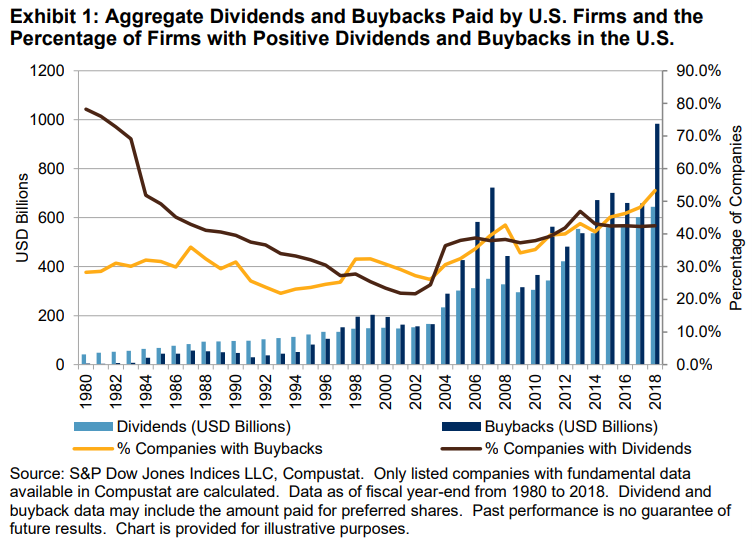

Since 1997, share buybacks have surpassed cash dividend payments and have become the dominant form of profit distribution by companies in the U.S.:

This paper presents an overview of U.S. equity purchases, including trends in corporate earnings distributions, the broad types and motives behind share buybacks, and the impact on price.

Its main conclusions are as follows:

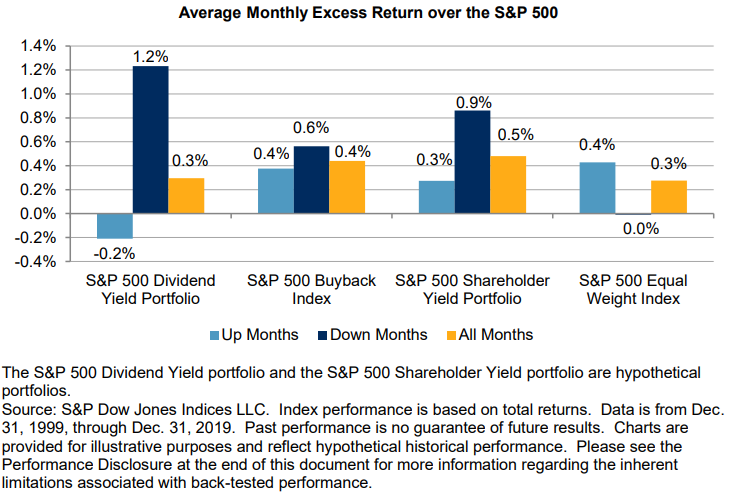

Over a long-term investment horizon, the equity portfolios of companies that buy their own shares generated positive excess returns relative to their benchmark indices in the large, mid- and small-cap segments of the U.S. market.

All portfolios of these stocks generated higher average returns than their benchmark indices in falling markets than in rising markets, regardless of index weighting methods.

Compared to dividend portfolios, the portfolios of companies that buy their own shares tended to have lower dividend yields, and most of their performance resulted from capital gains rather than dividend yields.

The portfolios of companies that buy their own shares have achieved more balanced win and excess return ratios in both rising and falling markets, making them a good complement to defensive portfolios that focus on dividend strategies and low volatility.

The equitable weighting method used in the construction of the equity purchase indices improves the profit ratios and excess returns in bull markets, making the performance of these indices more balanced in both rising and falling markets.

The impact of equal weighting is more significant for large-cap companies than for small- and mid-cap companies.

Access here: