Advantages of structured products

Disadvantages of structured products

Care to be taken when investing in structured products

How to decide to invest in structured products

This is the second part of an article on structured products.

In the first part we covered the characteristics and the various types of products, including deposits and structured bonds.

In this second part we develop the advantages, the disadvantages, and how to evaluate the interest of the investment in structured products by the particular investor.

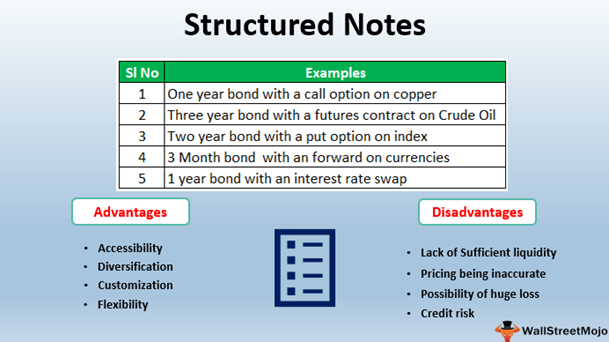

Advantages of structured products

The flexibility of structured notes allows them to provide a wide variety of potential returns that are hard to find elsewhere.

Structured notes may offer an increase or decrease in upside potential, decrease in risk, and overall volatility.

For example, a structured note may consist of a fairly stable security along with more leveraged call options on riskier stocks.

Such a combination limits losses while creating the potential for greater gains.

On the other hand, it can lead to repeated small losses if call options are too far from the strike price.

More often, a structured note will offer limited losses in exchange for limited gains when compared to investing in other assets.

Disadvantages of structured products

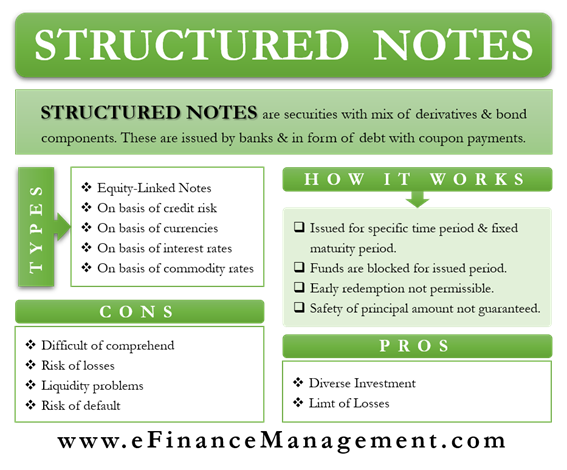

Derivatives are complex products, even when they are not combined with other financial products.

For example, commodity futures contracts require specific knowledge on the part of the investor to understand all of their implications.

This makes a structured note a very complex product as it is both a debt instrument and a derivative instrument.

Therefore, it is vital to know how to calculate the expected returns of a structured note.

Market risk is prevalent in all investments, and structured notes have these risks.

Some structured notes have capital protection, others do not.

For unsecured capital notes, it is possible to lose part or all of the invested capital due to the evolution of the derivative.

Low liquidity is also a problem for holders of structured notes.

The flexibility of structured notes hinders the development of trading markets for specific notes. This makes it very difficult to buy or sell a structured note on the secondary market.

Investors investing in a structured note should expect to hold the instrument until its maturity date. Thus, great care should be taken when investing in a structured note.

Structured notes also incur a higher risk of default than their underlying debt obligations and derivatives.

If the issuer of the note becomes insolvent, the entire value of the investment may be lost.

Care to be taken when investing in structured products

Structured notes are complex and often have limits on protection, performance, or both

This is a key issue because one of the main reasons to buy a structured note is capital protection, so breaking the barrier of protection in case of market loss can be a dangerous scenario.

There are products where protection is only limited or mild.

It means that there is a limit or “barrier” in the protection against loss, so that if the underlying index remains above the barrier (for example, 70% of the level on the date of issue), the capital protection is maintained in full, but if the index falls below the barrier, the protection is lost and the capital is repaid as if it had been invested directly in the underlying index.

There are also products where maximum returns are limited.

It means that if an index performs better than a certain value, the return is limited. For example, performance might be capped at 20%, in which case if the underlying index, such as the S&P500, grew by 30%, only 20% returns would be achieved.

Cost of structured notes

Structured products have complicated financial mathematics, and typically have higher costs than the underlying products or instruments.

Liquidity risk and opportunity cost

The secondary market for the structured product may be reduced or non-existent, which means that the pre-repayment selling prices may be very low and below the capital guarantee, if any.

To that extent, investment in a structured note should be considered over a medium and long-term horizon, or until repayment.

There may be opportunity costs not directly visible

For example, if the index is a certain index it is important to know whether it includes dividends or not, that is, whether the index is of total return or solely of price.

For example, in the five years to December 2021, the S&P 500 price index rose 59%, but the S&P total return index (including dividends) appreciated 73%.

Structured product counterparty risk

The return on capital depends on the creditworthiness of the bond issuer in its structured note. If, for some reason, the issuer is unable to repay the debt, the capital is at risk. It’s called counterparty risk, and when looking at structured products, it’s important to know which institution holds your capital and what your credit rating is.

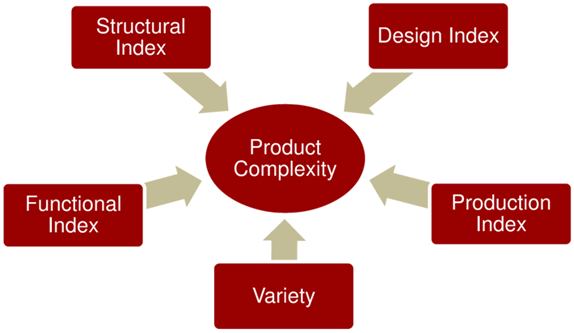

How to decide to invest in structured products

The wide variety of structured products offered can help meet the different needs of investors by providing different risk and return profiles – such as a degree of participation in an underlying asset with limited risk of deterioration – but at the same time, the breadth of the product range may make it difficult for some investors to compare and understand different products.

The complexity of the products is a potential source of risk for small investors.

Taken individually, the many structured products covered by the European Markets and Financial Instruments Directive (MiFID) are, by definition, complex as they are derivatives.

This definition and degree of complexity stems from the number of payment characteristics of a product and the number of component financial instruments required to replicate the payments of a structured product.

Financial structured products are not suitable for many investors for the following reasons.

They are too complex for most ordinary investors to understand.

They are costly in both manufacturing and distribution, and some of these costs may not be visible.

They can be promoted by financial sellers who can’t explain how they work.

They introduce additional levels of risk beyond the normal market risk that investors expect.

They do not adequately compensate investors for the additional costs or risks.

In these situations, high-quality advice for these investors may be important.

A properly diversified global portfolio, with an asset allocation that matches your investor risk profile, is almost always a better long-term solution for an average investor.