“Don’t fight the FED” and the end of the “FED put”

Monetary policy objectives and instruments

The impact of official interest rates on the economy

The impact of asset buying and selling programs or quantitative easing and quantitative tightnening on the economy

We are living in a troubled period of the markets, greatly influenced by the change in monetary policy, and it is appropriate to deepen this specific theme.

Moreover, as we will see monetary policy has a major impact on our investments.

It is useful to relate this topic to other recent articles.

In a previous article, we addressed the concrete question of how to act in an inflationary and interest-raising context such as the present one.

In another article, we saw the effect of changes in economic cycles on investments, and how we can position ourselves at those times.

Previously we had also deepened the themes of how we can live the frequent corrections of the stock market and the history and patterns of the various crises of this market.

Monetary policy has a powerful impact on financial markets and the prices of various assets, which makes it necessary to understand how it works and what its reality is at every moment.

Therefore, it is essential that all investors perceive the actions and implications of monetary policy, especially in times of great change such as those we live in today.

It is not surprising that this is one of the most discussed topics by the financial community.

It is important to leave an introduction note.

Most of the references and values relate to the U.S. economy and the market for two reasons.

Again, there is data and information about the US that does not exist in other countries, especially with the same depth or timeliness.

In addition, the U.S. has a unique weight and impact on other world economies.

However, what is happening in the USA is also happening in the Eurozone, UK, Switzerland, etc., which generalises the importance of this theme.

“Don’t fight the FED” and the end of the “FED put”

Just remember two very popular and often heard phrases.

“Don’t fight the FED”,or don’t fight the central bank.

This saying is by Marty Zweig, and was popularized in the 1980s and 1990s (the phrase “Don ́t fight the tape”, or don’t fight the market, is by the same author).

“Don’t fight the Federal Reserve” is a mantra that indicates that we should align our investments with the current monetary policies of central banks, not against them.

Aligning with the FED means that you should invest aggressively when interest rates are low, and more conservatively when those rates are high.

“The end of the FED put”, or the end of the fall stock market protection (put option) by the FED

The notion of “Fed put” has existed since the era of FED Governor Alan Greenspan, and is based on the belief by many market participants that the central bank will intervene if markets have a sharp fall.

The end of the “put” by the FED, which is now on the minds of many, is not to count on it happening.

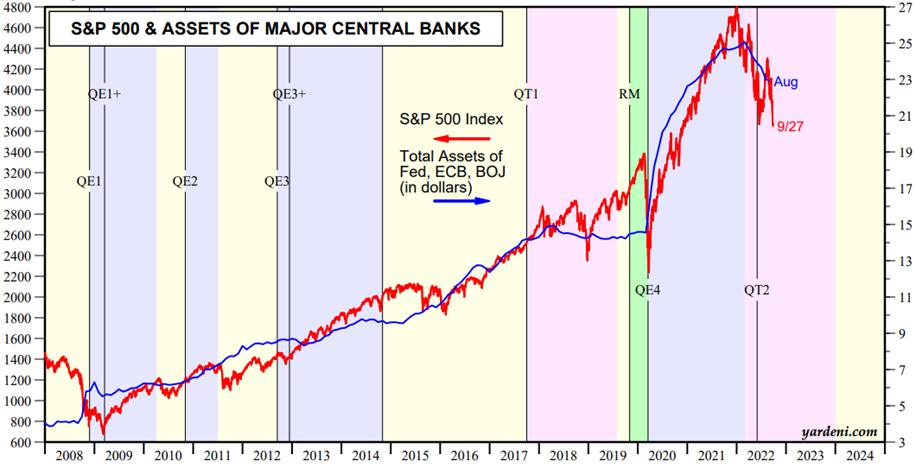

There is nothing better to illustrate this influence and impact than the graph of the relationship between monetary expansion (total FED assets) and the main Index of the U.S. market, the S&P 500, in recent years:

Source: Central Banks: Monthly Balance Sheets, Yardeni Research, September,28th, 2022

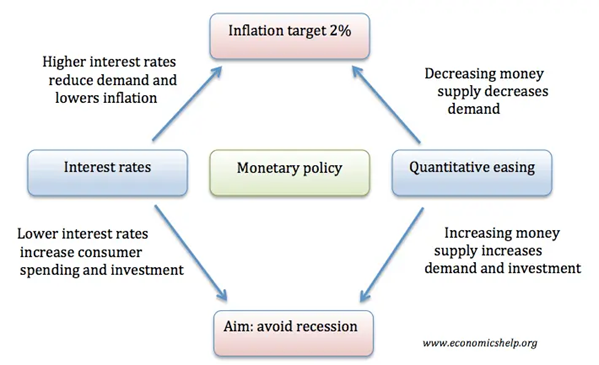

Monetary policy objectives and instruments

In advanced countries, this policy is developed by central banks independent of political power and aims at price stability and sustainable economic growth.

That was defined as a target inflation of 2% per year.

Traditional or conventional monetary policy has three main instruments.

First, the setting of official interest rates, to which commercial banks deposit and borrow funds from central banks.

Second, the definition of banks’ cash reserve requirements in central banks, which defines the lending capacity of banks.

Third, open market operations, or the purchase and sale of short-term treasury securities, which alter the liquidity that exists in the economy, and thereby demand and investment.

To recover from the great financial crisis and the recent pandemic, central banks around the world have developed an unconventional monetary policy.

It is a policy of buying and selling medium and long-term financial assets known as the Quantitative Easing program, typically used when inflation is low or even negative.

Next, we analyze the context and mechanisms for transmitting official interest rates and quantitative easing.

The impact of official interest rates on the economy

Official or fixed interest rates are the most widely used economic policy instrument used by central banks, and therefore most followed, around the world.

Interest rates at the FED, the US central bank, are certainly the most followed by all investors, given the importance of the US economy and capital markets.

However, the interest rates of the other central banks are also important for each country’s economy.

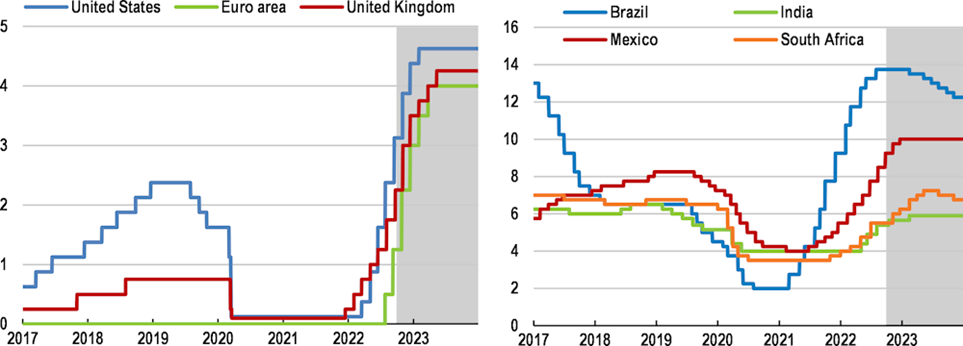

Recent developments in these rates were as follows:

Source: OECD Economic Outlook, The Price of War, Interim report, September 2022

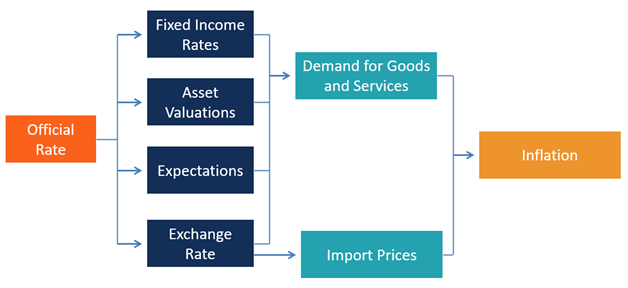

The following graph seeks to illustrate the mechanism for transmitting these official interest rates in the economy:

Source: Monetary Transmition Mechanism, CFI, February, 2021

Changes in official interest rates are transmitted to the economy through 4 different channels, market interest rates, rate expectations, asset prices and exchange rates.

When official interest rates rise (fall) the interest rates on bank loans and the implied yields required by bond investors also rise (fall).

This is the way that central banks influence the cost of financing households and businesses.

When official interest rates drop, economic operators’ expectations are that there will be an increase in loans and asset prices as a result of lower discount rates and better growth prospects.

When interest rates rise, the reverse happens, i.e. fewer loans and lower asset prices are expected.

Changes in official interest rates affect asset prices at two levels.

On the one hand, the impact on the bonds implied yields and the opportunity cost of capital.

A decrease in interest rates decreases bond yields and improves the attractiveness of stocks.

On the other hand, the impact on valuations, through the discount rate of the securities.

A drop in interest rates increases the prices of bonds issued at higher interest rates and increases the value of stocks (via the lowest discount on their future cash-flows).

The change in interest rates also has an impact on exchange rates, as a higher interest rate attracts more investment from around the world in search of higher returns, increases demand for this currency, and appreciates its exchange rate, and vice versa.

The impact of asset buying and selling programs or quantitative easing and quantitative tightnening on the economy

These programmes were launched when inflation and interest rates are close to zero, as happened in the Great Financial Crisis of 2007-08 and the 2020 crisis.

In this situation of very low rates, known as the liquidity trap, consumers do not spend and investors do not invest, and conventional monetary policy instruments are ineffective (negative rates are not solution).

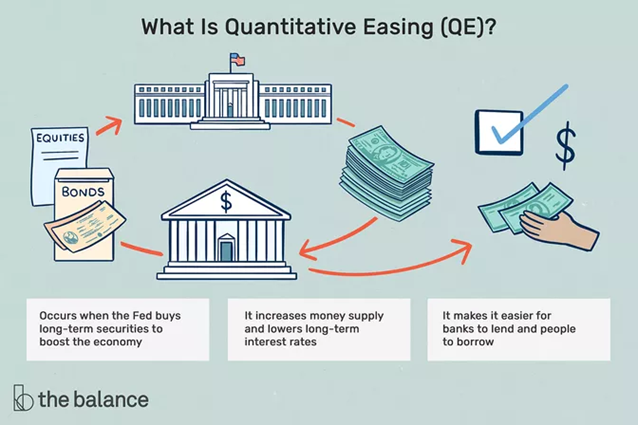

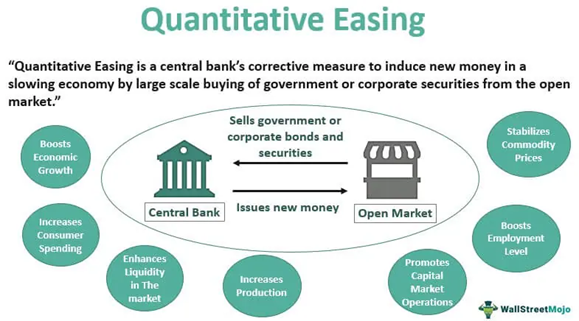

Quantitative Easing is a monetary policy program in which central banks buy predefined amounts of medium and long-term treasury bonds and other financial assets (municipal bonds, corporate bonds, stocks, etc.).

As a result, they inject liquidity to stimulate economic activity.

It is a program at all similar to open market operations, but in which the securities traded are not short-term treasury bonds, but are bonds and longer term or with more risk.

It was first used in Japan in 1995, and more recently in the Great Financial Crisis and the earthquake crisis, as we said.

Asset purchases increase their price and decrease implied bond yields while increasing the money supply.

The goal is to pull the economy out of recession and avoid deflation by improving financial conditions, increasing market liquidity and private sector credit supply.

Quantitative Tightening is the opposite program, that of the sale of assets, with the objectives of cooling off the economy, through the extraction of liquidity and the reduction of credit, and normalizing the balance of central banks.

Quantitative Easing has several transmission mechanisms.

By providing liquidity to the banking sector, it allows banks to lend more, and to streamline private consumption and investment.

Purchases of treasury bonds lower public debt costs, allowing to contain public indebtedness and strengthen public spending and investment.

Bond purchases lower interest rates and raise prices for all financial assets, bonds, stocks, etc.

The fall in interest rates increases investor demand for higher yielding securities, particularly higher risk, for example speculative bonds.

In essence, Quantitative Easing increases consumption, investment, production, employment and economic growth, improves market liquidity, and raises financial asset prices.

Obviously, quantitative tightening acts and has the opposite effects.