Morningstar is the leading global mutual funds analysis and rating agency, which is widely used by institutional investors.

Morningstar covers 4,000 mutual funds, including 1,150 funds and 300 ETFs in the US, and 91% of funds traded in Europe.

Therefore, we have dedicated a series of articles on this blog to the theme of the selection of investment funds, ranging from their description and characteristics, the types and policies of investment, to profitability, and costs.

We have also published several articles on the choice between active and passive (or indexed) investment funds, including their differences and their advantages and drawbacks.

In the Tools folder we have been presenting some of the largest equity and bond investment funds, assets and liabilities, traded in the USA and Europe.

What is the Active vs. Passive Fund Barometer?

Morningstar’s Active/Passive Barometer is a useful metric that can help investors better calibrate the chances of success with active U.S. investment funds (or active management) in different areas, based on recent trends and long-term history.

The Active/Passive Barometer is a semiannual report – published in March and September – that evaluates the performance of active U.S. mutual funds against passive (or indexed) mutual funds grouped into their Morningstar Categories.

This barometer is also very comprehensive, comprising more than 8,400 active and passive U.S. funds, which represent about $15.6 trillion in asset values under management, or about 69 percent of the U.S. mutual funds market.

It uses several unique ways to measure the success of active managers.

It evaluates active mutual funds against a composite of actual passive funds, rather than a theoretical comparison against any index without costs or charges.

Thus, the “reference” reflects the actual, net performance of fees or management fees of passive or indexed investment funds.

It assesses active funds based on their begining-of.period category classification to better simulate the funds an investor would have chosen at the time.

It evaluates how the profitability of the average dollar invested in various types of active mutual funds is compared to the average dollar invested in the composite of passive mutual funds.

It also analyses the success rates of the active mutual fund at the level of the fees charged.

Main conclusions

The main findings of this report are:

Low success rates of active fund managers in the medium and long term.

In general, actively managed funds have either failed to survive and or have not hit their average passive fund returns, especially in longer time horizons.

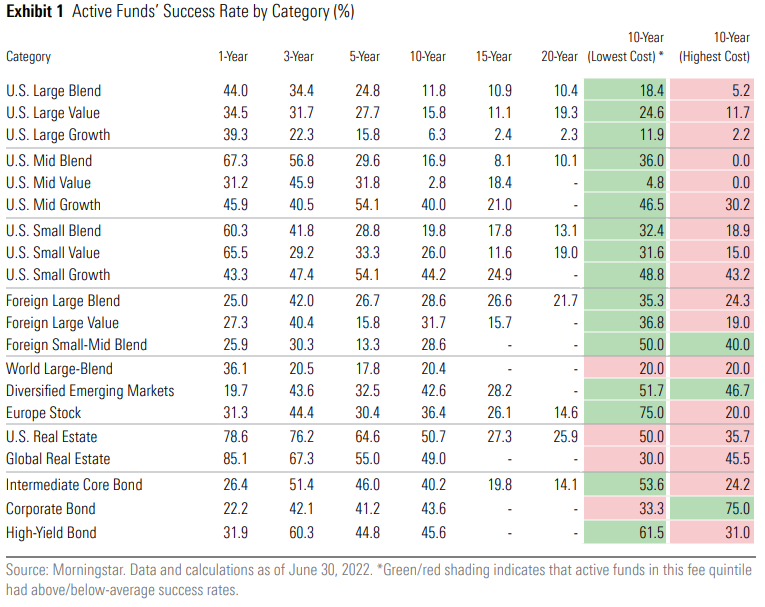

Only one in four active funds exceeded the average of their passive rivals during the 10-year period ending in June 2022.

Success rates of active fund managers by categories

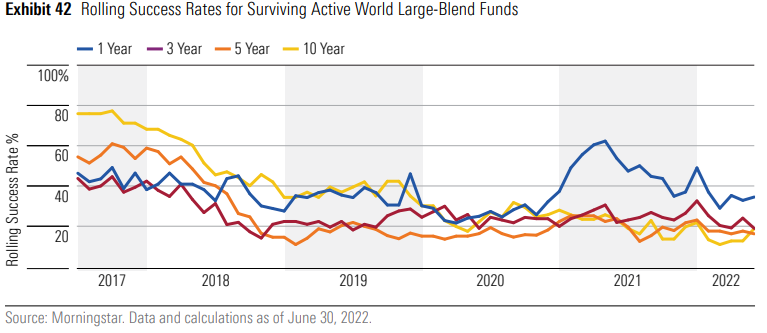

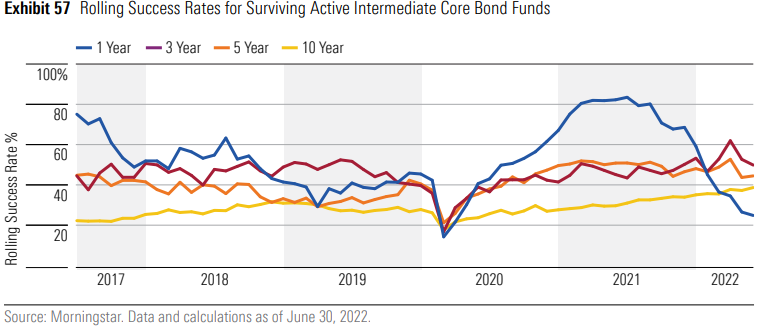

Long-term success rates were generally higher among foreign equity, real estate and bond funds, and lower among large U.S. equity funds.

Cheaper investment funds are more successful than the more expensive ones (32% success rate versus 19% success rate) during the 10-year period ended June 30, 2022.

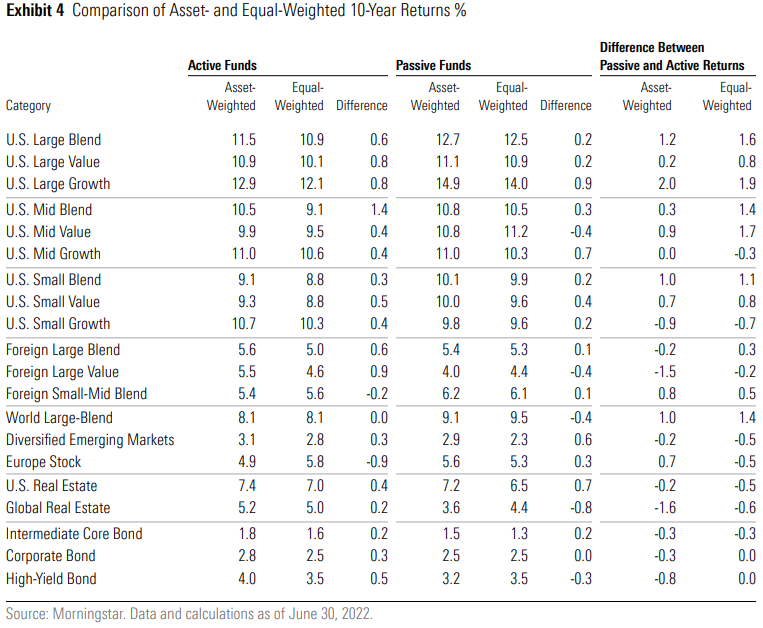

Over the past 10 years, investment returns in passive funds has exceeded that of average active funds in 18 of the 20 categories analyzed and 13 of the 13 U.S. categories.

Comparison of average 10-year annual returns between active and passive funds by categories

This means that investors have favoured the cheapest and highest quality investment funds.

The cheapest funds tend to have the greatest advantage over the more expensive funds in market segments with relatively high commissions.

In 2022, U.S. exchanges and bond markets were buffeted by economic, geopolitical and logistical disruptions.

However, most active funds were unable to capitalize on what was expected to be a market that could favor the choice of securities.

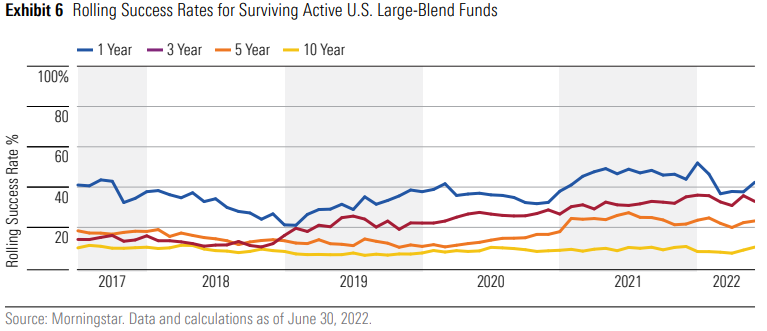

Only 40% of the funds active in the 20 Morningstar Categories included in the analysis survived and exceeded their average passive funds in the 12 months to June 2022, which is lower than the 47% success rate of funds active in calendar year 2021.

Morningstar also publishes a parallel evaluation version of European investment funds.

Access here: