New normal in the economy and markets around the corner, but how will it be?

Science’s victory over the pandemic coupled with the strength and effectiveness of continued economic policies drive stock markets and activity growth rates in the US and Europe to historic highs …, but we still have much of the world to vaccinate, new variants, inflation in focus, stimulus withdrawal process, worsening imbalances (our present was bought and is going to be paid by our future), and there are some excesses associated with new investors and especially new ways of investing

Index

Financial markets performance 1H21

Macroeconomic context

Micro-economic context

Economic policies

Markets valuation

Main opportunities

Main risks

Executive summary

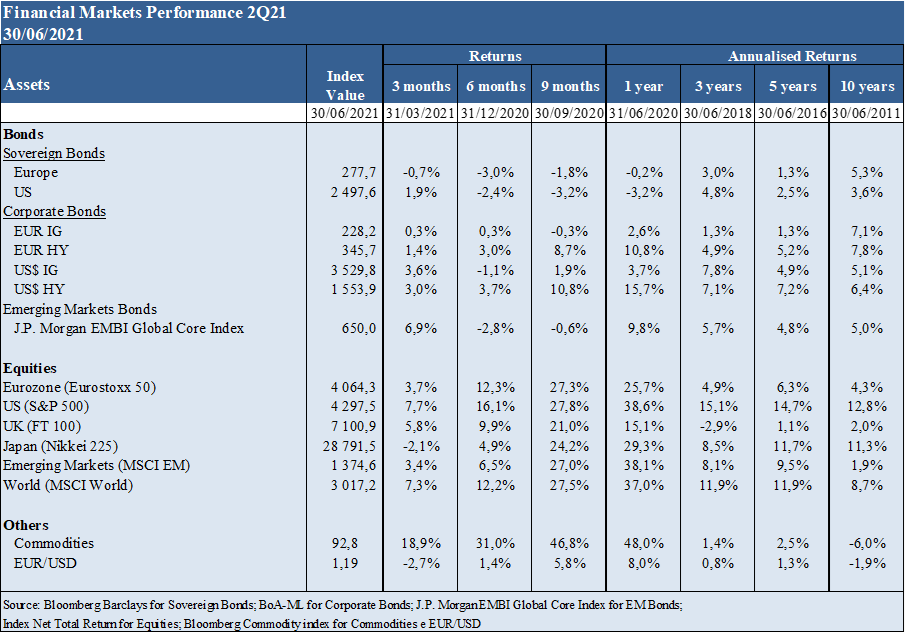

Performance 1H21: Stock markets at historic highs in the U.S. and Europe with volatility close to lows, in contrast to volatile bond markets.

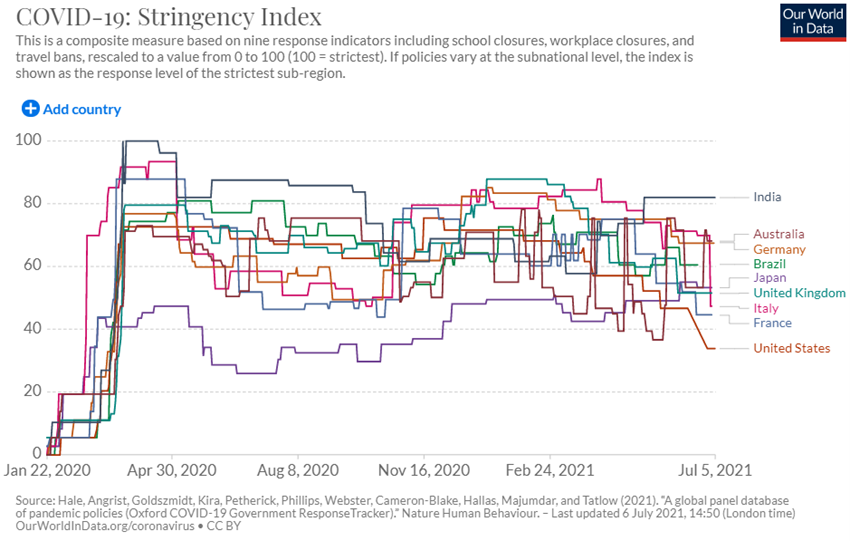

Status Covid-19: Accelerated vaccination in the US and Europe to contain the danger of multiplying cases associated with new and more contagious virus mutations, but Latin America and Africa are long overdue in the process.

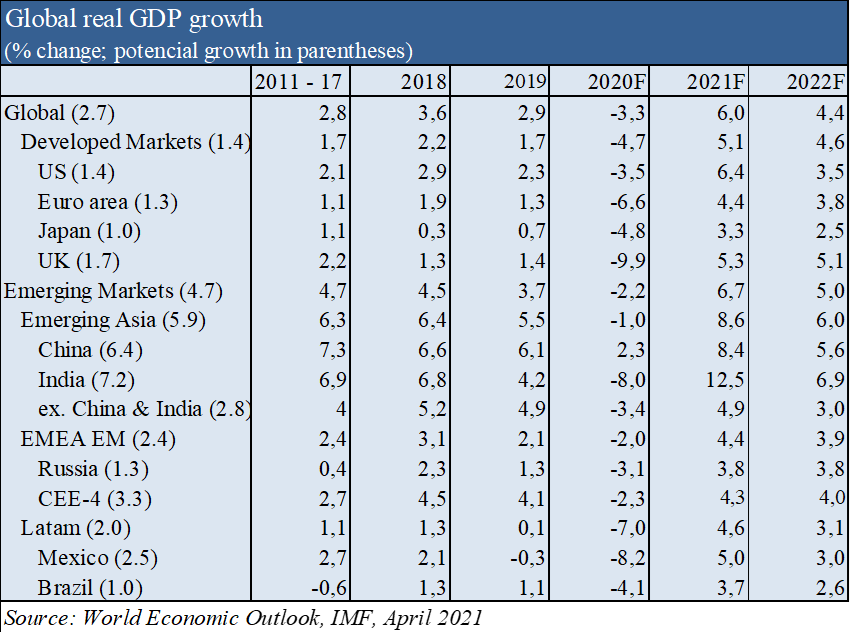

Macroeconomic Context: Strong activity growth, with the spectrum of inflationary pressures and slower recovery in employment.

Microeconomic Context: Growth rates of advanced and leading economic indicators hit historic highs and peaked in the quarter.

Economic policies: Maintaining accommodative policy by the ECB and the FED and developing structural fiscal policies in Europe and the US to strengthen competitiveness (infrastructure and digitisation), employment and combating climate change, but with announcements of transition to normality.

Equity markets: Stock markets recorded historic highs in the US and Europe and low volatility, with strong growth in earnings per share and a slight reduction in valuation multiples.

Bond markets: Fixed income markets were more volatile due to fluctuations in inflation and long-term sovereign interest rates, but with compression of credit spreads.

Main opportunities: Accelerating the vaccination process around the world to rapidly achieve global group immunity, reducing public health risk, and improving international trade, and an increase of pent-up demand and investing from excess savings.

Main risks: New mutations of the virus less controllable and more resistant, persistence of inflation and rising interest rates in the US, worsening weaknesses in some emerging economies, and correction of some market excesses.

In this scenario of ever less uncertainty with progress on ongoing vaccination and robust economic indicators, strong and persistent support of economic policies continues to favour equity markets over interest rates and credit.

Performance 1H21: Stock markets at historic highs in the U.S. and Europe with volatility close to lows, in contrast to volatile bond markets.

Science’s victory over the pandemic coupled with the strength and effectiveness of economic policies push US and European stock markets to historic highs and volatility near lows.

Bond markets were more volatile because of long-term interest rate fluctuations in those countries.

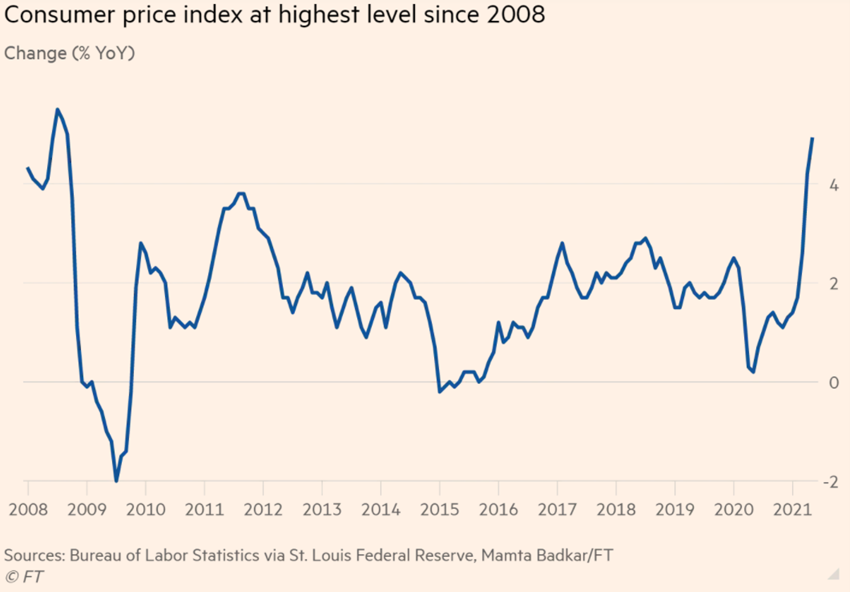

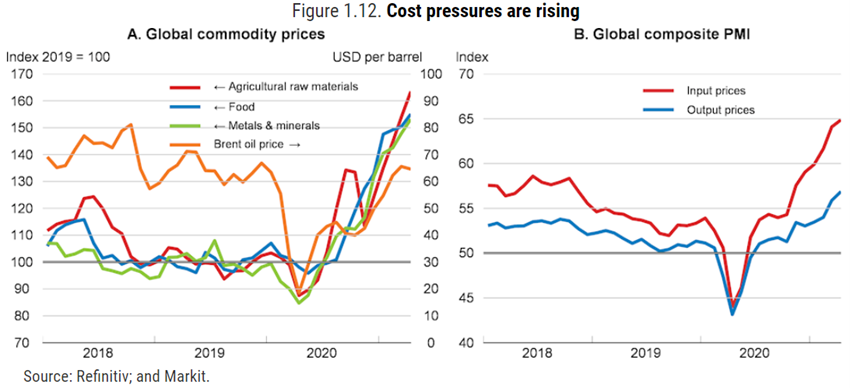

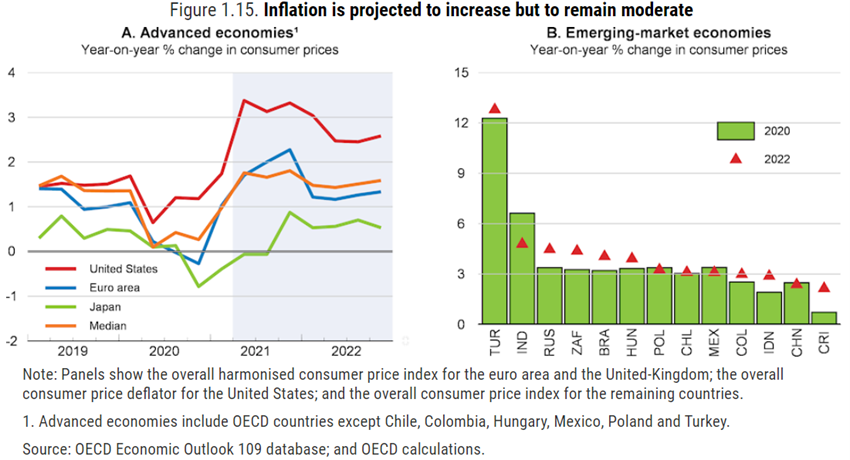

These financial markets performance was due to vary high economic growth rates and was conditioned by the controversy whether the current rise in inflation above the 2% target is transitory, as the authorities argue, or persistent, as some economists think.

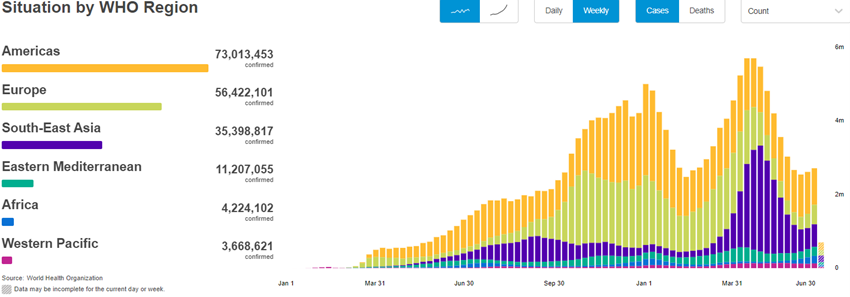

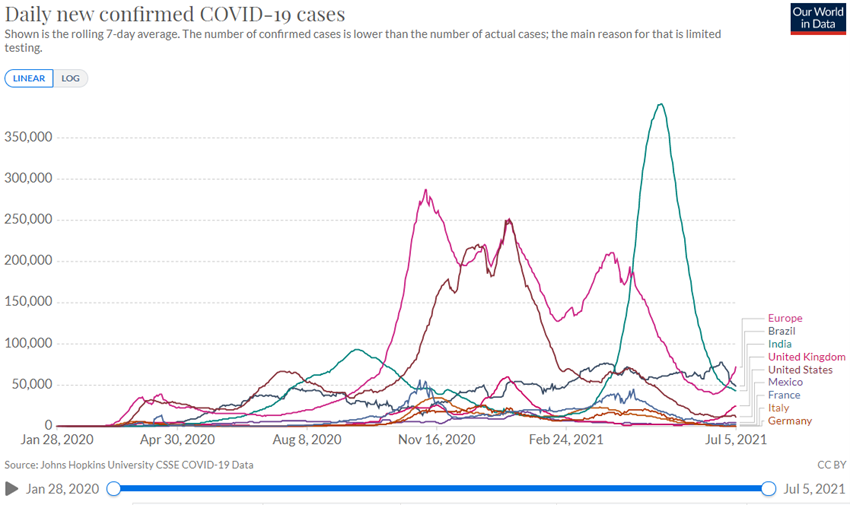

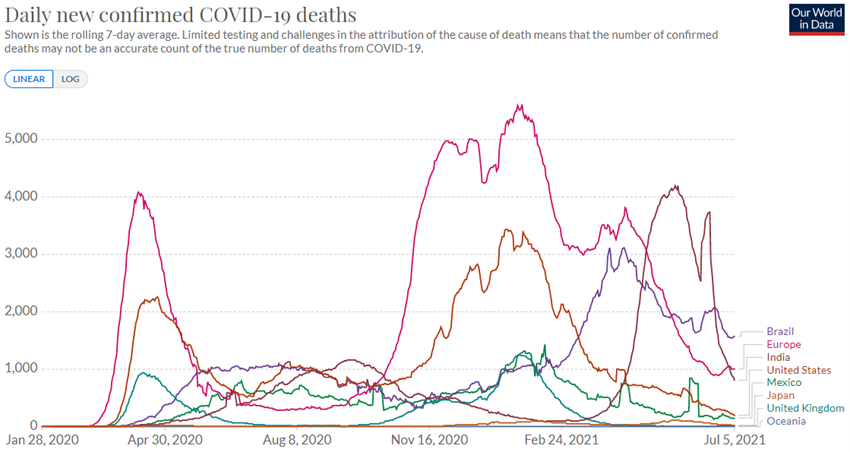

The Covid-19 virus has surpassed 184 million infected and nearly 4 million dead.

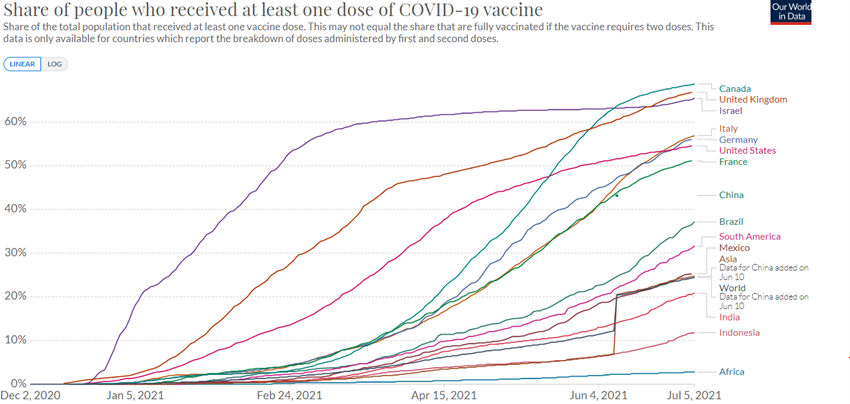

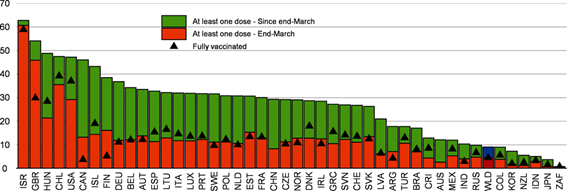

Developed economies are very advanced in the vaccination process and close to achieving group immunity while Latin America and especially Africa are long overdue. Globally, there are almost 3 billion doses of vaccination administered.

New variants have emerged resulting from mutations of the virus, with the delta originating in India being the most contagious and of greatest spread globally.

Vaccines are increasingly effective in fighting the pandemic, with an efficacy of more than 90% in reducing the risk of infection and especially hospitalization and mortality.

Most countries are heading for a full reopening of economic activity in the third quarter, except for India, some Latin American countries and especially Africa.

Most developed countries are expected to achieve group immunity during the summer, enabling the return to normalisation of economic activity.

Economic policy authorities in the US and Europe have maintained the purpose of doing whatever it takes to meet existing restrictions and reinforced the idea that they will only withdraw support when the recovery is sustainable.

Inflation is above the reference levels of the US and European central banks, although they believe that this is due to transitory factors and as such do not consider withdrawing stimulus yet.

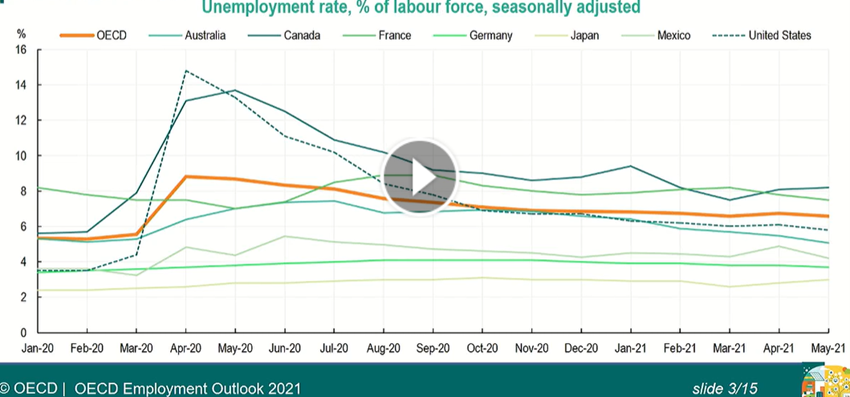

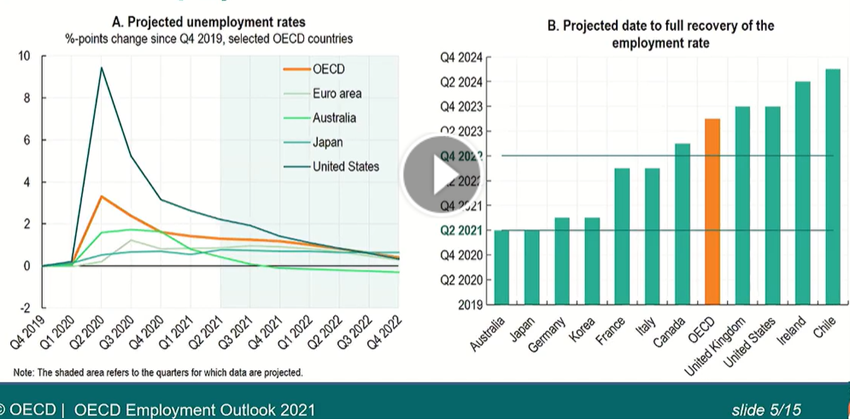

In its most recent report, the OECD estimates that there are currently 8 million unemployed and 14 million inactive due to the pandemic that will only be recovered in the third quarter of 2023.

Microeconomic Context: Growth rates of advanced and leading economic indicators hit historic highs and peaked in the quarter.

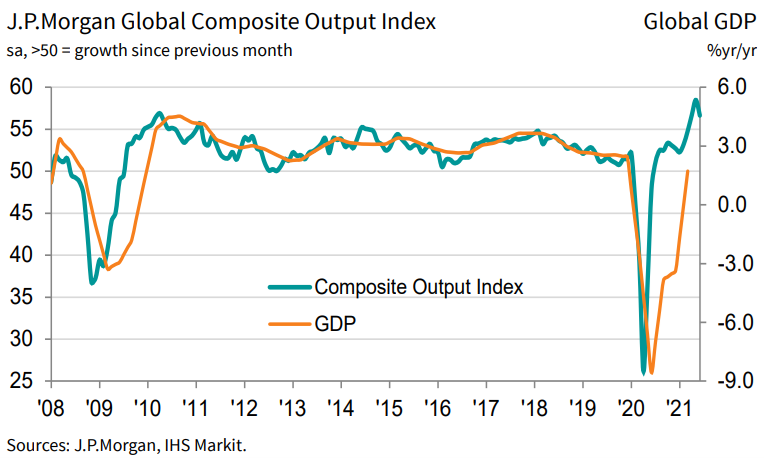

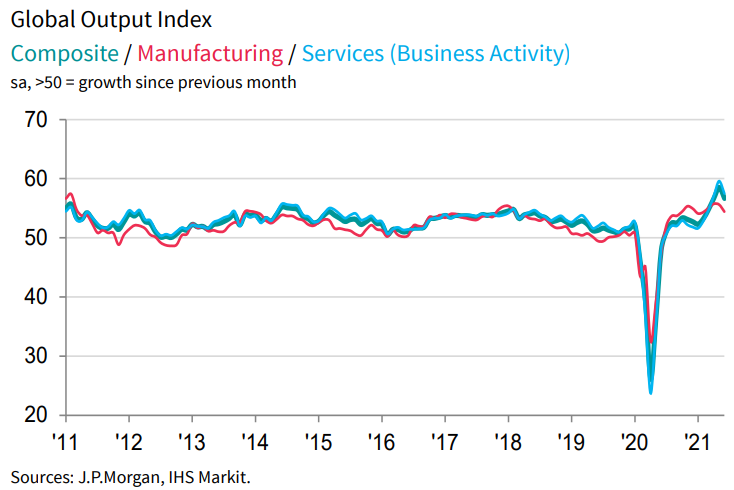

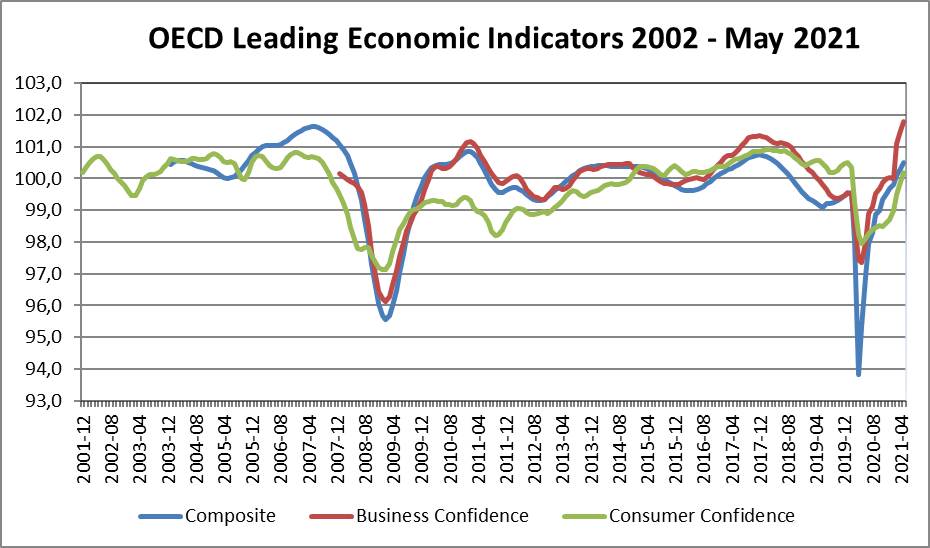

The Global Composite Output reached 56.6 in June, after the 58.5 high of the last 15 years reached in May.

The services sector performed better than the industry for the third month in a row.

The US had the best overall performance, closely followed by Ireland, Spain and the UK. The Eurozone also had the best record in the last 15 years (since June 2006). The big Asian economies showed worse performance, with slowdowns in China and contraction in Japan and India. Brazil, Russia, and Australia also had good growth rates.

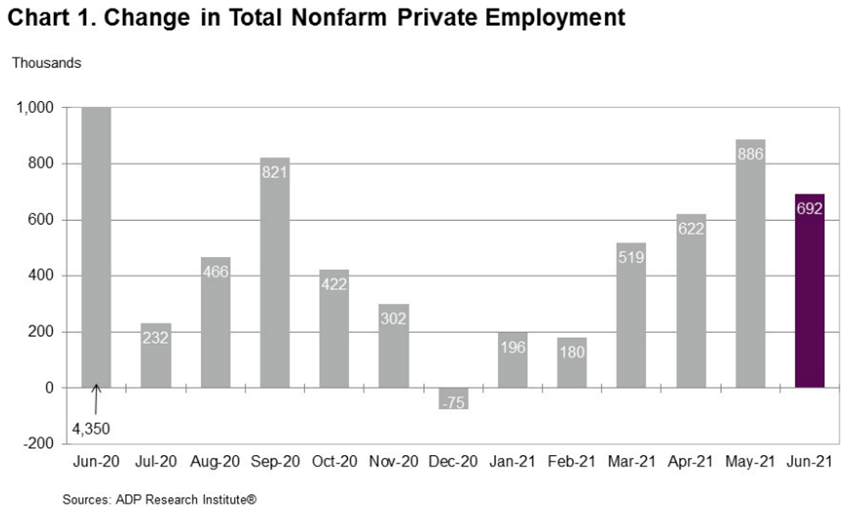

While the loss of net jobs from the US pandemic is still 7 million, the labour market remains robust, with the creation of about 3 million jobs in the first half.

The confidence of entrepreneurs and consumers in OECD countries has also improved.

Economic policies: Maintaining accommodative policy by the ECB and the FED and developing structural fiscal policies in Europe and the US to strengthen competitiveness (infrastructure and digitisation), employment and combating climate change, but with announcements of transition to normality.

The US and Europe maintain accommodative fiscal and monetary policies with the aim to achieve full recovery of activity and employment.

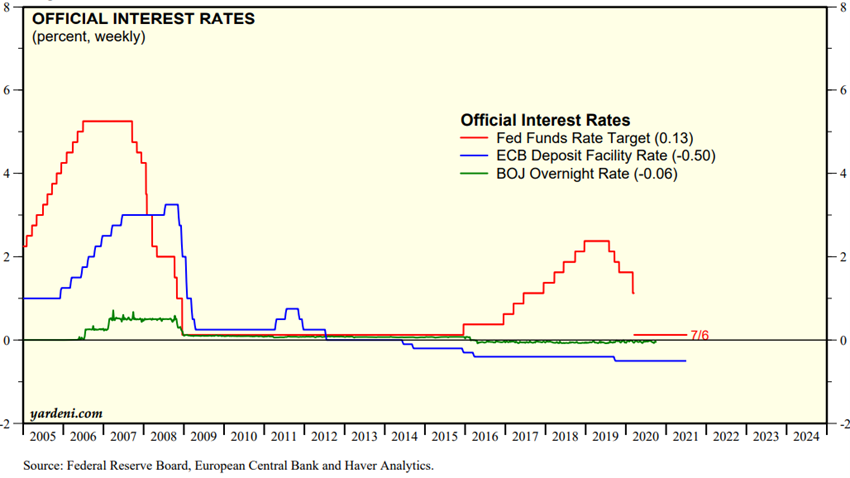

The ECB and the FED plan to maintain official interest rates in the medium term (the FED anticipates the first rates movement for the third quarter of 2023, of a total of 0.5%), despite inflation rates above 3% (well above the 2% target) because they consider this to be due to transitory factors resulting from failures in supply chains and bottlenecks or imbalances in the commodity markets associated with the transition between suspension and resumption of activity.

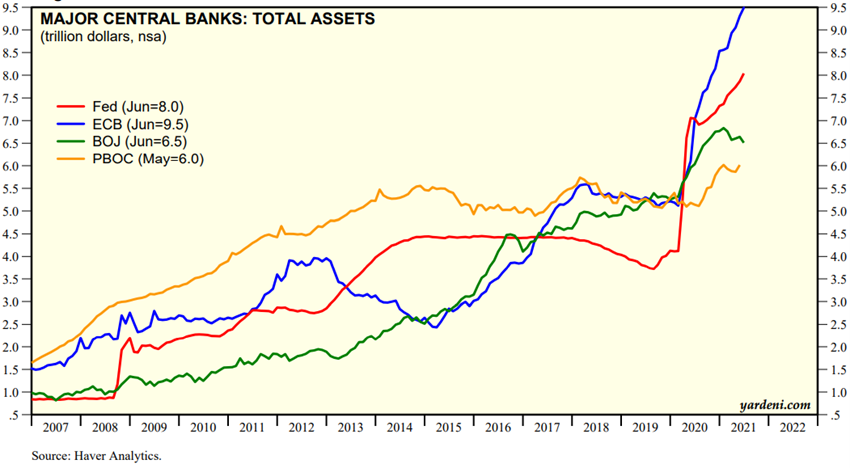

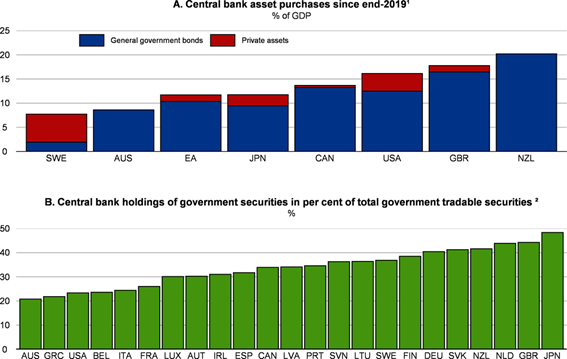

Major central banks around the world maintain the asset purchase program. By 2020 these programmes accounted for more than 10% of GDP in the Eurozone and more than 15% in the US and are a very important source of government funding. These central banks currently hold more than 30% and 20% of all government bonds in these countries, respectively.

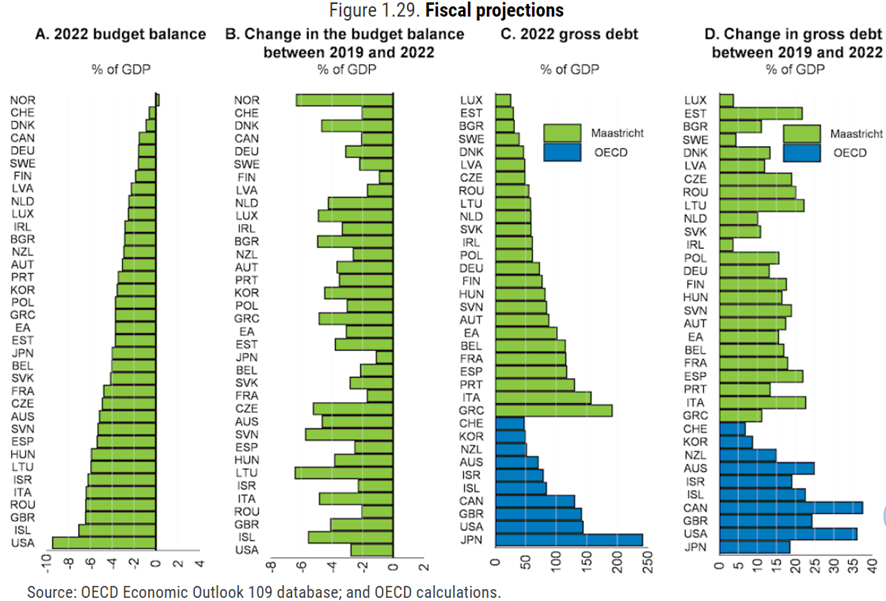

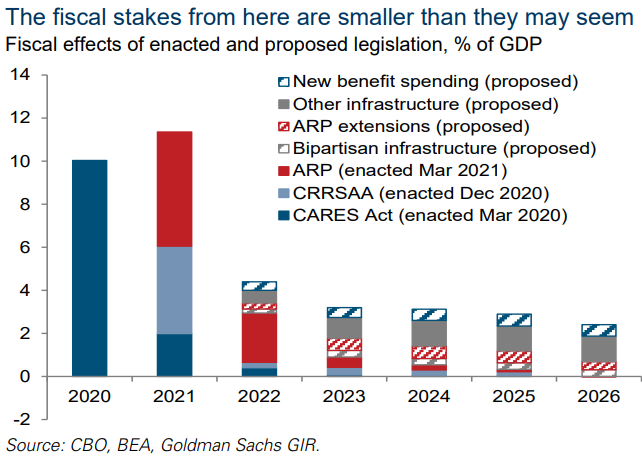

New fiscal frameworks for the immediate fight against the pandemic have soon be followed by new medium-term structural programmes in all geographies.

In the US, after the $1.9Tr of the ARP (8% of GDP) in March, the 900Bn of the CRRSAA in December and the $2.2Tr of CARES in March 2020, and with a public debt of more than 100%, President Biden announced his key priorities: making the tax system more progressive, increasing investment in fighting global warming and infrastructure, and using fiscal policy during adverse economic shocks.

The European Union’s NextGen programme of €750Bn is already underway.

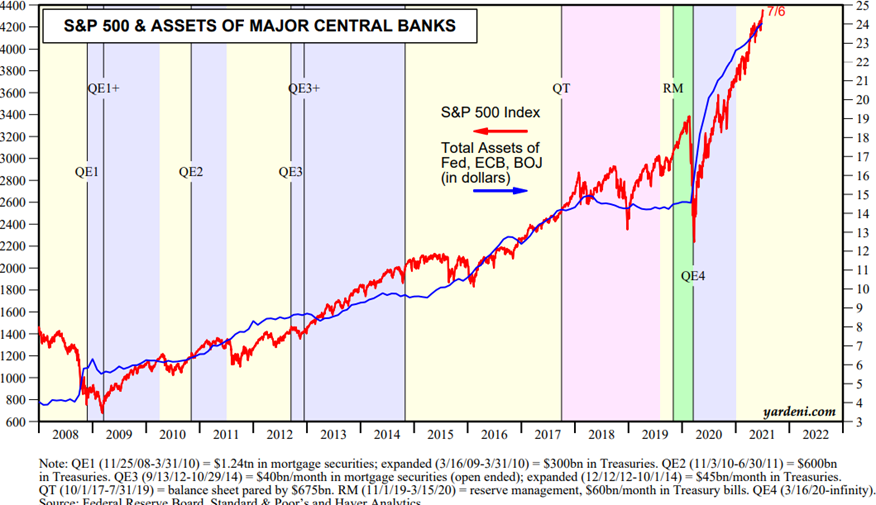

The unprecedented transfer of state funds to the private sector has been financed largely by monetary creation, aggravating fiscal and monetary imbalances.

Source: Major Central Bank Total Assets, Yardeni Research, July, 7, 2021

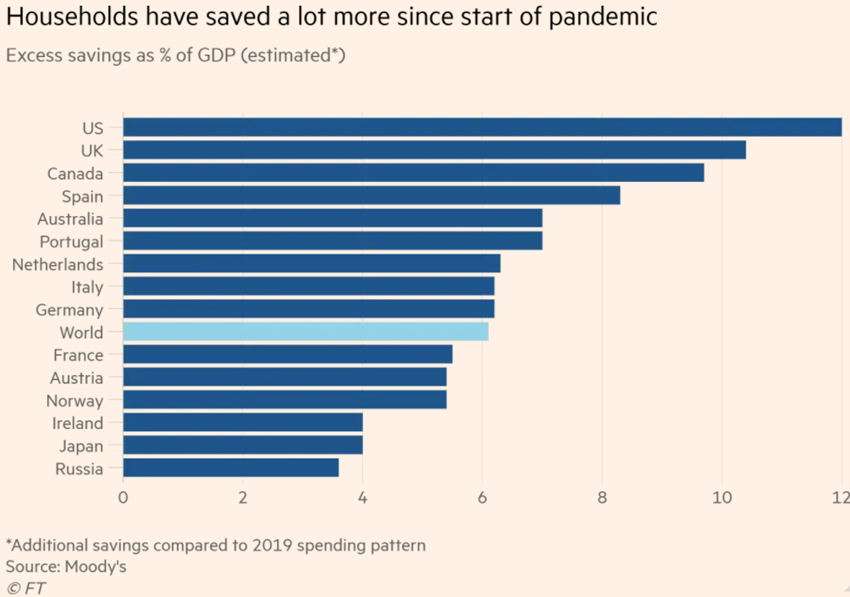

Support from governments and central banks around the world has improved financial conditions, including an increase of disposable income and household savings in countries such as the US, UK, Germany, etc.

The recovery in risk asset prices and the fall in benchmark interest rates has also led to an overall improvement in financial conditions.

Source: Central Banks:Monthly Balance Sheets, Yardeni Research, Jul, 7, 2021

Equity markets: Stock markets recorded historic highs in the US and Europe and low volatility, with strong growth in earnings per share and a slight reduction in valuation multiples.

U.S. and major European stock markets had one of the best half-yearly performances ever, at about 15 percent, and reached historic highs at the end of the first half.

This movement has been supported by economic policies, increased risk premiums and especially by asset rotation associated with low interest rates.

In 2021, the good performance of the equity market has been transversal to value and growth actions.

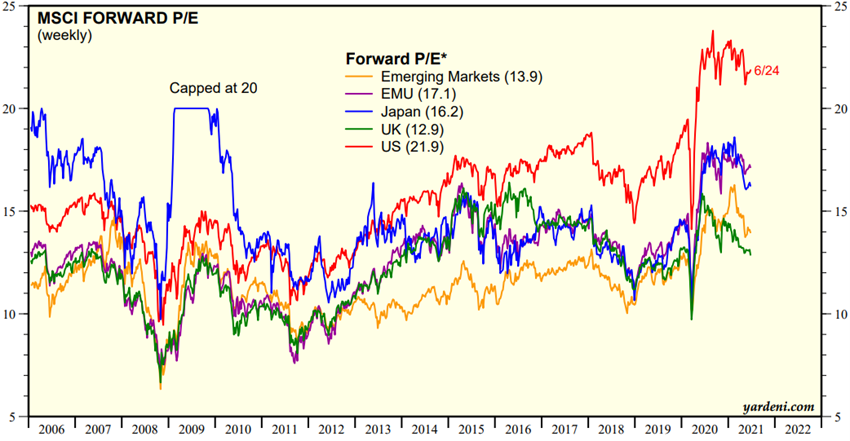

The valuation of the global equity market and in its the various regions is above the long-term average and has decreased slightly. The PER of 21.9x for the US is well above average and close to highs. The PER’s of 17.1x in the Eurozone, 16.2x in Japan and 13.9x in emerging markets are also above average.

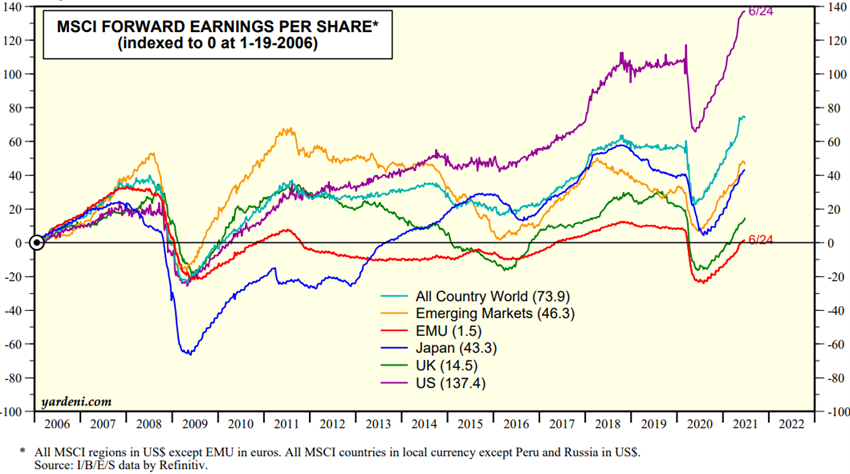

Estimates of earnings per action from the consensus of analysts have grown and already exceed pre-pandemic levels in the US and around the world, but are still below in emerging markets, Japan, and especially in the United Kingdom and the European Union. A determining factor for this rise was the increase in weight in the indexes of growth companies which have better profit margins, and more recently, an improvement of the financial conditions of two of the main value sectors, energy, and finance.

first quarter results season in the U.S. that begins soon and will last for the next 3 weeks (in Europe starts at the end of the month), will be important to validate and stabilize the projections and evolution of earnings per share.

The earnings season in the US that begins soon and will last for the next 3 weeks (in Europe starts at the end of the month), will be important to validate and stabilize the projections and evolution of earnings per share.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, Jul, 7, 2021

Source: Global Index Briefing: MSCI Metrics Comparisons, Yardeni Research, Jun, 30, 2021

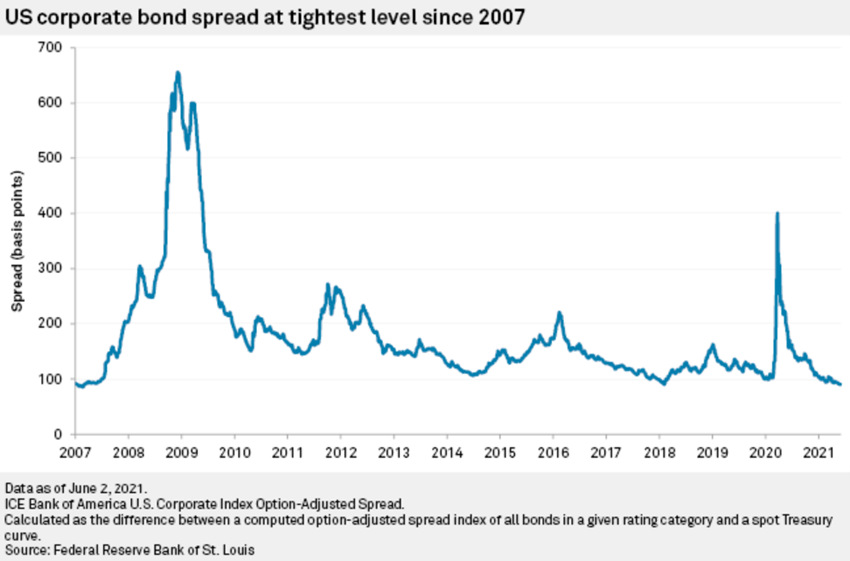

Bond markets: Fixed income markets were more volatile due to fluctuations in inflation and long-term sovereign interest rates, but with

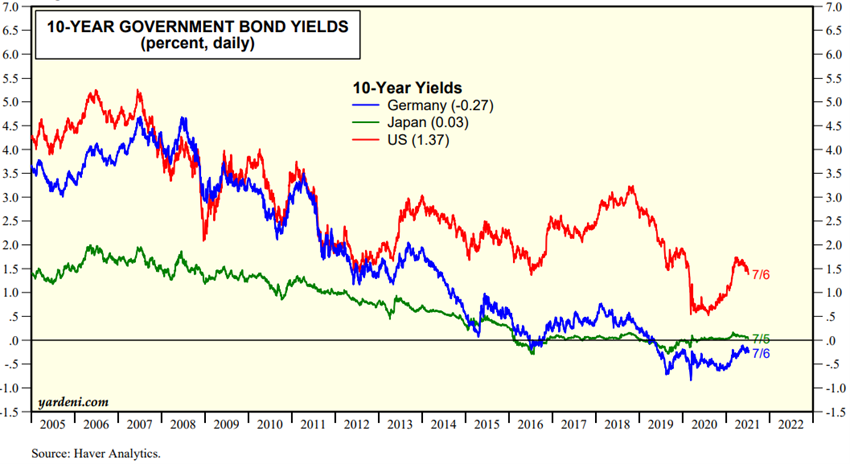

The increase in the inflation rate in the US and to a lesser extent in the Eurozone has led to an increase in interest rates on medium and long-term sovereign debt that extended to other bonds, with the consequent decline in their value.

Central banks around the world are determined on keeping benchmark rates at low levels and pursue monetary injection programs to stimulate economies until normal.

Medium- and long-term interest rates on treasury bonds are at historic low levels.

Credit spreads on investment rating companies’ bonds fell to 0.87%, the lowest level since 2007, while the ones of speculative rating companies were set at 3.12%, the lowest level since October 2018.

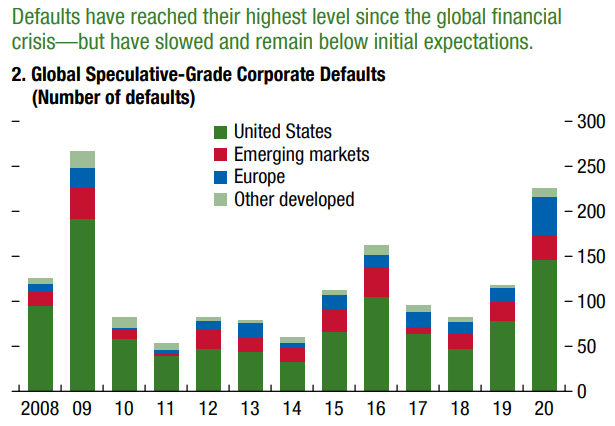

In 2020 there was no such significant increase in defaults as expected due to government support for sustaining the activity.

Source: Yardeni, Market Briefing:Global Interest Rates, Jul, 7, 2021

Source: Global Financial Stability Report Update, IMF, Apr 2021

The authorities’ determination to sustain the recovery is the best guarantee of support for economic activity growth, with a return to pre-pandemic levels in 2021 in the US and 2022 for major European countries.

The acceleration of the ongoing vaccination process around the world and especially in the countries that have been slow could anticipate group immunity globally, increase international trade and output.

Households have accumulated an impressive value of excess savings around the world with the pandemic (and its stimulus), which enhances a strong capacity for consumption and investment.

Fund inflows to the global equity market in the first half in the US totalled an impressive $588 billion, nearly equal to the sum of all the amounts in the last 20 years.

If the high inflation rate in the US and Europe becomes persistent, as some economists admit (especially due to the possibility of wage inflation on the return to work), central banks will have to anticipate the reversal of monetary policies, raise official interest rates, and reduce asset purchases. This will result in the rise in long-term interest rates, with a direct negative impact on the bond market, and indirect negative on the stock market due to lower appreciation of future cash flows and asset rotation by investors.

There is a risk that vaccines that have been shown to be effective for the various mutations of the virus, which are more infectious and lethal, may not be in the face of a new mutation that is more difficult to control and combat.

The fight against the pandemic has exacerbated the weaknesses and vulnerabilities of companies in some sectors, as well as countries such as Turkey, South Africa, and Brazil, which will have a more difficult recovery capacity, especially with higher interest rates and a stronger dollar.

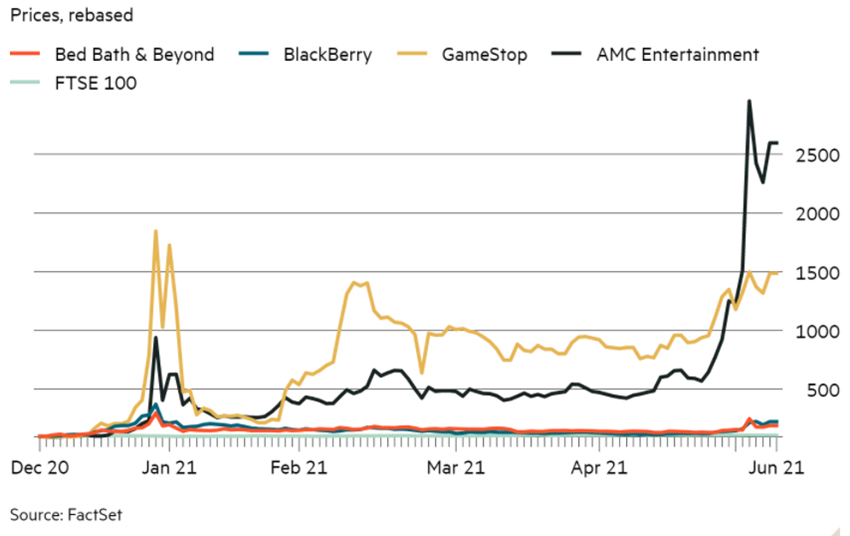

The market excesses we have seen in the valuations of listed companies known as “meme” pulled by social networks such as Reddit (WallStreetBets) and followed by many millions of leveraged retail investors who debuted in 2020 may have harmful and deeper effects when their inevitable correction occurs (e.g., Gamestop, AMC, etc.).