Thematic investments have gained interest and importance in recent years.

We believe that the correct management of personal financial investments involves investing by objectives, diversifying and adopting a core-satellite strategy, preferably investing in generalist investment funds.

However, we can complement these generalist investments with others, more opportunistic, specific and targeted.

This is where the interest in thematic investments lies.

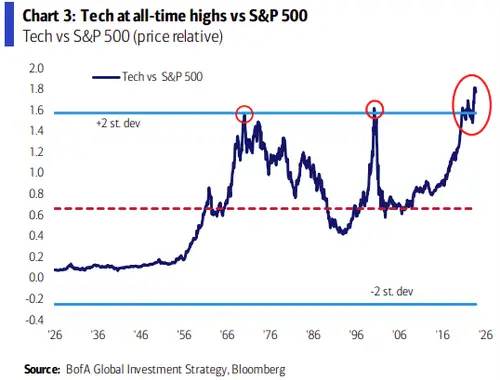

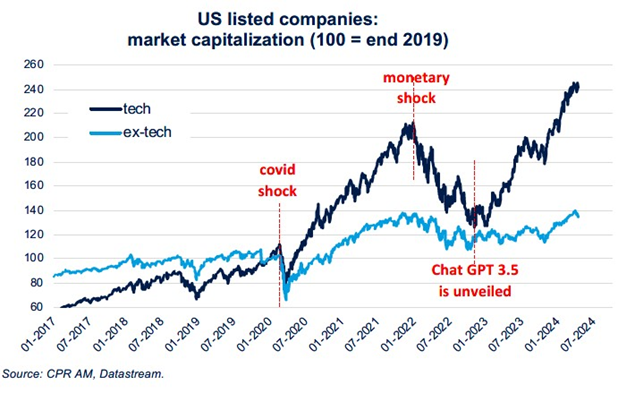

Take, for example, the superior performance of technology in recent years, which since the end of 2019 has advanced by more than 140 versus the 40% of the S&P 500:

In carrying out rigorous financial and investment planning, the individual investor should start by analysing their present and future financial situation, assessing their risk profile and setting their objectives accordingly.

These factors determine the allocation of the investment portfolio by the main asset classes, bonds and shares, and their subclasses or segments.

Investments in these classes and subclasses should be made, preferably, via investment funds, which are generalist and representative of the main stock and bond markets worldwide.

The investor should also diversify the various investments in order to mitigate the risk involved.

A modern and increasingly common way of investment management is to adopt a core-satellite investment strategy.

The core, primary or base component of the portfolio, is made up of generalist investment funds.

The satellite, secondary or complementary component can take the form of specific funds or even individual securities selected by the investor.

It is precisely in this satellite component that thematic investments come in.

The thematic world is very diverse. Among others, we will address cloud technology, artificial intelligence, biotechnology, sustainability, demography and longevity, etc.

There are some previous articles that may be interesting to be revisited, namely those related to ESG, Artificial Intelligence and innovation and technological disruption.

Other articles related to this subject are those in the secular stock series and the reports of Bessembinder’s two studies on the performance of the constituent stocks of the major indices, in the US and globally.

What is thematic investing?

The various areas of thematic investment: Technology, Megatrends and Sustainability

Investments in Technology or Disruptive Innovation

Investments in Megatrends

Investments in Sustainability

What is thematic investing?

In these terms, a given theme must be structural, international and multisectoral.

Thematic investing involves the creation of a portfolio, or part of a portfolio, bringing together a set of companies involved in certain areas that are expected to generate returns above the market in the long term.

The themes are based on megatrends such as the aging population, the digital revolution, or the rise of the middle class in emerging markets.

The various areas of thematic investment

Thematic investment can be grouped into three main categories:

• Disruptive technology or innovation

• Megatrends

•Sustainability

This compartmentalization is more theoretical than real, insofar as there are clear intersections of these 3 areas. For example, disruptive technology and innovation are themselves a megatrend. The same happens with sustainability.

Investments in technology or disruptive innovation

Investments in disruptive technology or innovation focus on understanding the long-term changes in the economics of business as the market evolves in response to advances in technology, emerging industries, and changing consumer preferences.

By investing in these expected changes, disrupted investors can benefit from opportunities that arise when the market underestimates the pace of change.

A disruption solution can focus on long-term trends that are still in the early stages of development.

Some examples may include cloud computing, autonomous driving, and artificial intelligence.

For instance, on November 30, 2022, start-up OpenAI publicly launched ChatGPT 3.5, an artificial intelligence “chatbot” that could produce grammatically accurate and detailed responses to any “prompt” entered by a user.

Within five days, the new app had 1 million users; as of January 2023, it had more than $100 million, and OpenAI, its creator, was valued at $29 billion.

The rapid adoption and success of ChatGPT started the artificial intelligence revolution, pivoted in the explosion of Nvidia, the dominant producer of the most advanced chips.

Then, the situation extended to a vast ecosystem that includes other chip producers, data centers, energy suppliers, companies that use these applications, etc.

These developments occur at a dizzying speed, and increasingly, as we will see below.

Investments in Megatrends

Megatrend investments focus on understanding long-term earnings growth, stemming from factors such as demographics, resource scarcity, or others.

By identifying these trends in gradual motion, megatrend investors can benefit from anticipating the effects.

Some significant changes happen gradually, over decades.

Many observers may see these changes but not realize how the world will be transformed in response.

Some examples of potential megatrends that could reshape markets include an aging population, the implications for changing consumption patterns, and a growing population that demands more efficient use of resources.

Investments in Sustainability

Sustainable investing is a discipline that incorporates financially relevant environmental, social, and governance (corporate) considerations into the investment research and decision-making process.

For investors seeking exposure to companies with sustainable business practices, such as strong human capital management and good corporate governance, sustainable investing can provide a way to invest in a strategy that reflects a disciplined assessment of these considerations.

Some examples of themes within this category include:

- environmental issues, such as investing in companies that respond to consumer demand for sustainable practices or that are focused on providing innovative solutions, such as alternative energy

- social issues, such as investing in companies that identify and target business opportunities in underserved areas, or companies that are committed to a diverse and inclusive workplace or that provide safe working conditions

- Corporate governance issues, such as investing in companies committed to incorporating best-in-class governance through aspects such as board composition and oversight, management incentives, capital allocation, and shareholder-friendly policies