What is the Media Response bias?

What is Media Response bias?

The media response bias is reflected in the tendency to react to the news without a reasonable examination or analysis.

Every day and every moment we are bombarded with news about the economy, finance, investments, and financial markets.

This news can be information or opinions of people without special qualifications, or even from experienced professionals.

In most situations the professional’s opinions are very different from each other or can be even volatile in a short time.

We often see financial analysts from major global banks on television or other media express opposing views on the same fact or information. Unfortunately, it is also common to see some of these analysts change their minds in a short time.

We must be aware of this situation because in many cases our reaction is to listen more of analysts who make statements according to our opinions and ignore or discard those who have different or contrary positions to our own.

Experts also suffer from the herding bias or instinct, not in terms of investments, but in terms of investment opinions or recommendations.

This happens especially in times of great stress or anxiety, such as market bubbles or reversals of cycles, or moments of euphoria and panic, extrapolating the situations. But it also happens in everyday life, when we seek to find reasoned, far-fetched and profound explanations for many situations that are anything more than normal statistical events.

Exposure to these opinions makes us react instantaneously and on impulse in terms of changing investments, giving rise to unplanned purchases and sales.

We forget that the investment process is a medium and long-term plan, very thoughtful, and we end up conducting transactions contrary to the plan in reaction to news and short-term fluctuations. We also forget all the work we have done in drawing the plan. More important than the design is the implementation and execution.

In this context, the existence of a financial advisor is essential, acting as a valuable assistant or a coach who helps us to stay on course or to adjust if circumstances justify, on a rational basis.

Some worst historical media predictions: Jim Cramer at Bear Sterns risk, Robert Zuccaro of the 30,000 Dow points, the consensus of analysts at Enron and the media signals of the biggest market bubbles

Next, we will see next some of the supposed analyst predictions that have become famous.

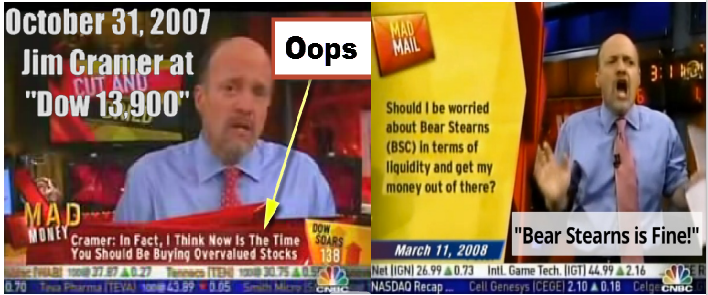

The one made by Jim Cramer, the host of CNBC’s Mad Money program, which in the midst of the sub-prime crisis in October 2007 predicted the Dow would reach 13,900, and that in March 2008, days before the collapse of Bear Sterns, claimed that the bank was safe.

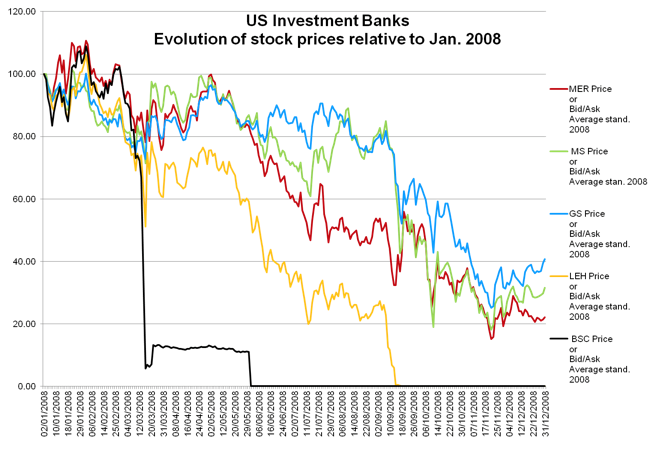

What happened to Bear Sterns stock (and other banks stocks) with the subprime crisis is shown in this chart:

Bear Sterns was purchased by JP Morgan for $2 per share on a weekend on March 17, 2008, and the previous Friday was traded at $30 per share (90% discount), and in May of that year was incorporated into that bank.

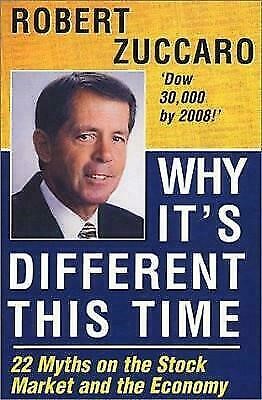

The prediction of Robert Zuccaro who published the book “Why this time is different” in the early 2000s, predicting that the Dow would reach 30,000 points in 2008.

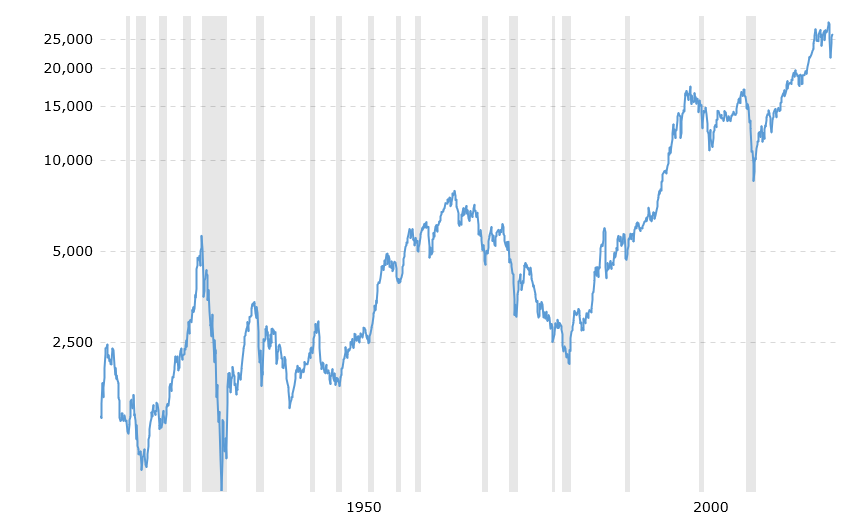

And what happened to the Dow Jones in the last 100 years is shown in the following chart:

It went from more than 12,000 points in the early 2000s to 7,500 in November 2008. It is not by chance that these predictions are made in times of recovery to a crisis, as was the case with the technological bubble of 2000.

It is in these moments of cycle reversal, in which some people were more accurate than others, that one is most tempted by the 5 minutes of fame and in which the audience is more receptive to hear. In these situations, it applies the old saying: “one quickly goes from the best to a beast, or vice versa” or “not everything is as bad as it seems or as well as it is judged”.

Zuccaro turned out to be right… more than 20 years later, in 2019!

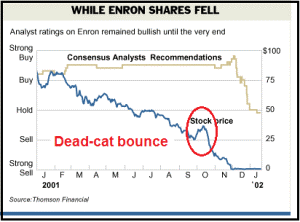

The consensus opinion of financial analysts who followed Enron had a strong buy recommendation in November 2001 and an average target price of more than $80 per share when the company announced bankruptcy.

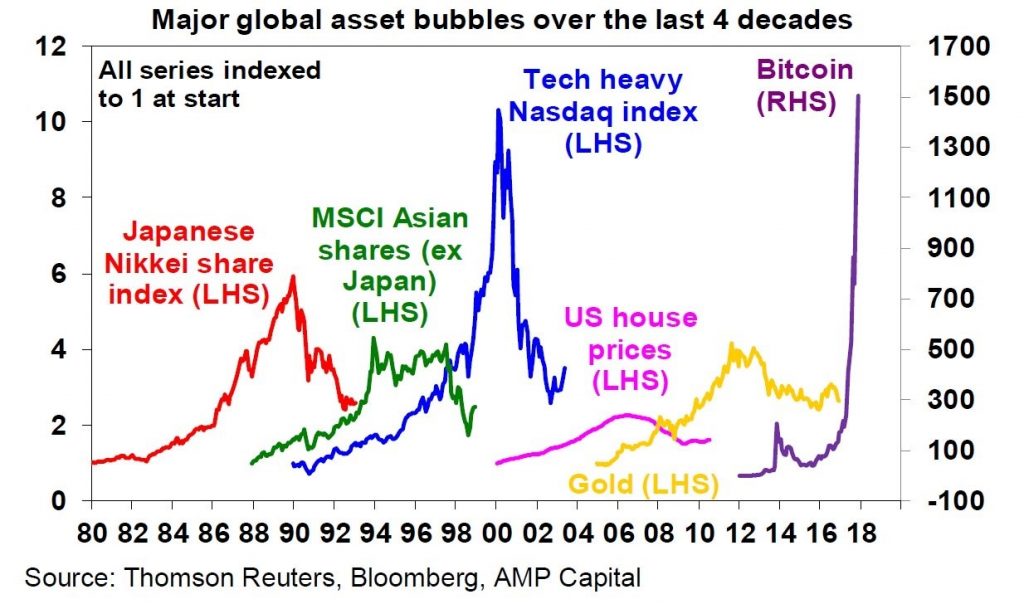

Almost all 4 major market bubbles of the last 4 decades, among others the Japanese miracle, the Asian crisis, the tech bubble, the great financial crisis and the current bitcoin have been fuelled by the media:

It is important not to forget two things.

First, the role of the media is to be the news and not to manage investments. Secondly, that the economist’s best definition is the one who is the best expert to explain the past, or such as Niel Bohr said “Making predictions is very difficult, especially about the future.”.