Market overbursts or failures create bubbles that tend to be corrected over time

What are the meme stocks

Euphoria of the movement of the meme stocks triggers the prices

But the markets also have their law of gravity and everything that goes up foolishly also falls a lot

About a year ago we published three articles on the recent democratization of investments in the stock markets, especially in the US.

In the previous article, we presented the first part, analyzing the current presence of individual investors in the spot market and options.

We conclude that the trend of democratization of the market continues at a good pace, being globally positive for the market and for new investors.

In the second part that we have just started, we will assess whether or not some of the excesses we have identified are being corrected.

Knowing market trends and how it works is important for investors.

Only in this way can one understand the central aspects, and distinguish the normal movements of some of their dysfunctions and distortions.

Market overbursts or failures create bubbles that tend to be corrected over time

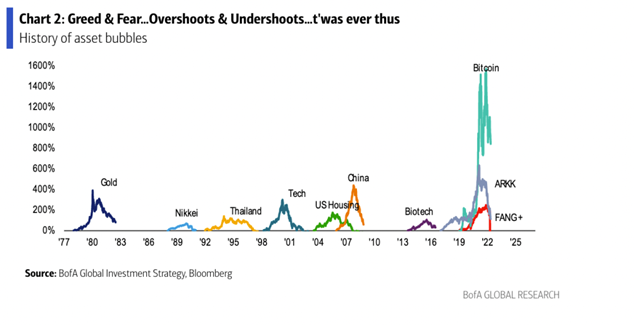

The long history of financial markets has had several bubbles, which stem from excesses or market failures, from the times of the tulip trading bubble in 1630 to those of the last 40 years, such as gold, technology, real estate, etc.

Inevitably these bubbles after exploding, also implode.

Let’s see that the excesses or failures found are also being corrected.

In fact, there have been corrections in meme stocks, SPAC IPOs, unprofitable technology and even cryptocurrencies.

In this first part, we begin with the meme stocks and a quote from Michael Burry about them:

“I don’t know when meme stocks such as this will crash, but we probably do not have to wait too long, as I believe the retail crowd is fully invested in this theme, and Wall Street has jumped on the coattails,” Burry told Barron’s (one of the first investors to spot and profit from the subprime mortgage crisis, “The Big Short” movie investor), July, 1, 2021

What are the meme stocks

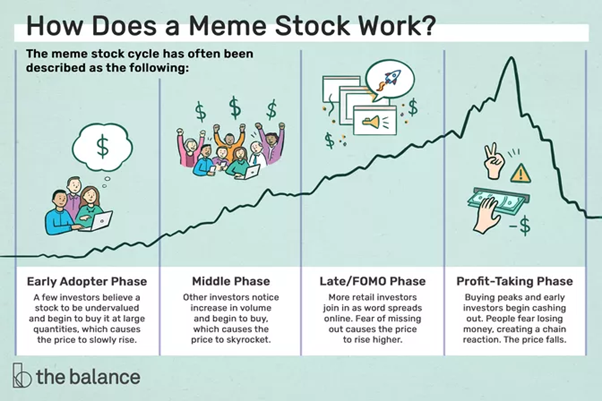

As we saw in previous articles, at the beginning of last year there was the emergence in meme stocks, so called because these are stocks bought by phenomenon of a spread of an idea, behavior, style, culture, imitation or follow-up especially through social media.

At the bottom is the investment by a group of believing individuals or a sect, of this idea.

In January 2021, massive investments were made in shares of Gamestop, AMC, Blackberry and Bed Bath and Beyond, among others.

These investments were triggered and fueled by waves of mobilization of individual investors on social media, especially Reddit through the community of 6 million Wall Street Bets members.

The stocks selected had in common the fact that they were stocks with the largest short positions in the market, taken by large institutional investors.

These are stocks of companies in financial economic difficulties, heavily indebted and with weak or even negative results.

In short trades, you bet on the decrease in prices.

The investor borrows the stocks and sells them in the market.

When stock prices fall the investor buys the stocks in the market, pays off the loan, and earns the difference between the highest initial selling price and the lowest final purchase price.

For this and many times, the mobilisation of individual investors has proposed the plan to fight large institutional investors.

The high and continued purchasing volumes of retail investors have caused a great deal of pressure in the prices of these stocks that have risen very sharply.

These price increases forced institutional investors with short positions to buy shares to minimize losses and reset collateral liquidity of the loan margin accounts, which promoted a further price increase. And so on.

It is called squeezing the market (short-squeeze) or cornering the market.

Euphoria of the movement of the meme stocks triggers the prices

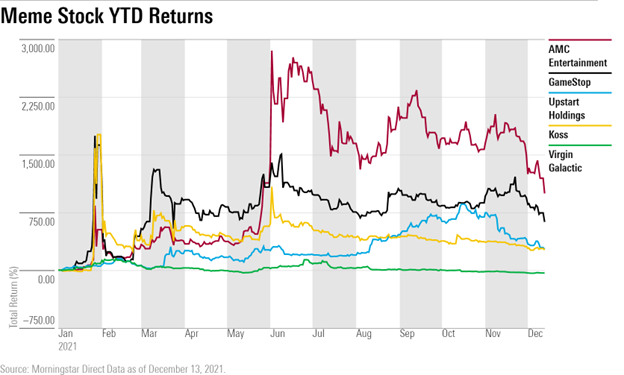

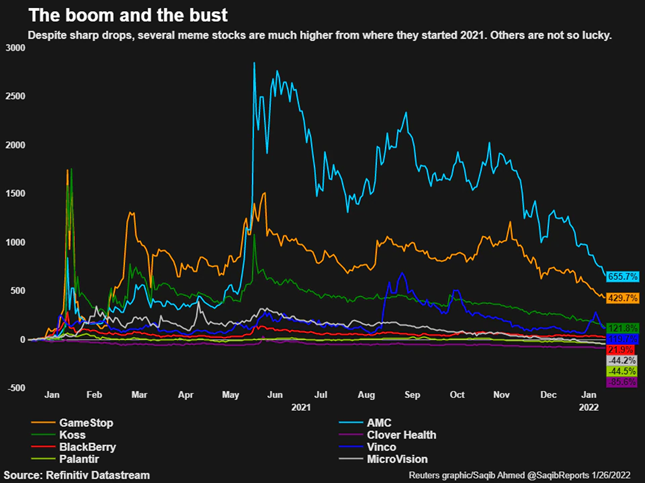

These market movements caused some of these stocks to record increases in prices of hundreds or even a few thousand percentage points in January and again by the time of the summer:

For example, Gamestop shares rose from $5 to $500 in six months.

Meanwhile, some of these companies took advantage of high prices to raise capital and strengthen their financial situation.

In some cases, the main managers also sold part of their stakes in the company’s capital.

From the summer of last year, the phenomenon began to fade due to the absence of improvement in the results of companies.

Still, at the end of the year, for many of these companies the gains were still considerable, not least because the stock market in general was very positive.

But the markets also have their law of gravity and everything that goes up foolishly also falls a lot

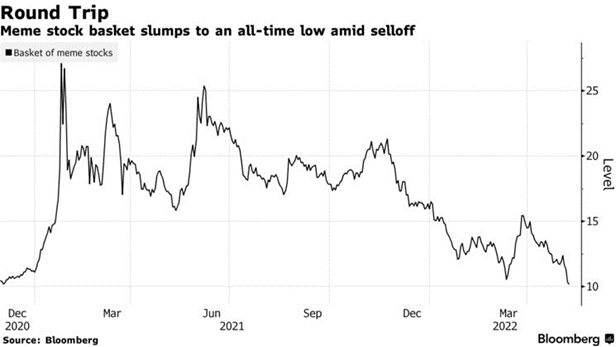

In the first half of this year, price declines increased, as expected.

The more negative environment of the markets made these most vulnerable stocks among the first to fall and very sharply, as we can see in the price developments of a basket of shares by the end of April this year:

All meme stocks have been correcting the excesses committed in the first part of last year:

Most of these stocks have already corrected most of these excesses.

However, there are stocks that still show gains of the order of hundreds of percentage points compared to past levels.

These are the cases of AMC and Gamestop, precisely the stocks that were at the epicentre of the phenomenon, despite the fact that they lost between 70% and 80% of their maximum levels.

Overall, the law’s challenge of gravity’s investment in meme stocks lasted just over a year.

Some individual investors won and many others lost.

Small investors can claim a moral victory.

In May of this year, Melvin Capital, one of the leading institutional investors with the largest short positions in these companies, succumbed after recording more than $3 billion in losses.

All stocks have a fundamental or intrinsic value. In the long run, the price tends towards this value. In the short term, there are deviations, by default or by excess. Therefore, it is important for the investor to buy at a fair value and with a margin of safety.

In the second part of this article we will discuss the theme of SPAC IPO, another manifestation of the market excesses of 2020.