CFDs are the most complex and highest-risk products in the broad family of structured products

What are Contracts-For-Difference (CFDs)?

How do CFDs trade or trade?

About 80% of CFD trades by investors record losses

CFDs are banned in the U.S., but are heavily traded in many countries, including Europe

European regulatory authorities have recently imposed some limitations on the offering and trading of CFDs

CFDs are the most complex and highest-risk products in the broad family of structured products

In previous articles we have presented the family of structured products.

We have identified its characteristics and the different types of products, including deposits and structured bonds, showing that it is a broad product family that encompasses products of very different degrees of complexity and risk.

Subsequently, we analyzed the advantages and disadvantages of investments in structured products, to conclude about the investors for whom they are intended.

One of the most complex and risky products is Contracts for Difference, or CFD, due to their high degree of leverage.

These products are naturally highly sought after by speculative investors, but they also attract many ordinary investors.

In this article we develop these contracts for differences, describing their characteristics, showing that they have a high probability of loss and that they can imply high losses, and that they are banned in several countries.

Contracts for difference have been growing a lot in Europe in recent years, where. they already reach an annual turnover of one billion euros.

This growth is based on very aggressive advertising campaigns and promotion by various celebrities developed by the specialized electronic platforms, which attract individual investors eager to trade currencies, stocks and cryptocurrencies.

Recently, European regulators have begun to step in and take over an industry they consider to have been in a free wheel and which has left many investors cashless.

The strong attraction of these CFDs to many investors is surprising, especially when we compare many situations with some disinterest in traditional investment products such as bonds, stocks and mutual funds.

But deep down this attraction lies in the search for quick and easy gain of investors, that is, in the speculative gene and greed from which we all suffer.

Investing in traditional products requires patience to extract the medium and long-term returns that many investors do not have and can seem uninteresting and unexciting.

What are Contracts-For-Difference (CFDs)?

Contracts for differences (CFDs) are contracts between investors and financial institutions in which investors take a position on the future value of an asset.

The parties agree to exchange the difference in the value of a financial product between the time the contract begins (opening) and ends (closing).

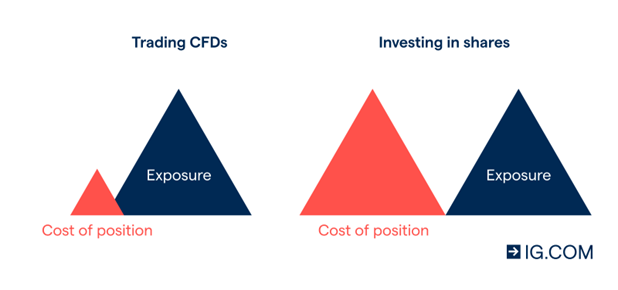

A CFD investor never owns the underlying asset, but has the profits or costs associated with the price change of that asset.

There is no delivery of physical goods or securities with CFDs.

A CFD investor never owns the underlying asset, but the profits or costs are calculated based on the price change of that asset.

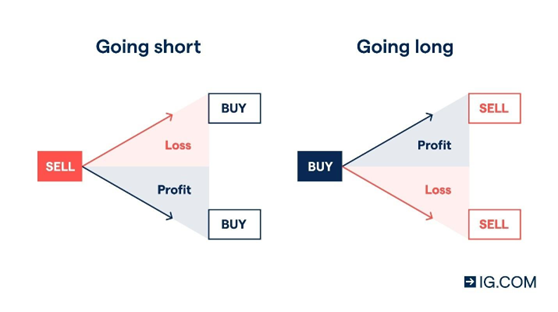

In essence, investors can use CFDs to place bets on whether the price of the underlying asset or security will rise or fall.

How do CFDs trade or trade?

CFDs are available for a variety of underlying assets such as stocks, commodities and foreign exchange.

A CFD involves two trades. The first trade creates the open position at a given price, which is later closed through a reverse trade at a different price, with the CFD provider.

If the first trade is a buy, the second trade (which closes the open position) is a sell. If the opening trade was a sell, the closing trade is a buy.

The investor’s net profit is the price difference between the opening trade and the closing trade (minus any commission or interest).

It is an advanced trading strategy that is used only by experienced investors.

Investors can bet on either an upward or downward move.

About 80% of CFD trades by investors record losses

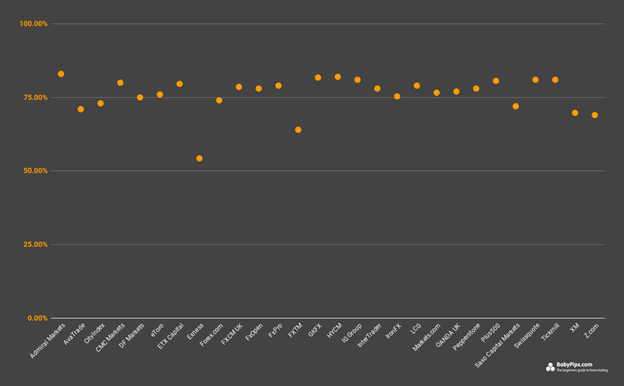

Considering the high risk of CFD transactions, regulators require trading platforms to inform and warn investors of the statistics of trades losses by investors.

Currently, between 74% and 89% of individual investor accounts trading CFDs lose money:

These losses are transversal to all traders, regardless of their product offer and trading rules.

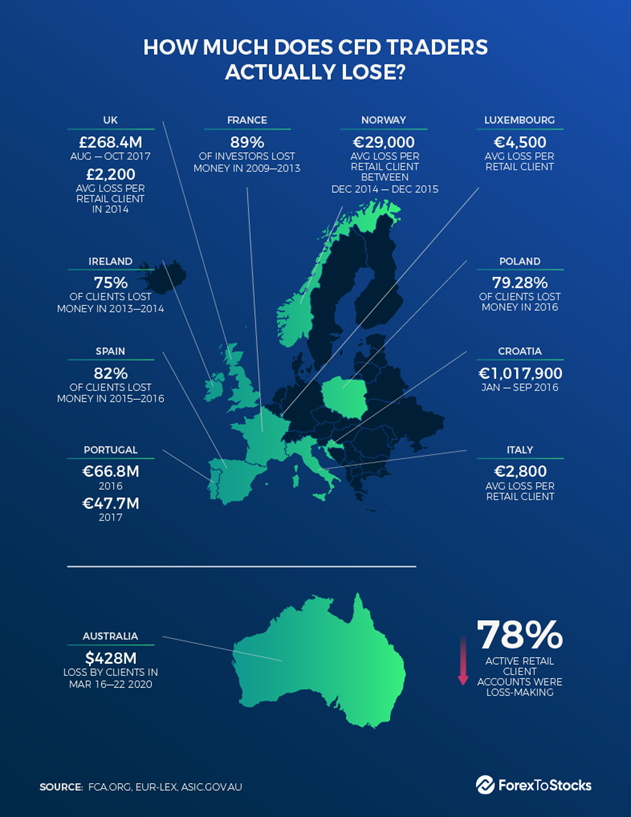

The loss figures in some European countries and Australia were as follows in 2017:

These are quite significant losses both in percentage of trades and in the amount of the loss.

CFDs are banned in the U.S., but are heavily traded in many countries, including Europe

CFD trading has been for a long time or has recently been banned in many jurisdictions, but they still trade in several countries.

CFD trading is prohibited in the United States.

It is possible to trade CFDs in countries such as the United Kingdom, Germany, Switzerland, Singapore, Spain, France, South Africa, Canada, New Zealand, Sweden, Norway, Italy, Thailand, Belgium, Denmark, the Netherlands and Australia, as well as the Hong Kong special administrative region.

European regulatory authorities have recently imposed some limitations on the offering and trading of CFDs

Regulators first limited the sale and trading of CFDs to individual clients three years ago.

Financial companies can only offer CFDs to appropriately experienced or qualified individual investors.

This trading is for people who have passed a suitability test and want to trade with leverage.

New requirements of duties towards consumers have been imposed, obliging providers to ensure that customers understand these businesses.

This forced brokers to limit the leverage they offered investors to a maximum of 30:1, with stricter controls put in place for more volatile assets.

Brokers are also required to close a client’s position when funds have fallen significantly.