The dividend aristocrats companies

The S&P 500 dividend aristocrats

The European dividend aristocrats

The S&P 500 dividend kings

The European dividend nobles

Other high dividend stocks in the U.S. and Europe

In another article, we looked at the investment in dividend stocks.

We’ve seen what they are, who they’re addressing, when they’re most interested, how they’re performing and how we can invest in those stocks.

We conclude that dividend stocks are generally very attractive and can be part of any individual investor’s investment portfolio.

Thus, it is important to know more thoroughly how we can invest in dividend stocks.

In this article we will see what are the main dividend stocks of developed markets, namely the USA and Europe.

In the Tools folder and integrated into the Best of Investment Funds series we cover the main investment funds of dividend stocks for u.S. and non-U.S. investors.

In the Tools folder we also published a note on the Hartford Funds study referred to in this article, including the access link.

In other articles, we will analyze the main dividend stock indices of developed markets.

Let’s underline an important note before we begin.

Here we focus on the stocks that pay the highest dividends.

We know that there is another way of distributing results to shareholders who are buy-backs, which are more tax-efficient and increasingly used.

What matters to the investor is the distributed overall income, whether by dividends or buy-backs.

In a next article we will cover stocks with higher buy-backs.

The dividend aristocrats companies

There are several types of dividend stocks.

From the outset, we have from the stocks that pay the highest dividend at any given time to those that increase dividends every year for a long period.

The second ones are more sought after because they are more consistent.

The financial reporting and rating agency S&P has long identified stocks that have increased dividends over a long period of years, calling them aristocratic dividend companies.

There are also a number of other indices, less known and less used, but which also receive names of the aristocracy, such as kings and nobles of dividends.

The idea seems to be that the traditional wealth of the aristocracy allows the payment of regular and stable incomes, similar to the income of the extensive rural properties, or the privilege of requesting the payment of taxes or feudal rents.

Next we will see the aristocratic companies of the dividends of the North American market and the European market.

The S&P 500 dividend aristocrats

Dividend aristocrats are companies in the S&P 500 index that have increased their dividend payments for at least 25 consecutive years.

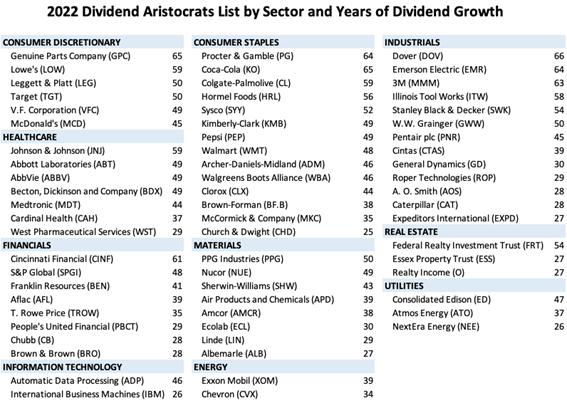

This list of the best dividend stocks in the S&P 500 combines well-known companies with almost unknown ones, but they all play key roles in the U.S. economy, as we can see for the year 2022:

These companies operate in many sectors of the economy, and share in common the commitment to reliable and long-term growth in dividends.

The aristocrats dividend stock index nearly matched the performance of the broader market index in the last decade, with a total annual return of 12.95% for dividend aristocrats versus 12.96% for the S&P 500 Index.

Dividend Aristocrats presented a lower risk than the market in general, measured by standard deviation.

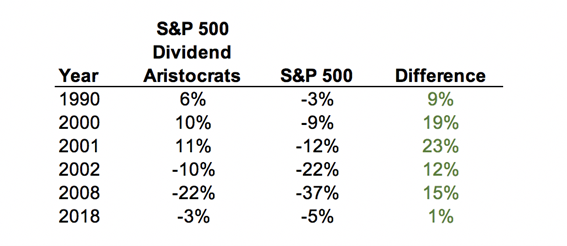

Note that a good part of the performance of these stocks in relation to the S&P 500 comes during recessions, 2000 – 2002 and 2008. In 2008, the dividend aristocrats index declined 22% while the S&P 500 fell 38%.

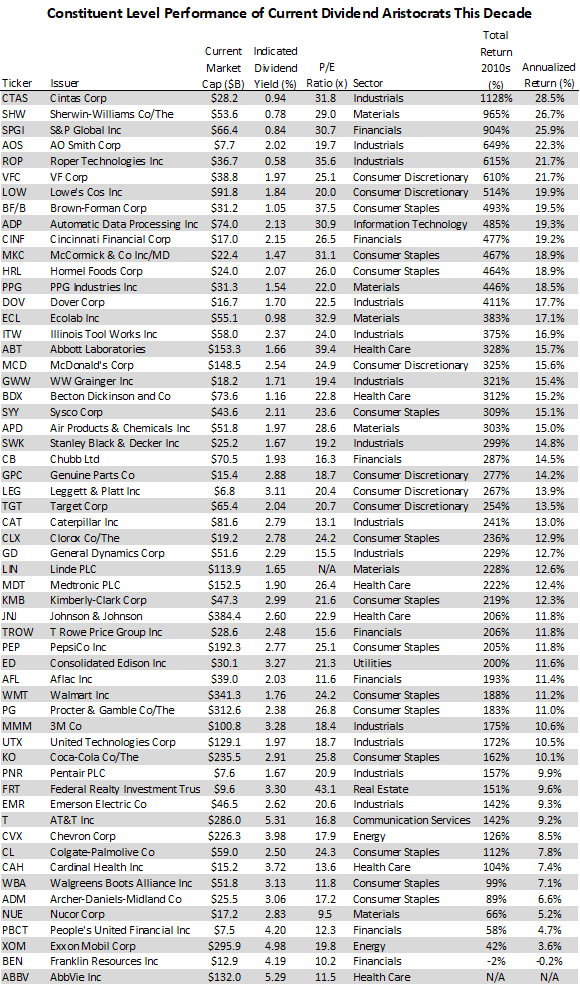

The table shows the performance of companies in the dividend aristocrats index of the last decade:

In that decade, the annual return of the S&P 500 index was 14.7%, above the historical average of 10.7%.

S&P has another dividend aristocrats stock index that is more used by investment funds than the S&P 500, which is the S&P High Yield Dividend, which is more diversified because it covers more companies and in a larger universe, that of the 1,500 largest U.S. companies.

The European dividends aristocrats

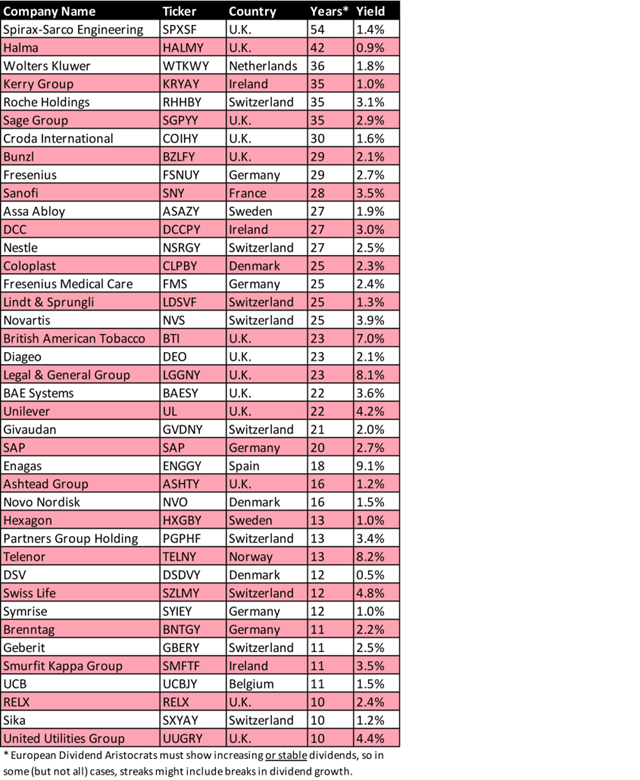

Like their US counterparts, European Dividend Aristocrats are recognised for constant and growing dividends.

European Dividend Aristocrats only need to deliver 10 years of stable or growing dividends.

The European dividends aristocrats of 2022 are as follows:

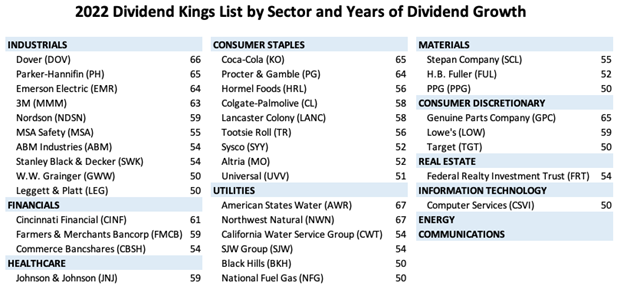

The S&P 500 dividend kings

Standard & Poors defines dividend kings as the stocks of U.S. companies that have increased their dividend swell in at least 50 consecutive years.

While there are more than 60 dividend aristocrats stocks, there are only 37 dividend king stocks:

The European dividends nobles

The 30 noble dividends are a restricted set of European stocks that have increased dividends in at least 20 consecutive years and have a capitalization of more than 5 billion euros.

The Noble 30 index consists of the following European shares: Nestle SA, Unilever NV, Munich Re AG, Air Liquide SA, Halma Plc, Total SA, Sage Group Plc, L’Oreal S.A. Coloplast A/S, Roche AG, Wolters Kluwer NV, Diageo Plc, Fresenius SE, Henkel AG & Co KGaA, Spirax-Sarco Engineering Plc, SAP SE, Croda International, Chubb Ltd, Koninklijke DSM NV, Philips NV, Assa Abloy A/B, Novartis AG, Lindt & Sprungli AG, Castellum AB, Novo Nordisk A/S, Fresenius Medical Care AG, Hermes International, Sanofi SA, Novozymes A/S and British American Tobacco.

Other high dividend stock in the U.S. and Europe

Financial markets media regularly publish their stock lists with high dividends.

In the following links we can see some examples of these lists of dividend stocks in the U.S. and Europe:

https://www.morningstar.co.uk/uk/news/219682/revealed-europes-most-sustainable-dividends.aspx