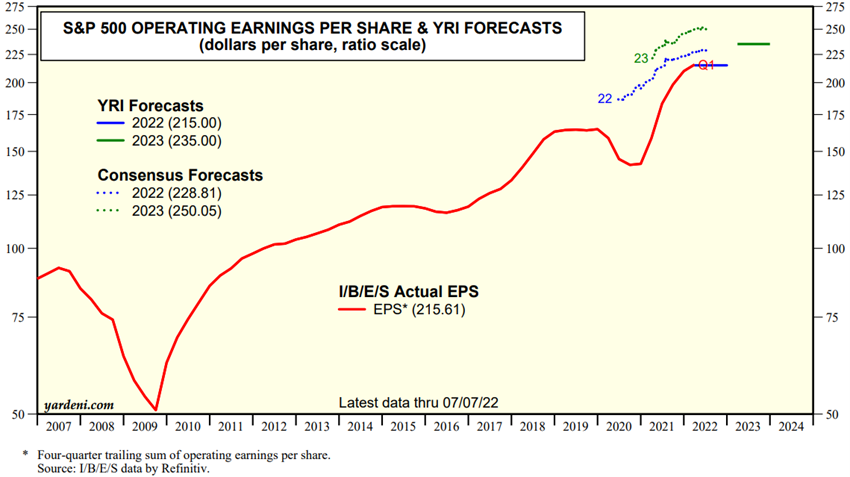

The PER of 16.5x for the US has fallen below the average of the last 5 years, being at the long-term average.

The PER’s of the remaining regions fell further to 10.8x in the Eurozone, 12.3x in Japan and 10.9x in emerging markets, below the historical average.

There continues to be a major divergence in the market between investors and analysts.

Stocks fall and valuation by multiples corrects, but analysts increase the earnings outlook for this year.

The outcome depends on the ability of the authorities to fight inflation with the least impact on economic growth.

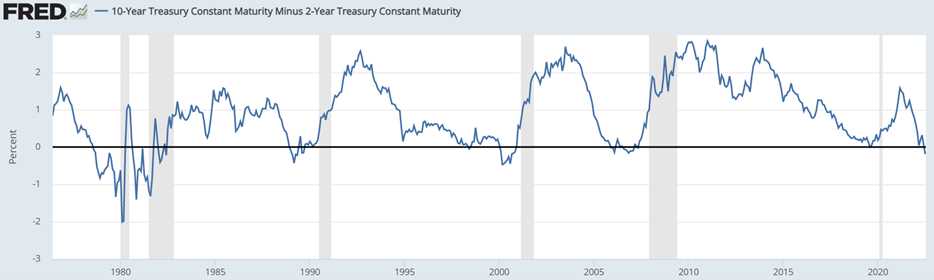

The gap between U.S. treasury bond rates at 10 and 2 years has become negative, which for some is a predictor of 6- to 9-month recession.

Financial markets are in the process of adjusting to the developing economic reality.

The interaction between growth forecasts, inflation, commodity prices and interest rates brings volatility and changes in market positioning in general and in relative terms, such as sectoral rotations of energy, raw materials and technology.

Value or quality companies with good cash-flow generation capacity are favored in the face of growth and with low or negative earnings.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, July, 12, 2022

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, July, 13, 2022

Source: Major Central Bank Total Assets, Yardeni Research, July, 14, 2022

Bond markets valuation

End of the long bond bull market. Fixed income markets correct more than 10% by rising long-term interest rates, and some widening of sovereign and corporate debt credit spreads

Bonds in developed countries have corrected more than 10% with the sharp rise in long-term interest rates, especially the US treasury bonds, reaching the 2019 levels.

The increase in credit spreads has increased, especially Europe’s sovereign debts and speculative debt.

The U.S. treasury bond market is starting to trade at interesting levels.

The end of the long bull market of bonds changed the negative correlation between stocks and bonds, posing new challenges to portfolio management, namely to the traditional portfolio 60/40.

Source: Federal Reserve Bank of Atlanta, July, 15, 2020

Source: Market Briefing:Global Interest Rates, Yardeni Research, Julyr, 14, 2022

Main opportunities

The positive signs for market reversal are the sustained fall in inflation, primarily in energy, agricultural and commodity prices.

Main risks

The threat of stagflation or even recession in the US has been increasing in probability, and is almost certain in Europe.

It is admitted that even if it happens in the US, its severity will be low due to the financial situation of families and businesses.

In Europe, the concern is greater, especially if Russia cuts off gas supplies in winter.

If the war in Ukraine continues there will be a worsening of economic and financial imbalances in the most vulnerable emerging countries and the possibility of social uprisings.

Source: OECD, Long term interest rates forecast, July, 15