This is the third article on how to make an assessment of market scenarios, based on risks and opportunities, taking as an example the current context.

In the first two, we analyzed the motivations and objectives of this exercise, and developed the main risks of the situation l.

In this article we will see the opportunities, as well as the criticality of being able to focus on the main issues or the most influential factors, to the detriment of the others, for the success of the exercise.

Opportunity factors may seem smaller than risks, but they are equally important

#O1 More cheap and attractive markets.

#O2 Financial capacity of families.

#O3 Financial capacity of companies.

The conclusion: The central issue of markets is to assess the extent to which the pressure exerted by inflation, restrictive monetary policy and the war in Ukraine (which is totally unpredictable) in economic growth, is damnated and softened by the financial capacity of households and businesses mainly accumulated in the last three years

Opportunity factors may seem smaller than risks, but they are equally important

In times of devaluations and losses, the risks seem to be more intense and important than opportunities.

And vice versa, in periods of great valuations opportunities seem to supplant the risks.

It is normal, and is the result of investors’ bias towards the markets.

There are other equally important biases.

Many have forgotten that in the last three years, between 2019 and 2021 inclusive, the U.S. stock market had consecutive annual returns of more than 20%.

The truth is that significant losses, such as those in excess of 20% this year, make you forget past returns, even very recent ones.

That is why we believe that it is very important that we adopt two perspectives.

First, realize that not everything is as bad as you think, not as well as it sounds.

Second, always maintain a medium and long-term view of investments, avoiding the noise of short-term fluctuations, moments of euphoria and misfortune.

#O1 More cheapest and attractive markets.

Financial markets have fallen a lot.

Stock markets fell more than 20% and bonds fell nearly 20%.

The fall in the stock markets was mainly due to a contraction of the multiples, as the results per share of the companies have not yet underwent an adjustment.

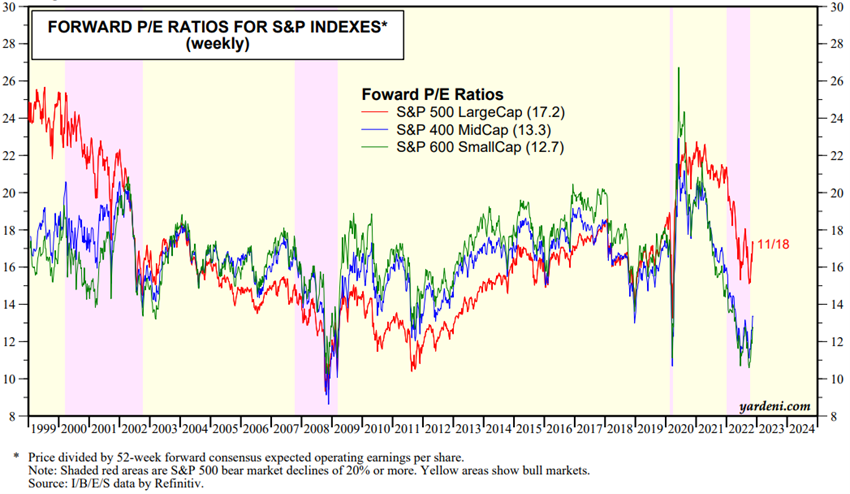

The S&P 500’s PER fell from 22x to close to 16x, and the mega-caps from 25x to 19x, are close to the long-term average.

For medium and small capitalisations, the fall was even higher, from 22x to 13x, and from more than 26x to 12x, respectively, both of which were trading at levels much lower than the gcf’s long historical average and close to 10x.

Analysts are now starting to make small adjustments to company results forecasts, but the big question is what the economic growth scenario will be.

#O2 Financial capacity of families.

In developed countries, families have received strong support to support the effects of the crisis in terms of income and employment.

This support has significantly increased its savings.

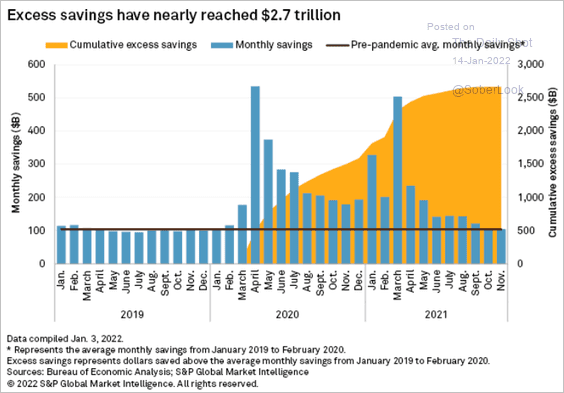

The excess savings of U.S. households at the end of 2021 are estimated to have a cumulative value of $2.7 trillion, which is compared to an average monthly savings rate of close to $100 million:

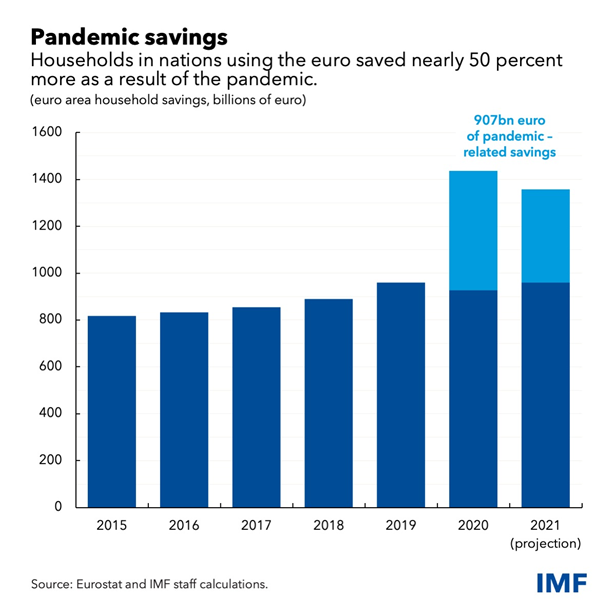

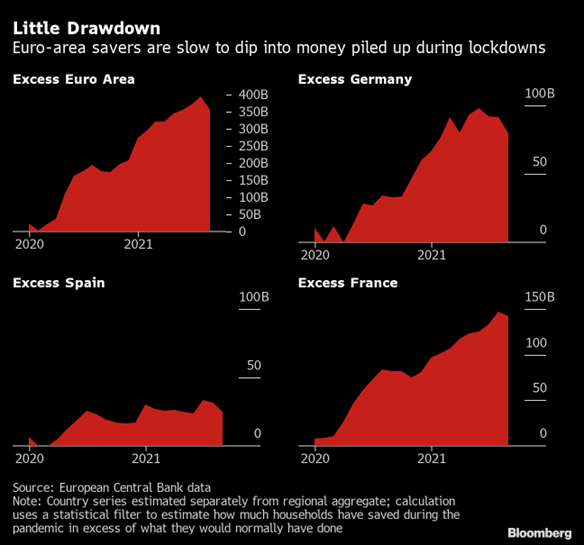

In the Euro zone, it is estimated that the excess savings accumulated in the pandemic will have been €900 billion by the end of 2021:

Full employment, excess savings and the appreciation of financial investments in recent years have substantially improved the financial capacity of households in developed countries.

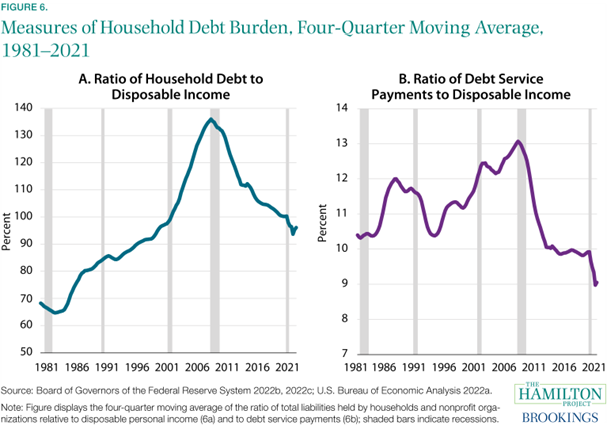

In the US, household indebtedness ratios are at very low levels compared to disposable income:

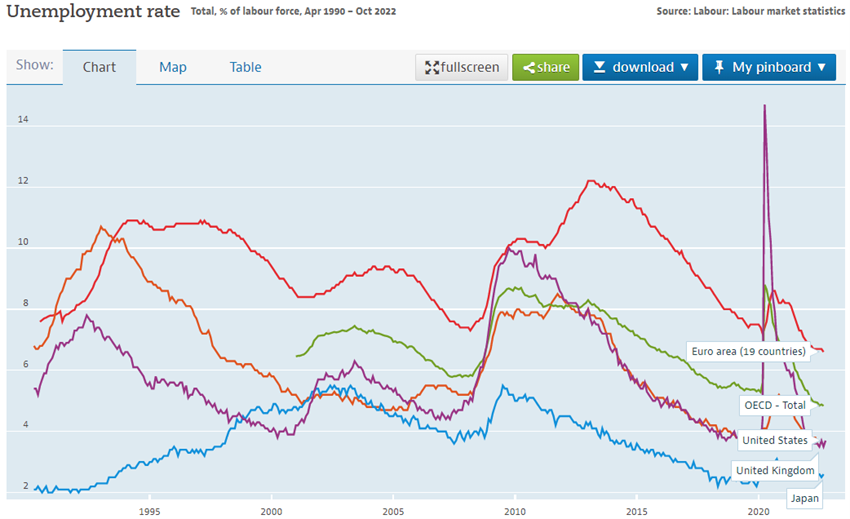

The unemployment rate is at minimum levels in developed countries:

#O3 Financial capacity of companies.

Companies also show a good financial situation.

They have benefited from good levels of household consumption, low interest rates and moderate energy prices in recent years.

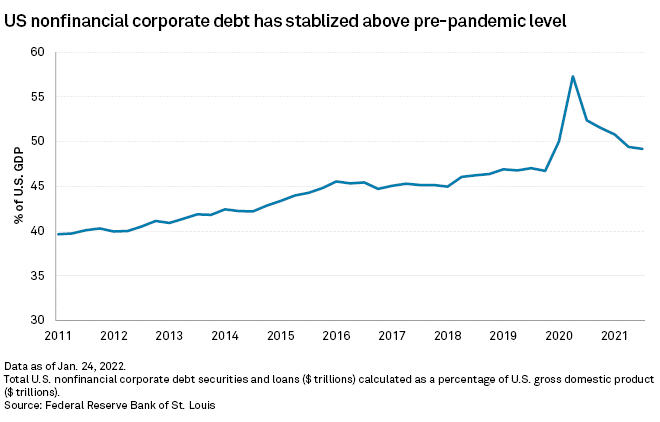

The indebtedness of U.S. companies is in line with their long-term historical evolution:

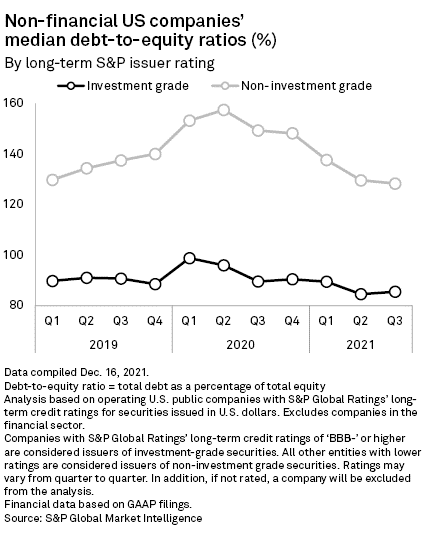

Corporate indebtedness ratios are also at a moderate level:

The median leverage ratio (between debt and equity) of investment quality companies stands at 85%, after reaching 98.5% at the peak of the pandemic.

In speculative risk companies, this ratio stands at 128%, after reaching 157% at the peak of the pandemic.

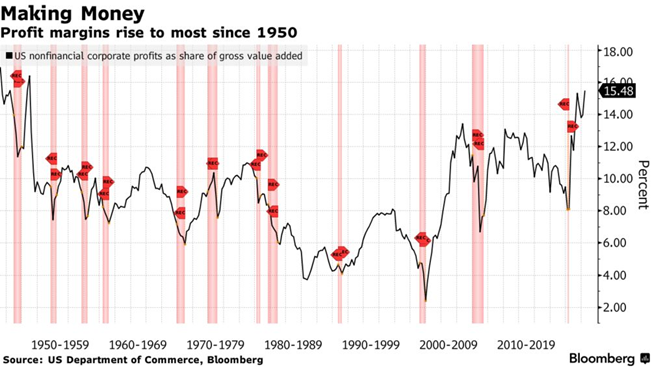

Corporate profit margins are also at a high level:

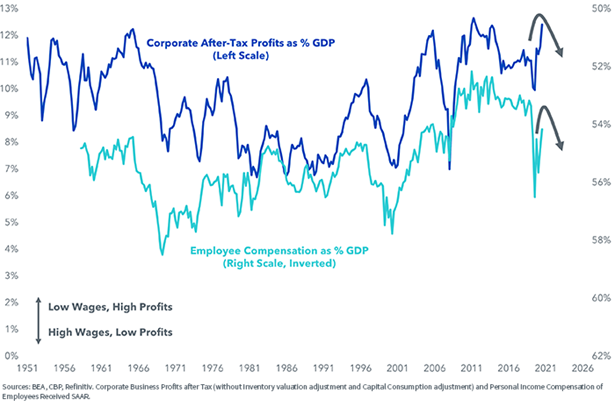

Profit margins are at their highest level in 50 years at 15.5%.

The question that can be asked is to what extent they will be able to resist the ongoing wage increase:

The conclusion: The central issue of markets is to assess the extent to which the pressure exerted by inflation, restrictive monetary policy and the war in Ukraine (which is totally unpredictable) in economic growth, is damnated and softened by the financial capacity of households and businesses mainly accumulated in the last three years

At each moment there is a multiplicity of factors in action, but there are usually a small number of dominant factors, that is, those whose importance influences and determines the direction and evolution of markets.

The most important and most difficult in this whole evaluation exercise is not to lose focus on the main issues.

Currently, the central aspect is the sharp rise in inflation and its fight against monetary contraction and interest rate increases.

It all started when inflation started to rise at the end of 2020.

At the time and until the end of 2021, many economic policy makers considered that inflation was temporary and not persistent.

It was associated with the breakdown of supply chains, considered as transitory, so it did not deserve action to be contradicted.

However, some economists realised that inflation was persistent and was spreading to prices for energy, raw materials, finished goods, services and even falling wages.

In the summer of 2021, these economists warned of the need to stop monetary stimulus and start fighting inflation.

But monetary stimulus continued to ensure the recovery of the pandemic.

In the fall, with inflation already above 5%, these economists warned that the U.S. was in danger of stout, i.e. virtually zero economic growth and high inflation.

Inflation continued to rise, and the war in Ukraine still caused it to rise further.

Currently, inflation is at more than 8% in almost all the world, maximum levels of the last 40 years.

Central banks have only very recently begun to act, with interest rate hikes and liquidity withdrawal.

Now they say they will not stop until inflation returns to the 2% level in the medium term.

What is at stake is to assess the cost of this action in terms of economic growth and employment.

With regard to the war in Ukraine, it is an external and very unpredictable factor, so it is not worth doing scenarios and what we have to assume is reality.

We know that when it is over, markets will have a positive revaluation associated with eliminating the geopolitical risk premium.

Contrary to the effects on economic growth of the fight against inflation, we have the good financial capacities of households and businesses, and it is important to assess the resistance they can offer.