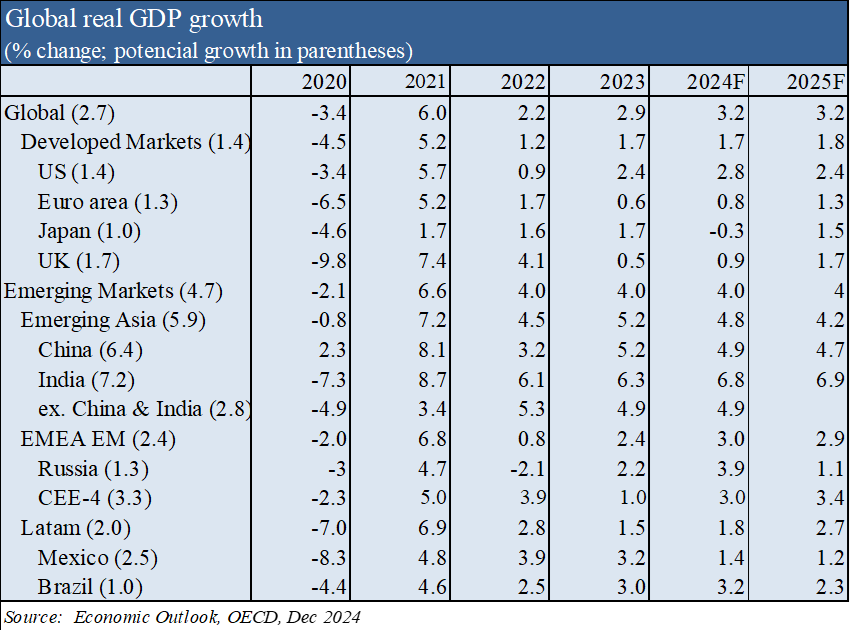

In 2024, the outlook for economic growth remained divergent: strong in the US, stagnant in Europe, and below target in China.

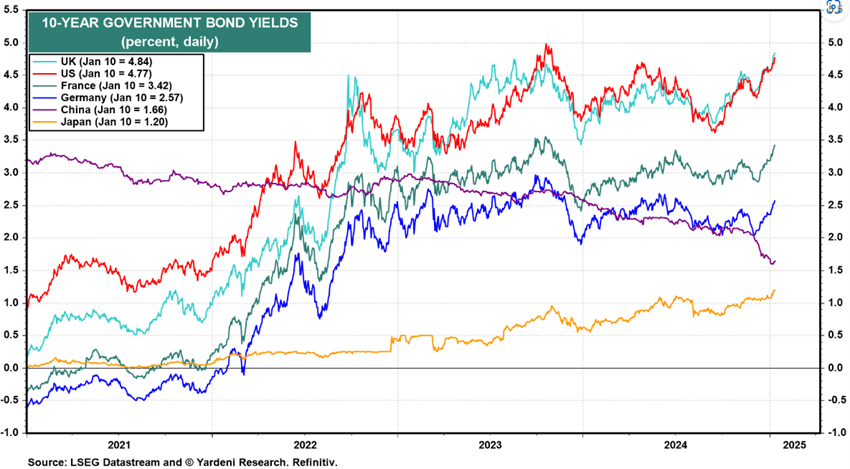

Inflation and official interest rates have come down in all countries, but long interest rates in the U.S. are nearly 1% higher since the beginning of the year.

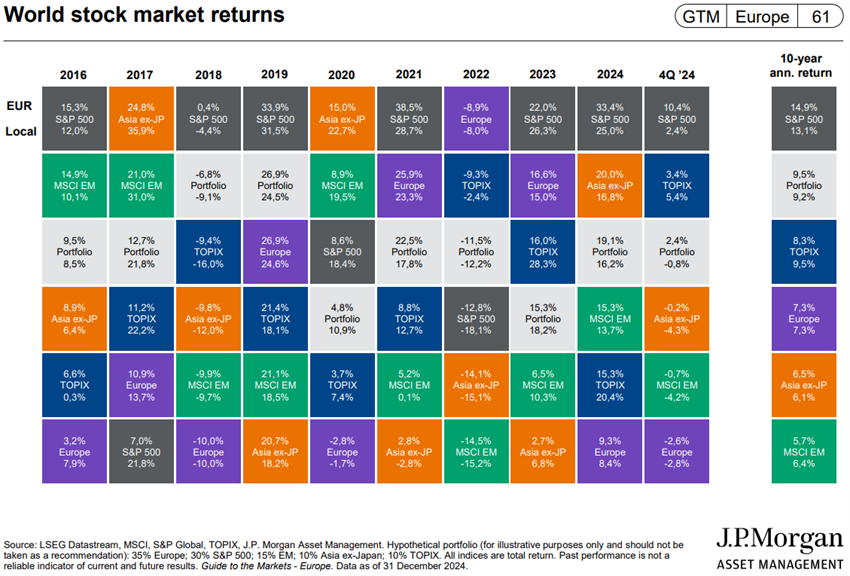

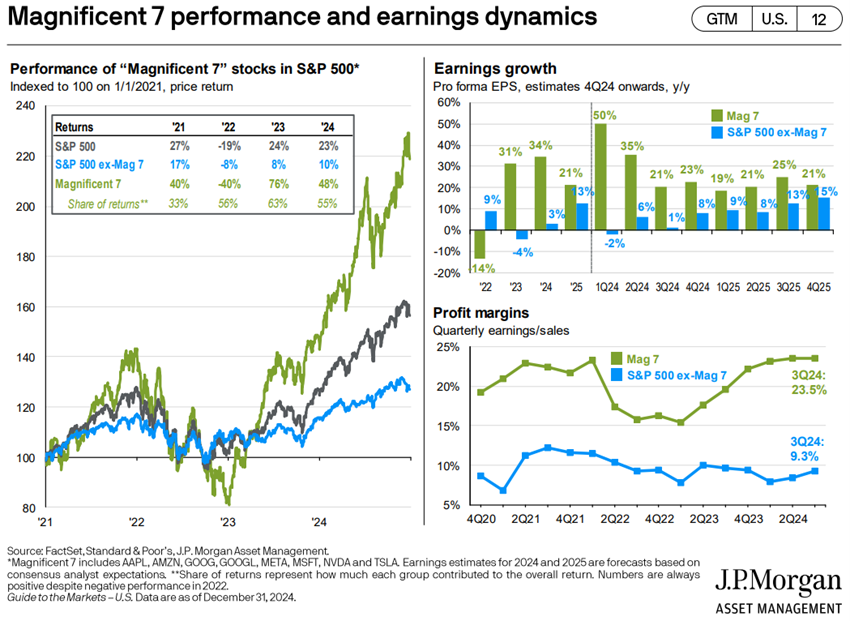

US stock indices have risen more than 20% and are at highs, with Mag7 accounting for more than half of this appreciation.

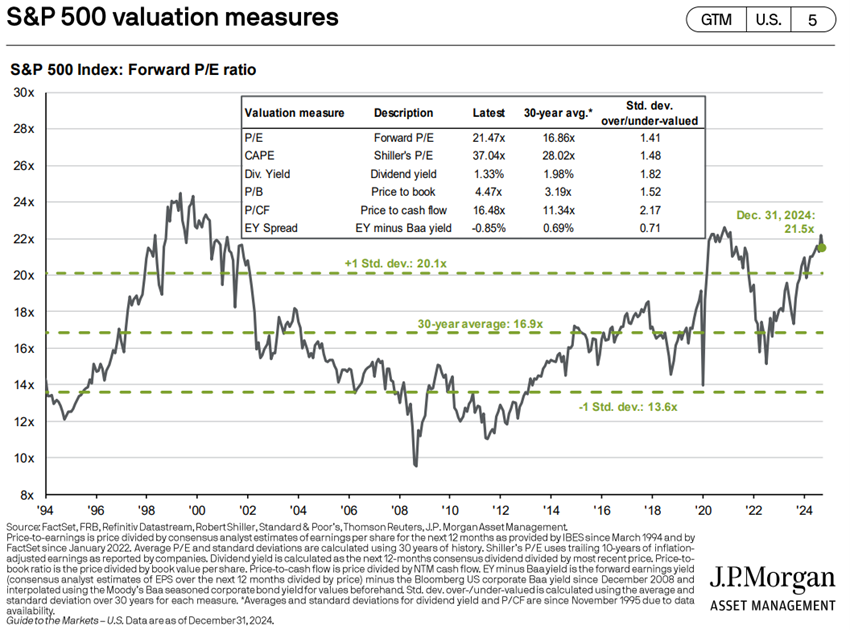

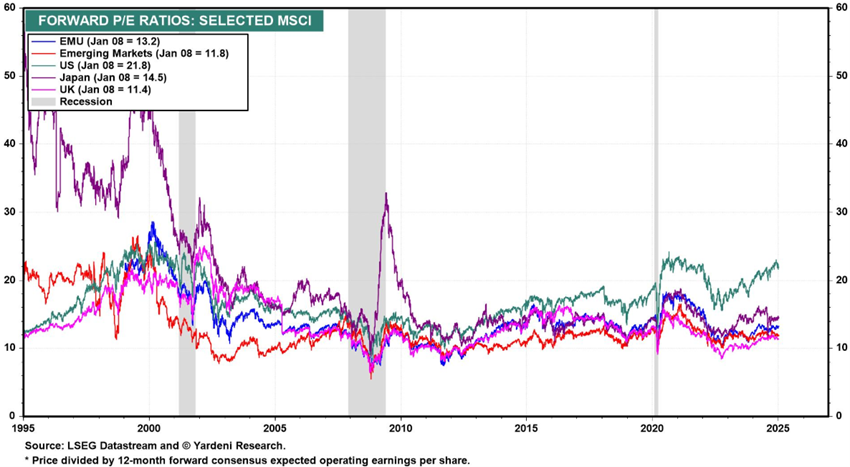

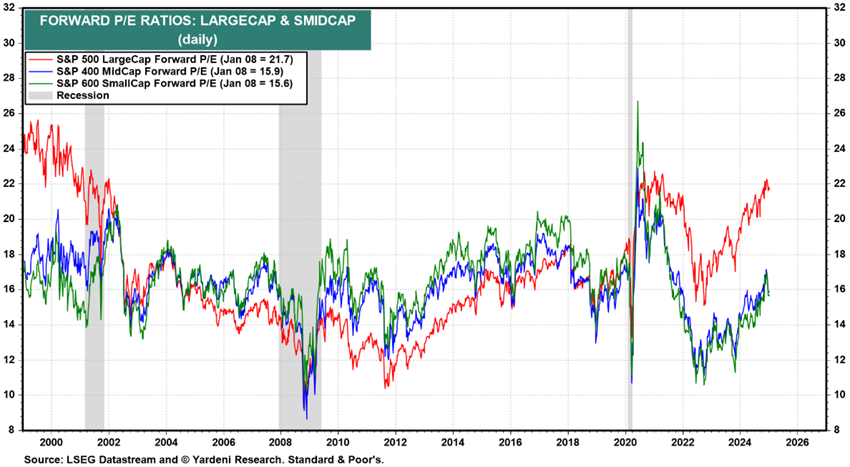

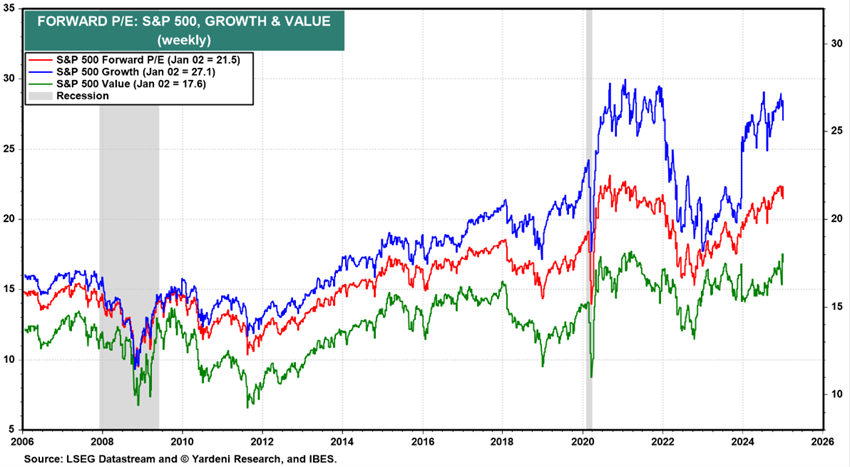

Stock market valuations are well above the historical average, especially in the US.

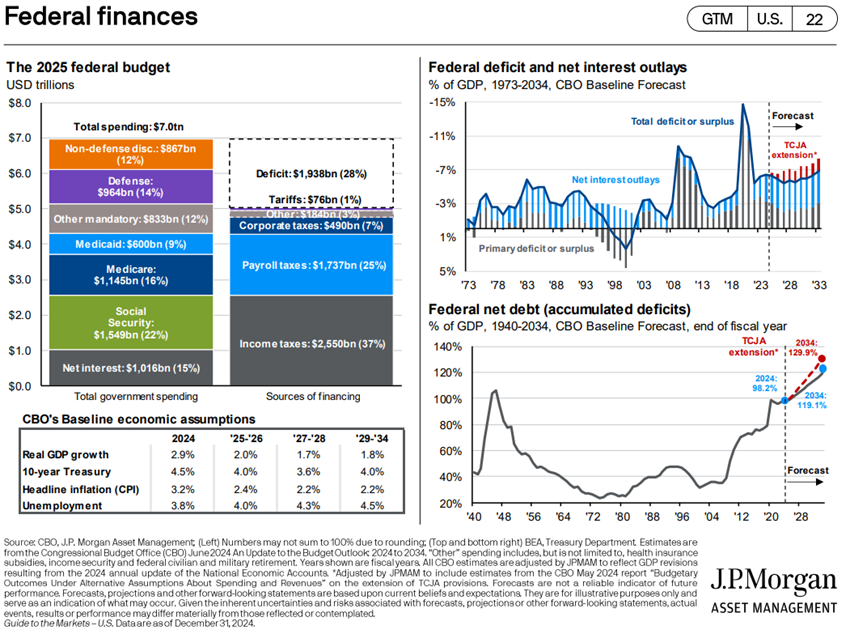

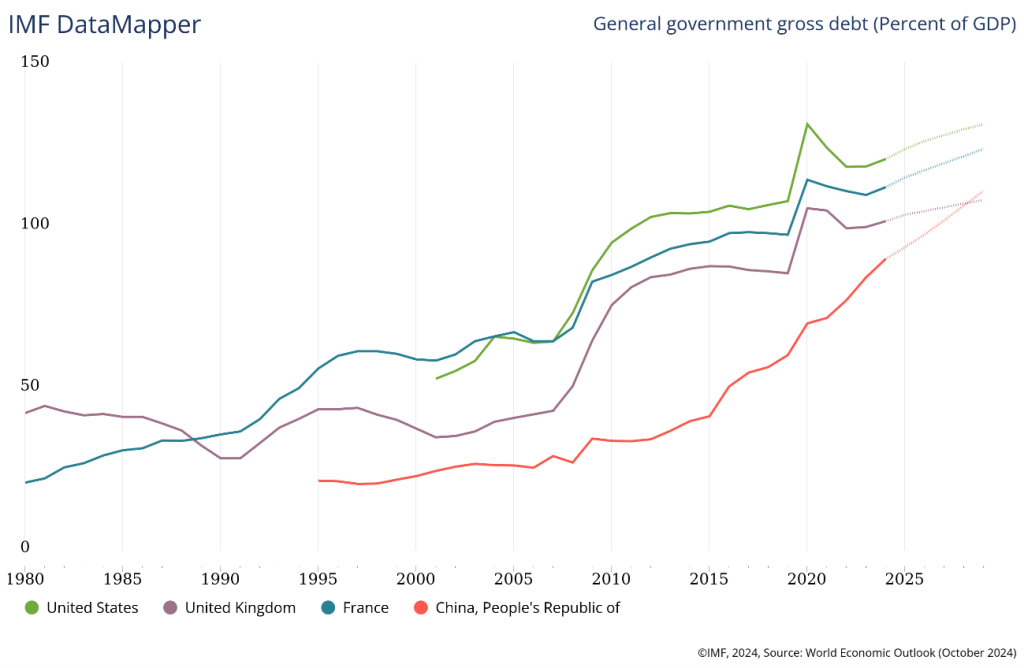

US 10-year and 30-year interest rates are between 4.5% and 4.9%, reflecting the favourable macro environment, high levels of deficits and public debt, and the potential effects of Trump’s policy agenda (raising tariffs and lowering taxes).

Recently, we published our Outlook for the financial markets for 2025.

Now, we do our usual quarterly outllok.

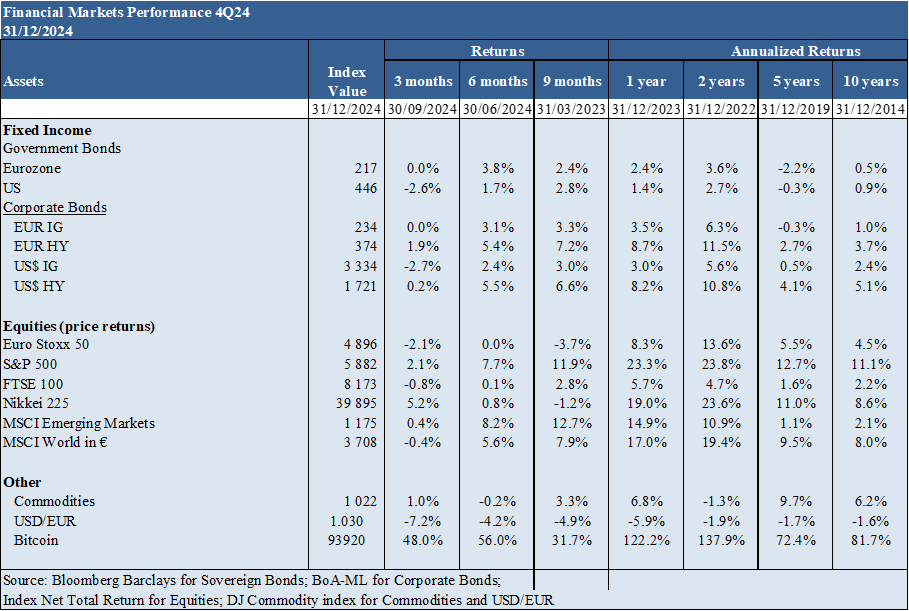

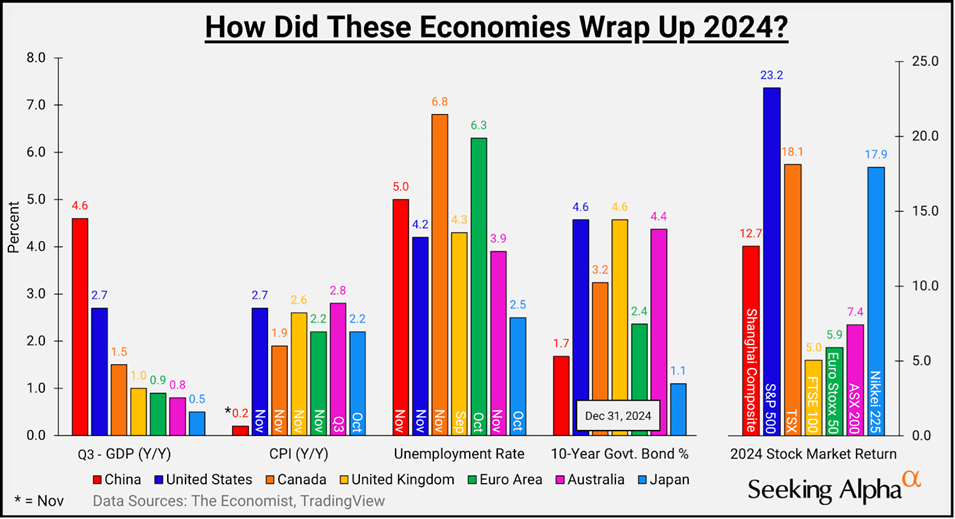

Performance 4Q24 Markets: Equity markets in major developed countries appreciated well, led by the U.S., with 22 percent of the S&P 500. Long-term treasury bond interest rates fell in these countries as inflation declined, with the exception of the US, which recorded a 1% increase.

Macro Context: Economic growth is out of sync globally, with the US at a good level, Europe practically stagnant and China falling short of the authorities’ target. Inflation in the US and Europe continues to fall.

Micro Context: The main instant and advanced economic indicators show a slight decline almost everywhere in the world.

Economic policies: Central banks started reducing official interest rates in the second half of 2024, in line with the decline in inflation, although signaling smaller cuts in the near future.

Equity markets: North American, European and Japanese equity markets at peak levels, with high valuations especially in the US.

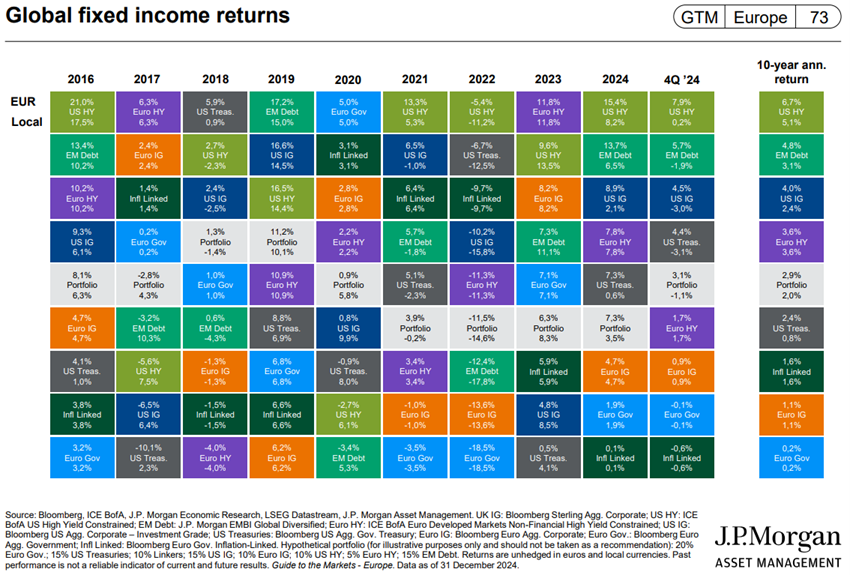

Bond markets: Long interest rates fell in developed economies except the US, with inverse impacts on bond performance as credit spreads held.

Key opportunities: Better-than-expected earnings and guidance performance in the U.S. earnings season.

Crossroads between the preference for investments in stocks or cash in the US, in a less global and more divergent world.

4Q24 financial market performance: Equity markets in major developed countries appreciated well, led by the U.S., with 22% of the S&P 500. Long-term treasury bond interest rates fell in these countries as inflation declined, with the exception of the US, which recorded a 1% increase.

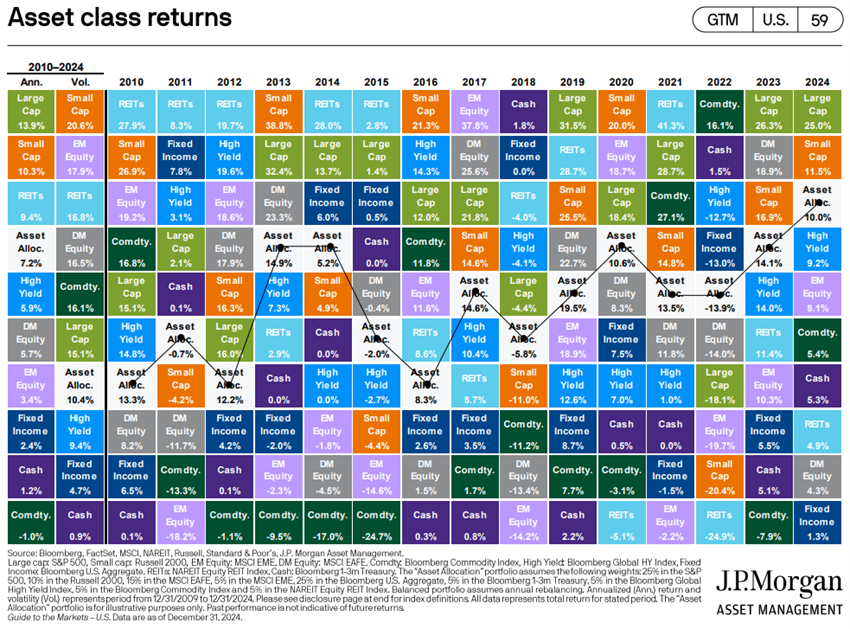

2024 was another emblematic year for the markets.

Buoyed by economic growth, the AI frenzy and the Fed’s interest rate cuts, the S&P 500 gained 23%, the Nasdaq rose 30% and the Dow gained nearly 13%.

The main U.S., Japanese and European stock indexes reach new highs, with high sectoral and individual concentration.

Western bond markets are performing well, appreciating as a result of falling interest rates.

Crypto trends remained in focus as Bitcoin rose to a new all-time high of over $108,000, then fell back to around $95,000, a gain of more than 110% to close out the year.

Macroeconomic context: Economic growth is out of sync globally, with the US at a good level, Europe practically stagnant and China falling short of the authorities’ target. Inflation in the US and Europe continues to fall.

Stabilization of global economic growth forecasts to 3.2% in 2024 and 2025, with 2.8% and 2.4% in the US, 0.8% and 1.3% in the Eurozone, 4.9% and 4.7% in China, respectively, but below the long-term average.

U.S. consumer spending continued to drive the economy, rising 4.1% for the year, compared to 1.6% in 2023.

Inflation in the US and the Eurozone stood at 2.7% and 2.2% in November, respectively, rising for the third consecutive month.

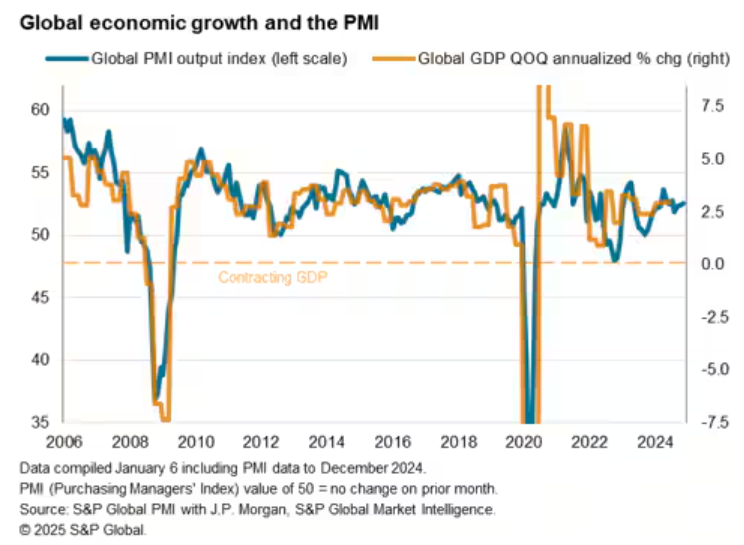

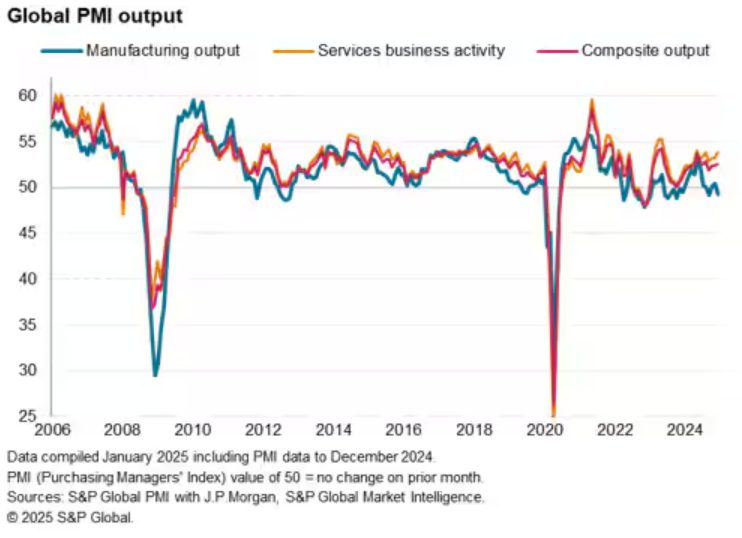

Microeconomic context: The main instant and advanced economic indicators show a slight decline almost everywhere in the world.

We are living in a two-speed economy, with the widening of the gap between industry and services in the last year and a half.

The unemployment rate in the US is at 4.0%, levels close to the lows.

The latest global PMI indicator shows a small increase in global pressures on selling prices at the end of 2024, as a result of rising tariffs for services, notably in the euro area.

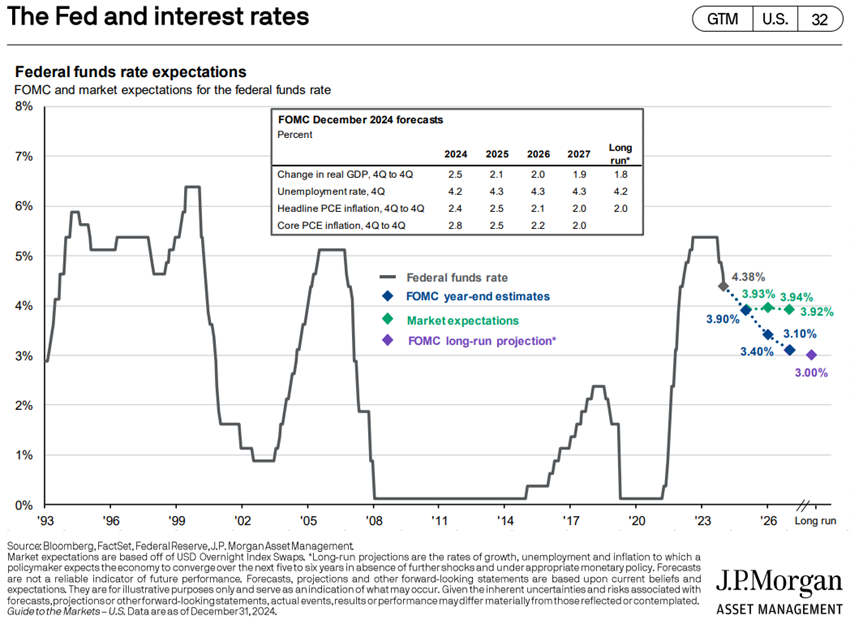

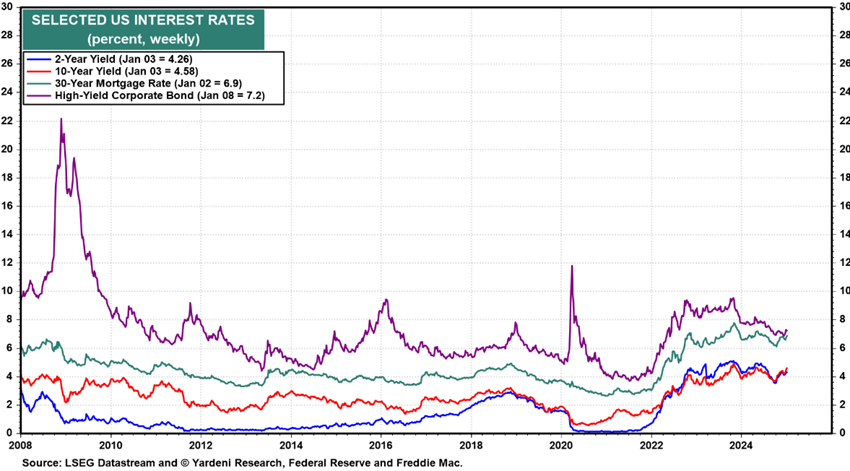

Economic policies: Central banks started reducing official interest rates in the second half of 2024, in line with the decline in inflation, although signaling smaller cuts in the near future.

In December, the Fed and the ECB cut official interest rates to the levels of %-4,5% and 3%, respectively.

The Fed’s projections point to a decrease in this rate from the current 4.33% to 3.4% in 2025, and 2.9% in 2026. The Fed maintained its projections for its preferred measure of inflation – the private consumption price index (PCE) – to 2.8% in 2024, 2.5% in 2025 and 2.2% in 2026.

The ECB forecasts inflation of 2.4% in 2024, 2.1% in 2025 and 1.9% in 2026.

The Bank of England reduced the official interest rate to 4.75%.

Equity market valuation: North American, European and Japanese equity markets at peak levels, with high valuations especially in the US.

The US stock market is at peak levels, with the S&P 500 closing the first 9 months with a gain of 21%, driven and very concentrated in mega capitalizations.

The other stock markets also advanced slightly in the quarter.

The 21.5x forward PER for the US is above the long-term average, dropping to 18.0x without the 10 Mega Caps.

Japan’s PER of 14.5x is also above average.

The PER of the other regions fell slightly to 13.3x in the Eurozone, 11.4x in the UK and 11.8x in emerging markets, all below the historical average.

The PER of mid-cap and small-cap U.S. stocks are both at 15.9x to 15.6x, around the long-term average.

The PER of U.S. growth stocks is at 27.1x and that of value stocks is at 17.6x.

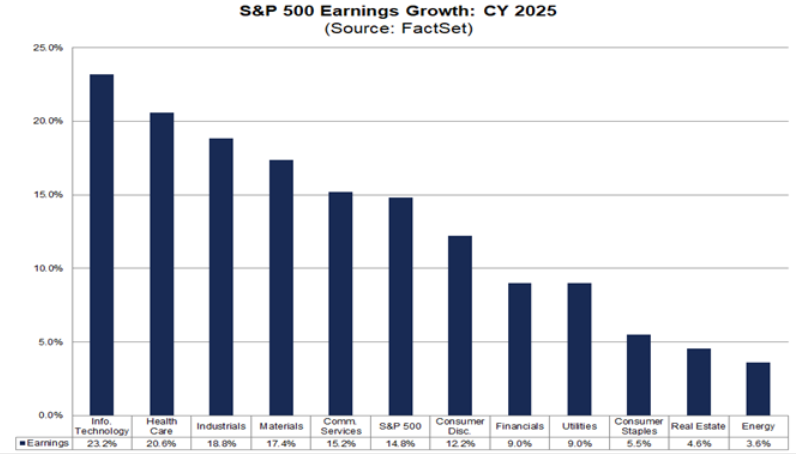

Analysts predict earnings growth for S&P companies of 10.0% in 2024 and 15.2% in 2025.

The North American market continues to be moderately attractive despite high valuation multiples due to the expectation of growth in annual results. The earnings season that starts on January 15th and lasts for 3 weeks will be a good indicator.

Europe has weak growth and greater geopolitical risk, due to the war in Ukraine and the elections in France and Germany, while China is struggling with the exhaustion of the development model, which benefits India as one of the main bets of emerging markets.

https://www.ii.co.uk/investing-with-ii/international-investing/us-earnings-season

Bond market assessment: Long interest rates declined in developed economies except the US, with inverse impacts on bond performance as credit spreads held.

Long-term risk-free interest rates have risen 0.7% in the United States and 0.4% in Germany since the beginning of the year, devaluing bonds.

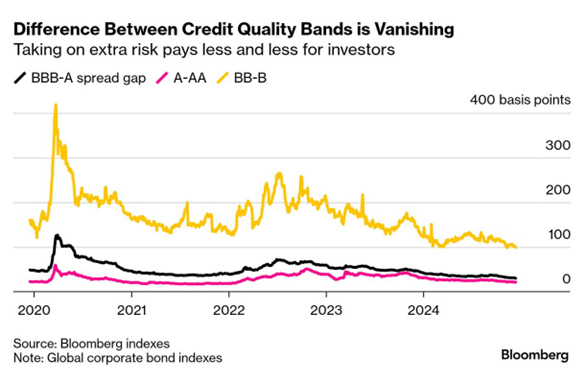

Credit spreads in the U.S. and Europe remained stable.

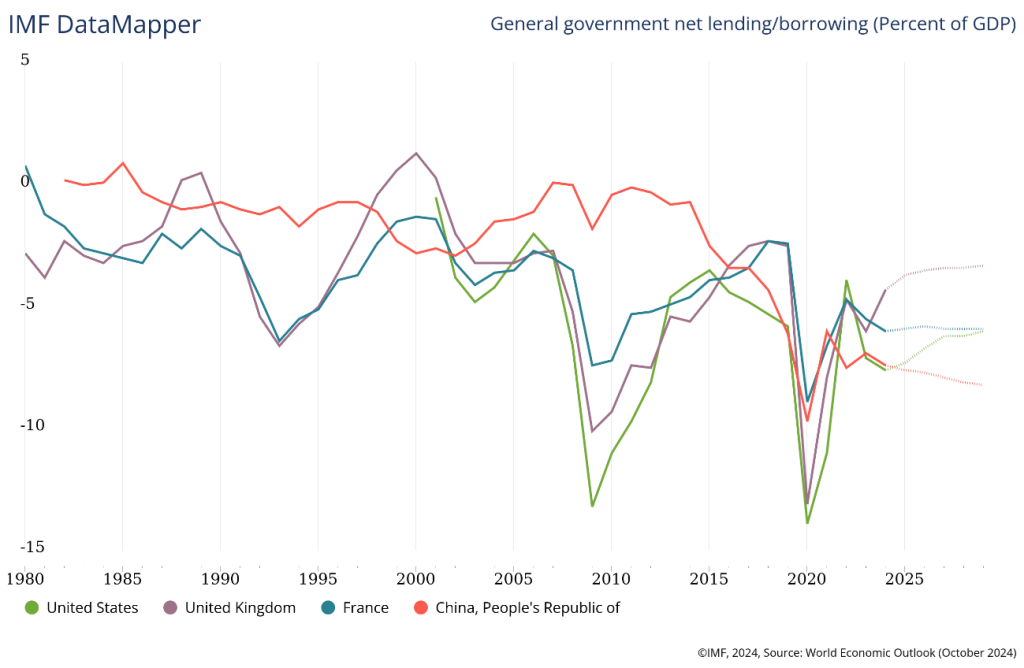

There is a lot of uncertainty about the future evolution of long interest rates in the US and Europe, due to the evolution of inflation, trade policies, and the greater financing needs of public accounts.

Main opportunities: Better-than-expected performance of the earnings season in the US, in terms of earnings and guidance.

With equity markets trading at historically high levels, the next gains will result from an improved earnings season performance, or a sharper decline in inflation.

Any of these movements will reinforce the movement of asset rotation from liquidity to the stock market.

The reduction in interest rates will value long bonds with good credit risk.

Main risks: The maintenance of long interest rates at a high level in the US (due to the effect of strong economic growth, rigid inflation, rising tariffs, and financing of larger public deficits), harms investment in equities. The evolution of geopolitical risks remains unknown.

This concern is accentuated by the possibility of reduced financing by large countries such as China, whether for internal or geopolitical reasons.