Reminder: Performance of the North American stock market with and without FAANGM

What is behind and common to the various companies that make up the FAANGM?

FAANGMs are leading global companies operating in huge markets with almost impregnable MOATs

FAANGM refers to a group of popular tech stocks: Facebook (now Meta Platforms, Inc.), Apple, Amazon, Netflix, Microsoft, and Google (now Alphabet Inc.).

These growth stocks are notable for their dominance in the respective sectors and markets in which they operate, which have resulted in high valuations in recent years.

In the first article we made a brief general presentation, highlighting the history of its growth and appreciation.

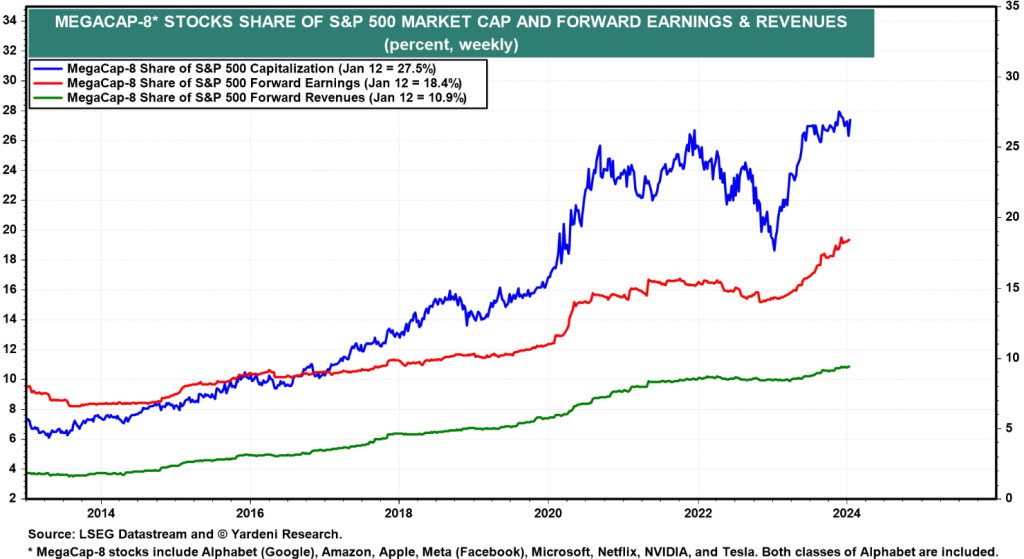

In the second article we develop the weight, contribution and importance in market indices, as well as the distortions caused in market analysis if we do not take into account the effects of these heavyweights.

In this article, we’ll take a closer look at what FAANGM actually are, starting with the analysis of their business.

We will use all the FAANGM because we will use the analyses that have been published by Yardeni Research on them on a weekly basis for 10 years.

Recall: Performance of the North American market with and without FAANGM

The importance that FAANGM has for the stock market in general cannot be overstated, which is well evidenced by its weight in the S&P 500, the world’s leading stock market index.

The combined market cap is more than $7 billion as of January 2024, with a weight in the S&P 500, the main US stock index, of 25% (mega caps 8 also includes Tesla):

With this weight, the evolutions of these companies have an impact not only on these indices but on the entire global stock market, due to their strong presence in the investment portfolios of most investors, and the indicative and directional effect of the news that these leading global companies have on the economic and financial situation in general.

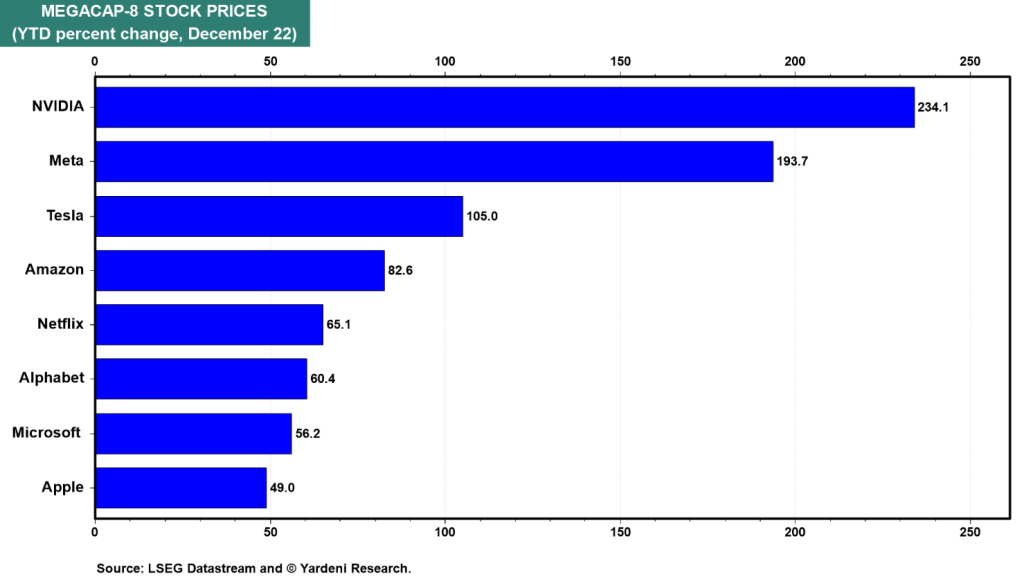

Each of these companies has seen its market capitalization grow substantially in recent years thanks to its dominant position.

Of the 6 companies, 5 are in the top 10 worldwide in terms of market capitalization, with Apple and Microsoft in 1st and 2nd place, respectively. Alphabet (Google) and Amazon are 4th and 5th, and Meta (Facebook) is 9th. Meta is the only company in the group with a market cap of less than $1 billion.

Since 1995, FAANGM’s shares have performed extraordinarily well

For example, Apple’s stock is up 287% over the past five years, and Microsoft’s stock is up 214% over the same period.

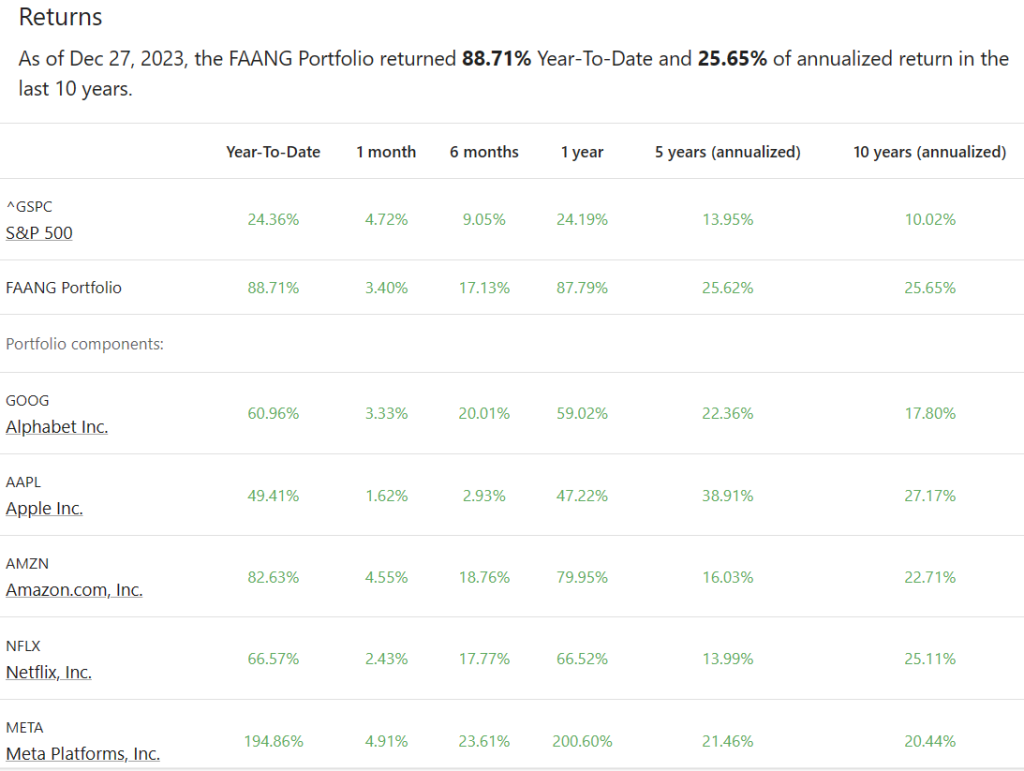

And in the last 10 years, the performance of the FAANG has also been much higher than the market:

These FAANGM stocks performed poorly in 2022, especially Amazon (-38%), Alphabet (-26%) and Meta (-65%), but have recovered quite a bit this year, with a combined performance of over 50% (well above the 23% of the S&P 500).

What is behind and common to the various companies that make up the FAANGM?

Over the past five years, FAANGM stock has risen rapidly, and several factors have contributed to this increase.

Much of this increase is due to technological innovation, financial performance, and dominance of the market in which they operate.

Each of these companies has been at the forefront of innovation, launching new products and services every year to stay ahead of the competition.

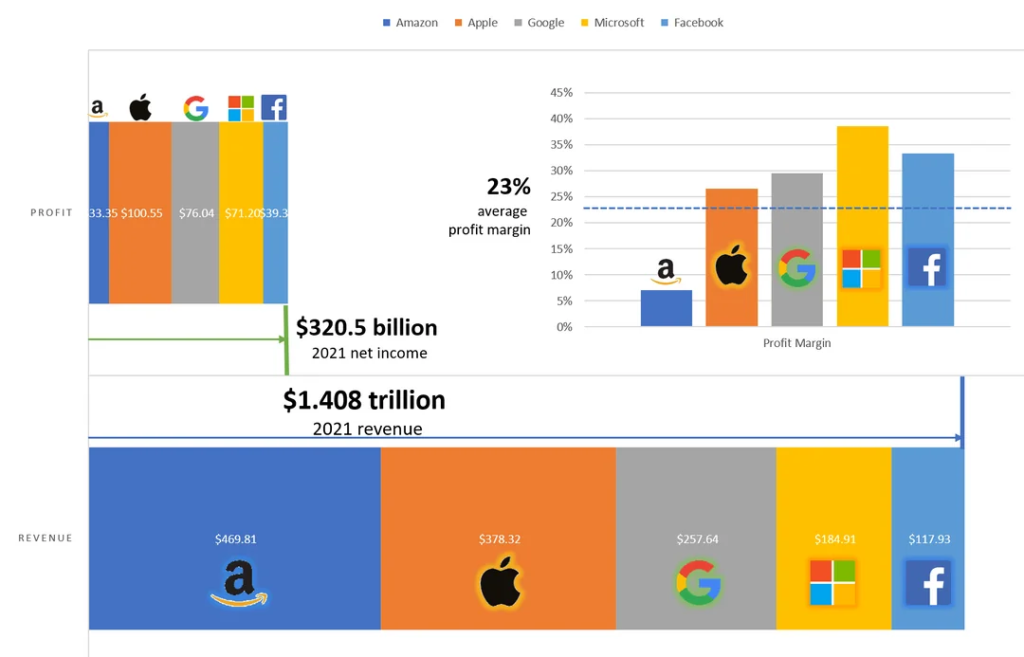

FAANGM shares also have strong fundamental indicators, generating significant profits and strong revenue growth.

These factors have contributed to an increase in investor confidence and therefore more investment.

FAAMG shares also dominate their respective markets, with some having more than 50% of the market share.

This has helped to create a virtuous circle of growth, as their dominant position allows them to invest in new products and services, increase revenue, market share, and support further developments and investments.

These stocks have performed extraordinarily well in recent years, far outperforming the market average.

Therefore, they have attracted more and more investors, with the main shares being held by the majority of private and institutional investors.

Thus, it is very important to understand what these companies really are, what moves them and differentiates them from the rest.

The Market Screener website provides a wealth of economic and financial information on a wide range of listed companies and is a very useful source of information for investors.

For example, in the following link we can access information from Microsoft:

https://www.marketscreener.com/quote/stock/MICROSOFT-CORPORATION-4835/

FAANGMs are leading global companies operating in huge markets with almost impregnable MOATs

FAANGM sells the main smartphones (iPhone), work tools (Windows), search engines (Google search), social networks (Facebook), smart chips (Nvidia), e-commerce marketplaces (Amazon), where they have high and solid market shares.

In addition, they also have a strong presence in the high-growth business of cloud and artificial intelligence.

In fact, they are leading companies, operating in global markets (billions of customers), with a portfolio of cutting-edge products and services, in constant development, improvement and innovation.

These companies have a history of investing in research and development internally and through acquisition, always being attentive to opportunities to expand their business into new markets.

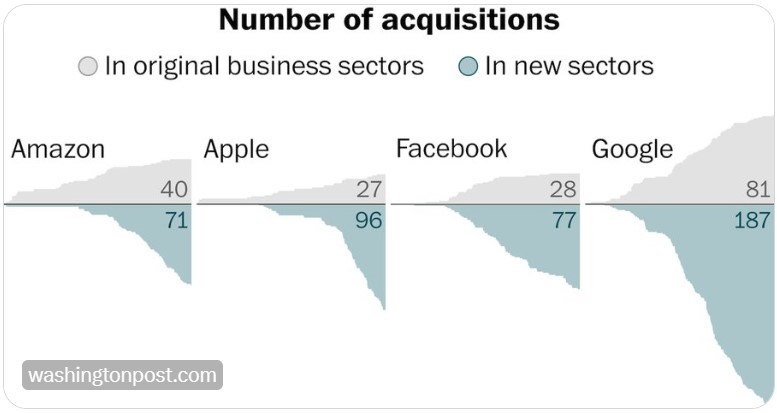

In recent years, each of these companies has made more than a hundred acquisitions in the market segments in which they operate and in new businesses:

Overall, these acquisitions have been extremely profitable.

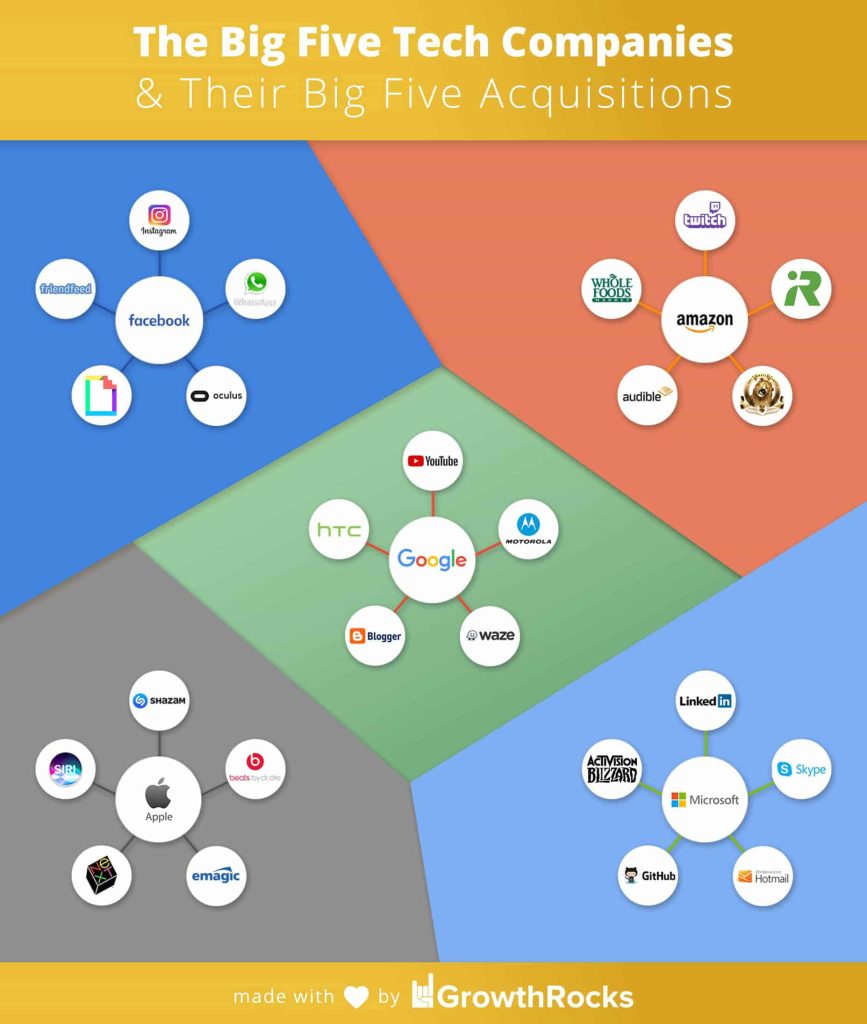

The 5 largest acquisitions made by FAAMG were the following:

We can highlight the purchases of Whatsapp and Instagram by Facebook, YouTube and Waze by Google, and Skype, Linkedin and Activision Blizzard by Microsoft.

The following link shows some of the main acquisitions made by FAAMG in recent years in more detail:

https://www.visualcapitalist.com/the-big-five-largest-acquisitions-by-tech-company/

The competitive advantages of these companies are highly durable and sustainable, with the largest known economic moats.

Note: The term “economic moat” or “economic moat”, popularized by Warren Buffett, refers to a company’s ability to maintain competitive advantages over its competitors in order to protect its profits and market share in the long run (just like a medieval castle, the moat serves to protect those who live inside the fortress and their wealth from outsiders).

It was precisely because of his “economic moat” that Warren Buffett chose Apple as his biggest Berkshire investment, after for many years he was very critical and avoided any investment in technology companies because of the prices and multiples at which these companies trade.

The main risks faced by these companies are the reversal of the globalization trend (competition and access to Asian markets) and regulatory aspects (with some incidents in Europe).

The Investopedia website has very good summaries about the Magnificent 7 or FAANGM:

https://www.investopedia.com/magnificent-seven-stocks-8402262#toc-the-bottom-line

In the next article we will see how the economic and financial figures and indicators of these companies.