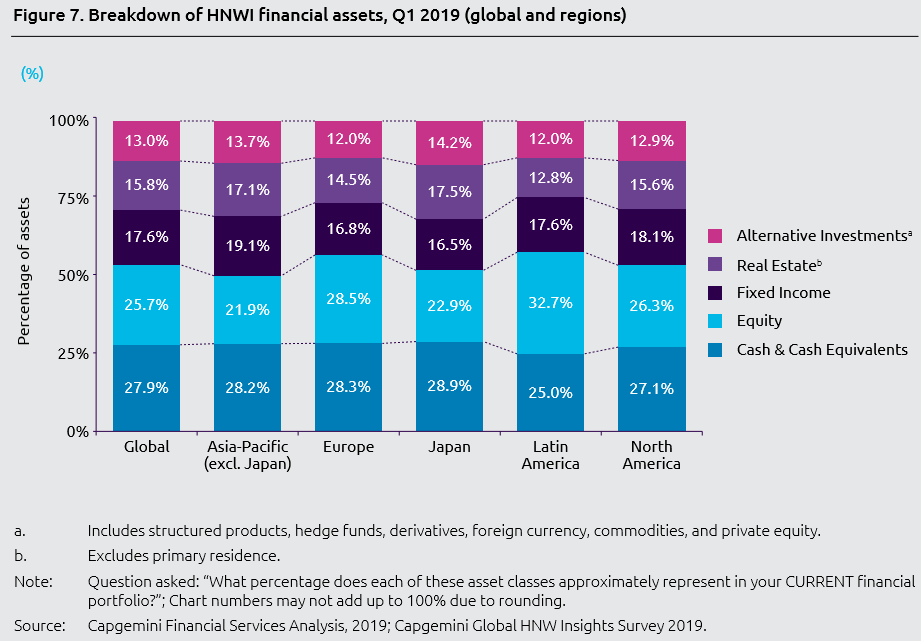

Despite asset allocation differences between countries driven by social-economical and wealth reasons, the richest households (High Net Worth Individuals) in any part of the world invest their financial assets in the same way: 28% in cash, 26% in shares, 18% in bonds, 16% in real estate and 14% in other alternative investments

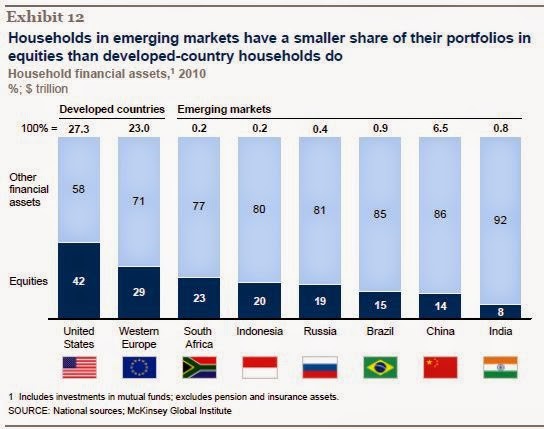

Households in advanced countries invest more in financial markets than those of countries in the less developed

American and European households invest more in the stock markets than those of other regions

However, when we focus only on the high net worth individuals, they invest their assets in the same way in any country in the world

Households in advanced countries invest more in financial markets than those of countries in the less developed

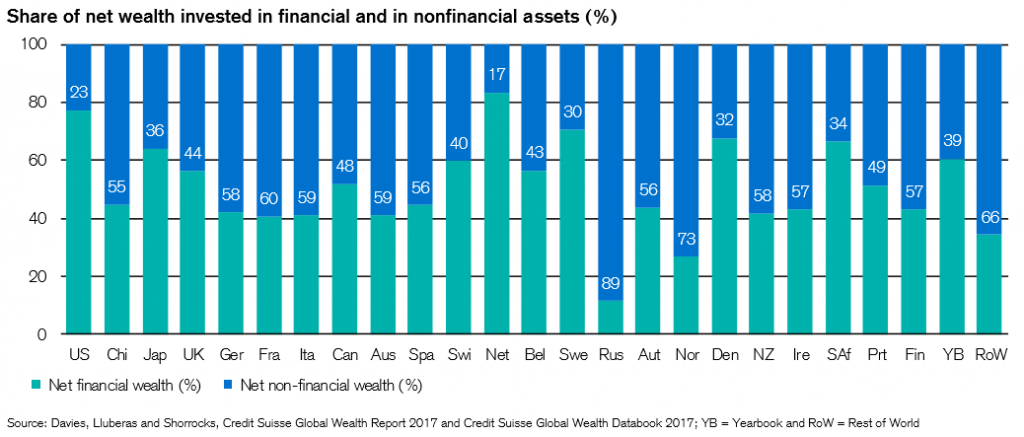

Household assets can be invested in financial assets, including shares and bonds, or in real assets, the most relevant being real estate.

When we look at the world there are great regional differences in terms of asset composition and distribution of financial investments.

In the more advanced economies people invest more in financial markets.

In the US, households net worth (deducted from debts) of invested in financial assets exceeds 60%, in Japan and in some European countries such as Denmark and Switzerland the 50% while in emerging countries such as China and the Czech Republic this percentage is 40% and India and Indonesia is still well below, between 1% and 20%.

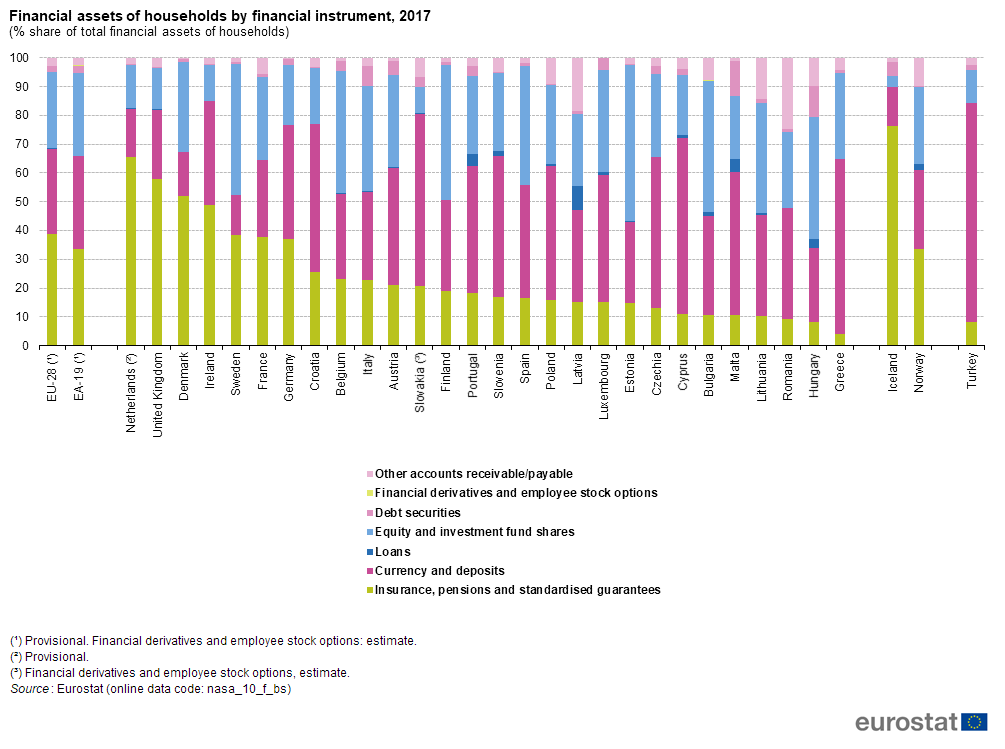

American and European households invest more in the stock markets than those of other regions

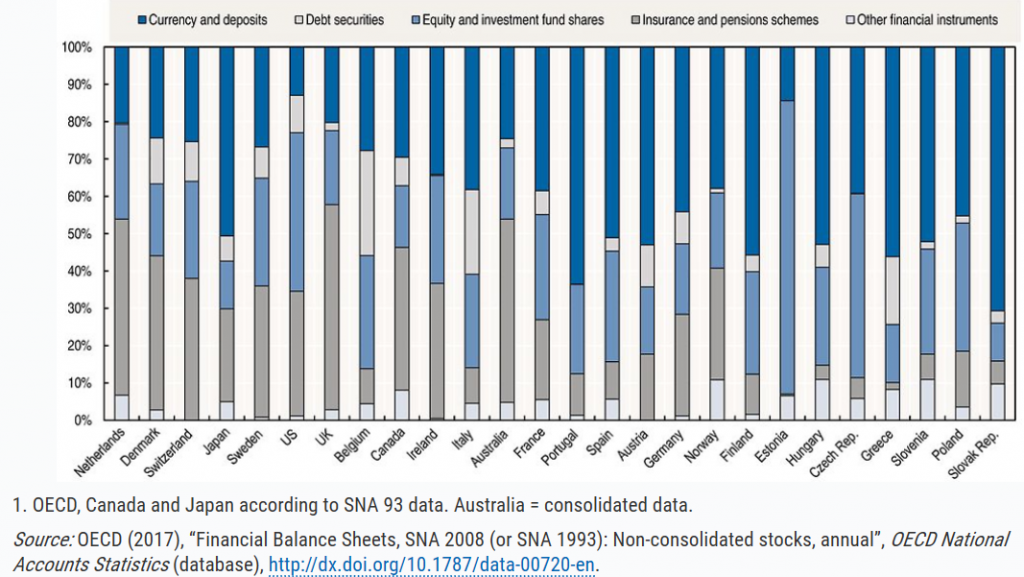

However, in developed countries there are still differences in the distribution of investment by financial assets classes.

The US invests the most in stocks, with a weight of 45%, followed by Sweden and Canada with percentages close to 40%.

Households in major European countries such as Italy, France and Germany invest about 20% in shares. In Portugal, the value is less than 15%.

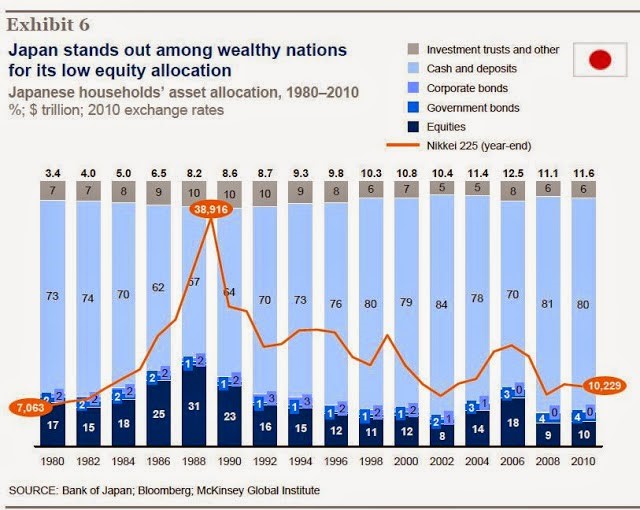

In Japan, household investment is mainly made in deposits, with the weight of shares insignificant and little higher than Slovakia.

In Europe, emerging or less developed economies also place most of their financial assets to liquidity and deposits.

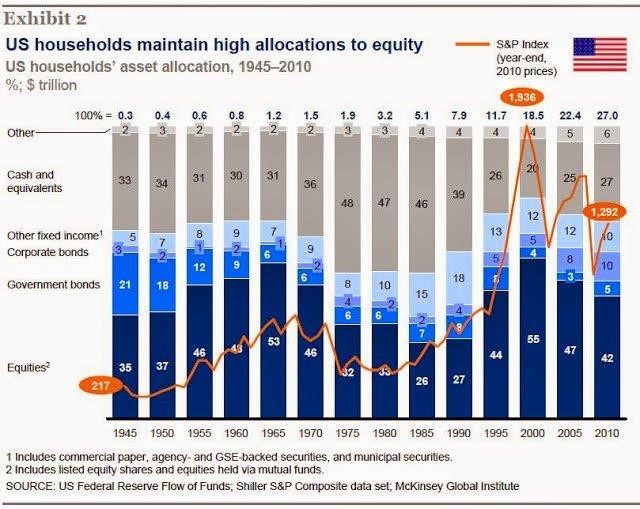

Traditionally, US households invest heavily in stocks.

In the US the allocation to shares is high with values in the range of 40% to 55%, to bonds is about 20% and cash at 25% to 30%.

These cultural aspects are intrinsically linked to the civilizational roots of US creation and development, but also of the growth of the capitalist economy and the world’s largest capital market, which underlie this situation.

Investment in stock markets is also important in Western Europe, and very low in emerging economies.

European households invest 30% in the stock markets and those of emerging countries allocate no more than 8% to 20% of their financial assets to these markets.

In Japan, very little is invested in stocks. Most financial assets are bank deposits.

This is largely due to the devastating effects of World War II on the Japanese economy and more recently to the debacle of the Japanese miracle since the early 1990s that destroyed much of the wealth invested in stocks.

However, when we focus only on the high net worth individuals, they invest their assets more or less in the same way in any country in the world

The High Net Worth Individuals are those who have a net worth available for investment (excludes own housing) exceeding 1 million U.S. dollars.

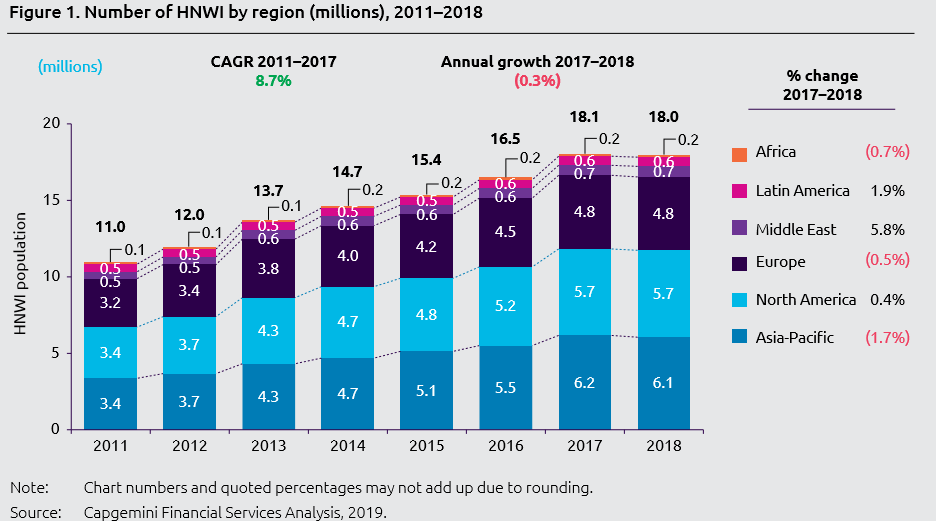

In 2018, there were about 18 million of these people worldwide:

6.1 million live in Asia Pacific, 5.5 million in North America and 3.8 million in Europe.

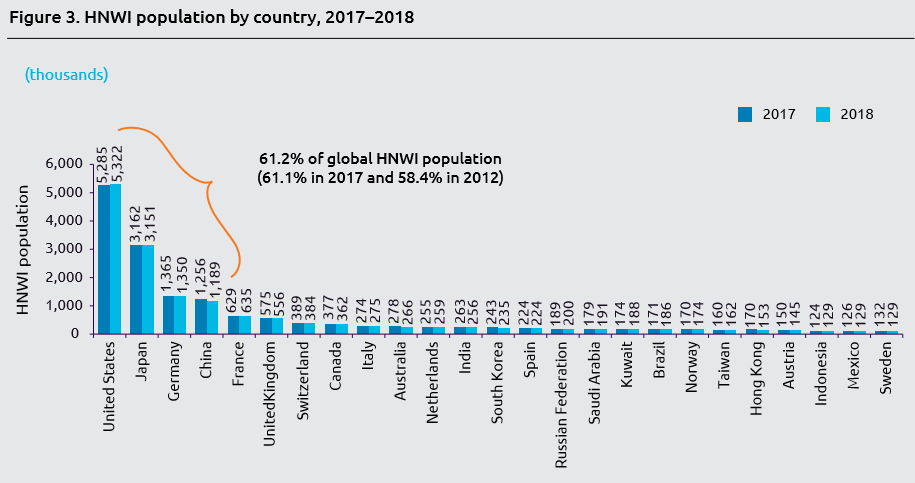

In terms of countries the situation is as follows:

5.3 million live in the US, 3.2 million in Japan, 1.3 million in Germany and China, 600,000 in France and the United Kingdom, 400,000 in Switzerland and Canada.

The allocation of assets of these people in the various regions of the world is as follows:

We see that the allocation of assets of these high net worth people is quite uniform in the various regions, being about 28% applied in savings and deposits, 26% in shares, 18% in bonds, 16% in real estate and 13% in alternative investments.

In conclusion:

- The differences in household investments are fundamentally explained by underlying cultural, economic and social reasons: the Western capitalist models and that of the Asian countries in which it exists; the way people relate to the state, namely nation-state versus civilization state; differences in household disposable income in the world; the degree of development and historical performance of financial markets and shareholders in advanced geographies.

- However, at the level of the wealthiest families there are great similarities because these families are more global than local, more alike, resulting in a great similarity of these aggregates in terms of cultural, social and economic attributes.