The democratization of equity investments, despite being a global positive trend, has flaws associated with the learning process of new investors that time will be attest to correct

#1 Increase in volumes and the weight of options traded by retail investors

#2 Increase in margin leverage investing by retail investors

#3 Herding bias and social media blind followership practices by new retail investors

The main excesses focus on some short squeeze stocks, such as Gamestop and AMC

Although, the high IPO volumes and especially SPAC volumes also indicate some market excesses

The democratization of equity investments that has brought many new investors into the capital market in recent months has generated several foci of irrational exuberance or market excesses that need to be taken care of.

At all times, markets exhibit signs or indicators of irrational exuberance. It has always existed and always will be.

However, what is different in the current picture is that these foci of irrational exuberance are multiple, varied and dispersed, and the very dimension of the excesses of individual and summed cases is extraordinarily high.

This leads us to state that there is no market bubble in general, there are several situations of isolated bubbles that as a whole reach reasonable proportions. The risk is that the losses that may occur by the natural outcome of these localized and punctual situations, may have a contagion feat, and spread to other assets.

The second big difference, and perhaps more important than the first, is that they are focused on a majority of new investors, so more inexperienced. These are mainly younger generations, with lower wealth, who in 2020 had a very positive experience by taking advantage of the opportunity and volatility of the market generated by the pandemic, but which is now dissipating.

A survey by Deutsche Bank found that almost half of US retail investors in the past year were completely new to the markets. They are young, mostly under 34 and have between $1,000 and $5,000 to invest, and a completely new mindset.

This youth and inexperience of new investors is so great the risks of this situation. For the development of the capital market, it is essential that these investors are successful.

However, the process of setting expectations to the new reality of the market is complicated. After significant gains it is very difficult for these investors to accept the reality of more moderate performance prospects and in line with the historical average.

We must combat the recency bias. This is the main challenge of the present.

Market excesses result from the increase in options volumes, margin account leverage and viral movements of social media by new retail investors, which can create a self-feeding spiral to the point of non-return

These new investors are more aggressive, much more willing than more experienced investors in the stock market to borrow to finance their investments, take full advantage of options to leverage equity investments, and use social networks as a research tool to find investment targets.

In a recent study, about 43% of retail investors said they are using options, margin or both. Twenty-three percent of respondents said they were using options and 10% are borrowing money to trade on margin account.

These strategies amplify gains, but also increase losses, which exposes investors to a significant risk of loss.

#1 Increase in volumes and the weight of options traded by retail investors

New investors are buying call options, a type of derivative contracts that give the holder the right to buy the underlying asset at a price indicated within a specific period, for a small premium.

Buying call options contracts is a very leveraged investment, in some cases 20 to 1 or even more, where values can increase significantly depending on the evolution of the price of the underlying asset and can reach more than 100% in a single day.

Options trading has become affordable and easy for new investors, thanks to new, commission-free platforms such as Robinhood.

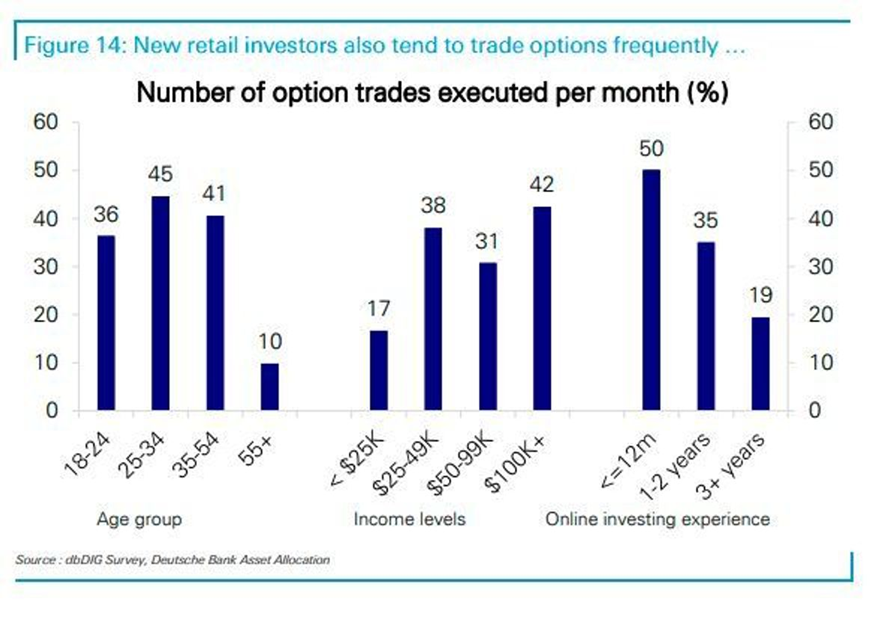

According to the Deutsche Bank study, more than 50% of new investors often use options, with the same value being traded more than 10 times a month compared to those with more than two years of experience, where the comparable value was only 19%:

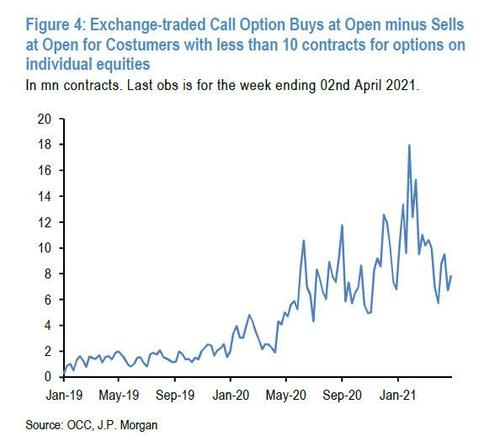

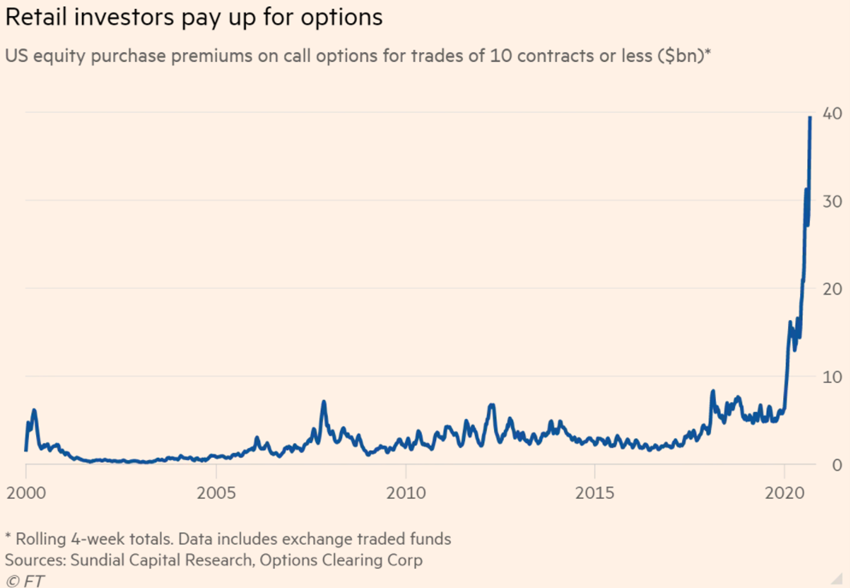

The number of small size options contracts traded weekly has increased substantially since April 2020:

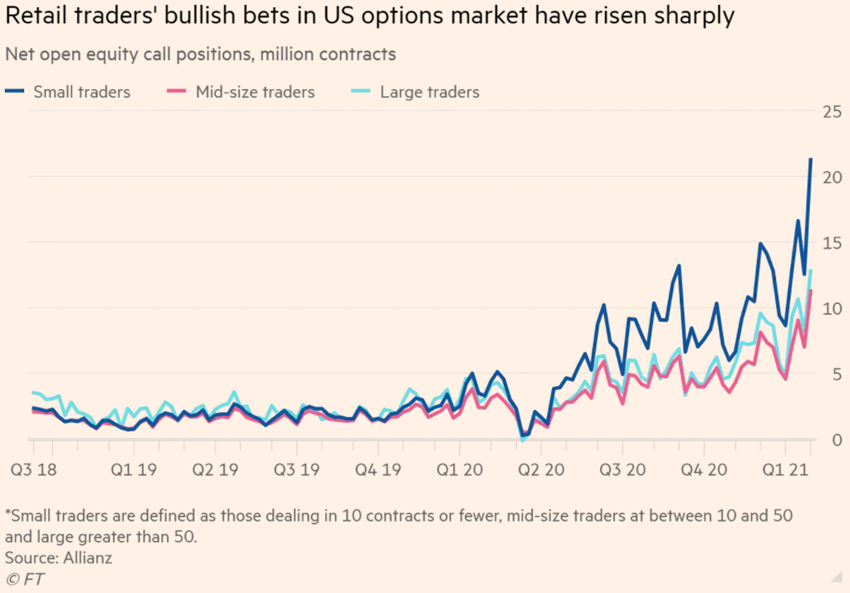

The net open equity call positions contracts traded from March 2020 by retail investors (small contracts, up to 10 units) tripled or quadrupled:

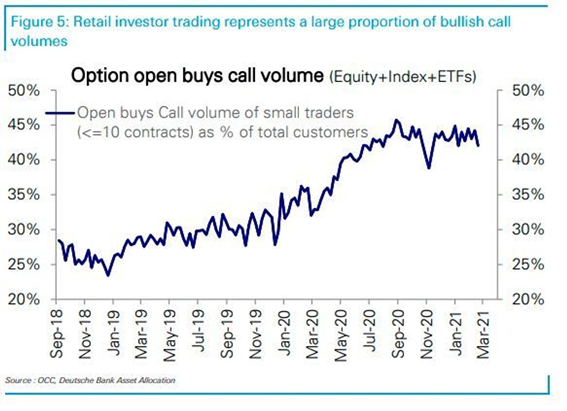

Retail or small traders contracts went from 30% to almost 50% of the total volume of open buys call contracts (“call”):

The value of premiums paid for options by retail investors has multiplied by more than 10 times compared to the previous decade’s average:

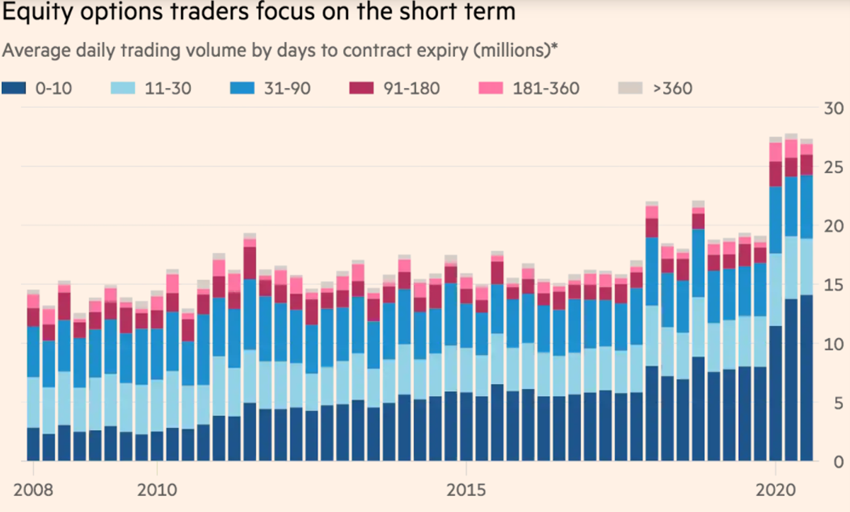

Most of these contracts are very short-term, up to 30 days:

#2 Increase in margin leverage investing by retail investors

According to Deutsche Bank, 26% of new investors in the last year say they have used some kind of leverage to buy shares, compared to only 9% among those who have invested from one to two years. This number drops to 3% for more experienced investors.

Access to leverage — in the form of collateralized loans (in “margin account”) of brokers or financial derivatives as options – is easier than ever.

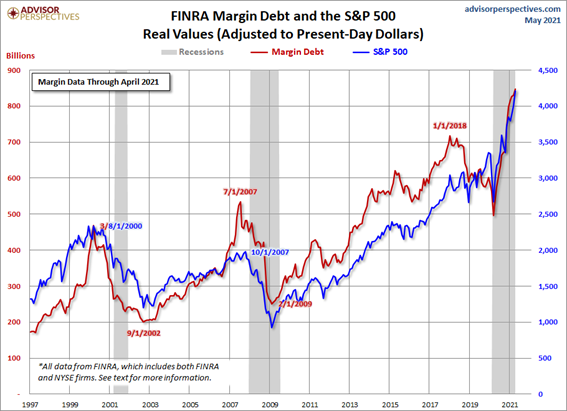

Debt in U.S. margin accounts skyrocketed to a record $799 billion in January 2021:

#3 Herding bias and social media blind followership practices by new retail investors

Social networks are exerting a lot of influence, whether it’s reddit’s WallStreetBets forum, Twitter, WhatsApp messaging groups, or live trading sessions streamed and discussed on sites like Discord or Twitch.

These 3 effects – options, loans in margin accounts and social media – exert influence in the same direction and feed, acting as a virtuous circle. The increase in call options, margin account investment and concerted action via social media contribute to the same result and reinforce the effects of rising asset quotes in a positive cycle environment (note that the coverage of options bought by retail investors means that sellers of the options have to make some purchases of the underlying asset in the cash market).

It is like the dance of chairs where the music doesn’t stop, or when it stops there are still thousands of chairs available.

The risk arises when the opposite happens, when there is a stronger correction.

Calls or settlements of margin accounts are made, which require sales of assets and/or decrease the financial capacity to purchase options, creating a vicious circle.

The prices of these assets fall until they approach the market value of the most stable and experienced investors.

The main excesses focus on some short squeeze stocks, such as Gamestop and AMC

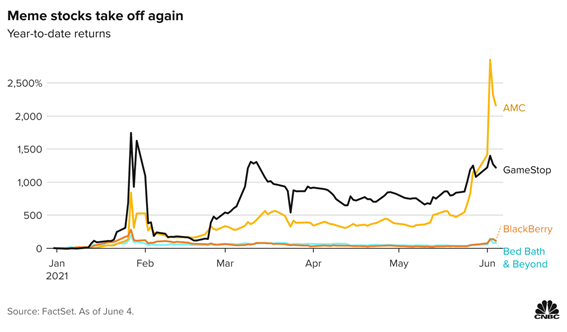

Many Reddit posts induce to buy some stocks such as Gamestop, AMC, and similar ones, which have in common the fact that they have large short positions by institutional investors and have been dubbed “meme” stocks.

The rise in prices of these stocks caused by the buyer pressure exerted by the new retail investors means that those investors have to liquidate their short positions by buying the stocks, reinforcing the volumes bought and the rise in prices.

These movements have arisen by waves, at the end of January, early March and in the first days of June:

However, just as it is not worth having short positions in these stocks because it is like fighting a giant wave that seems to have no end and which has already led some professional investors to record losses of more than 5 billion dollars, it is also not justified to invest in these stocks.

These are stocks of companies that are in weak financial situation and with high losses for some years, with no prospect of restructuring that significantly alters the situation, and whose prices have skyrocketed, being in a real bubble.

This bubble will only remain as long as these investors remain believers.

Although, the high IPO volumes and especially SPAC volumes also indicate some market excesses

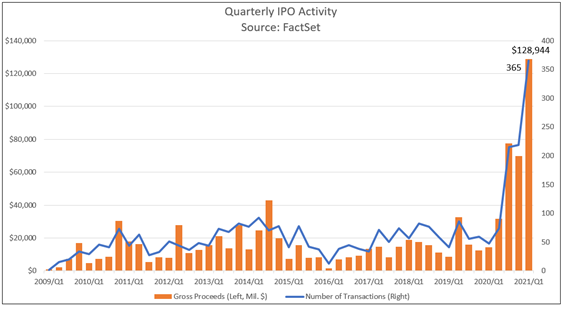

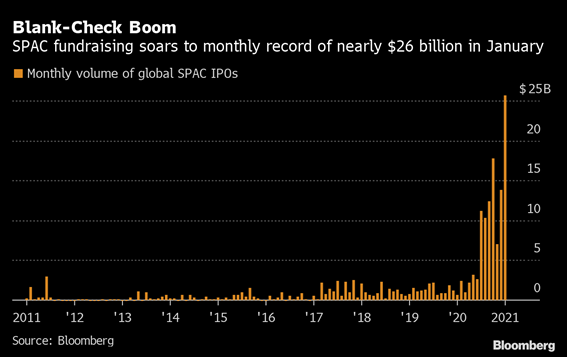

With markets flooded with liquidity, overall initial public offerings or IPO figures and their revenues generated recorded the best performance in 20 years.

This was before we included SPAC in IPOs, which in the first quarter alone completed more business and raised more revenue than the record full year of 2020.

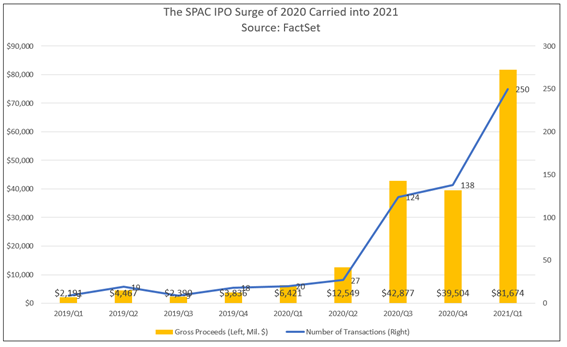

Last year, SPACs accounted for 55.7% of all IPOs. In the first quarter, SPACs accounted for 68.5%.

In the following chart we see that SPAC is a phenomenon that emerged very recently in 2020:

Special Purpose Acquisition Companies (SPACs), sometimes also called blank check companies, are companies created for the express purpose of merging, stock exchange, acquiring assets, buying shares, reorganizing, or combining similar business with one or more companies.

SPAC raises funds by quoting on a stock exchange and then use those funds to invest in promising private companies and turn them into listed companies through mergers. Investors do not know in advance which companies will be the targets of SPAC, so they are committed based on the records of those who execute and sponsor them.

Most of the new SPACs that were launched in 2020 will take between 18 and 24 months to target a company to merge, negotiate a deal and close the purchase, according to industry standard.

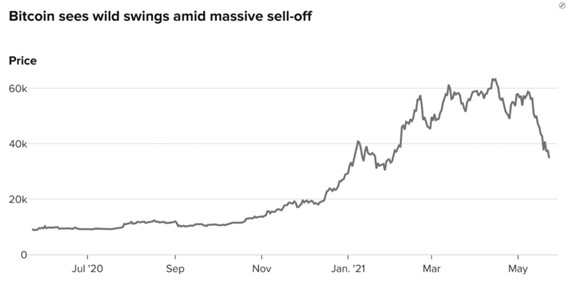

And even cryptocurrencies in general, and Bitcoin in particular, have had a behaviour and volatility that result from some of these circumstances

The latest drop in cryptocurrency and Bitcoin prices in particular is due to the fact that they are young assets, preferred by new investors and in the form of leveraged investments.

There are many reasons to explain the recent fall in the value of cryptocurrencies, from inflation fears, to concerns that regulators around the world will disapprove of virtual assets, including in the United States, and Elon Musk’s tweet about Bitcoin’s electricity consumption.

But the main reason is that these are risky and volatile investments, so that is how they behave.

Bitcoin is a very young asset. It has only been around for 13 years, and until recently it’s been traded for hundreds or a few thousand dollars. More than a year ago, Bitcoin was trading below $7,000 and then peaked at close to $65,000 last month.

Bitcoin has also been bought by new investors through leverage.

Recently, when Bitcoin’s share price fell, leveraged credit purchases of more than $12 billion were settled in the space of a few weeks, which caused steeper declines.

The biggest current market challenge is the smooth correction and soft landing of these excesses, the adequacy of the management of expectations to the new market cycle, and an increased financial education of the rules or good investment practices to this group of new investors

As we said at the beginning of this post, there has always been and always will be market excesses. What makes this situation different is that the excesses are multiple, existing in several assets, have a significant size, with some assets inflated by tens of billions of dollars, and investors are new to the market.

It is inevitable that these excesses will be corrected over time.

In our opinion, the stock market will gain solidity when investors adapt earnings expectations to normal market cycles and improve investment selection and management processes and practices.

https://www.morningstar.com/articles/1071800/meme-stocks-where-are-they-now

https://www.ft.com/content/0ac9ecba-7408-4466-81ed-ae15f6333e36