Definition, history, major cryptocurrencies, uses and functions, users, international recognition, growth, central bank digital currencies, blockchain technology, advantages, risks, returns, valuation, and how to invest

Why and how did they appear and develop?

Market size and the main cryptocurrencies

What are their uses or functions?

What is their international legal recognition (governments and companies)?

The growth in the use of cryptocurrencies

Cryptocurrencies and digital currencies, including central bank digital currencies

How do they work, are created, and produced?

Their advantages and promoters

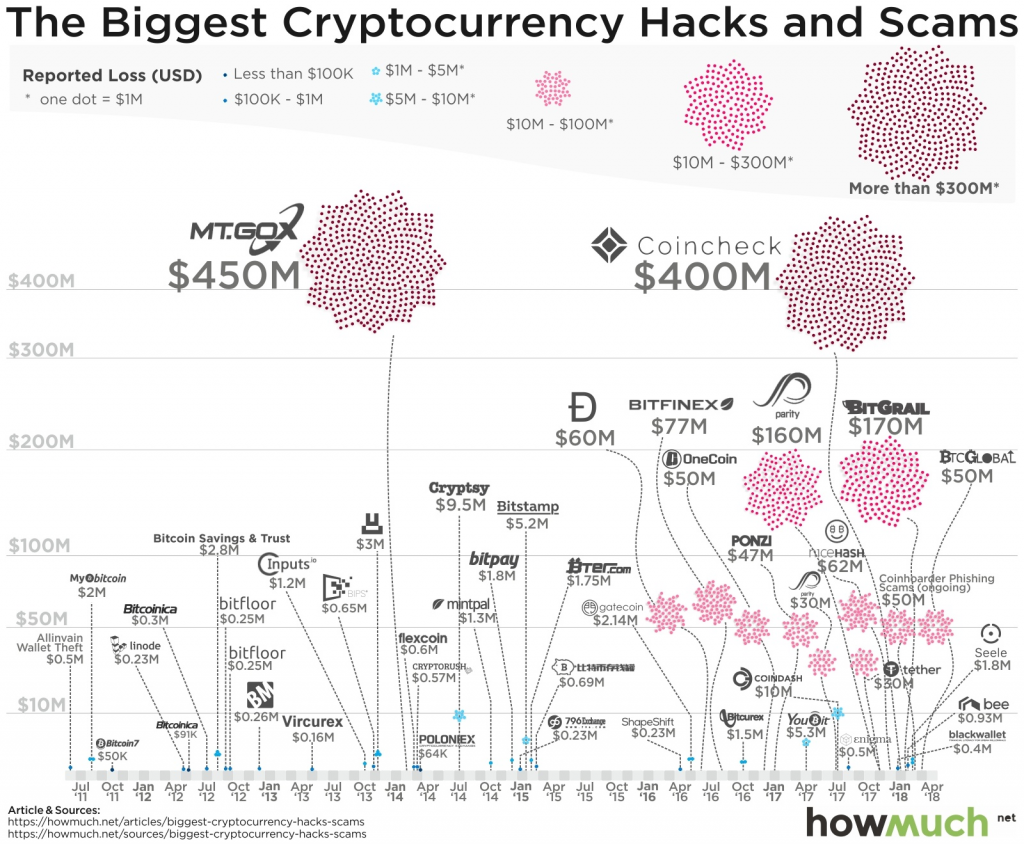

Their risks, scandals, and critics

How to invest in cryptocurrencies?

Bitcoin valuing more than 300% in 2020 and reaching the all-time high price of $30,000 (and Ethereum, the second largest cryptocurrency to value 445% in the year), it’s hard to ignore the reality of cryptocurrencies even for the most sceptical. For this reason, we start a series of articles on cryptocurrencies.

We start with a warning or a disclaimer: We know little or almost nothing about cryptocurrencies, but it is a theme that intrigues us and attracts attention as economists and investors. Following our principles and advice, we never buy or invest in things that we do not quite know what they are, such as cryptocurrencies.

That way, as we publish articles we will be simultaneously learning and disseminating information about cryptocurrencies.

This series will be based on articles available on the internet and on wikipedia and investopedia. Our work will be assembly and editing, selecting, filtering, analysing or commenting on the contents according to our knowledge and experience in economic and financial matters.

This is the inaugural post of this series in which an approach and an overview of its main aspects will be made. In the end we will mention the next developments.

What are cryptocurrencies?

A cryptocurrency is a digital asset designed to function as a means of exchange, in which individual currency ownership records are stored in an existing ledger. This storage is done in a computerized database form, using strong encryption to secure transaction logs, to control the creation of additional currencies, and to verify the transfer of ownership of the currencies.

It usually does not exist in physical form (such as paper money) and is usually not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to centralized digital currency and central banking systems.

Why and how did they appear and develop?

In the history of the evolution of money there has been an unceasing search for alternative coins to the currencies used as a generally accepted means of payment, namely that they comply with the required properties and can serve their various functions more efficiently.

Although there had been initiatives to develop cryptocurrencies already in the 1980s, these developed soon after the Great Financial Crisis, supported by general discontent and the discrediting of the financial institutions resulting from the speculative behaviour of commercial banks in the subprime crises, and the subsequent action of banks bailout and the intense activity of monetary issuance by central banks.

Bitcoin, first launched as open-source software in 2009, is the first decentralized cryptocurrency created by programmer under the pseudonym Satoshi Nakamoto, still unknown.

Since the launch of Bitcoin, more than 6,000 altcoins (alternative variants of bitcoin, or other cryptocurrencies) have been created.

Market size and the main cryptocurrencies

Tokens, cryptocurrencies, and other types of non-Bitcoin digital assets are collectively known as alternative cryptocurrencies, typically abbreviated as “altcoins” or “alt coins”.

The term is commonly used to describe Ethereum, Dogecoin, Ripple, Litecoin, bitcoin derivatives such as Bitcoin SV, and other currencies and tokens created after Bitcoin.

The size of cryptocurrencies market can be measured by its total market capitalization:

The total market capitalization of the various cryptocurrencies exceeded one trillion dollars at the end of 2020.

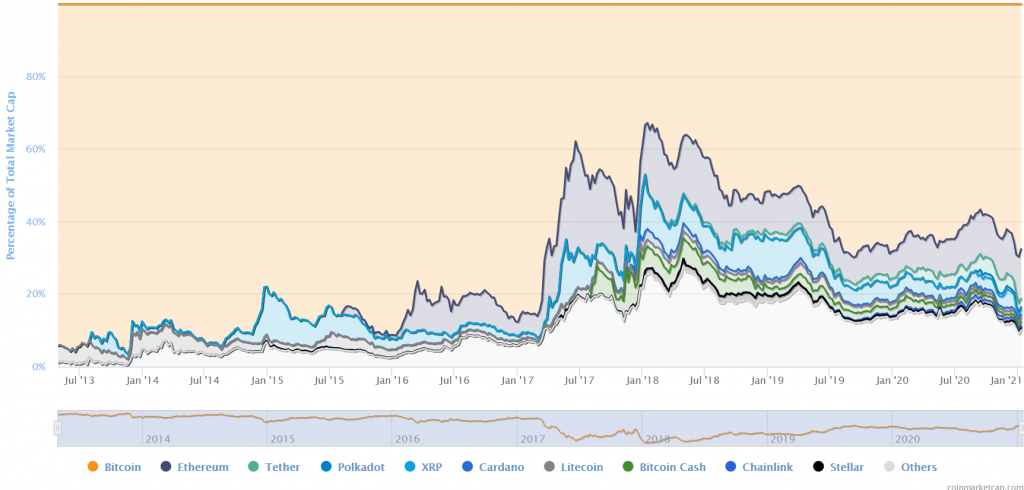

Bitcoin has a dominant market share:

Bitcoin has a 60% share, followed by Ethereum with 20%.

What are their uses or functions?

At its inception, cryptocurrencies have as their main use, to serve as a means of payment in exchanges or trade in digital or e-commerce channels, in place of fiat currencies.

Later it was admitted the use for purchases or exchanges in other channels besides digital.

More recently, there are those who attribute to cryptocurrencies the uses of reserve currency, for example, in hedging the inflation risk or loss of purchasing power, as an alternative or even substitute for gold.

Pursuing in this line there are those who give them the use of investment, seeing an intrinsic value in the various economic uses, in the technology, in the system and in the model of operation that are associated with it.

Who are your main users?

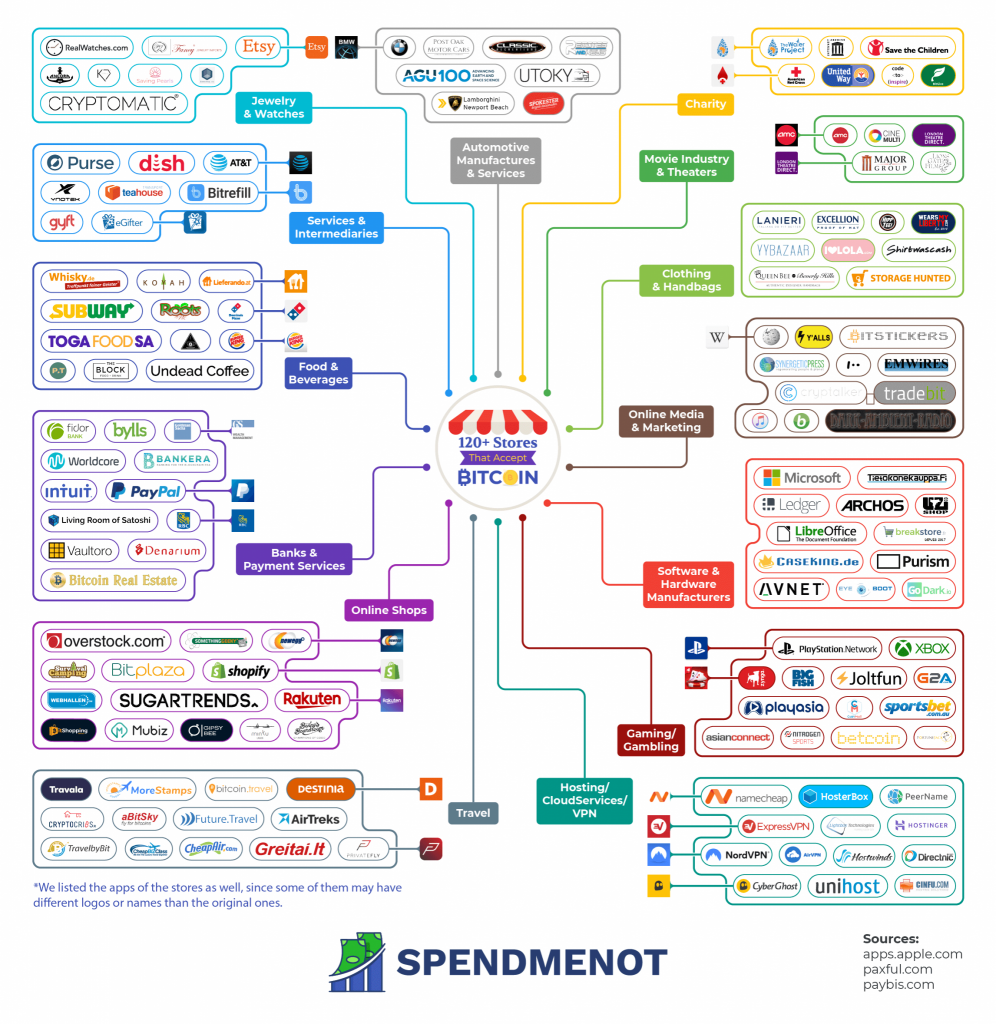

The main users are mainly technology companies linked to e-commerce.

Some companies such as Flexa, Gemini and NCR Corporation have started integrating cryptocurrencies into their automatic payment terminal (POS) systems and some merchants who have POS systems such as Starbucks, Wholefoods, Nordstroms, etc. accept payments in cryptocurrencies.

More recently, there have been even larger company additions, such as Square and PayPal. Facebook is even developing its own digital currency, Lybra.

Several supranational humanitarian agencies have begun accepting donations in cryptocurrencies, including the American Red Cross, UNICEF and the UN World Food Programme.

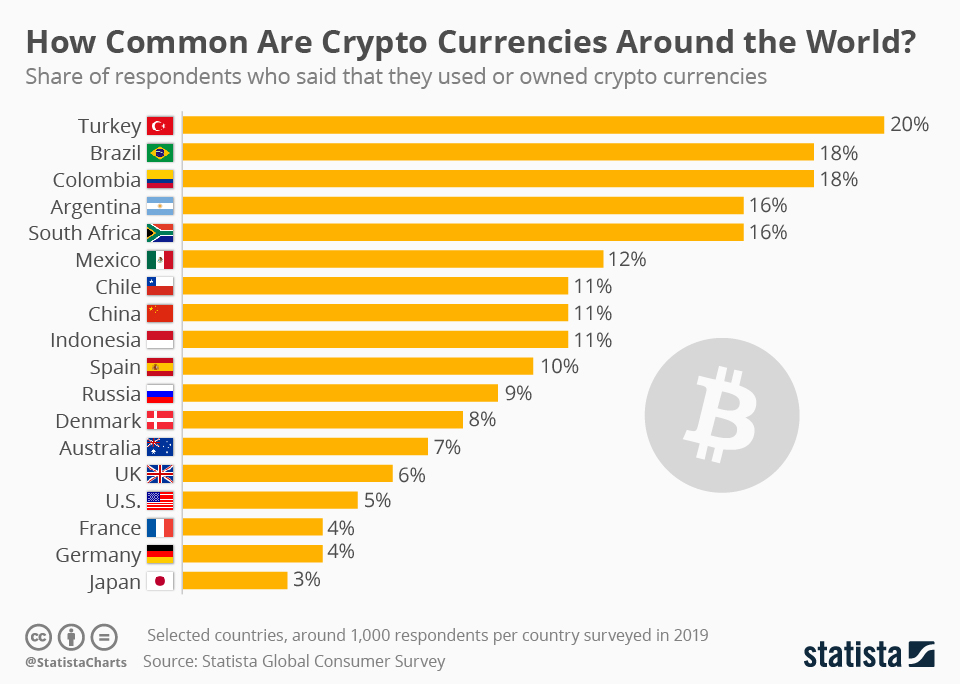

In terms of end-users, individuals or families, the main users and holders are from the following countries:

Turkey is the leader among each of the countries included in the study, having depreciation of its national fiat currency, the lira, resulted in the continued popularity of cryptocurrencies.

Latin America is the region with the highest percentage of cryptocurrency holders and users. It has 5 of the top 10 countries in the sample, all with double digits in terms of cryptocurrency adoption. In Brazil and Colombia, 18% of respondents admitted to owning and using digital assets. This is followed by Argentina, with 16%, and Chile with 11%.

What is their international legal recognition (governments and companies)?

The legal status of cryptocurrencies varies substantially from country to country and continues to be undefined or changed in many countries. Although some countries have explicitly allowed it to be used and trade, others have banned or restricted it.

According to the Library of Congress, in eight countries an “absolute ban” on trade or use of cryptocurrencies applies: Algeria, Bolivia, Egypt, Iraq, Morocco, Nepal, Pakistan and the United Arab Emirates.

An “implicit ban” applies to 15 other countries, including Bahrain, Bangladesh, China, Colombia, Dominican Republic, Indonesia, Iran, Kuwait, Lesotho, Lithuania, Macau, Oman, Qatar, Saudi Arabia and Taiwan.

In the United States and Canada, state and provincial securities regulators, coordinated through the North American Association of Securities Administrators, are investigating “bitcoin schemes” and initial cryptocurrency (ICO) offerings in 40 jurisdictions.

Several government agencies, departments and courts have classified bitcoin differently. The Central Bank of China banned the treatment of bitcoins by financial institutions in China in early 2014. In February 2018, the Chinese Government suspended virtual currency trading, banned initial coin offerings, and ended cryptocurrency mining.

In Russia, although cryptocurrencies are legal, it is illegal to buy goods with any currency other than the Russian rouble.

The regulations and prohibitions that apply to bitcoin extend to similar cryptocurrency systems.

Although cryptocurrencies are digital currencies that are managed through advanced encryption techniques, many governments have taken a cautious approach, fearing their lack of central control and the effects they could have on financial security.

Regulators in several countries have warned against cryptocurrencies and some have taken concrete regulatory action to deter users.

In addition, many banks do not offer services for cryptocurrencies and may refuse to offer services to virtual currency companies.

The growth in the use of cryptocurrencies

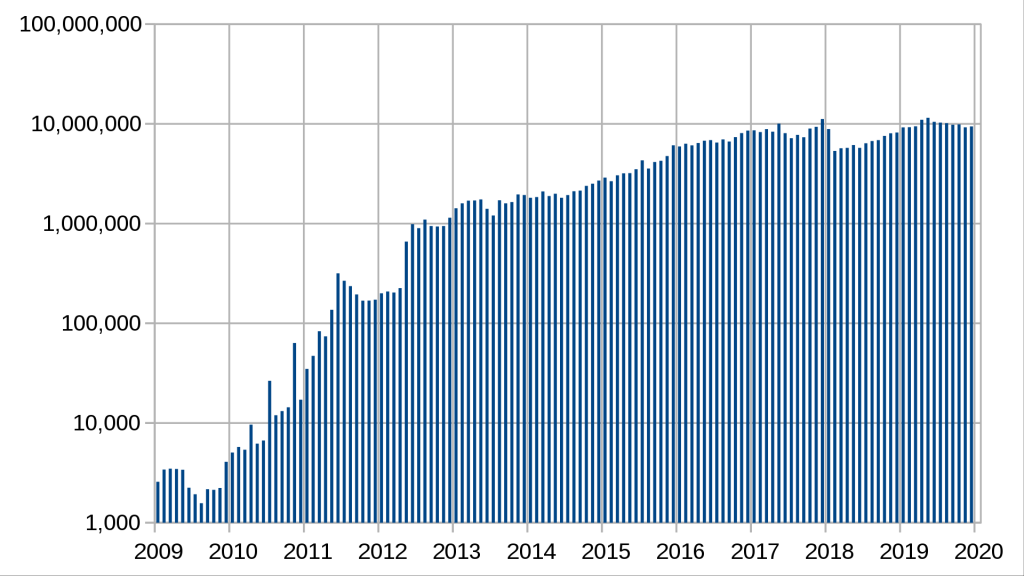

The first Bitcoin transaction was carried out in 2009 to pay for the order of two pizzas.

Since then the growth of Bitcoin trading volumes has been remarkable as can be seen in the following chart:

Cryptocurrencies and digital currencies, including central bank digital currency

In August 2018, the Bank of Thailand announced its plans to create its own cryptocurrency, the Central Bank’s Digital Currency (CBDC).

Since then, many others have been studying the launch of digital currencies issued by central banks in countries such as the US, the UK, China and even the Eurozone, among others.

How do they work, are created, and produced?

In centralized banking and economic systems, such as the U.S. Federal Reserve system, monetary authorities or governments control the supply of currency by printing units of fiat money or requiring additions to digital bank book records.

Decentralized cryptocurrency is produced by the entire cryptocurrency system collectively, at a rate that is defined when the system is created, and which is publicly known.

In May 2018 there were more than 1,800 cryptocurrency specifications.

Within a cryptocurrency system, the security, integrity and balance of the logbooks are maintained by a community of parties who control each other referred to as miners, who use their computers to help validate and time transactions, adding them to the ledger according to a certain time stamping scheme.

This allows the digital currency to be undetectable by the issuing bank, the government or any third party.

Most cryptocurrencies establish that they will gradually decrease the production of this currency, placing a limit on the total amount of that currency that will ever be in circulation.

Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement. This difficulty is derived from leveraging cryptographic technologies.

The validity of each cryptocurrency’s coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.

By concept and design, blockchains are inherently resistant to data modification.

Their advantages and promoters

Firstly, cryptocurrencies seek to assert themselves as a means of payment in the digital trading environment, replacing interbank transfers and other electronic means of payment, such as cards, etc. Secondly, they seek to replace physical currency or paper money.

The main advantages of cryptocurrencies, such as digital or virtual currencies in relation to electronic means of payment are the reduction of transaction costs, the reliability of the means of payment, thus the control of movement and ownership.

For physical currencies, they have additional advantages such as eliminating handling, risk of loss, and deteriorating use of the currency.

There are also those who attribute to cryptocurrencies a more political advantage such as the independence of central banks, since it is a decentralized currency and person by person exchange.

As a corollary of this independence, it results in the possibility of constituting itself as an asset of refuge against inflation that originates from the monetary creation made by central banks. In this line, it can be assumed as a better alternative than gold, since it is not subject to the costs of extraction and movement of this metal.

The biggest promoters and advocates of cryptocurrencies are, on the one hand, investors who were in the early days of cryptocurrency development and who have established and maintained commercial interests in currencies, and on the other, digital trading entrepreneurs.

In the group of investors stand out Barry Silbert, the founder of the Incubator Digital Currency Group, Dan Moorehead, the founder of investment boutique Pantera Capital, brothers Cameron and Tyler Winkerloss, owners of the cryptocurrency exchange Gemini, Michael Novogratz, founder of Galaxy Digital Holdings, and digital programming company Digital Asset Holdings.

In the group of e-commerce entrepreneurs, come Jack Dorsey, founder of Square, and Dan Schulman, CEO of Paypal.

More recently, the interest of major financial market investors such as Paul Tudor Jones and Stanley Druckenmiller has emerged.

Their risks, scandals, and critics

Concerns abound that alternative currencies could become tools for anonymous web criminals.

Cryptocurrency networks show a lack of regulation that has been criticized for allowing tax evasion and money laundering. Money laundering issues are also present in regular interbank transfers, however, in these transfers, for example, the account holder must at least provide a proven identity.

In February 2014, the world’s largest bitcoin exchange, Mount Gox, filed for bankruptcy. The company claimed to have lost nearly $473 million of its customers’ bitcoins, probably due to theft. This equates to approximately 750,000 bitcoins, or about 7% of all existing bitcoins. The price of a bitcoin dropped from a maximum of about $1,160 in December to less than $400 in February.

Many renowned academics, investors and bankers have openly criticized cryptocurrencies.

Cryptocurrencies have been compared with Ponzi schemes, pyramid schemes and economic bubbles such as real estate market bubbles.

Paul Krugman, winner of the Nobel Prize in Economic Sciences, has repeated many times that it is a bubble that will not last and parallels the tulip mania.

Big investor Warren Buffett also thinks the cryptocurrency will have a bad ending.

In October 2017, BlackRock CEO Laurence Fink called bitcoin a “money laundering index.” He stated that “Bitcoin only shows the demand for money laundering in the world.”

Howard Marks of Oaktree Capital Management said in 2017 that digital currencies were “nothing more than an unfounded fashion (or perhaps even a pyramid scheme), based on the willingness to attribute value to something that little or nothing beyond what people will pay for it,” and compared them to the tulip mania (1637), the Sea Bubble (1720) , and the technological bubble (1999).

Economist Nouriel Roubini, in testimony before the U.S. Congress in 2018, said Bitcoin is a mania like other bubbles, and that it could tend to zero. In his opinion, it is not scalable, it is not safe, it is not decentralised, and it is not a currency. More recently, he added to the risks that many central banks, such as China, Sweden and even the Eurozone, are thinking of creating their own digital currency.

James Dimon, CEO of JP Morgan, positively evaluates blockchain technology, considering, however, that Bitcoin has little interest, especially when central banks will be compelled to act if its size increases significantly.

Returns and valuation

As we mentioned earlier, the first transaction made with Bitcoins was made on May 22, 2010, by Laszlo Hanyecz when he agreed to pay 10,000 Bitcoins for two Papa John pizzas. This is seen as the most expensive purchase in cryptocurrency history.

Since that date, the evolution of the price of Bitcoin has been as follows:

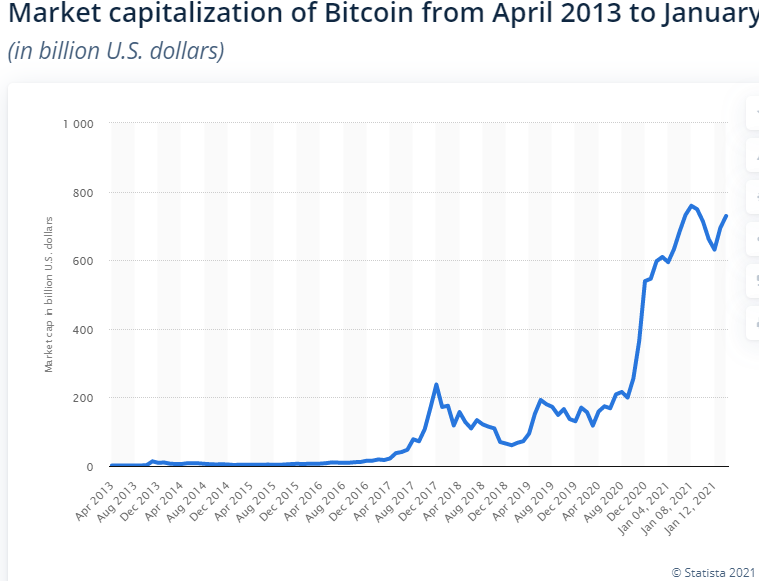

Recently, the price of Bitcoin has exceeded $30,000.

In the purchase of the pizzas, the recipient of bitcoins got a bargain, paying $25 for the pizzas, while 10,000 Bitcoins were worth about $41 at the time. Over time Hanyeczs’ pizzas got more and more expensive.

Nine months after the purchase, Bitcoin reached parity with the US dollar, making the two pizzas worth $10,000, and in 2015 – the fifth anniversary of Bitcoin Pizza Day – the two pizzas were valued at $2.4 million.

Today, Bitcoin is over $30,000, making pizzas worth more than $300 million.

Bitcoin reached a combined capitalization of more than $230 billion in 2017, which was surpassed at the end of 2020, when the unit price of Bitcoin exceeded $30,000 for the first time in history:

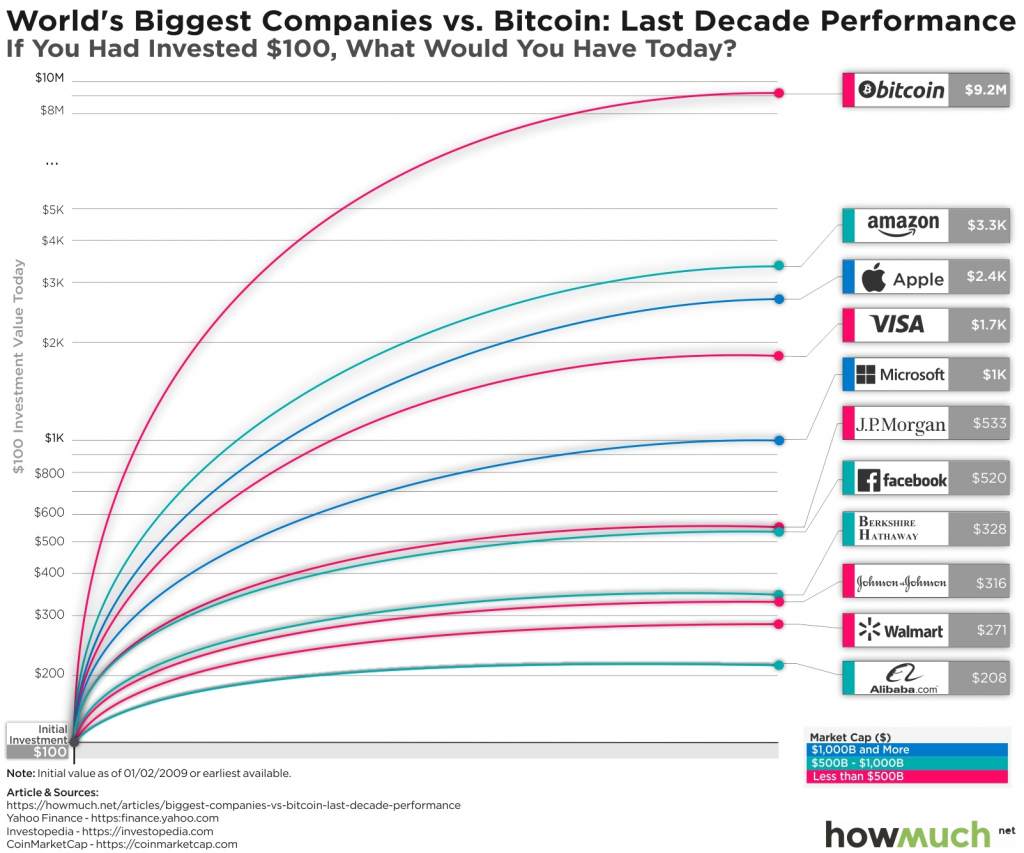

The huge appreciation of Bitcoin between 2009 and 2019 stands out largely from other investments, such as the best stock valuations:

The $100 bitcoin investment 10 years ago would be worth more than $9.2 million in 2019, compared to $3,300 in Amazon and $2,400 at Apple.

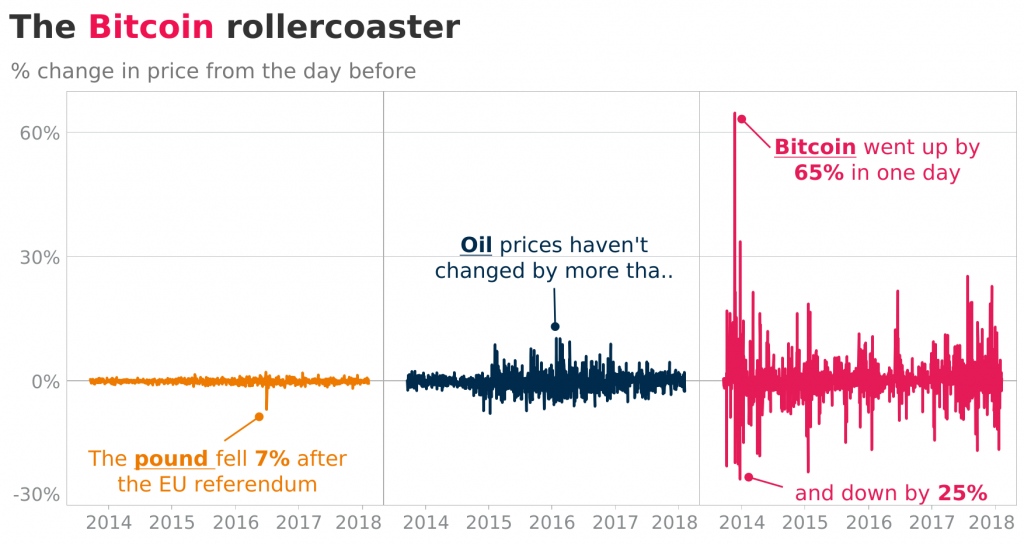

The following chart compares Bitcoin’s volatility with that of the pound sterling and oil between 2015 and 2018:

Bitcoin’s volatility is considered by some of its investors to be an asset, and for most critics, proof of its vulnerability as a means of payment.

How to invest in cryptocurrencies?

The first way to invest in Bitcoin is by buying a currency or a fraction of the currency through trading applications such as Coinbase.

In most cases, one needs to provide personal information to create an account and then deposit money, either through bank transfers or debit or credit card payments.

When the purchase is made, the purchase is kept secure in an encrypted wallet that only the user has access to.

From there, the buyer has access to Bitcoin’s price performance and the option to buy or sell.

For those who are not interested in buying or owning Bitcoin in itself, a simple option is to buy shares of a publicly traded bitcoin fund. Like investment funds or ETFs, bitcoin funds offer a portfolio that holds or trades the currency.

In conclusion, we will say that throughout this series we will discuss in more detail the following aspects, among others:

- The origin, history and development of cryptocurrencies, Bitcoin and others.

- Cryptocurrencies, fiat currencies and digital versions of these.

- The uses and users of cryptocurrencies. What is the international use of cryptocurrencies? Cryptocurrencies in the world.

- Worldwide recognition and acceptance of cryptocurrencies.

- Blockchain technology and cryptocurrencies.

- The organization and operating structure of the issuance and the register of cryptocurrencies.

- The growth of transaction volumes and the appreciation of cryptocurrencies.

- How to buy and sell cryptocurrencies. Exchanges such as Coinbase, initial coin or ICO offerings.

- The functions of cryptocurrencies: means of payment, unit of account, coverage for inflation, substitute for gold, and substitute of fiat currencies.

- How cryptocurrencies are evaluated. Currency or asset, or neither one nor the other?

- The advantages and promoters/advocates of cryptocurrencies.

- The risks and critics of cryptocurrencies.

- Cryptocurrency millionaires. Who makes money from cryptocurrencies.

- How to invest in cryptocurrencies.

https://coinmarketcap.com/charts/

https://www.amazon.com/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861