Confusion of confusions

“Confusion of Confusions”, Joseph de la Vega

The Confusion of Confusion is the first written book on stock markets and the modern economy in general.

It was written on the basis of the world’s first stock exchange managed by the Dutch company of East India in 1688.

The dutch company’s first stock exchange in East India was modeled by the economic cooperative associations of Bengali and Southeast Asia, but had distinct European characteristics.

It is still considered one of the top ten books on the stock exchange in the world.

Assessing the risks and opportunities of financial markets at any given time allows us to bring order to a world of many variables, and to better understand and understand developing scenarios

The objectives of assessing financial market scenarios, risks and opportunities

The example of the perfect storm of the markets

Risk factors are strong and several, complicating the analysis

#R1 We have the highest inflation in the last 40 years, above 8% per year

#R2 We have a new monetary policy regime, quantitative tightening, made necessary to fight inflation.

#R3 Fiscal policy is limited.

#R4 We have the end of the bull market of bonds that lasted more than 40 years.

#R5 We have the war in Ukraine.

It is a useful exercise that any investor should do from time to time, and in particular, in the most extreme market periods, of sharp corrections or rises, as it helps to maintain perspective and curb impulses.

In the articles we publish from Quarterly Outlook we end up with an analysis of the main risks and opportunities, after a flash-back of the performance of financial markets, the macro and micro situation, including economic policies, and the assessment of bond markets and shareholders.

Before we go through past performance, we analyze the macroeconomic and micro-economic situation

For the performance of this exercise it is useful to address the issues most discussed by the financial community at each moment, using specialized media.

Assessing the risks and opportunities of financial markets at any given time allows us to bring order to a world of many variables, and to better understand and understand developing scenarios

Every day we have new news about financial markets, movements, decisions, indicators, communications, comments and opinions.

It’s too much information, too fuzzy and confusing, and often extreme. It’s the breaking news, the biggest falls and ups, the top picks and the daily selling ideas, etc.

This noise can lead us to two extreme attitudes that we want to avoid, between inaction and hyperactivity.

So from time to time, having time to understand, evaluate and form our opinion on what is happening in the markets is the best we can do to counter these behaviors.

To this end, we need to look at the economic and financial context in which we are at all times, and to make an assessment of the possible scenarios, and in particular, of the main risks and opportunities in place.

This analysis is always necessary, but it gains importance in the contexts of higher volatility, such as the current one.

We will use precisely the current situation to exemplify this exercise of scenario analysis, risk and opportunity.

The objectives of assessing financial market scenarios, risks and opportunities

The purpose of this assessment is not to try to guess the future to change the positioning of asset allocation and investments.

In another article we saw that the right to predict and decision the moments of the markets is difficult, if not impossible, and can cost a lot of money.

One of the objectives is to understand and accept market volatility in the short term, and to focus on the profitability and risks of investment in the medium and long term.

Another goal is to better understand reality, to be prepared for what can come. This anticipation helps to curb impulses and stay on course.

Another objective, especially in times of increased volatility, is to review the personal financial plan, and small adjustments can be made to asset and investment allocations.

No big changes, nothing drastic.

For example, if we are close to retirement, we can fine-tune the calibration of asset allocation to the effect of volatility by increasing the weight of bonds against that of stocks.

And when volatility in the stock market is abnormally high, we can replace some of the exposure to risk.

We can adjust investment styles between value and growth, focusing more on defensive companies over aggressive ones, dividend and more stable companies, and large capitalizations over smaller capitalisations.

The example of the perfect storm of the markets

Financial markets are continuously in a very complex multi-level adjustment process, creating disorientation and tensions in analysts and investors.

There are many and several factors of instability acting simultaneously.

There are structural and conjuncture factors.

There are extraordinary issues that haven’t occurred in a long time.

There are completely new situations.

There are many negative factors acting simultaneously, which have led Jamie Dimon to admit that we may be in the face of a perfect storm.

But there are also some positive circumstances.

The factors are so many and so diverse that it is impossible to find a historical pattern.

Economists tend to go back to digging up similar contexts, but we are faced with a very specific and different set of events and circumstances.

And it is in a context of the joint interaction of all these factors in which markets develop.

Therefore, the explanations are very varied and the discussions are very tense.

Everyone meets and advocates a perspective, but hardly sees the situation as a whole.

Thus, they end up being partial and somehow biased, by privilegiating a prism vis-à-vis others.

The intensity of the discussion about the situation and remedies is aggravated by the long division among economists about the causes.

The prejudice of reason or not misrepresents the vision, and aggravates what is already complex.

In fact, much of this discussion is not new, and has been the subject of opinions over a long period.

Risk factors are various and intense, complicating the analysis of

The risks are various and intense, seeming bigger and stronger when experiencing significant losses, and vice versa.

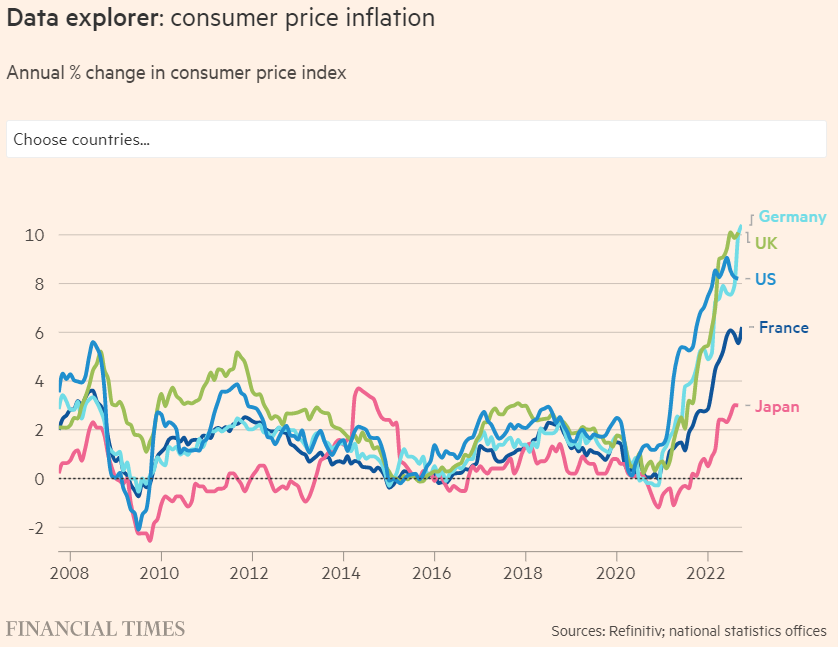

#R1 We have the highest inflation in the last 40 years, above 8% per year

In recent years, inflation has been below the 2% target of central banks, and the big threat was to avoid deflation.

History tells us that high inflation is very pernicious in economic and financial terms, so it must be vehemently combated.

In an earlier article, we deepened the theme of inflation.

More importantly, central banks have already warned that combating inflation is their priority and that they will develop their monetary policy until it returns to the annual target level of 2% in the medium and long term.

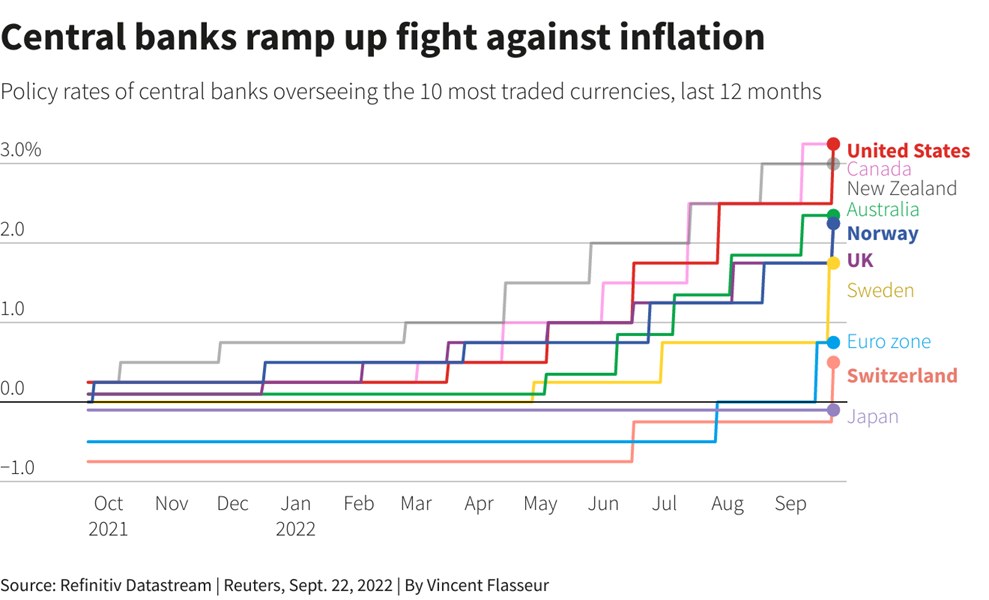

#R2 we have a new monetary policy regime, quantitative tightening, made necessary to fight inflation.

The only way to fight inflation is by monetary contraction, or quantitative tightening.

We have become accustomed to the quantitative easing of the last 20 years, since the days of Alan Greenspan, and especially after the Great Financial Crisis, which brought us zero interest rates and high liquidity.

The motto was to recover the economy.

Central bank balance sheets have increased a lot and interest rates have reached zero.

We live the accuracy of the “don’t fight the FED” motto in the monetary expansions made to get us out of the GCF and the crisis, and now we have to fear it the other way around.

In previous articles, we looked at the action and effects of monetary policy.

Interest rates are rising and the money supply is in contraction.

This brings back aggregate demand, including consumption and investment, causing a slowdown in economic growth and employment.

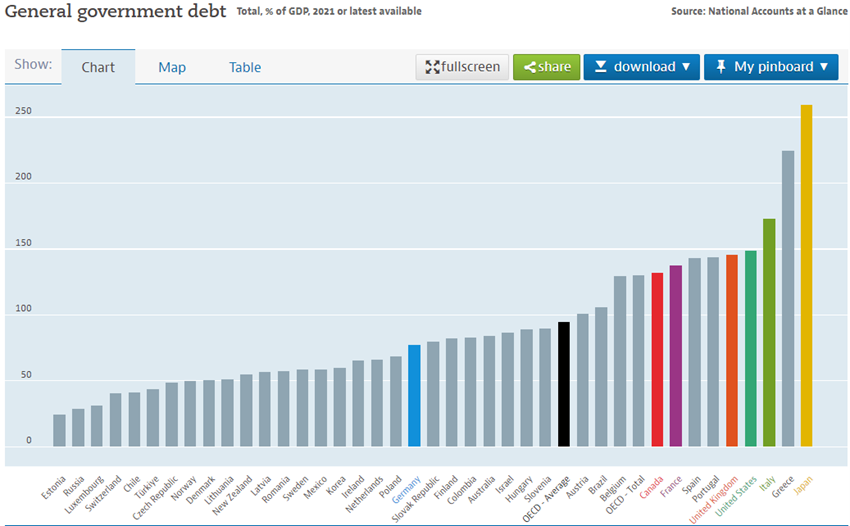

#R3 Fiscal policy is limited.

Inflation increases the cost of living and decreases disposable income.

The poorest countries and families are the ones who suffer the most and need support.

However, almost all countries have significantly increased their indebtedness.

The imbalances in public accounts were already coming from behind and were compounded by the government support needed to respond to the crisis.

In addition, debt costs are rising after several years of very low levels.

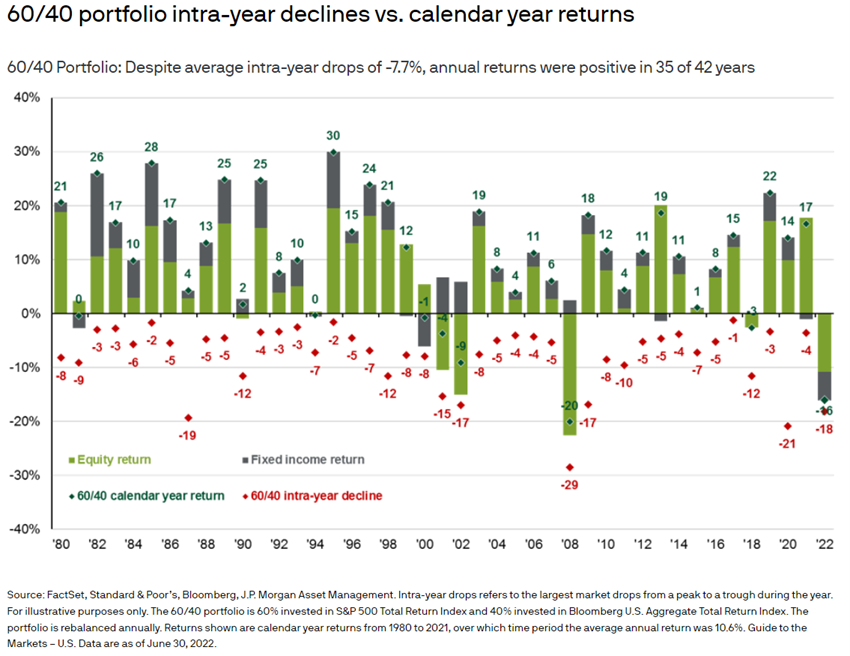

#R4 We have the end of the bull market of bonds that lasted more than 40 years.

The rise in interest rates caused sharp losses in bond investments, as well as in those of stocks.

The simultaneous losses of these investments challenge the value of the traditional 60/40 portfolio, used by many investors.

In the U.S., this portfolio has lost nearly 20% this year.

In previous articles, we looked at the end of the long bull market of bonds and the effects on the traditional 60/40 portfolio.

#R5 We have the war in Ukraine.

A war in Europe, as there was almost 70 years ago.

The last World War ended in 1945.

It was a humanitarian calamity. It was a war between developed countries, with history and institutional foundations that they thought were solid.

The construction of Europe in recent years has been a priority.

The end of the cold war, the fall of the Berlin Wall, nuclear disarmament, the supranational institutions, were in that sense.

No one believed that a war could be repeated in Europe with these dimensions.

This is where we have a war in Europe, triggered by Russia’s invasion of Ukraine on 24 February 2022.

War that divides Europe. On one side is Russia, a nuclear power. On the other is Ukraine, which has had demonstrations by the international community in general, and with strong economic support and military equipment by the Nato countries. China and India, Russia’s neighboring Asian powers, avoid taking a stand.

Europe’s security and the defence of Western democracies are at stake.

But interests of geopolitical world dominance are also being played. There’s no prospect of the war ending anytime soon. We haven’t talked about peace talks in a long time.

And the accounts of the dead and the displaced is frightening and it’s never going to stop.

In a previous article, we looked at the influence of geopolitical risks on financial markets.

In the second part of this article we will continue to address the most relevant risks to financial markets.