Complete life insurance products have a financial component

Simple term or term life insurance

Complete life insurance with fixed interest

Universal fixed-interest life insurance

Variable-yield life insurance

Indexed universal life insurance

The difference between risk life insurance and financial life insurance

This article is part of a series on personal insurance.

Insurance is a basic and priority element of our personal finance plan that defines our needs and financial goals, as it gives us a protection from risk and guarantees us a safety net in the face of unforeseen adversities.

In the initial article of this series we looked at the penetration, densities and spending of insurance in the world and presented the general program of this series.

We have also seen that we must buy protection insurance against financial shocks of low probability and high impact (loss amount).

In the second article, we addressed life insurance that is exclusively risk, that is, without a financial component, presenting its characteristics and costs.

In this third article, which we have divided into two parts, we will address capitalization insurance, a combined product of life insurance and financial investment.

Complete life insurance products have a financial component

Life insurance started out as exclusively risk, and over time, it evolved to also associate a financial component.

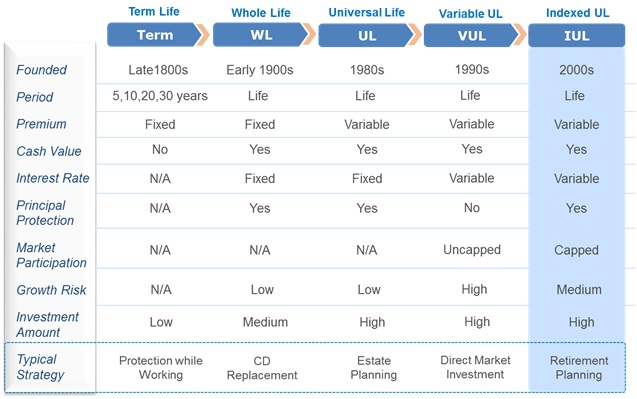

There are five major types of life insurance, which have emerged in this order over time – term or term life insurance, permanent or complete life insurance, universal life insurance, unit-linked variable life insurance (variable yield rate) and unit-linked indexed life insurance.

The main characteristics of each of these types of life insurance are described below.

Simple Life Insurance with term or term

Term Life insurance, introduced in the late 1800s, pays a death annuity if the insured dies within the specified period, and its premium costs a fixed amount.

It can also protect the family against a loss of human capital or against its potential for future earnings, if it is associated with total and permanent disability coverage.

The protection ends if the premium is not paid.

This insurance offers the highest protection for the lowest premium and does not have a financial component.

Complete Life Insurance with fixed interest

The next product, permanent, full or lifetime life insurance, introduced in the early 1900s, fundamentally adds the financial component and transforms insurance products into an investment option.

It also provides permanent life insurance with a guaranteed death benefit.

The value of the investment yields a low but fixed interest rate.

This is as an alternative to term deposits.

Universal Life Insurance with fixed interest

Universal Life insurance, introduced in the 1980s, makes the premium payment a variable amount, allowing the policy not to be cancelled due to non-payment of an occasional premium.

However, missing or paying a lower premium will negatively affect the benefits of the policy.

This product is commonly used by life insurance wills in estate planning.

Life Insurance with variable yield

The next development in the evolution of insurance products was Variable Life insurance, introduced in the 1990s.

This product allows capital investment in capital markets.

The potential increase in return on investment therefore presents a higher market risk.

The disadvantage of this product is the higher management fees, usually 2%, compared to other financial instruments.

Indexed universal life insurance

Indexed Universal Life, the newest product, introduced in the 2000s, retains the best features of previous product lines.

IUL insurance offers permanent life insurance with a flexible premium.

This insurance provides market returns subject to maximum limits, which limits upside potential. However, the value of capital is not invested directly in the market.

The risk is reduced because the capital is protected from any market loss and the volatility is lower than the market.

Typically, capital grows tax-deferred and can be used tax-free, which makes IUL an option for retirement investment.

The difference between risk life insurance and financial life insurance

The risk life insurance that we saw in the previous article broken down into 3 parts is exclusively for protection and safeguarding in relation to the risk of a life claim, covering death and usually also the total or permanent disability of the policyholder.

Financial life insurance goes further and in addition to covering the risk of life claims, it also has a financial component of capital investment.

Financial life insurance products are hybrids, consisting of a traditional risk life insurance policy and a capital appreciation component in the form of an investment plan.

In some jurisdictions, such as the US and the UK, these insurances are called annuities.

The insured pays a premium, but this amount is divided into two parts, one to cover life insurance, and the other to make investments in the financial markets.

These investments can provide a fixed and pre-defined rate of return and guaranteed capital, or in the case of unit-link insurance, a variable rate of return, with guaranteed capital or not, and resulting from the performance of the portfolio of the investments made.

In the latter case, the rate of return and the protection of capital result from the performance of the investments made by the insurer under the investment policy defined in the group policy or from indexation to a pre-defined market index.

The investment vehicle portion is similar to an investment fund, in which all the premiums received are pooled and invested.

The insured holds shares in the funds and the net asset value is reported regularly.

The market risk of the unit-link is borne exclusively by the insured, although some products offer guarantees or minimum rates of return.

Unit-links sold by insurance companies have several distinct characteristics.

Policy premiums benefit from various deductions for charges, which can help businesses manage their tax expenses and costs.

The unit-link market has developed to compensate for falling interest rates and to limit pressure on life insurers to match guaranteed rates of return.

Unit-links can also be divided into contracts with or without capital guarantee.

A capital-backed product sets a minimum threshold on the unit value held or the value of the contract.

These may take the form of a capital guarantee, a minimum return guarantee or guaranteed payments.

On the other hand, unsecured unit links are determined solely on the basis of the performance of the underlying assets.