Goal-based investing (GBI) creates individual investment portfolios for each goal

The rationale and benefits of investing with a goal-based investing plan

The GBI plan guidelines

Goal-based investing (GBI) creates individual investment portfolios for each goal

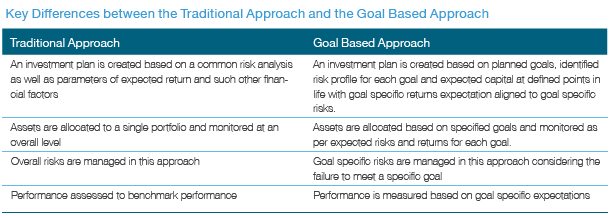

Making a goal-based investing plan is to create investment portfolios segregated by concrete objectives, with individual and specific purpose (e.g. reserve or emergency fund, retirement, children education fees, etc.), allocated funds, amount of capital that is intended to be achieved and a deadline for doing so.

Each investment objective portfolio has associated a specific asset allocation, subsequently translated into concrete investments, based on the time-term and the personal and objective risk tolerance (postponing dream holidays is less critical than exhausting retirement money or not having money for car repair or for an immediate need for healthcare).

The performance of each investment objective portfolio, as a whole and at the level of each concrete investment that makes it, in terms of profitability and risk, must be assessed in relation to the initial expectations.

The rationale and benefits of investing with a goal-based investing plan

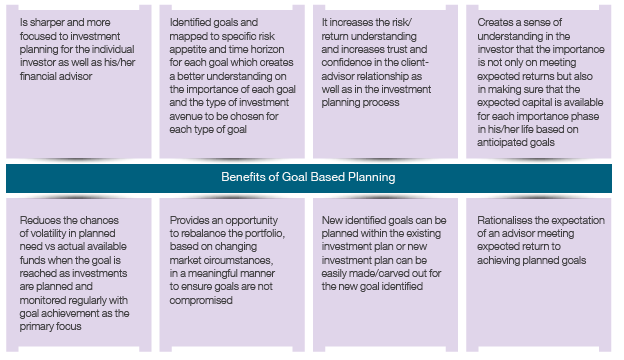

Investing according to a goal-based investment plan brings with it a set of important advantages:

- It is more focused, concrete and clear for the investor and the financial advisor, if any, being a reference framework of great value for the advisory relationship;

- Improves understanding of the path to achieving each goal;

- Increases understanding of the compromise or trade-off between profitability and risk;

- Creates a sense of importance and urgency to achieve the goal;

- Reduces emotional changes in behaviour and actions by the investor regarding the investments made in response to erratic market movements, helping him to keep the course;

- Allows for the rebalancing of each of the objective portfolios;

- Enables the management and review of the set of objectives and funding;

- Streamlines investment expectations.

Source: Vitro

The Goal-based investing plan guidelines

It’s not a single plan. There are several investment plans, one for each goal.

For each investment plan or objective, it must be established: 1) Name (or an identification; 2) Target value of final capital; 3) Value of initial capital; 4) Value and periodicity of future contributions (ideally automatic); 5) Asset allocation; 6) Selected investments.

The implementation of the plan begins with the realization of the initial investments. The main issue focuses on how to distribute the initial capital and regular future contributions by different objectives.

The essential thing is to have a set of achievable or attainable plans. It is not necessary for everyone to be 100% sure.

What matters is that critical objectives have a higher probability of achievement, the important objectives a reasonable probability, and aspirational objectives a non-negligible probability (here is manifested the risk tolerance between concurrent objectives), that is, that there is a correspondence between the importance/priority with the degree of certainty of achievement.

In this quest or competition, some people choose to cut some of the objectives or plans to maximise the remaining individual and joint probability, and there are those who create and pursue all goals while accepting and looking at different achievement possibilities.

There are several very useful tools that help us make these choices or commitments to determine the best balance of our options and decisions, as the backtesting exercises or the Monte-Carlo simulations.

The plan begins to come true with the initial investments, but it does not end here. You must keep up with him, monitor him and manage it.

In subsequent articles we will see how the investment plan is elaborated and built in practice.