Bitcoin (BTC), the pioneer and dominant with more than 50% market share

Ethereum (ETH) and smart contracts, on the rise

Dogecoin (DOGE), social media tipping targeted to a broader demographic

Binance Coin (BNB), a method of payment of cryptocurrency exchange transactions

Theter and stable coins, based on the exchange relationship with the fiat currencies

Cardano (ADA), a rigor created by many experts

Polkadot (DOT), interoperability of blockchains

Litecoin (LTC), the silver version compared to Bitcoin gold

Uniswap, decentralized and open-source cryptocurrency exchange on the Ethereum blockchain

Chainlink, bridge between decentralized contracts

Stellar (XLM), blockchain network for enterprise solutions such as financial institutions

Bitcoin Cash (BCH), one of the most successful blockchain update technology

Monero (XMR), secure, private, and undetectable currency, the target of suspected criminal uses

There is room for how many?

Of the 4,000 existing cryptocurrencies, we will address the top 10 in terms of market share and the attractiveness and interest of their features

In the previous post on the history of cryptocurrencies we saw the definition of cryptocurrencies and how they emerged within the history of money. In this article we will describe the main cryptocurrencies existing, from Bitcoin to its rivals.

To understand and to evaluate cryptocurrencies as a whole and especially individually, it is very important to know the characteristics of the main ones. Only then will we have a more global idea of reality, its applications, its potential, trends, and future prospects.

It is not enough to know about Bitcoin, despite its strong dominance. Moreover, it is increasingly important to understand where this dominance comes from to analyse possible future threats to the position it holds. Given Bitcoin’s preponderance in the cryptocurrency universe, it often seems that Bitcoin’s competitive context is fiat money and gold, forgetting rival altcoins (in addition to central bank digital currencies).

We must not forget that pioneers who gain a relevant market position have an important competitive advantage. However, it is not always sustainable. Just remember the case of the mobile phone industry. Less than 20 years ago, in the early 2000s, who would dare to say that Nokia, Motorola and Blackberry would not be the giants of mobile phones. But after Apple, Samsung and Huawey showed up!

Cryptocurrencies that emerged after Bitcoin are collectively called “altcoins” and have often tried to present themselves as modified or improved versions of Bitcoin.

Today, there are more than 4,000 cryptocurrencies. Although many of these cryptocurrencies have little or no trading volume, some enjoy immense popularity among dedicated communities of supporters and investors. In addition, the field of cryptocurrencies is always expanding, and the next large digital token can be released tomorrow.

Although Bitcoin is widely seen as the pioneer in the world of cryptocurrencies, analysts take many approaches to assess and are commonly attributing great importance to its market share and attractiveness of functionality.

While some of these currencies may have some impressive features that Bitcoin does not have, to a large extent an “altcoin” is yet to emerge that can match the level of security Bitcoin networks achieve.

Top Cryptocurrencies: Bitcoin, Ethereum, Binance Coin, Ripple, Tether, Cardano, Pokadot, Uniswap, Litecoin, Chainlink, Stellar, Bitcoin Cash

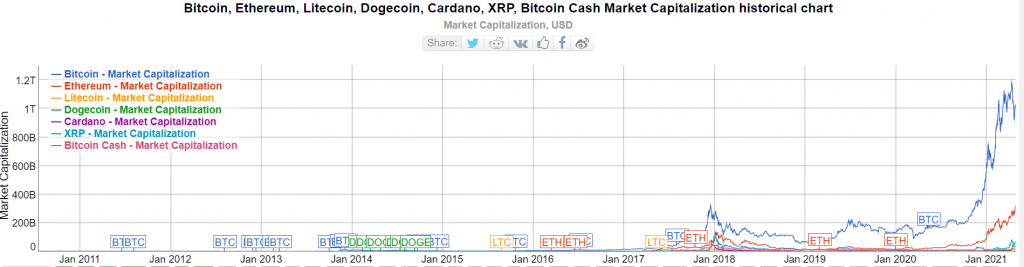

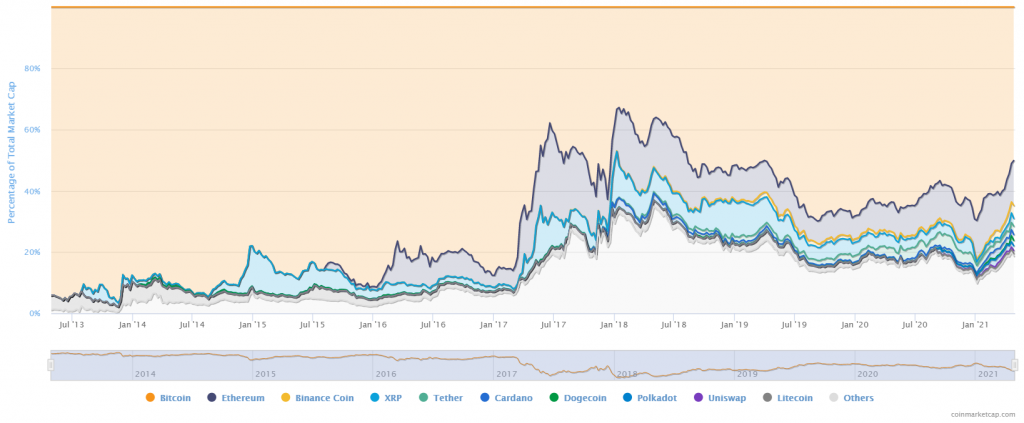

The market cap value of the total cryptocurrencies has recently exceeded $2 trillion, with Bitcoin alone already worth more than $1 billion:

Bitcoin has a market share in terms of market capitalization of more than 50%, followed by Ethereum with 20%. Then come Binance Coin, Ripple (XRP), Theter, Cardano, Dogecoin and others.

Below we will describe the main features of each of the main cryptocurrencies, fundamentally based on the information accessible on wikipedia and investopedia, two sources that may not be complete, experts, deep, technical-analytical and updated, but have the advantage of being independent, impartial, rigorous and credible:

https://en.wikipedia.org/wiki/Cryptocurrency

https://www.investopedia.com/tech/most-important-cryptocurrencies-other-than-bitcoin/

Bitcoin (BTC), the pioneer and dominant with more than 50% market share

Bitcoin is a purely digital phenomenon, a set of protocols and processes. It is also the most successful among hundreds of attempts to create virtual money through the use of encryption, the science of making and breaking codes.

Bitcoin has inspired hundreds of imitators, but it remains the largest cryptocurrency by market capitalization, a distinction it has maintained throughout its decades-long history.

Bitcoin is a digital currency, a decentralized system that works on a protocol and records transactions in a distributed ledger called “blockchain”.

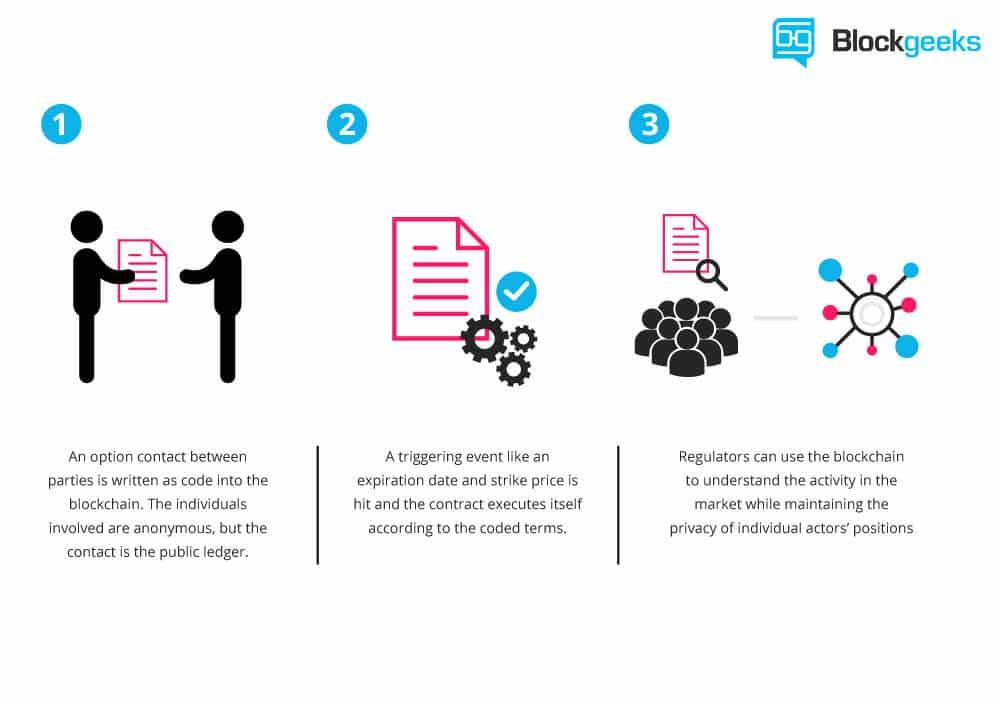

The fundamentals of blockchain technology are quite simple. Any blockchain consists of a single chain of discrete information blocks, arranged chronologically. In principle, this information can be any chain of 1s and 0s, which means that it may include emails, contracts, land titles, marriage certificates or exchanges of bonds.

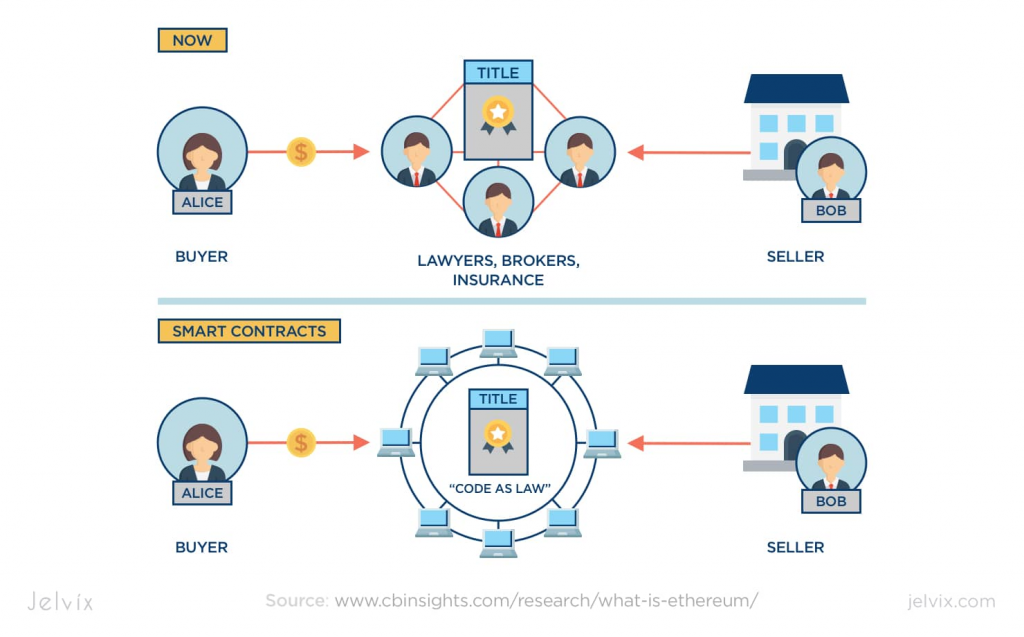

In theory, any type of contract between two parties can be established on a blockchain, provided that both parties agree to the contract, eliminating any need to involve a third party in any contract. This reality opens a world of possibilities, including person-to-person financial products such as decentralised loans or savings and verification accounts, where banks or any intermediary is irrelevant.

While Bitcoin’s current goal is a means of payment and a store of value, there is nothing to say that Bitcoin cannot be used in such a way in the future, although consensus would need to be reached to add these systems to Bitcoin.

Bitcoin miners manage complex computer platforms to solve complicated puzzles to confirm groups of transactions called blocks. After success, these blocks are added to the blockchain register and miners are rewarded with a small number of Bitcoins.

Other Bitcoin market participants can buy or sell “tokens” through cryptocurrency or person-to-person exchanges.

The Bitcoin ledger is protected against fraud through a distributed trust system. Bitcoin exchanges also work to defend against potential theft, but high-level thefts already occurred.

This versatility caught the attention of governments and private companies. In fact, some analysts believe that blockchain technology will ultimately be the most impactful aspect of cryptocurrencies.

Ethereum (ETH) and smart contracts, on the rise

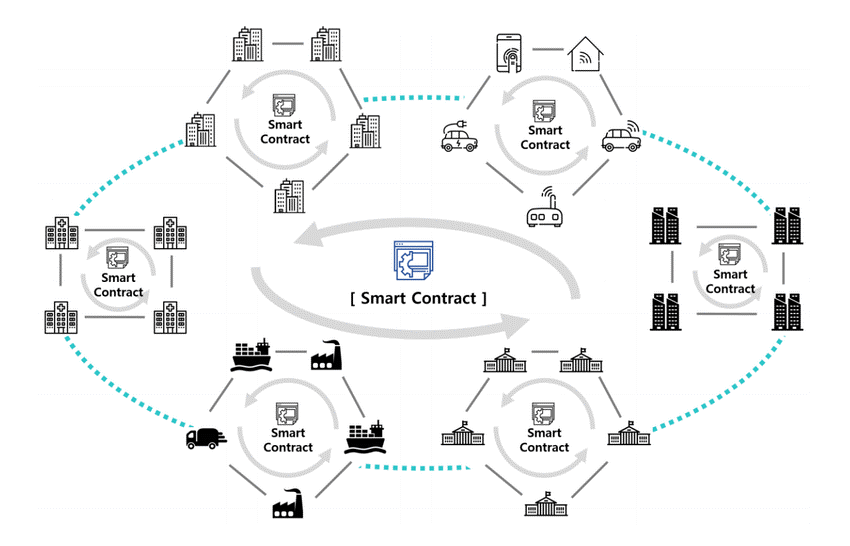

Ethereum is a decentralized and open blockchain with the functionality of a smart contract.

Ether (ETH) is the platform’s native cryptocurrency. It is the second largest cryptocurrency by market capitalization, after Bitcoin. Ethereum is the most actively used blockchain.

Ethereum was proposed in 2013 by programmer Vitalik Buterin. The development was crowdfunded in 2014, and the network went live on July 30, 2015, with 72 million pre-extracted coins.

The Ethereum Virtual Machine (EVM) can run full Turing scripts and run decentralized applications. Ethereum is used for decentralized financing, and has been used for many initial coin offerings.

Ethereum is different from Bitcoin in many ways. Bitcoin is a unique form of digital money where users can send, receive, and maintain only Bitcoins. Ethereum is an intelligent contract platform that allows entities to leverage blockchain technology to create numerous different digital books and can be used to create additional cryptocurrencies that work on top of their blockchain.

Dogecoin (DOGE), social media tipping targeted to a broader demographic

Originally formed as a joke, Dogecoin was created by IBM software engineer Billy Markus and Adobe software engineer Jackson Palmer. They wanted to create a peer-to-peer digital currency that could reach a broader demographic than Bitcoin. In addition, they wanted to distance it from the controversial history of other coins.

Several online exchanges offer DOGE/BTC and DOGE/LTC trading.

Dogecoin is an altcoin with many users. Mainstream commercial applications of the currency have gained traction on internet, such as a tipping system, in which social media users tip others for providing interesting or noteworthy content.

Trading physical, tangible items in exchange for DOGE takes place on online communities such as Reddit and Twitter, where users frequently share currency-related information.

On May 4, 2021, the value of Dogecoin first surpassed the symbolic hurdle of $0.50, a greater than 20,000% increase in one year.

Binance Coin (BNB), a method of payment of cryptocurrency exchange transactions

Binance Coin is a cryptocurrency that functions as a payment method for the fees associated with trading on the Binance Exchange. Those who use the token as a means of payment for the exchange can trade at a discount. Binance Coin’s blockchain is also the platform on which Binance’s decentralized exchange operates. The Binance exchange was founded by Changpeng Zhao and the exchange is one of the most widely used exchanges in the world based on trading volumes.

Binance Coin was initially an ERC-20 token that operated on the Ethereum blockchain. It ended up having its own release on the main network.

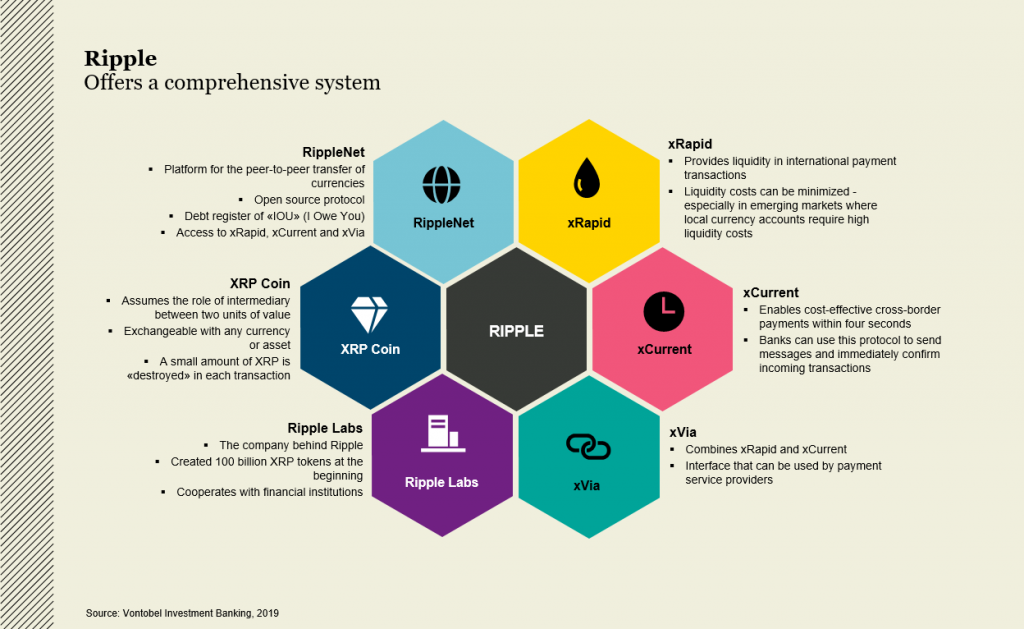

Ripple (XRP), a means of payment for electronic transactions used by Banco Santander and Mastercard, among other

Ripple is a real-time gross settlement system, an exchange and shipping network created by Ripple Labs Inc., a US-based technology company.

Launched in 2012, Ripple is based on a distributed open-source protocol and supports tokens representing fiat currency, cryptocurrency, commodities or other value units such as frequent flyer miles or mobile minutes.

Ripple aims to enable secure, instant, and nearly free global financial transactions of any size at no charge. The ledger employs the native cryptocurrency known as XRP.

Sourte: Vontobel Investment Banking, 2019

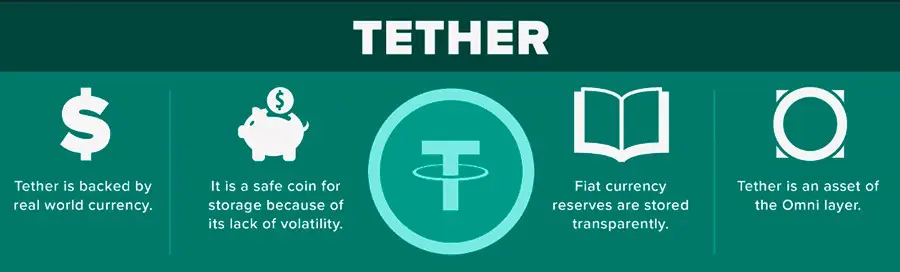

Theter and stable coins, based on the exchange relationship with the fiat currencies

Tether is a controversial cryptocurrency with tokens issued by Tether Limited. In the past, it stated that each token was supported by a US dollar, but on March 14, 2019 it changed this relationship to include loans to affiliated companies.

Tether is called a stable currency because it was originally designed to always be worth $1.00, keeping $1.00 in reserves for each tether issued. However, Tether Limited states that tether owners have no contractual right, other legal claims, or warranties that tethers will be refunded or exchanged for dollars. On April 30, 2019, Tether Limited’s attorney claimed that each tether was supported for only $0.74 in cash and cash equivalents.

Source: Coinbureau

Cardano (ADA), a rigor created by many experts

Cardano is a “Ouroboros” proof-of-stake cryptocurrency that was created with a research-based approach by engineers, mathematicians and cryptography experts. The project was co-founded by Charles Hoskinson, one of the five initial founding members of Ethereum. After having some disagreements with the direction Ethereum was taking, he left and later helped create Cardano.

The team behind Cardano created their blockchain through extensive experimentation and peer-reviewed research. The researchers behind the project have written more than 90 articles on blockchain technology on various topics, this research being Cardano’s backbone.

Due to this rigorous process, Cardano seems to stand out among his proof of participation peers as well as other large cryptocurrencies.

Cardano has also been dubbed the “assassin” of Ethereum” since it is said that its blockchain is much more capable. That said, Cardano is still in the early stages. Although it has won Ethereum for the consensus model of proof of participation, it still has a long way to go in terms of decentralised financial applications.

Cardano aims to be the world’s financial operating system, through the creation of decentralized financial products like Ethereum, as well as the provision of solutions for chain interoperability, electoral fraud and screening of legal contracts, among other things.

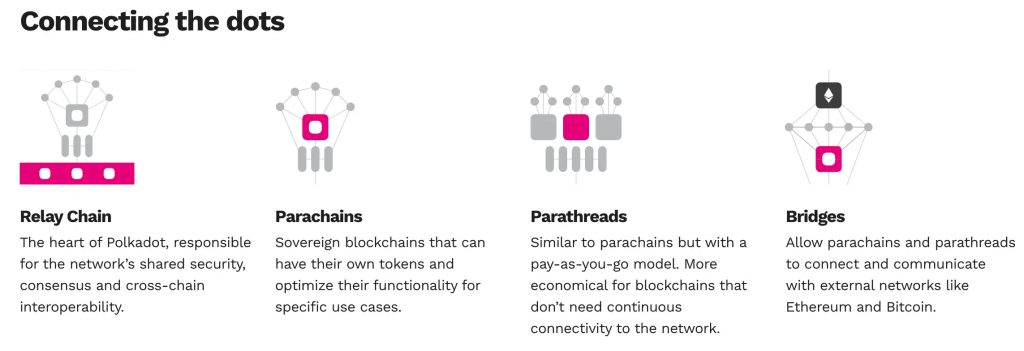

Polkadot (DOT), interoperability of blockchains

Polkadot is a unique cryptocurrency that aims at interoperability among other blockchains. Its protocol is designed to connect blockchains with and without permission, as well as oracles to allow systems to function together under one roof.

Polkadot connects different individual blockchains to a single network, seeking to do to blockchain what the Internet has done to individual computers around the world. Polkadot is a blockchain network specializing in underlying processes such as interoperability and communication, security, scalability, and transaction verification.

Polkadot’s main component is its relay chain that enables interoperability of varied networks. It also allows parallel “parachains”, or blockchains with their own native tokens for specific use cases.

Source: Website Polkadot

This system differs from Ethereum because instead of creating only decentralized applications in Polkadot, developers can create their own blockchain, while using the security that the Polkadot chain already has. With Ethereum, developers can create new blockchains, but they need to create their own security measures that can leave new and smaller projects open to attack, so the greater the blockchain, the greater the security it has. This concept in Polkadot is known as shared security.

Polkadot was created by Gavin Wood, another member of the founders of the Ethereum project who had different opinions about the future of the project.

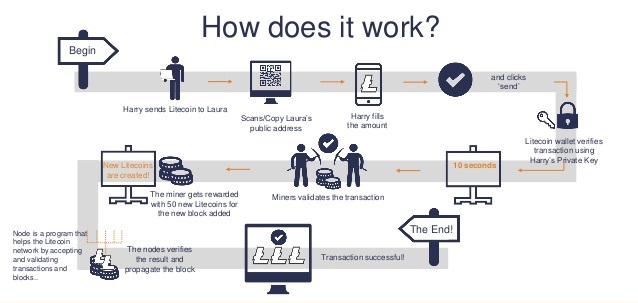

Litecoin (LTC), the silver version compared to Bitcoin gold

Litecoin, launched in 2011, was one of the first cryptocurrencies to follow in Bitcoin’s footsteps and has often been referred to as “silver for Bitcoin gold”. It was created by Charlie Lee, an MIT graduate and former Google engineer.

Litecoin is based on a global open-source payment network that is not controlled by any central authority and uses scrypt as proof of work, which can be decoded with the help of consumer quality CPUs.

Although Litecoin is like Bitcoin in many ways, it has a faster block generation rate and therefore offers a faster transaction confirmation time.

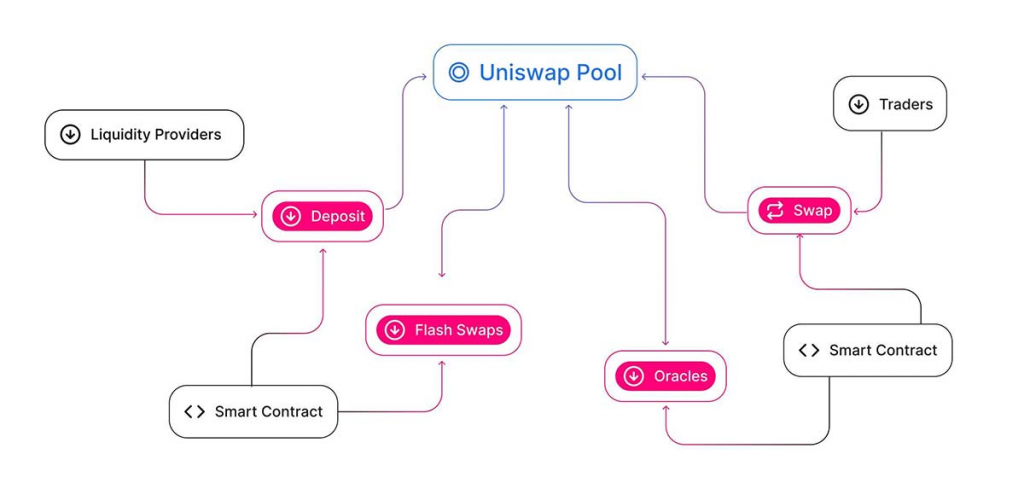

Uniswap, decentralized and open-source cryptocurrency exchange on the Ethereum blockchain

Uniswap is one of the leading decentralized cryptocurrency exchanges that operates on the Ethereum blockchain.

Most cryptocurrency transactions occur on centralized exchanges such as Coinbase and Binance. These platforms are governed by a single authority (the company that operates the exchange), require users to place funds under their control and use a traditional order book system to facilitate trade.

Uniswap is a type of exchange that is completely different because it is fully decentralized – meaning it is not owned and operated by a single entity – and uses a relatively new type of trading model called automated liquidity protocol.

Uniswap is also completely open-source, which means anyone can copy your code to create their own decentralized transactions. It even allows users to list or collect tokens for free on the exchange. Normal centralised exchanges are profit-oriented and charge very high fees to list or quote new currencies, so this is also another notable difference.

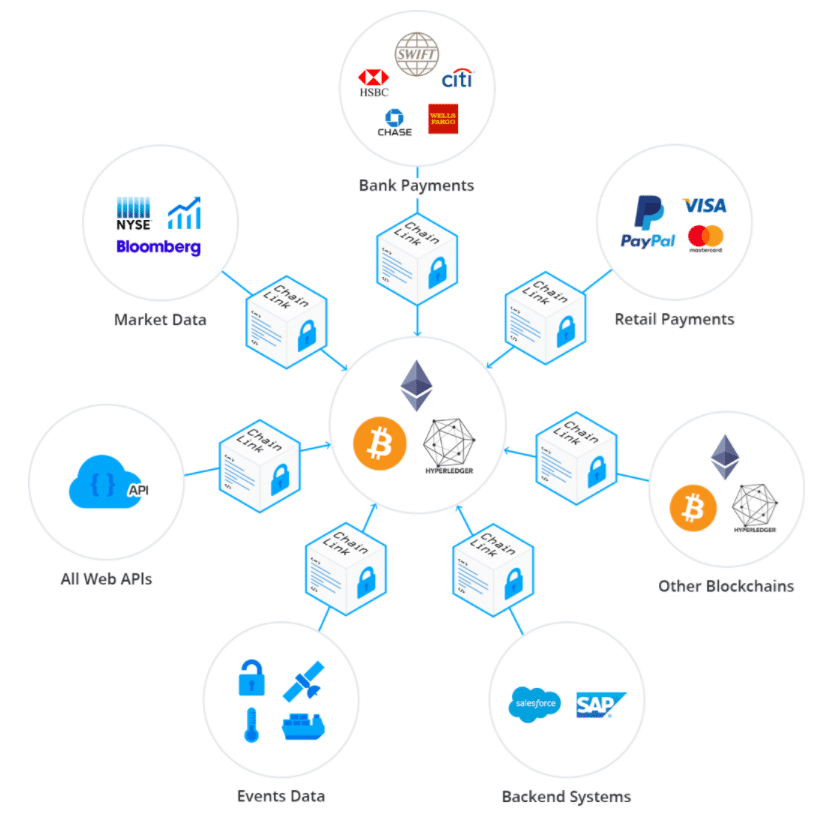

Chainlink, bridge between decentralized contracts

Chainlink is a decentralized oracle network that bridges smart contracts, such as those from Ethereum, and data outside it. Blockchains themselves do not have the ability to connect to external applications in a reliable way. Chainlink’s decentralized oracles allow smart contracts to communicate with external data so that contracts can be executed based on data that Ethereum itself cannot connect to.

Chainlink’s blog details several usage cases for your system. One of the many use cases that are explained would be to monitor the water supply for pollution or illegal siphon in certain cities. Sensors can be created to monitor corporate consumption, water levels and local water bodies. A Chainlink oracle could track this data and feed it directly into a smart contract. The smart contract could be created to execute fines, issue flood warnings to cities, or billing companies using too much water from a city with data received from the oracle.

Chainlink was developed by Sergey Nazarov along with Steve Ellis.

Stellar (XLM), blockchain network for enterprise solutions such as financial institutions

Stellar is an open blockchain network designed to provide enterprise solutions by connecting financial institutions for large transaction purposes. Large transactions between banks and investment firms that would normally take several days, some intermediaries, and cost a good deal of the money, can now be made almost instantly without intermediaries and cost little or nothing for those who do the transaction.

Although Stellar has positioned itself as a corporate blockchain for institutional transactions, it is still an open blockchain that can be used by anyone. The system allows cross-border transactions between any currencies. Stellar’s native currency is Lumens (XLM). The network requires users to keep Lumens to be able to trade on the network.

Stellar was founded by Jed McCaleb, a founding member of Ripple Labs and developer of the Ripple protocol. He eventually left his role with Ripple and co- founded the Stellar Development Foundation.

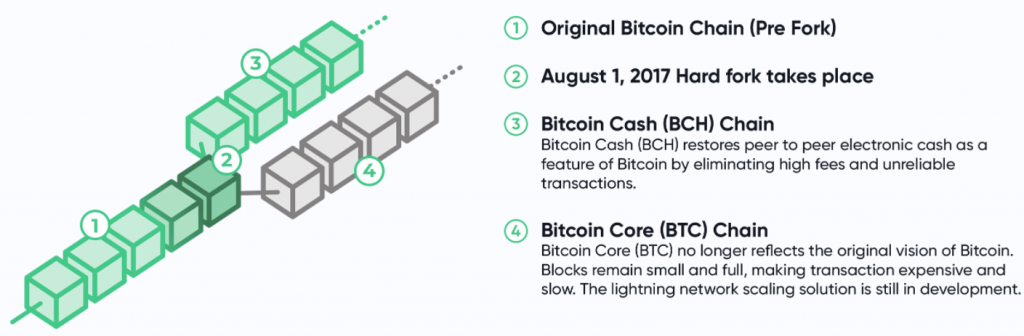

Bitcoin Cash (BCH), one of the most successful blockchain update technology

Bitcoin Cash (BCH) has an important place in the history of altcoins because it is one of the first and most successful hard forks of the original Bitcoin.

In the world of cryptocurrency, a fork occurs as a result of debates and discussions between developers and miners. Due to the decentralised nature of digital currencies, wholesale changes to the code underlying the token or currency in question should be made due to the general consensus; the mechanism for this process varies according to the particular cryptocurrency.

When different groups fail to reach an agreement, sometimes the digital currency is split, with the original chain staying true to its original code and the new chain starting life as a new version of the previous currency, supplemented with changes to its code.

BCH began its life in August 2017 as a result of one of these divisions. The debate leading to the creation of the BCH had to do with the question of scalability; the Bitcoin network has a limit on the size of the blocks: one megabyte (MB). BCH increases the block size from one MB to eight MB, with the idea that larger blocks can perform more transactions within them, so the transaction speed would be increased. It also makes other changes, including removing the Segregated Witness protocol that impacts block space.

Monero (XMR), secure, private, and undetectable currency, the target of suspected criminal uses

Monero is a secure, private and undetectable currency. This open-source cryptocurrency was launched in April 2014 and soon gained great interest among the crypto community and enthusiasts. The development of this cryptocurrency is completely donation-based and community-driven. Monero was launched with a strong focus on decentralization and scalability, and allows total privacy using a special technique called “ring signatures”.

With this technique, a group of cryptographic signatures appears including at least one actual participant, but because they all seem valid, the real cannot be isolated. Due to exceptional security mechanisms like this, Monero has developed an unpleasant reputation – it has been linked to criminal operations around the world. While this is one of the leading candidates for anonymous criminal transactions, the privacy inherent in Monero is also useful for dissidents of oppressive regimes around the world.

There is room for how many?

This is a question that many poses, as well as which of the existing ones will have the greatest growth prospects in the future. This will be a topic that we will discuss in the next articles.

Bitcoin currently dominates, having a first mover advantage, has conquered an important critical mass of market and its technology is quite advanced. However, there are others that have emerged later begin to smart interest and present other features.

https://coinmarketcap.com/charts/

https://www.amazon.com/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861