JP Morgan’s outlook

Robeco’s Perspectives

Vanguard’s Perspectives

Charles Schwab’s Perspectives

Every year, usually in December, the major banks and asset managers publish their medium- and long-term financial asset returns outlook for the US.

We believe that this is an exercise that is worth knowing and monitoring, even more important than the annual forecasts, since this is the main world market and we defend the importance of developing a long-term investment process.

The projected annual returns are made for long time horizons, usually between 10 and 15 years.

These insights help us analyse changing market dynamics and identify promising investment opportunities, and are useful for guiding our active asset allocation strategy in the medium and long term.

Naturally, being such a long forecast period, the margin of error of this exercise is greater in the short term, as there is a time smoothing factor for the average and many exogenous and unforeseen factors can arise in this period.

This means that this exercise does not take into account the volatility of short-term markets.

This analysis is highly dependent on starting conditions, such as levels of economic growth, interest rates, monetary and fiscal policy directions, and financial market valuation multiples.

Next, we will develop a brief summary of the analyses made by a group of 4 institutions – JP Morgan, Robeco, Vanguard and Charles Schwab.

We recommend that investors read some of these publications, which are published annually, as mentioned.

In addition to the interest of the views and analysis of the main economic and financial fundamentals, these publications are also useful and interesting for investors to learn about the dynamics of the markets.

In this regard, we highlight the publications of Charles Schwab and Robeco, for different, almost opposite reasons.

Charles Schwab’s report is very didactic and explanatory of how these perspectives are constructed. It is easy to read and helps to understand the movements and interdependencies of the functioning of the markets of the various assets.

Robeco’s report is very in-depth and detailed, being a more advanced level of approach to the same topic.

JP Morgan’s outlook

JP Morgan begins by noting that we live in a time of significant economic transition.

We are moving from a world of disinflation, ultra-easy monetary policy and fiscal moderation to a world with risk of two-way inflation, conventional monetary policy and greater use of fiscal tools.

Estimates of the returns of the main assets in dollars are as follows:

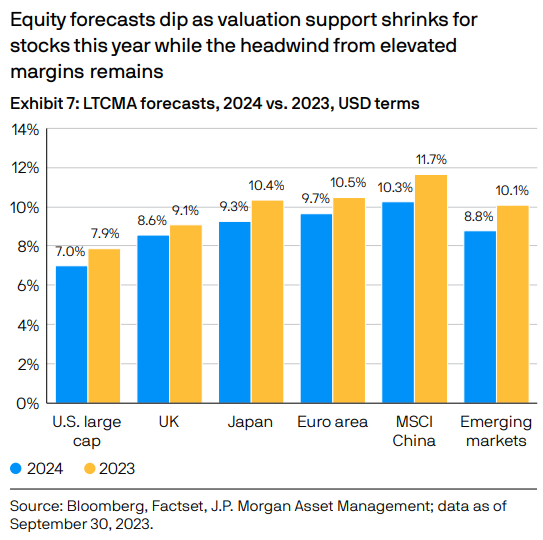

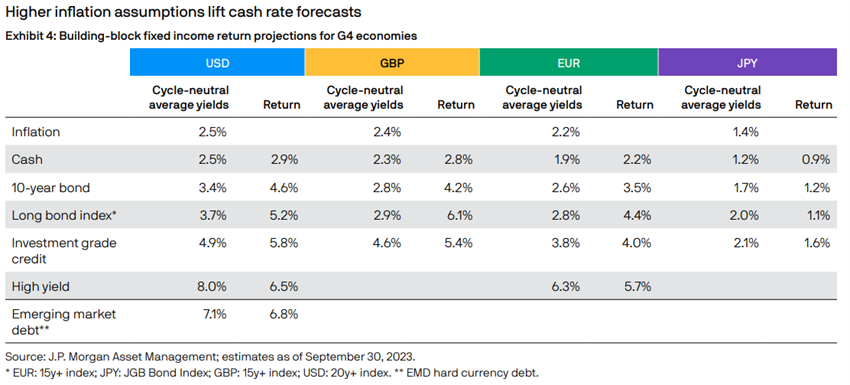

Estimates are for annual returns of 8% to 10% for equities, depending on geographies, 4% for U.S. Treasury debt, 5% for investment-rated corporate debt, and slightly above 6% for high-yield debt.

The traditional 60/40 dollar portfolio results in an annual return of 7%.

The prevailing high key interest rates support the forecasts for fixed income, raising the yields on investments in cash holdings and liquidity instruments from 0.40% to 2.9% in dollar terms.

Forecasts for bonds also rose 0.40% to 5.1%.

The gap between the returns of developed market and emerging market equities narrows this year, while the outlook for ex-U.S. developed markets remains attractive.

Forecasts for almost 80% of the coverage universe are above the realized returns of the last 10 years.

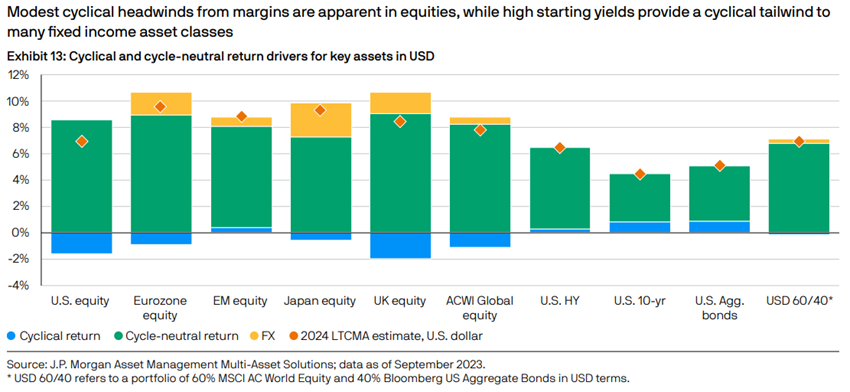

JP Morgan also notes that, compared to the past, there is a slight downside for equities due to the margin growth cycle, and at the same time, a slight benefit for bonds, derived from the starting point of implied yields.

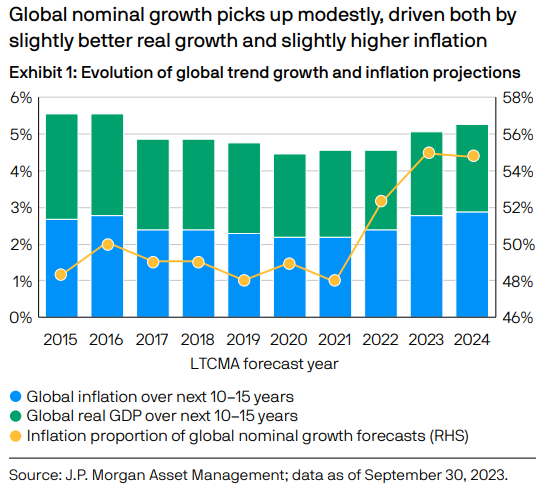

These estimates are based on a macroeconomic framework whose global growth forecast rises slightly to 2.4% compared to the previous year.

Developed market inflation forecasts rise from 0.10% to 2.3%, reflecting the return of inflation in Europe and Japan and the higher inflation levels prevailing in the US.

The link to the report is as follows:

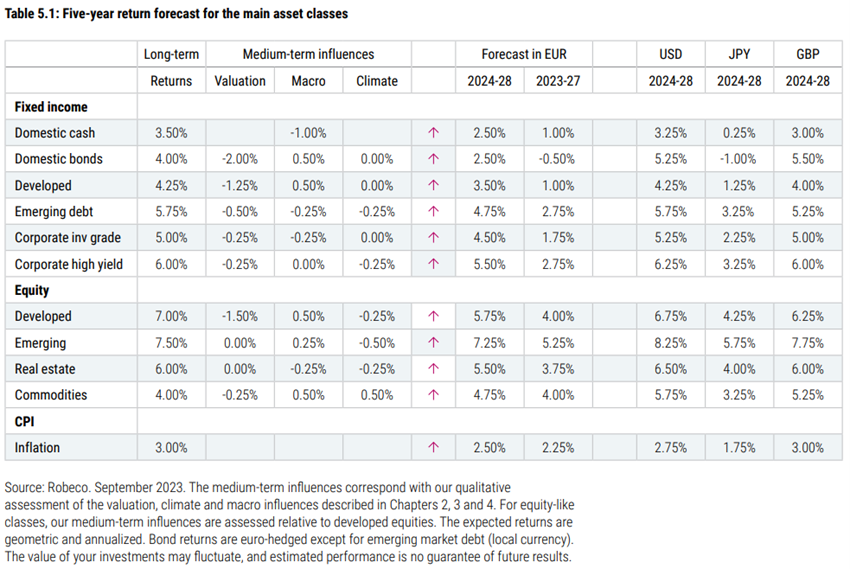

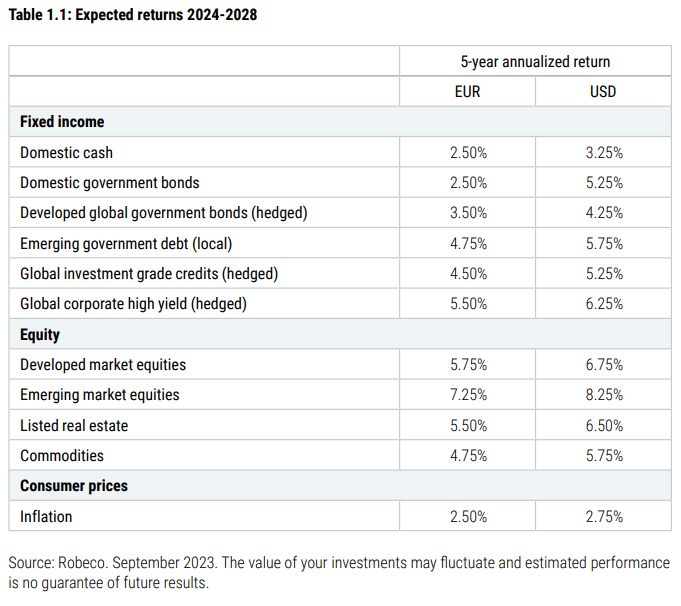

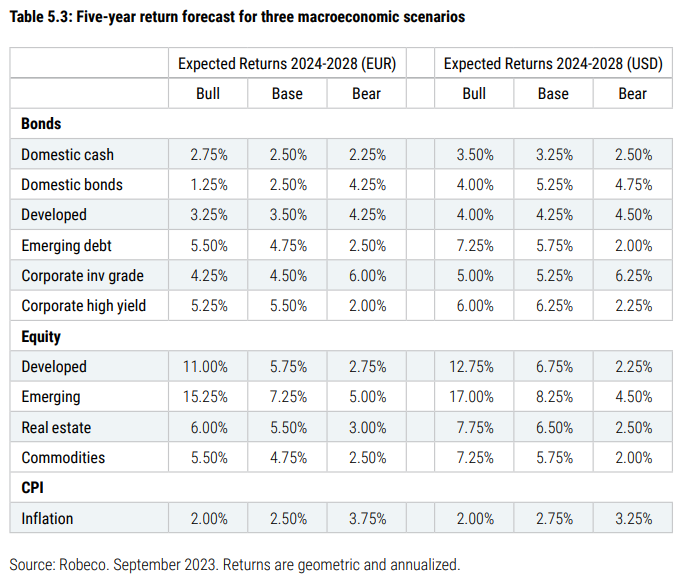

Robeco’s Perspectives

Robeco’s ‘Triple Power Play’ publication for 2014-2028 makes predictions for the markets over the next 5 years:

Forecasts result in annual returns of 7% and 7.5% for developed and emerging market equities, respectively, 4.0% and 4.5% for U.S. and European sovereign bonds, 5% for investment rating bonds, and 6% for high-yield bonds.

Cash and cash are expected to deliver returns of 3.5%, slightly above the estimated inflation rate of 3.0%.

Robeco predicts that there are three separate but overlapping forces in this period.

Firstly, the government’s fiscal policies, which pose a challenge for central banks, altering the balance between inflation and economic growth.

Second, the dominance of capital as a factor of production is being challenged by labor, driven by relocation and climate concerns.

And finally, there is a geopolitical confrontation between the U.S. and China over technological supremacy, which is reshaping the global economy, alliances, and trade policies.

In financial markets, we are moving from a world with low risk-free rates and high expected risk premia to a world with higher risk-free rates but lower expected risk premiums.

Robeco also notes that volatility will be higher in this context of higher interest rates than in the past, which benefited stability.

This reality increases the value of diversification in asset allocation between stocks and bonds.

The report can be accessed at the following link:

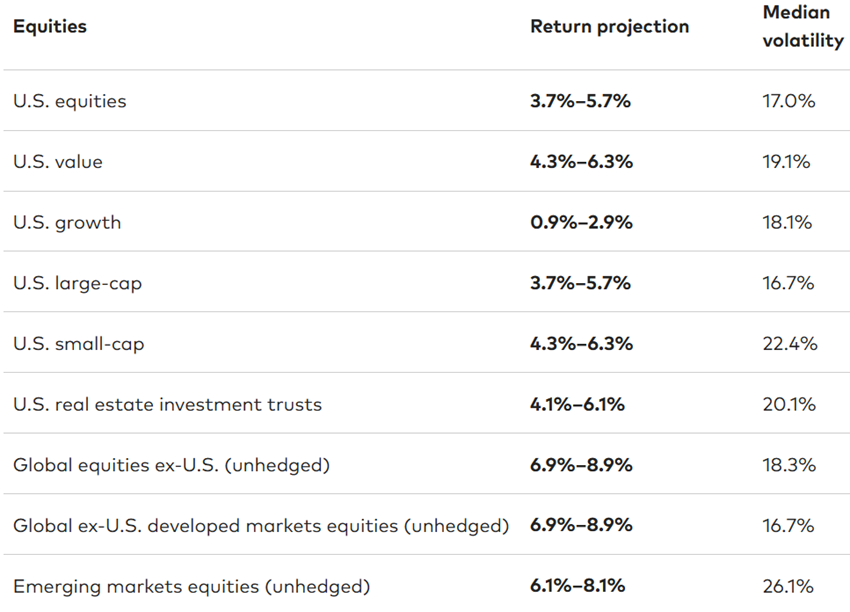

Vanguard’s Perspectives

Vanguard publishes nominal profitability and volatility forecasts over a period of 10 years.

His forecast for the stock markets is as follows:

The projected annual returns for U.S. stocks of 3.7% to 5.7% are lower than the historical average. This situation is even more pronounced in the case of growth stocks, and is due to the fact that valuations are at a higher level than average.

For developed market equities, ex-US and emerging markets, the expected annual returns are between 6.9% and 8.9%.

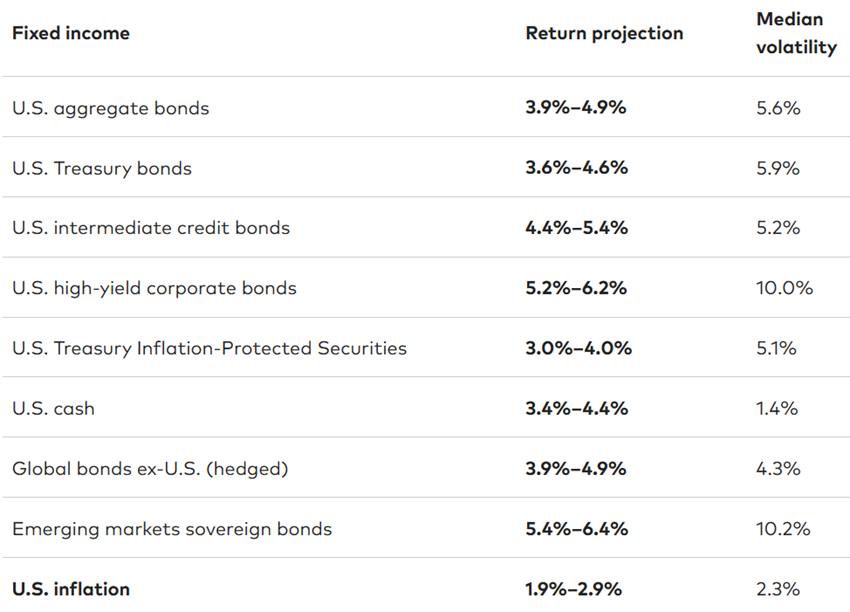

Vanguard’s forecast for the bond market is as follows:

It forecasts annual yields of 3.9% to 4.9% for U.S. investment rating bonds, 3.6% to 4.6% for treasury debt and 4.4% to 5.4% for corporate bonds.

It estimates yields of 5.2% to 6.2% per annum for high-yield bonds.

And from 3.9% to 4.4% for cash availability or liquidity investments, with inflation of 1.9% to 2.9%.

These returns are mainly due to the fact that current risk-free interest rates are at historically high levels.

The link to the full article is as follows:

https://advisors.vanguard.com/insights/article/series/market-perspectives

Charles Schwab’s Perspectives

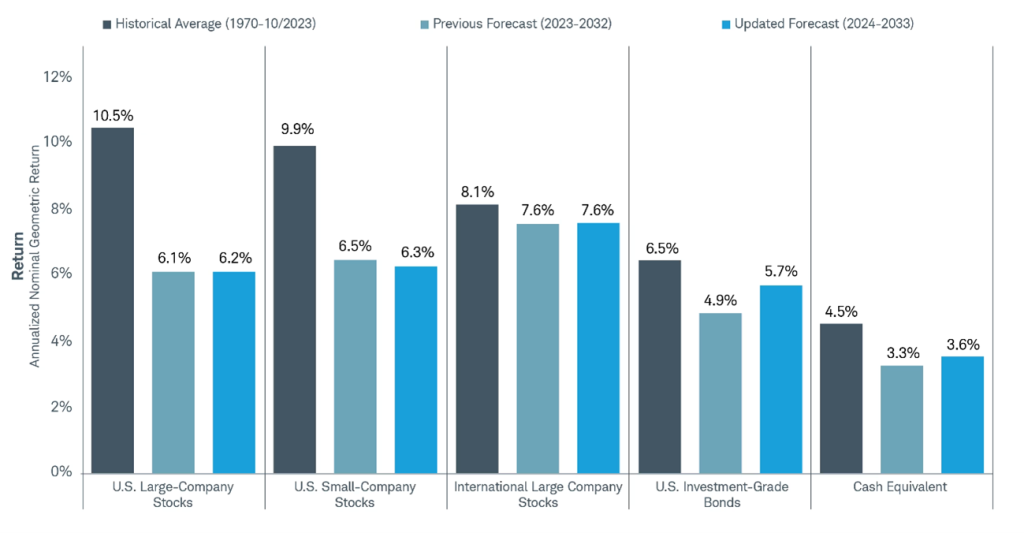

Charles Schwab’s forecasts are also for annualized nominal rates over a 10-year period:

It forecasts annual returns of 6.2 to 6.3% for U.S. equities, 7.6% for international equities, 5.7% for good-rated bonds and 3.6% for cash holdings.

All of these forecasts are below the very long-term average between 1970 and 2023, most notably for U.S. equities.

Overall, this is due to the prospects of lower inflation than in 2010 and, in particular, the comparatively higher valuation multiples of the stock.

These forecasts are based on a macroeconomic framework of US real GDP growth of 1.7% per year, less robust than in the previous decade, and inflation rates of 2.3% per year.

This analysis can be accessed at the following link:

https://www.schwab.com/learn/story/schwabs-long-term-capital-market-expectations