The Chinese capital market has a very high participation of private or retail investors, with low foreign investment

The fall in Chinese stocks and the outflow of foreign investors since 2021

Has China become uninvestable with the disappearance of $2 trillion from market capitalization in 3 years?

Internal problems: examples of intervention by the authorities in relation to large economic groups

The external problems: U.S.-listed technology companies were at risk of being delisted only recently

This article is part of a series dedicated to investing in Chinese stocks.

In the first article, a general introduction to the topic was made,including a synthesis of the remarkable performance of economic growth and development in the last 4 decades, as well as the challenges it has faced especially since mid-2015.

In the second article, aspects of China’s strong economic growth over the past 4 decades were developed.

The third article was divided into two parts, in the first addressing the performance of the Chinese stock market in the last 4 decades, while in the second, a framework was made of the perspectives of the current understanding of the economic reality and the markets by foreign investors.

In the fourth article, also divided into two parts, we began to develop the main challenges of the Chinese economy.

In this article we analysed how it all started, the problem of the construction sector, explaining its direct and also indirect effects.

It was thought that this would be the central problem, combined with the draconian Covid response policy.

But appearances are often deceiving.

In the most recent articles we have shown that China’s problem is deeper and more structural, and focuses on the lack of change in the economic development model, from an economy based on public investment to an economy driven by private consumption.

Chinese government authorities intend to stimulate and boost consumption to grow the economy, but have been unable to achieve this goal.

We have already touched on two of the reasons, the response to the financial insecurity of households and the problem of the demographic winter.

In the following article we continued to give an explanation of this fact, focusing on the themes of the political, economic and social model, as well as on geopolitical problems.

In the last article we discussed whether the Chinese market is that cheap or not, or whether the aversion of foreign investors is justifiable.

In previous articles we have already developed the size and weight of the Chinese economy in global terms, its enrichment in recent years, as well as its convergence with the most developed countries.

Also in previous articles we have addressed the growth of investment in emerging equity markets, as well as their attractiveness, with emphasis on the Chinese market.

In another article, we also delved into the specifics of the structure, functioning and activity of the Chinese stock market.

In this article we develop in more detail the fall of Chinese stocks in the last 3 years and argue that it is not only economic and financial reasons that we have seen earlier that have caused this fall.

There are other reasons that have to do with the development of the capital market itself, and above all with the direction that the Chinese authorities want to give it.

The exit of foreign investors from the Chinese capital market was also due to a disappointment with the authorities’ interventions in the market, which led many to wonder if the Chinese market is investable.

This factor is also a key element for the fall in the value of shares and will be decisive for future developments.

The Chinese capital market has a very high participation of private or retail investors, with low foreign investment

To understand the functioning and movements of the Chinese stock market, we must first know its peculiar structure.

In fact, there is not one Chinese stock market, but rather three.

There is the mainland capital market, the main market, for type A shares, traded on the Shanghai and Shenzhen stock exchanges.

There are also two off-shore markets, Hong Kong’s H-equity capital market and the U.S. American Depository Receipts (ADR) market, which are more focused on fast-growing sectors such as technology, healthcare and consumer.

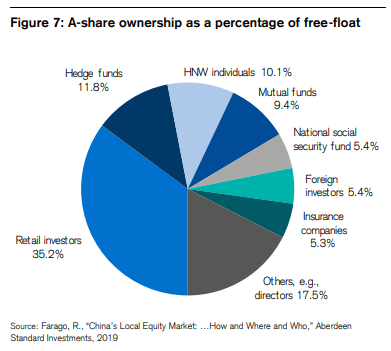

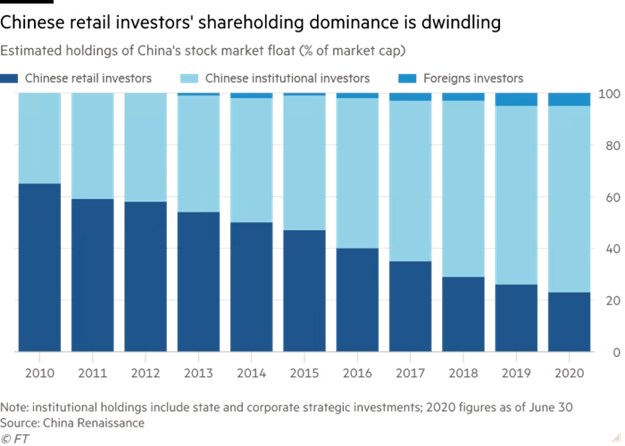

China’s A-share market is dominated by retail investors.

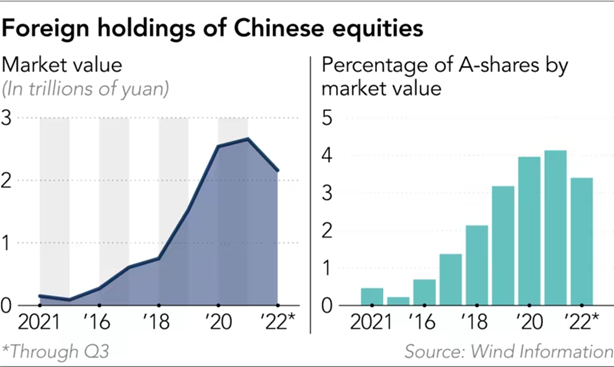

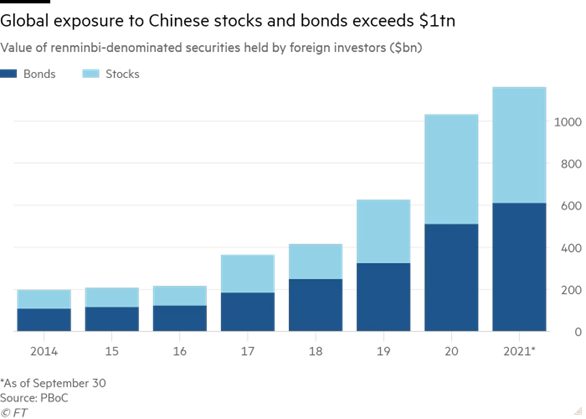

The participation of foreign investors in the Chinese market is very low:

Retail investors, who dominate the market, tend to have shorter holding periods, which can contribute to high levels of turnover and market volatility.

The 220 million retail investors account for about 60% of the Chinese stock market’s turnover.

Compared to other markets, China’s A-shares have low levels of coverage by financial analysts.

There is a very interesting analysis done in 2023 by Bentley Reid on the structure of the Chinese capital market.

The fall in Chinese stocks and the outflow of foreign investors since 2021

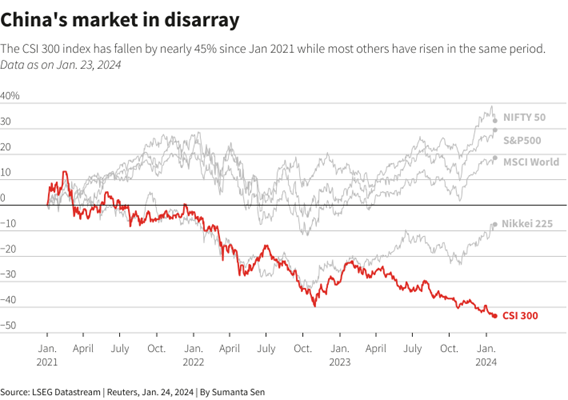

Between the end of 2022 and the beginning of 2024, the CSI 300 index of the Chinese stock market lost almost 50% of its value, while most other markets showed significant appreciations:

In that same period, another major index, the MSCI China, lost 60%, equivalent to $1.9 trillion.

This devaluation has a cause-and-effect relationship with another phenomenon, that of the withdrawal of foreign investors.

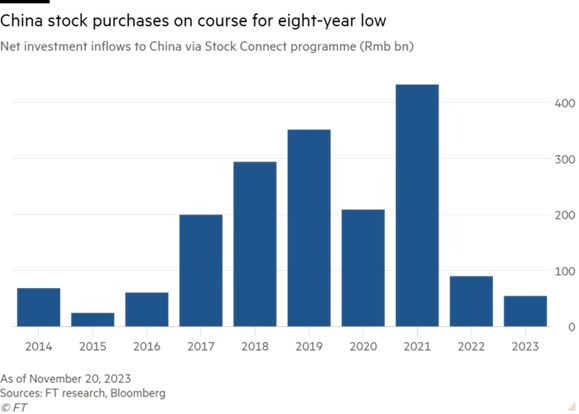

Since 2014, foreign investment in the Chinese stock market has been growing, but it had a sharp drop in 2022:

Stock sales by foreign investors were also strong from 2022 onwards:

In 2023 alone, almost $4.6 billion in foreign investment left China’s stock market, which continued at the beginning of this year.

As a result, the value of India’s total capital market capitalization surpassed that of China in 2023

Has China become uninvestable with the disappearance of $2 trillion from market capitalization in 3 years?

This aversion to Chinese stocks by global investors has become more entrenched over the past 15 months thanks to weak economic growth, an unresolved crisis in the real estate sector, insufficient government support for markets, and frayed diplomatic relations between Beijing and Washington.

Many of these investors consider that the Chinese market is no longer investable.

In fact, in May 2023, at the Hiroshima summit, the group of the seven most developed countries in the world, also known as the G7, called for de-risking relations with China, pointing to anti-market policies and practices that distort the global economy.

What does China want to do with its capital market, which is still in its infancy, compared to developed markets?

The Chinese capital market, despite its large size, is a developing market and still very incipient in terms of its bases, structures, rules and procedures.

The Chinese authorities have been inconsistent with their approach to the stock market, first adopting a liberal and reformist spirit, and then shifting to interventionist and dirigiste action when economic and market problems arise.

Internal problems: examples of intervention by the authorities in relation to large economic groups

The market crisis of 2015 triggered the intervention of the authorities on some of the main operators, from traders to the largest shareholders of large private economic groups.

Thus, the disappearances of some of the main shareholders or CEOs of these large groups for some time were announced, who reappeared some time later, with the suspicion that they had been questioned by the authorities during that period. ~

Later in 2021, authorities banned Jack Ma’s Alibaba from going ahead with the stock exchange listing of its online financial subsidiary Ant Group, worth $34 billion

The external problems: U.S.-listed technology companies were at risk of being delisted only recently

More than 100 Chinese companies, including Alibaba, JD.com and Baidu, have been identified by the U.S. securities regulator as facing delisting in 2024 if they did not deliver audits of their financial statements.

However, in December 2022, U.S. regulators gained full access to audits of Chinese companies for the first time, reducing the threat of the tech giants being expelled from U.S. stock exchanges.

The authorities’ ongoing measures to stem the problem of falling prices

Earlier this year, the Chinese government changed the first head of China’s capital markets regulator, appointing veteran Wu Qing.

At the same time, the authorities suspended short selling, exits from global passive funds, and the closure of investment funds before a period of 5 years practiced by some brokers.

More recently, the Chinese government issued a set of important guidelines (the third in 2 decades) to be implemented within a maximum of 5 years, aiming to improve the quality, robustness, flexibility and competitiveness of the market.

These guidelines aim to strengthen regulation, prevent risks, and promote the qualitative development of the capital market.

And they include stricter criteria for the admission and permanence of listing on the stock exchange, greater regulation of high-frequency trading activity, penalization of manipulation, market abuse and short selling.

In parallel, they also include measures to increase medium- and long-term capital raising to the market through the development of public equity funds, and by improving the framework for insurance companies’ investment products and banks’ asset management products.

In the following articles, we will continue to delve into each of these aspects and the consequences regarding the interest of the Chinese stock market for foreign investors.

This central question of the attractiveness of the Chinese market is very pertinent because, as we know, investing well means diversifying risks, doing so, above all, in the world’s largest economies and companies, and privileging those that are world leaders and consumer goods, in order to put the economy to work for us.