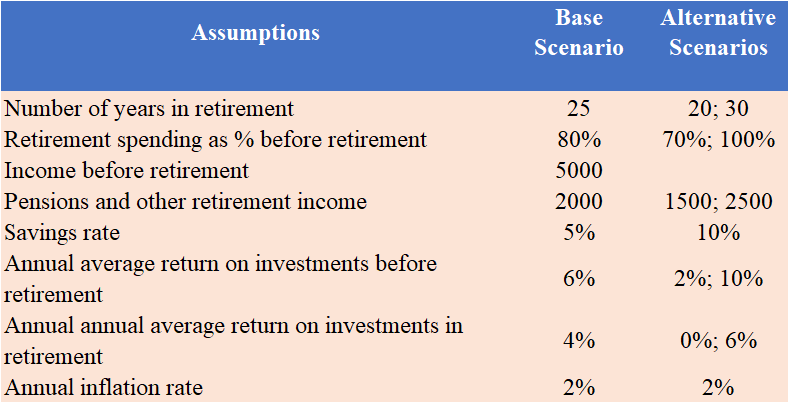

Reminder: The assumptions of base and alternative scenarios

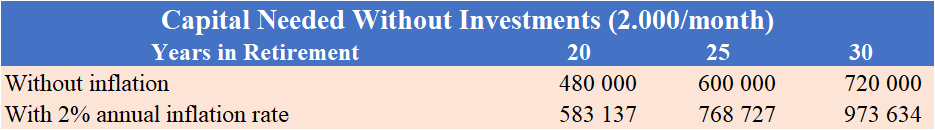

If we don’t invest, how much money are we going to need?

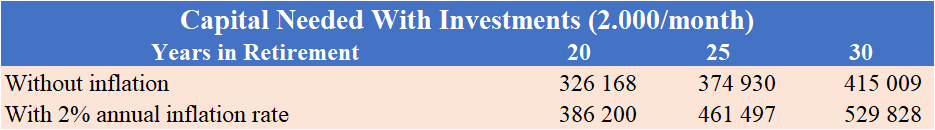

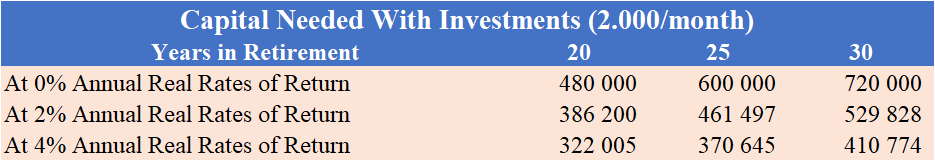

If we invest, how much money are we going to need?

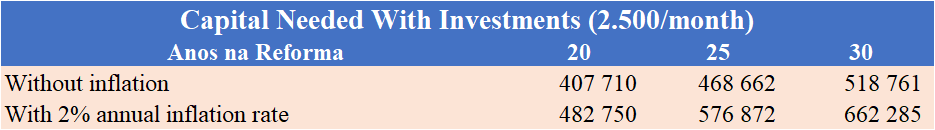

Alternative income scenarios of 1,500 and 3,000 with 2% annual rate of return

The scenario of 2,000 with an annual rate of return of 0% and 6% per year

How we apply these calculations

What experts say: the JP Morgan’s Guide of Retirement

How much money do people have for retirement?

The use of retirement calculators

After the initial broad presentation article in this series, we now start the development of the various aspects related to retirement.

In this article, we’ll look at how much money we’re going to need to live out retirement.

This is a question that many do not know how to answer.

No doubt each case is a case, but the analysis of a base case helps us to frame and understand our situation.

Not least because it’s very easy to extrapolate this case to our situation.

The financial issues of retirement have always been important.

After all, it is the period of our living in which we are financially more unprotected.

During our working life, we are younger, we have more energy and our employability is greater, so we always have the possibility to work harder to make more money.

In retirement, what we have is the result of what we did before. It is difficult to obtain new sources of income.

In addition, retirement presents today new challenges to our finances. We live longer and longer. Our public or social pensions may be low and may fall even further, especially compared to working incomes.

In addition, we have the challenges linked to the very monetization of retirement savings.

In recent years, with such low interest rates, it is very difficult to obtain interesting returns with very conservative investments or portfolios that can ensure better preservation of capital.

And if inflation rates remain high for a few years, the purchasing power of our assets and our pensions also falls.

Reminder: The assumptions of base and alternative scenarios

We will remind the main assumptions that we established in the initial article of the series.

In the following table we summarize the assumptions used:

In the basic scenario we consider the case of a person with 25 years in retirement, monthly income before retirement of 5,000, spending on retirement of 80% of income before retirement and pensions of 2,000 (which constitute the only income source).

In this situation, the income we need from our supplementary personal plan should be 2,000 (= 5,000 x 0.8 – 2,000).

In Alternative Scenarios we will make adjustments to the following variables. We consider 20 and 30 years of life in retirement, complementary incomes of 1,500 and 2,500, expenses of 70% and 100% and annual real rates of return of 0% and 6%.

It is obvious that both pensions and spending depend on the salaries (and pension systems of each country), having seen this situation in this previous article.

However, we have moved forward with these values which seem to us to be quite reasonable.

We chose the values used both in the base scenario and in alternative scenarios because they are reference values for many people of a middle or middle/upper social class in developed countries.

The values used have the added advantage of being taken as a basis for adjusting to our personal case by applying multiples.

If we only need a supplementary income of 1,000, we just take the baseline scenario and multiply by 1/2 (we divide it half).

If we need 3,000, we choose the alternative scenario of 1,500 and multiply by 2.

And if we want 10,000, we take the 2,500 scenario and multiply by 4, and so on.

How much money do we need to live through retirement

To know how much money we will need to live through our retirement we need:

– Know the annual income we will have in retirement, i.e. pensions

– Estimate the annual expenses we will have

– Calculate the deficit that we will face and we will have to cover, by the difference between spending and annual income

– Determine the amount of capital needed for the entire retirement period

– Count on inflation in those years

– Consider the income from investments of this capital

Let’s see how what results we get in the various scenarios.

If we don’t invest, how much money are we going to need?

If we do not invest, the money we will need is obtained by simply multiplying the number of years we expect to live in retirement by the estimated value of annual spending, if we do not consider inflation.

If we take inflation into account, to ensure that the purchasing power of income is sufficient to accommodate rising spending prices, we will need more money.

The following table shows the capital needed to provide supplementary monthly retirement income of 2,000 for a retirement life of 20, 25 and 30 years.

In the first line we have the simplest calculation that we mentioned earlier, that of multiplying the years by the incomes needed.

For example, for 25 years, which equate to 300 months, with incomes of 2,000 per month, we get 600,000.

In the second line we have introduced the effect of inflation on the necessary incomes to ensure that we maintain purchasing power.

We grow annual incomes at a rate of 2% per year.

In this case, for the same 25 years used in the previous example, the required capital increases to 768,767.

It is obvious that for only 20 years we need a lot less and for 30 years of much more.

In any case, it is very simple to adapt to each particular case by applying the multiple factor of proportionality in the value of the incomes needed and longevity.

For example, if we need a monthly supplementary income of 1,000, equal to half the amount used, the capital will be half.

And if we need 5,000, equal to 2.5 times the amount used, the capital will be 2.5 times, and so on.

If we invest, how much money are we going to need?

If we invest, we will need less money in retirement because we will have the proceeds of that investment. Thus, everything will depend on the rate of return of our investments.

We won’t know the actual income until we get to retirement. Until then, we can only think of expected income. One thing is certain, because theory and practice have already demonstrated this: the more income corresponds more risk; that is, there are no free lunches!

What we will do is calculate the present (or current) value of a series of cash-flows of future income with a capital growth rate given by the rate of return.

Assuming an average annual rate of return of 4%, the money we need in retirement will be:

We see that if we invest, using annual nominal rates of 4% and 2% real rates, in the period of retirement, the capital we need decreases significantly.

For a life expectancy of 25 years, the capital needed without inflation is 374,929 and that with inflation is 461,497.

These figures are compared with 600,000 and 768,727 previously obtained, without investments and therefore zero profitability.

That is, if we invest at a rate of 4% per year, which with annual inflation of 2% translates into the real rate of 2% per year, we do not need about 40% of capital without or with inflation.

This is a very significant and worthwhile savings. This shows well the power of investment even with moderate rates of return. It is the effect of coumpounding of income on capital growth for many years.

The adaptation to the intended personal income simply consists of using the corresponding multiple, for example 1/2 for an income of 1,000.

Alternative income scenarios of 1,500 and 2,500 with the same 2% annual rate of return

The capital needed for a monthly supplementary income of 1,500 with a 4% annual rate of return, without and with annual inflation of 2%, is as follows:

To live 25 years in retirement with monthly supplementary income of 1,500 without inflation we need a capital of 281,197 without inflation, which increases to 346,123 with inflation (increase in income at this rate to maintain purchasing power).

The capital needed for a monthly supplementary income of 2,500 is as follows:

To live 25 years in retirement with a monthly supplementary income of 2,500 without inflation we need a capital of 468,662 without inflation, which increases to 576,872 with inflation.

The income scenario of 2,000 with rate of return of 0% and 6% per year

For we have 2,000 supplementary income over the course of retirement with real rates of return of 0%, 2% and 6% per year the following capitalis required:

For a 25-year pension and a 0% rate of return we need 600,000, decrease to 461,467 (by almost 25%) if the rate is 2% and fall to 370,645 (about 40% less) if the rate increases to 6%.

It is important to note that we have not presented calculations for negative real rates of return, which may happen.

It is sufficient that the rate of remuneration of investments is lower than the inflation rate, which happens whenever we leave the money in demand deposits or apply it in successively renewable term deposits with lower rates than inflation (which is often the case).

Although rare, it may still happen that the inflation rate may be abnormally high, as was the case in some periods of the past after the war or in the early 1980s.

If the actual rates of return are 0% or 4%, that same person would need a capital of 600,000 (plus 30%) or 370,645 (minus 20%), respectively.

It should be noted that the simulation of other rates does not obey a proportional or linear rule, but rather exponential, so multiples cannot be used.

How we apply to our personal case

In the baseline scenario of the previous section we presented the objective of obtaining a supplementary retirement income of 2,000, simulating a hypothetical situation of income from work before the retirement of 5,000, spending 80% of income (4,000) and a public pension of 2,000.

We also looked at the income situations of 1,500 and 2,500 as alternative scenarios.

As we said, the results we have presented allow us to analyze all the situations we want, because the calculations are linear and proportional.

All we have to know is the supplementary income we want.

For example, if we need a supplementary income of 8,000 we only have to multiply by 4 the income values of 2,000.

If we need only 750 we have to split the income values by half of 1,500.

And we don’t need a lot of calculations to know the additional income we need.

We can accept the 80% spending equivalence rule or proceed with any other estimate.

Then it is very easy to know the value of our public pension through national pension systems, especially in developed countries.

With this we find out what we spend, what we have and how much we lack.

What experts say: JP Morgan’s Guide to Retirement

In many articles on personal finance, the value of 1,000,000 (and sometimes even double) is presented as the total target capital for retirement for a middle class person in the US or Europe, including public and social pensions.

Typically, this type of approach seeks to alert people to the need to plan for retirement and to save and invest in advance and with periodic and regular contributions.

We believe that this approach may have the opposite effect. By presenting such a high capital, usually without any framework for the household and the incorporation of public pensions, and especially the salaries and expenditures concerned, the approach may become negative.

As we will see, in many cases, this capital is not only decontextualized, which leads to loss of credibility, but also is or at least may seem unattainable, which can lead people to give up on making the retirement plan.

Therefore, we consider more useful the references of values according to the values of annual salaries and establishing multiple goals throughout life.

These figures are more realistic because they take into account public and social pensions, spending as a percentage of income and household savings capacity.

For example, JP Morgan’s Guide of Retirement presents lifetime salary multiples for a two-person household with total annual salaries between $30,000 and $300,000, and with savings rates between 5% and 10%.

The target capital ranges from 2.5x salaries to 13.7x salaries at 65 years for the household.

For an aggregate with $100,000 annual salary, the corresponding multiple is 7.5x, which would give a capital of $750,000.

We can access this guide at the following link:

And just as or more important than knowing the value is to understand the issue and above all the process.

We will address precisely the calculation of these lifetime multiples in a subsequent article in this series.

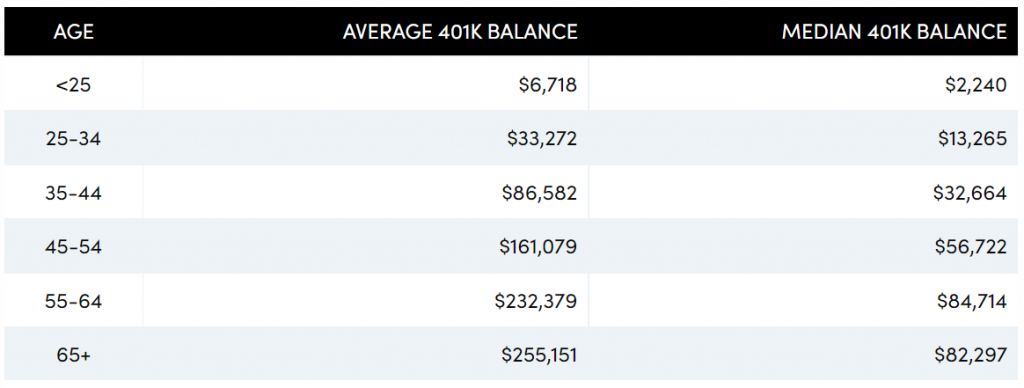

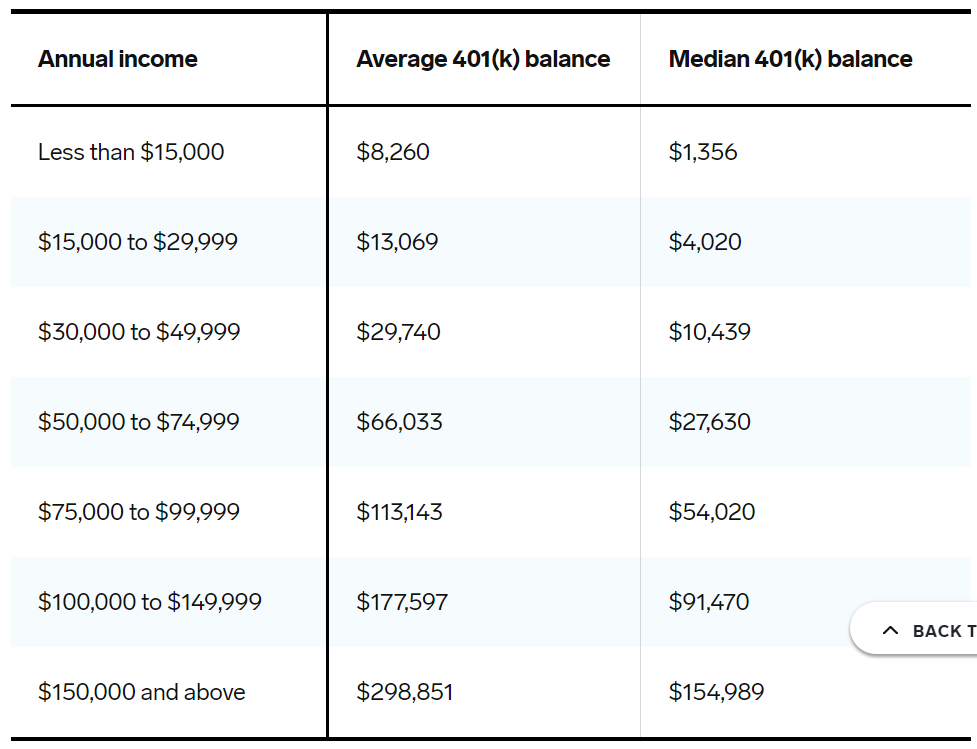

How much money do people have for retirement?

It is also interesting to know how other people prepare for retirement.

In the US, 49% of adults aged 55 to 66 had no personal retirement savings in 2017.

And 30% of men and 22% of women in this age group had more than $100,000.

In the US, most personal retirement plans are the 401k plans.

These are plans promoted by companies, which bring together contributions from workers and companies, and have tax advantages.

According to Fidelity, the average balance of these plans was about $160,000 to $180,000 for people between the ages of 50 and 69, and their holders had a contribution rate of about 10% to 12% of salary.

According to the How America Saves study published by Vanguard, the average balance of 401k plans is $230,000 to $250,000 for people aged 55-64 and >65 years, respectively.

However, median values (corresponding to 50% of participants in these plans) drop considerably to $85,000 and $82,000, respectively.

For all participants (of any age), the average balance is $129,000 and the median is $33,000.

We can access this study at the following link:

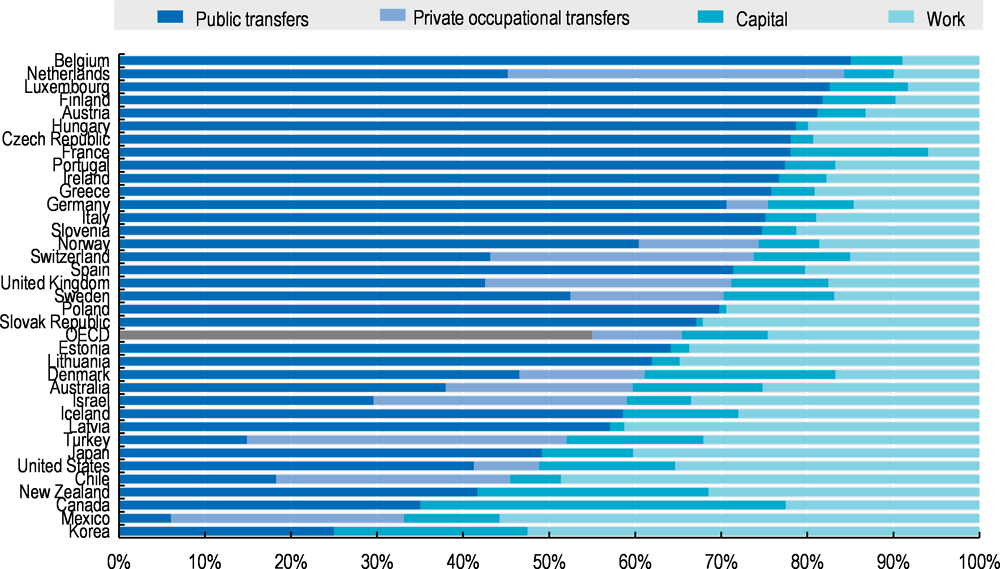

Another interesting information is to know the sources of income of people of retirement age.

For OECD countries, the income situation of people over 65 is as follows:

The use of retirement calculators

On the internet there are a number of retirement calculators that we can access that help us establish the retirement objective capital.

Among the most frequently used and useful are the income from Vanguard, New Retirement, Flexible Retirement Planner, MarketWatch Retirement and Bankrate that we have already covered in the Tools and Calculators folder of this blog.

In the following link we find a recent critical analysis of some of the best retirement calculators:

https://www.thebalance.com/retirement-calculator-reviews-4061796