What are dividend stocks?

The importance of dividends in the valuation of stocks

The advantages of investing in dividend stocks

The performance of dividend stocks

Who and when to invest in dividend stocks?

How to invest in dividend stocks?

In this article we will analyze what dividend stocks are, what their advantages are, what their performance is and how we can invest in these stocks.

We will see that dividend stocks are a good option for a diversified investment portfolio because they provide more security and stability of income than the other stocks.

We will also see that they can be a good alternative for investors with more conservative risk profiles, such as retirees.

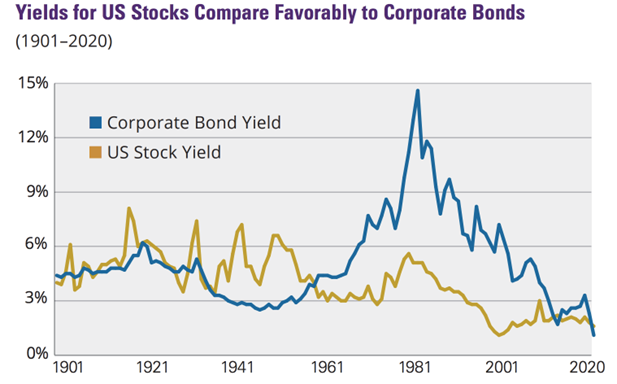

They are equally interesting at times when bond interest rates are very low, as has happened in the recent past, or at times of great volatility in the equity markets, such as the current one.

In previous articles we addressed a close topic, although different.

We recently said that value and quality stocks, in which most stocks are included in dividends, are a good defensive option for the current context of inflation and rising interest rates.

Previously, we focus on the theme of value strategies in relation to growth strategies.

In fact, although not all value stocks are dividends, there is a very large overlapping between the two.

In the Tools folder and under the series investment funds we will present some of the main dividend investment funds for Us and other european investors.

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” John D. Rockefeller, 1908

What are dividend stocks?

Dividend stocks are those that regularly distribute earnings to shareholders through the payment of dividends, in considerable and typically increasing amounts.

As investors we have two sources of expected income.

The payment of dividends and the appreciation of the stock price in the market.

The payment of dividends can be made in cash or in kind, through the purchase of own stocks by the company and the subsequent amortization and decrease of that amount of stock buy-backs.

Most U.S. stocks pay their investors a quarterly dividend and the largest companies consistently increase that dividend over time.

This gives investors the accumulation of a regular and current income.

Investors may or may not reinvest this dividend.

In European companies it is more frequent to pay an annual dividend.

Companies that pay dividends tend to be the most stable companies, so investing in these companies provides stability to the investor’s portfolio.

That is why they are also classified as low-risk investment.

The way to identify dividend stocks is through the so-called dividend rate or dividend yield.

This rate is the quotient between dividends paid annually and stock price, expressed as a percentage.

Procter and Gamble and Coca-Cola are two good examples of dividend stocks.

Typically, these are stocks of current consumer goods, financial and energy companies.

It should be stressed that if we say nothing to the contrary, dividend stocks are those that pay cash dividends.

This note is important because companies distribute earnings to shareholders in two ways.

By paying cash dividends, or by repurchasing shares (so-called “buy-backs”), which are a form of payment of dividends in kind.

Buy-backs are a more efficient way of distributing results because they are not subject to taxation of cash dividend income.

In this way, the tax impact on shareholders differs.

Buy-backs have begun to be used mainly from the 1980s onto the US, and are now as important a source of income distribution as dividends paid.

Big companies like Apple, Microsoft, banks, pharmaceuticalcompanies, and others, favor buy-backs.

From the investor’s point of view, the distribution of total earnings to the shareholder is more important than the way it is done.

In this way, we should have this more global income perspective when we address the issue of the execution of investment in dividend stocks.

The importance of dividends in the valuation of stocks

To get an idea of the importance of dividends, there is nothing better than seeing the impact dividends have on the overall appreciation of stock markets.

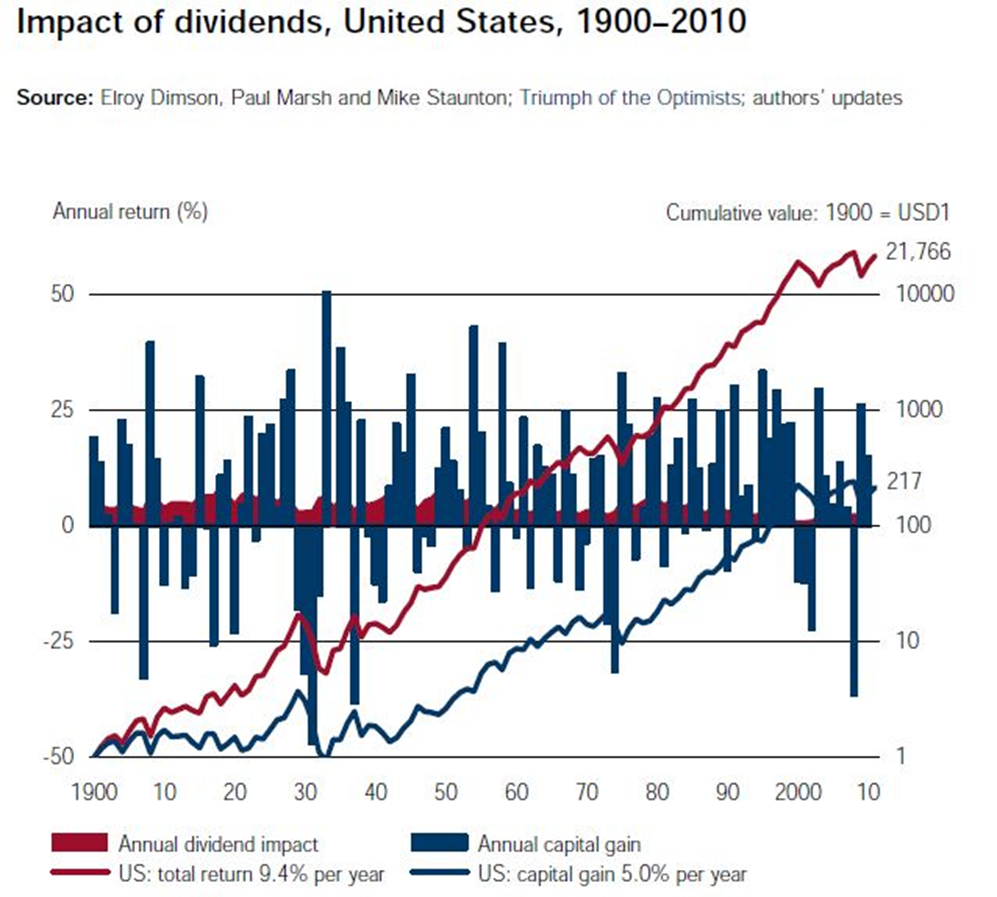

Among the various studies that analyze the contribution of dividends, we highlight that of Dimson, Marsh and Staunton that decomposed the appreciation of the S&P 500 stock market between dividends and price growth for the period 1900 to 2010:

During this period, the S&P 500 had an average annual return rate of 9.4%, 5% of which was attributed to capital gains and 4.4% to dividends.

Thus, dividends represent about 43% of the total return on equity investment, with the remaining capital gains.

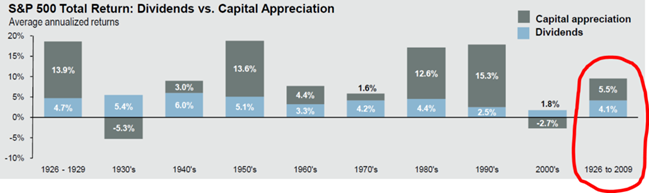

The record of this contribution in the decades was also examined:

Source: Standard & Poor’s, Ibbotson, J.P. Morgan Asset Management

In terms of average annualized earnings for decades, dividends contributed 4.1% and capital gains 5.5%.

It should be noted that part of the lower contribution of dividends from 1980 on, is explained by the increase in buy-backs we mentioned earlier.

This study also allows to highlight a great advantage of dividends that stems from its great stability.

While capital gains fluctuate widely, dividends remain in a narrow band, typically between 2.5% and 5%.

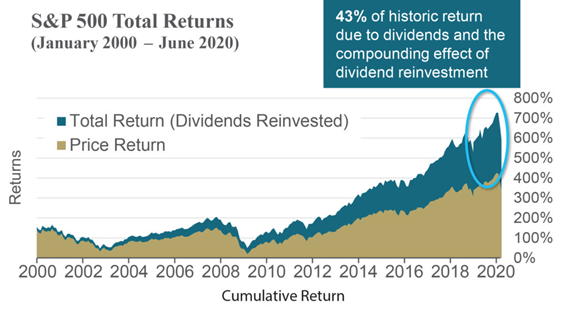

In the last two decades, dividend stocks have maintained a contribution of around 43%:

Sources: FactSet, Mellon Investments Corporation June 30, 2020.

The advantages of investing in dividend stocks

Dividend stocks have several advantages.

First, dividend stocks provide two benefits to investors. On the one hand, the dividend, and on the other, the appreciation of the price.

Second, they allow a consistent yield.

Third, most dividend stocks are from defensive sectors and can withstand negative cycles with reduced volatility (and are therefore considered non-cyclical).

The defensive sectors are not dependent on large cycles and are therefore considered non-cyclical. The most common defensive sectors are food and beverages, utilities, current consumer goods, pharmaceuticals and health.

Fourth, companies that pay good dividends also have large amounts of cash or liquidity on the balance sheet. They are robust companies with good long-term performance prospects.

Fifth, much of the profitability of the equity markets comes from dividends. Historically the average annual dividend rate of the S&P 500 has been 2%.

Few people realize the big difference that makes this rate of 2% over time.

In the previous section we saw precisely the impact of these dividends on the valuation of stocks in the long term, by the effect of the compounding of income.

Sixth, in some periods the average annual dividend rate compared well with the interest rate on 10-year treasury bonds:

Source: Wellington Management and Hartford Funds, 02/2020

At these times, dividend stocks are even closer to bond investment. Lower risk grade and similar profitability

In a way, the advantages of dividend stocks are the greater stability or the more defensive nature of companies and the payment of a periodic income.

The performance of dividend stocks

In addition, dividend stocks tend to perform better than the other stocks.

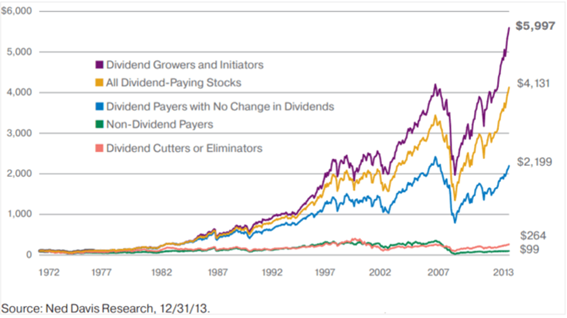

NED Davis Research published a study in 2014 that concludes that dividend-paying stocks perform much better than the rest in terms of more profitability and lower volatility:

The 1972 $100 investment in dividend-paying stocks rose to $4,131 in 2013, while those that don’t pay until they had a slight devaluation.

More importantly, the stocks that started or increased dividends were the ones that valued capital more significantly, to $5,997 in 2013, which compared to the $2,199 for the shares that did not change dividends, and the $264 of the shares that had dividend cuts.

The following study by Hartford Funds shows the percentage of companies performing better than the index, distributed by five years of dividend payments, for the period between 1930 and 2019:

Source: Wellington Management and Hartford Funds, 02/2020

66.7% of the companies in the first quintile (i.e., of the 20% of the companies with the highest dividends in the S&P 500) performed better than the index (or the overall average).

The companies in the second quintile (those in the range of 20% to 40% of the highest dividend companies) also had a better record. 77.8% of these companies beat the index.

The third quintile, the result was equal to the first, with 66.7% of the companies performing better than the index.

For 40% of the companies with the lowest dividends, those of the fourth and fifth quintiles, only 44.4% had higher yields than the S&P 500 average.

It was also shown that dividend-paying stocks provided an average annual profitability of 10.4%, which was higher than the 8.5% of the S&P 500 stock average between 1927 and 2014.

As you would expect, its volatility was also lower in this period. The standard deviation of companies that do not pay dividends was 30%, much higher than the 18% of the shares that pay dividends.

Hartford Funds updated this study in 2022 with very interesting conclusions, synthesized in the Tools folder.

Who and when to invest in dividend stocks?

Dividend stocks are suitable for portfolios with broad diversification, contributing to greater stability (or lower volatility and cyclicality).

Therefore, these stocks are also more useful in times of instability, of great fluctuation or of the fall of the markets.

They are particularly interesting for more risk-averse investors, pensioners, as well as those investors who want to get a regular and current income.

How to invest in dividend stocks?

We can invest in dividend stocks in two ways. Through mutual funds or exchange-traded funds (ETFs) that hold dividend shares, or investing directly in these individual stocks.

Mutual funds specializing in dividend stocks invest in a set of these shares and distribute the dividends they receive by the fund’s investors on a regular basis.

To this extent, they provide immediate diversification.

Alternatively we can invest directly and individually in dividend stocks.

It takes more work than investing in a fund, but allows the investor to choose the stocks he wants.

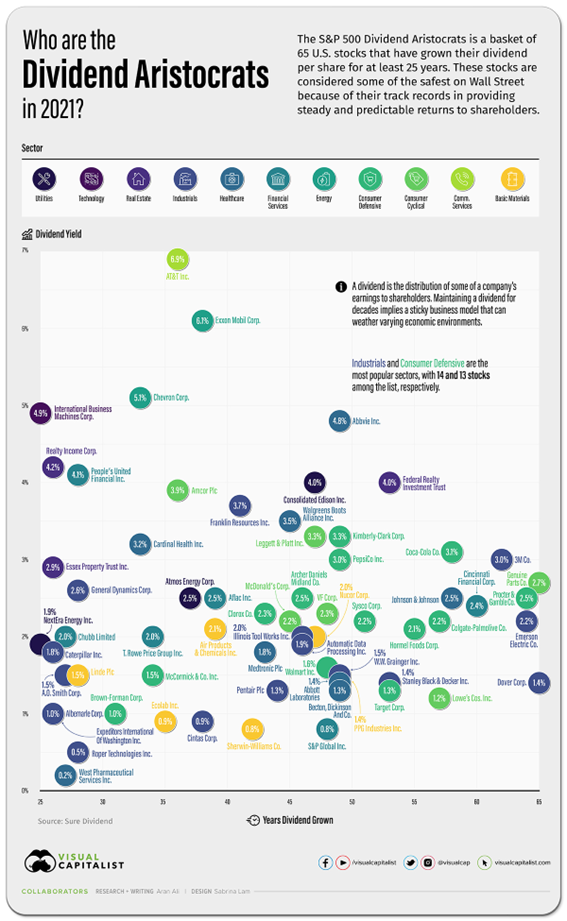

Standard and Poor’s annually identifies dividend aristocrat companies in the S&P 500, a group of 65 U.S. companies that have a consistent and growing dividend payment history over the past 25 years.

The dividend aristocrats companies of 2021 were:

For this year, these 65 companies are as follows:

https://money.usnews.com/investing/stock-market-news/articles/dividend-stocks-aristocrats