What are structured products?

Characteristics of structured products

The various types of structured products

Structured products cover a very wide range of product types with very different degrees of risk and complexity

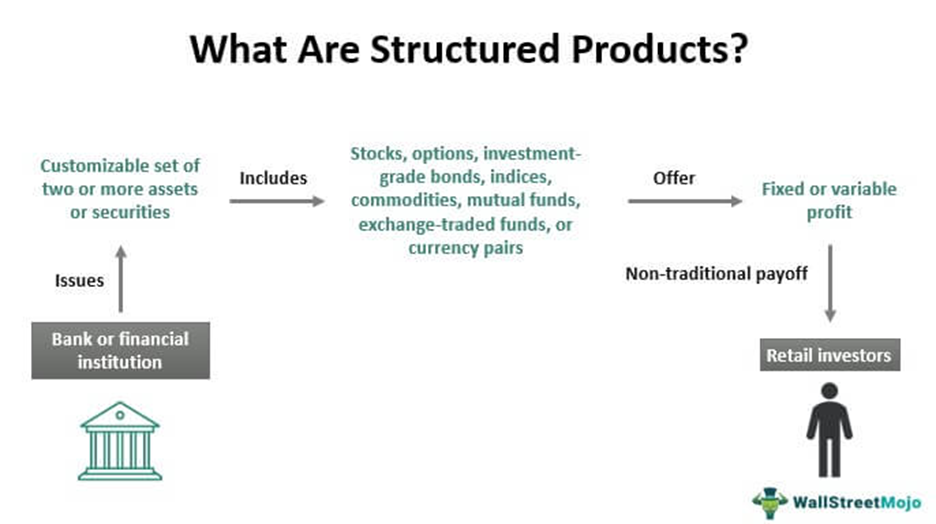

One innovation that has gained traction as a complement to traditional investment products is the investment class widely known as structured products.

A structured product is a debt security (a bond), which also contains an embedded derivative that adjusts the risk-return profile of the security.

The return of a structured product is tied to the performance of an underlying asset, asset group, or index.

The main advantage of structured products comes from the flexibility that allows them to offer a wide variety of potential returns that are difficult to find in other products.

The main disadvantages of structured products stem from the fact that they are complex financial products, which have market risk, low liquidity and risk of default.

What are structured products?

A structured product is a debt security issued by financial institutions.

Their return is based on stock indices, a single stock, a basket of stocks, interest rates, raw materials or foreign currencies.

The performance of a structured product is tied to the return of an underlying asset, asset group, or index.

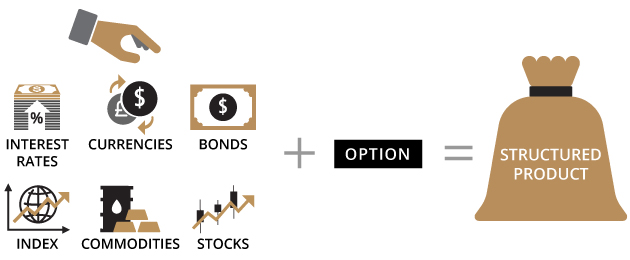

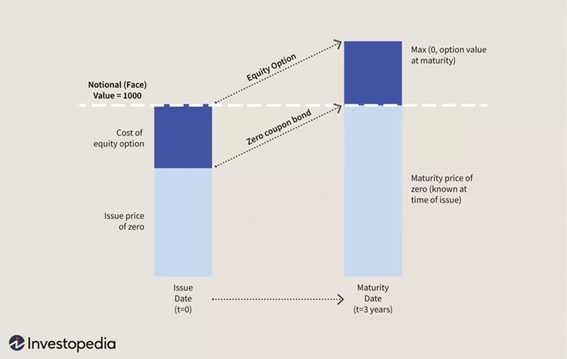

All structured products have two components: a bond and a derivative.

The bond component constitutes the majority of the investment and provides part or all of the capital protection.

The remaining investment not allocated to the bond is used to buy a derivative product and offers potential for appreciation to investors. The derivative component is used to provide exposure to any asset class.

Characteristics of structured products

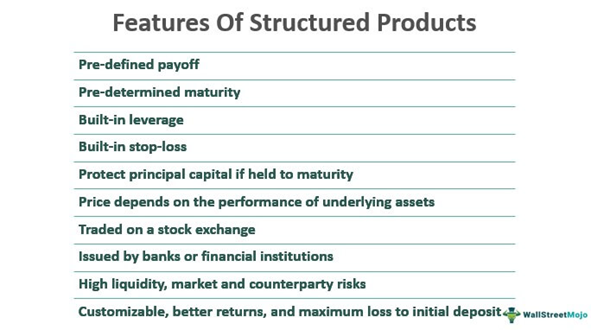

The main characteristics of structured products are as follows:

Structured products are debt securities issued by banks and other financial institutions, with a pre-defined term and return conditions and which depend on the performance of the indexed underlying assets.

They may have partial or total protection of the invested capital, have leverage and loss limits.

They have market and counterparty risk and some liquidity, and in some cases can be traded on the stock exchange.

The various types of structured products

Structured products include hedge bonds, inverse (or reversible) convertible notes and leveraged notes.

Types of Structured Products

Structured products can be divided into three broad categories, depending on the level of risk at maturity:

Structured Deposits

An investor buys a time deposit with a return indexed to any underlying asset.

It works similarly to a term deposit account, except that earnings depend on the performance of the asset and not on a fixed interest rate.

Protected capital structured notes or bonds

They are obligations that guarantee the capital invested at the time of maturity, thus protecting the initial investment.

They are often structured as loans from banks or other financial institutions until the product expires.

Investors may lose invested capital if the issuer declares bankruptcy.

Capital-risk structured notes or bonds

They are investment instruments that offer a higher rate of return, but do not guarantee the repayment of capital at maturity.

An investor can lose money depending on the evolution of the market.

In addition, the rate of return is affected by the performance of the underlying assets.

Structured products cover a very wide range of product types with very different degrees of risk and complexity

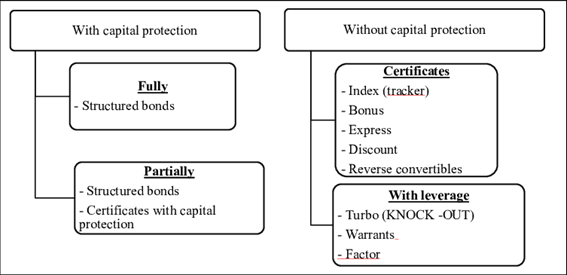

Structured products can be classified in different ways.

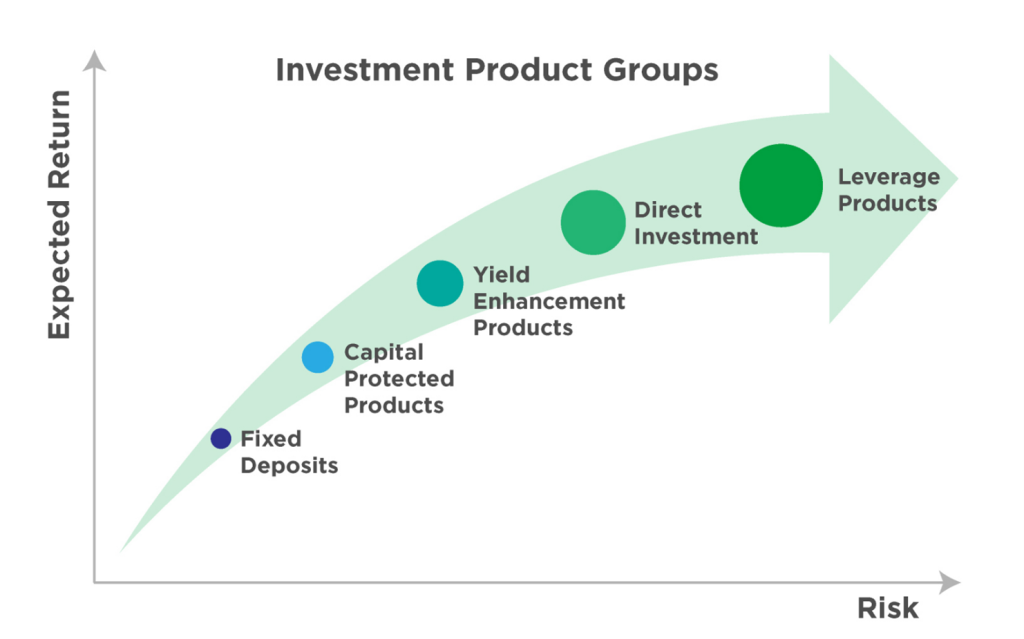

The European Structured Investment Products Association (EUSIPA) provides a reference framework used in the sector, starting by distinguishing two major families, investment products and leverage products.

Investment products are products for which any downward exposure does not exceed a given percentage of the price fall of the underlying asset.

These products constitute the vast majority (>95%) of the market by volume.

Structured investment products include the following:

Capital protection products, which ensure that a fraction of the investment (usually, but not necessarily 100%) will be returned to the investor at maturity unless a default occurs.

Therefore, there is little scope for major losses, excluding counterparty risk.

Within this category there are products with maximum limit (which specify a maximum return) and products without maximum limit.

Yield-boosting products offer limited returns and expose investors to potential losses, which are mitigated by a discount.

— Equity products offer unlimited participation in any increase in the value of the underlying asset. The upward participation rate can be higher than 100%, for example, for certificates of superior performance. There is also a 1:1 share in the decline of the underlying. Non-leveraged indexed certificates fall into this category.

In turn, structured leverage products are products with downside exposure that can exceed a price drop in the underlying in percentage terms.

They are sold as warrants or options and include the following.

— Leverage products with knock-out barrier features. The “knock-out” barrier means that the product expires or ends prematurely under certain conditions. For example, the term can be triggered if the underlying increases or decreases by a certain amount.

— Barrier-free leverage products, including indexed and leveraged certificates, for example.

— Products of constant leverage, calibrated on a daily basis.