The incentives of initial public offerings and the sentiment and timing of the market

What are initial public offerings or IPO via SPAC

The advantages of IPO via SPAC versus traditional IPO

SPAC’s IPO exploded in 2021, like a gold rush, to calm down again in recent times

A year ago we published three articles on the recent democratization of investments in the stock markets, especially in the USA.

We considered the movement to be globally positive, while pointing out flaws that would probably be corrected over time.

These articles are intended to take stock of the situation.

In the first, we looked at the current presence of individual investors in the spot market and options.

We have shown that it remains and underlined the idea that it is very beneficial for the market and for new investors.

In the second article we began to address the issues of the various excesses or market failures brought about by this democratization of the market.

Being such a diverse subject, covering different aspects, we had to divide it into parts.

Thus, in this article we deepened the case of “meme” stocks, shares of companies that were subject to excessive demand and consequent eruption of prices, due to a massive movement of a community of investors, mostly young and young.

In this article, which constitutes the second part of the excesses or failures, we focus on the theme of the initial public offerings of SPAC, a fast track to the introduction into the stock exchange of companies that exploded in 2020.

We believe that it is essential to understand each of these distortions in order to know the mistakes we must avoid making.

The incentives of initial public offerings and the sentiment and timing of the market

Before further analysing this matter, it is worth taking note of the opinions expressed by the major investor Warren Buffett on initial public offerings in general, comparing them with the current transactions of the stock market:

“In my view, you’re way more likely to get incredible bargains in an auction market. It’s just the nature of things… Sometimes there will be IPOs in terrible markets, and they may come very cheap. But by and large, that is not when IPOs come. They come when the seller thinks that the market is ready for them. And they come with an informed seller thinking it’s a pretty good time to go public. And, you know, you’ll make better buys, in my view, in an auction market.”, Warren Buffett

“The idea of saying the best place in the world I could put my money is something where all the selling incentives are there, commissions are higher, the animal spirits are rising, that that’s going to better than 1,000 other things I could buy where there is no similar enthusiasm … just doesn’t make any sense. The fear of missing out on a popular IPO can cloud investors’ judgement, leading them to make poor investment decisions, “, Warren Buffett

As expected, there is a strong correlation between market sentiment and the volume of exchange listing admissions.

The more positive the market time, the more start-up companies and others want to access the market.

Investor demand is higher, making sales prices higher and transaction viability more assured.

However, there are many companies, some large, that need a few years to go on the stock exchange.

For example, many unicorns, or companies with a private capital market valuation of more than $1 billion, can take more than 3 to 5 years to be ready to trade on the stock exchange.

Preparing the exchange listing takes a long time to do.

Companies have to go through a long process of internal organisation and management, growth to a certain level, and capacity to process and report economic and financial information.

Companies also want to avoid the risk that when they are ready to go on the stock exchange, they face a market of negative sentiment or in crisis.

One way to reconcile these realities, to raise capital from market investors when the company is not yet fully ready for a public listing is through the SPAC IPO.

To cut steps and anticipate some of this deadline, many start-up companies have merged with SPAC vehicles to speed up this process.

What are initial public offerings or IPO via SPAC

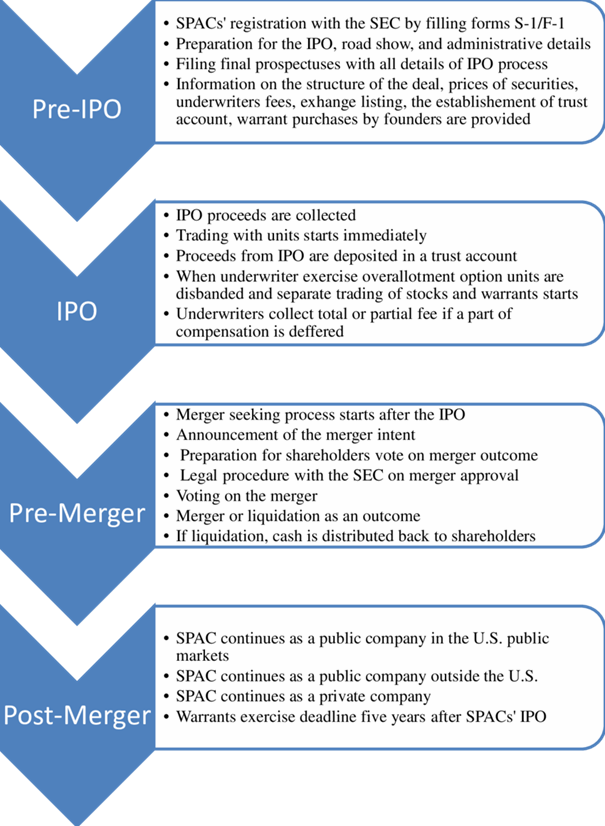

A SPAC (“Special Purpose Acquisition Company”) is a vehicle company consisting of investors with the sole purpose of mobilizing funds through an initial public offering (“IPO”) to acquire another company.

In this way, SPAC carries out the exchange entry of this private company.

The goal of SPAC is to accelerate the process of mobilising funds by start-ups in the capital market.

SPAC is a company that makes a faster IPO with a set of investors – because it has fewer regulatory requirements (and less protection granted to investors), raising capital for the purchase and/or merger with the private company, promoting its access to the capital market.

SPAC is a company promoted by reputable managers in the financial community.

Typically, these managers or founders also invest in SPAC itself, with a stake of about 20%

The funds raised are in a segregated and remunerated deposit account.

Managers usually have about 18 to 24 months to make an acquisition, a period that can be extended with the permission of investors.

After this period, if the acquisition is not made, the money is returned to investors.

In some cases the company to be acquired is known from the outset, in others it may be at the discretion of the promoters.

In recent years several well-known companies have accessed the market in this way.

These were the cases of Virgin Galactic, DraftKings, Opendoor and Nikola Motor.

The advantages of IPO via SPAC versus traditional IPO

The advantages that are normally attributed to IPO via SPAC are several.

First, to access the experience and ability of promoters to identify and attract the company and manage the IPO process.

Second, to avoid the slowness and costs of a traditional IPO.

Third, the possibility of investing in a company at a lower value would be paid in an IPO, as the same is done at an early development stage.

When the environment is very positive, it took itself a step further than usual.

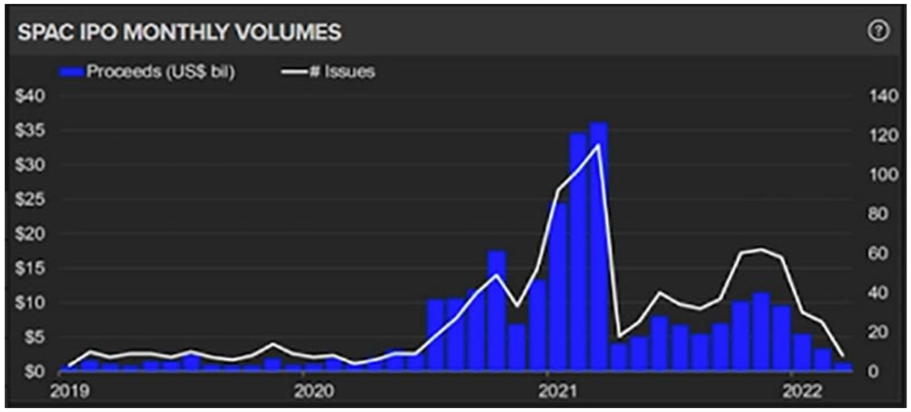

SPAC’s IPO exploded in 2021, like a gold rush, to calm down again in recent times

The number of SPAC IPO has never been higher than in 2021:

By 2022, the trend has been to return to historical levels.

The correction and volatility of the market have led to the withdrawal of many SPACS IPO, such as panera bread.