The increase in participation of retail investors in the stock market continues

Options trading by retail investors also remain at a high level

Financial leverage has decreased and is at average levels

In the first we presented the evidence of the phenomenon of democratisation, the way it expresses itself and its impacts.

In the second we saw that, in general, this democratization was positive, bringing new investors to the market.

In the third we warned of some risks and excesses of irrationality

associated with this phenomenon, concluding that over time, the market would be correcting these failures.

Now we take stock of this situation.

In the next article we evaluate whether the market excesses that we identified as having been brought by democratization have already been corrected or not.

It is important to know and be aware of the functioning of the market in order to better understand how we should act and above all the mistakes that we must avoid.

The increase in participation of individual investors in the stock market continues

As can be seen in the following chart, US retail investors have increased significantly their investments in equity mutual funds since 2020:

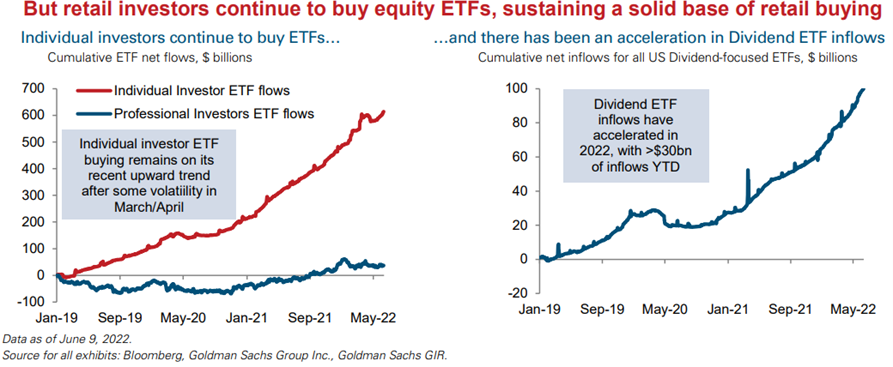

Purchases of ETF funds in general, and dividends in particular, have grown greatly in the last two years:

Much of the excess savings generated by government support for the crisis have been invested in these funds, and so they remain, after their end, and more importantly, despite their decrease, associated with the recent reduction in disposable income and increase in the cost of living.

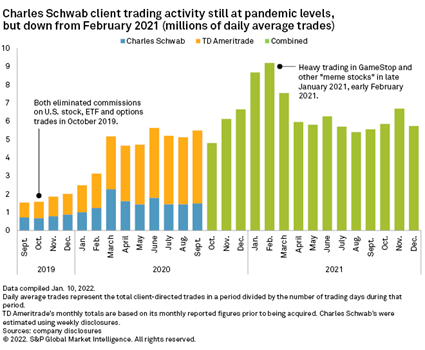

At the same time, the direct participation of retail investors in the US stock market has also increased:

This increase in transaction volume by retail investors was initiated before the pandemic with the introduction of Robinhood’s zero-exchange commission practice in 2019.

This practice was soon followed by the remaining large and traditional brokers of the market, such as Charles Schwab and some of the largest banks.

And it was reinforced with part of the investment of government support for families.

This new investor base, usually from younger generations, benefited from the greater availability of time provided by remote work and the access and use of social networks to disseminate knowledge information and mobilization for market investment.

In these terms, the participation of individual investors in the stock market remains high, which reinforces the idea that the democratization of the market is here to stay.

This increased participation is positive in two measures.

The market has a broader base of investors.

New investor families benefit from the higher relative returns of this type of investment in the medium term.

It is normal and even positive that in recent months there has been some decline in investment in times of correction, associated with economic and financial instability.

Families realize that in times of greater market volatility, it is best to wait a little for moments of more clarity and stability.

Transactions in options by individual investors also remain at a high level

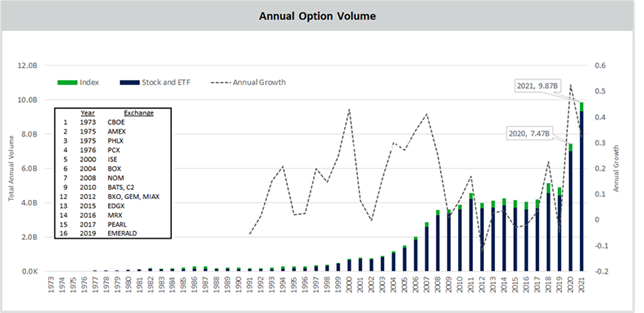

Global transaction volume rose from just over $4 billion in 2019 to $7.4 billion in 2020 and $9.9 billion in 2021, annual growth of 30% and 40% respectively.

There was a drastic change in trading volume in 2019:

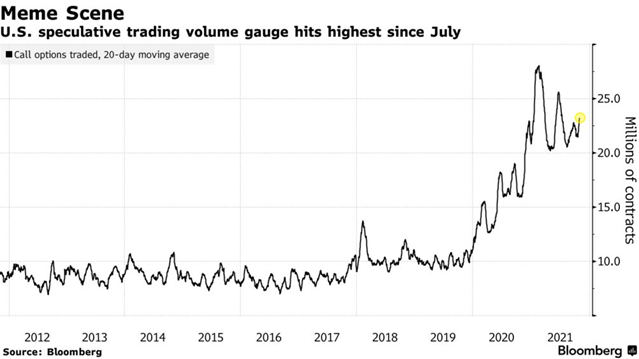

The 20-day moving average of call options (i.e., that confer the right to buy the stock at a certain price) traded in the US that remained below 10 million contracts between 2012 and 2019, exceeded 15 million in 2020 and exceeded 27 million contracts in 2021.

These types of contracts – speculative call options – are usually a sign of euphoria and market oversupply.

In the first months of 2022, options transactions by individual investors decreased:

Source: Bloomberg, Goldman Sachs Group Inc., Goldman Sachs GIR, June, 9.

This reduction also accompanied the lower investment in individual stocks.

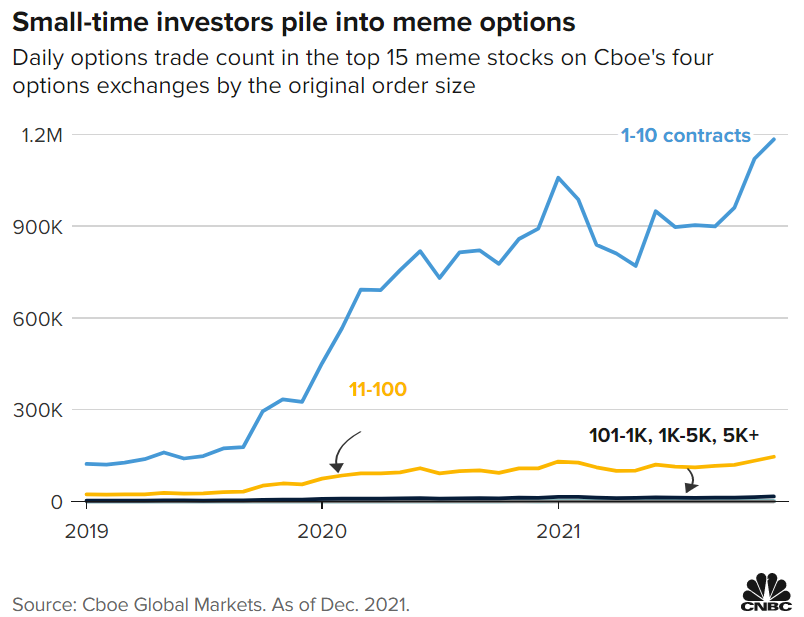

However, individual investors continue to trade large volumes of meme stock options:

As we know and see in other articles the meme shares were a phenomenon that began in early 2021 when a multitude of new individual investors mobilized by social media decided to invest in shares of companies in financial difficulties and with large short positions of individual investors such as Gamestop and AMC.

These stocks reached astronomical and unreasonable values in the first half of the year. Since then they have been falling, but some are still at very exaggerated levels, as we will see later.

The greater participation of retail investors in the options market is overall positive as options are an interesting investment risk management tool.

However, the vast majority of individual investors use the options market for speculative positions rather than hedging and risk management, and there is still very high activity in options on meme stocks.

Financial leverage has decreased and is at historically average levels

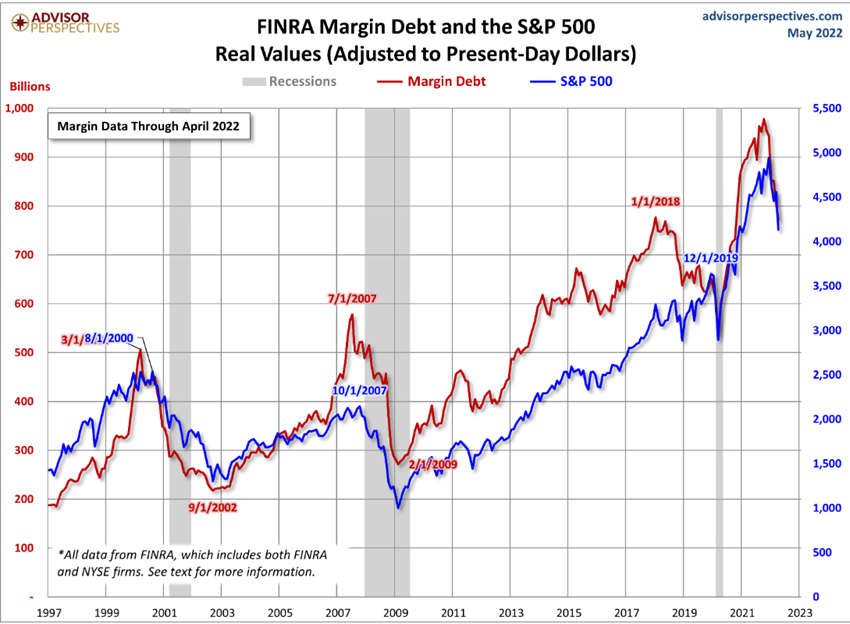

US stock market leverage remains high as seen in the following chart, which shows the evolution of margin financing volumes alongside that of the S&P 500 index:

The leverage of the market, that is, the volume of financing of investments in margin account remains high, but with a reduction in the first months of the year, which is obviously very correlated with the movement of the index.

The market’s fall forces investors to strengthen liquidity in margin accounts and close or settle positions.

The value of margin account financing reached US$773 billion in April 2022, down from US$144 billion compared to the same month a year earlier:

As financing volumes tend to increase with market appreciation, it is useful to analyze the value as a percentage of the total market.

Current debt has declined 0.34% in the last 12 months, and is now below the average for the past 50 years.

This means that the market is not overleveraged and is a positive valuation measure.