The investment watch marks the investments that benefit the most depending on the stage of the economic cycle

The profitability rates of the main assets are quite different at each stage of the

And the same is true for the main asset subclasses

With regard to the stock market, the sectors also have different behaviours

Differentiation that is also evident in terms of factors or styles of investment in the stock market

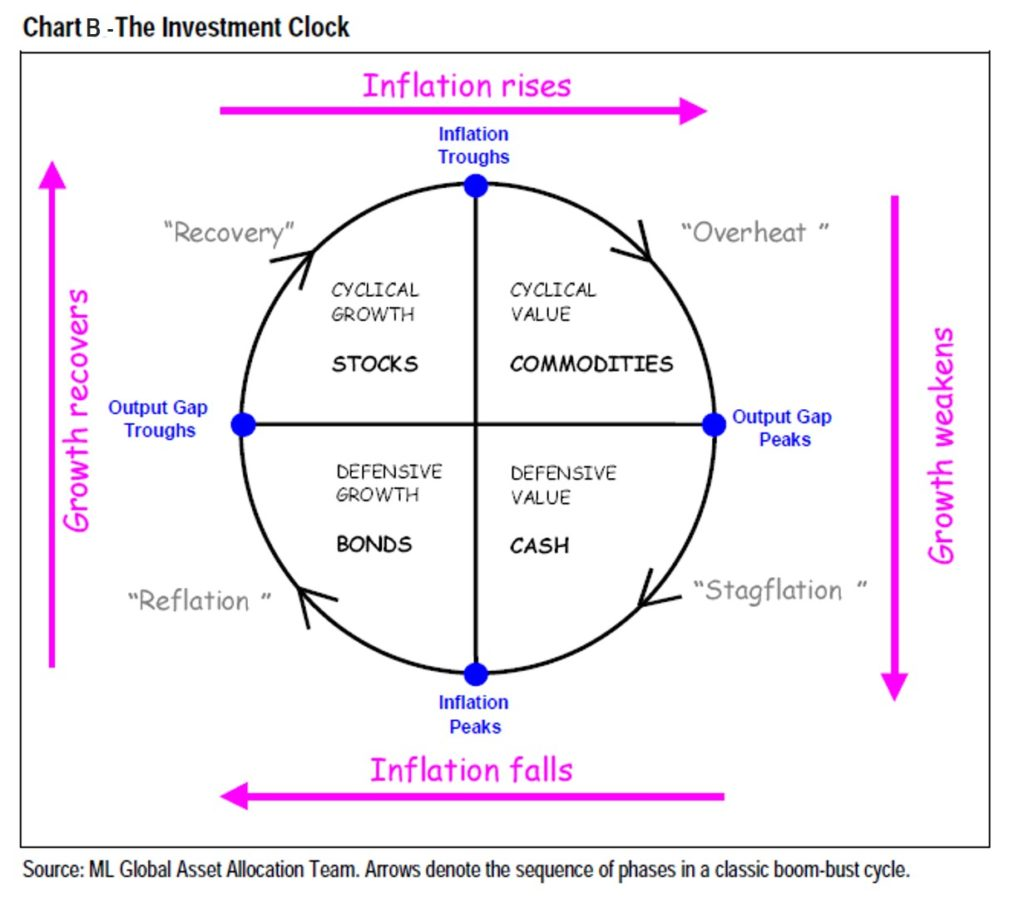

The investment watch marks the investments that benefit the most depending on the stage of the economic cycle

Asset classes have different behaviour stemming from the phases of the economic cycle, taking into account, inter alia, movements and levels of GDP growth and inflation rates.

Therefore, the well-known investment clock establishes four stages of the economy to which preferred investments correspond:

In the first quadrant up and to the right, which corresponds to the situation in which inflation increases and growth decreases, the preferred investment is cyclical value with emphasis on commodities or raw materials, at a stage of economic overheating.

Turning clockwise and in the second quadrant, which illustrates the situation of lower growth and rising inflation, known as stagflation, the privileged investment should be liquidity in a phase of defensive value.

Moving into the third quadrant, marked by a decrease in inflation and recovery in growth, known as the reflation phase, the appropriate strategy is defensive growth favoring bond investments.

In the fourth and final quadrant, characteristic of synchronized rise in inflation and growth, called recovery, it is the context of cyclical growth that favors investment in stocks.

All economic cycles go through these four phases with greater or lesser duration and intensity.

These phases arise and result from the combined behaviour of various economic actors, families, businesses and governments (including those responsible for fiscal and monetary policies.

Contrary to what it may seem, it is very difficult to guess and anticipate these phases of the cycle with use for investments.

We can, like professionals, make small adjustments to the portfolio, but it is not worth making major changes to consider the most appropriate investments at any given time.

Drastic changes do not work and usually come out of time, either too early or too late.

Therefore, this reality reinforces the idea, value and importance of diversification, because it only allows to navigate correctly throughout the cycles, combined and in association with rebalancing.

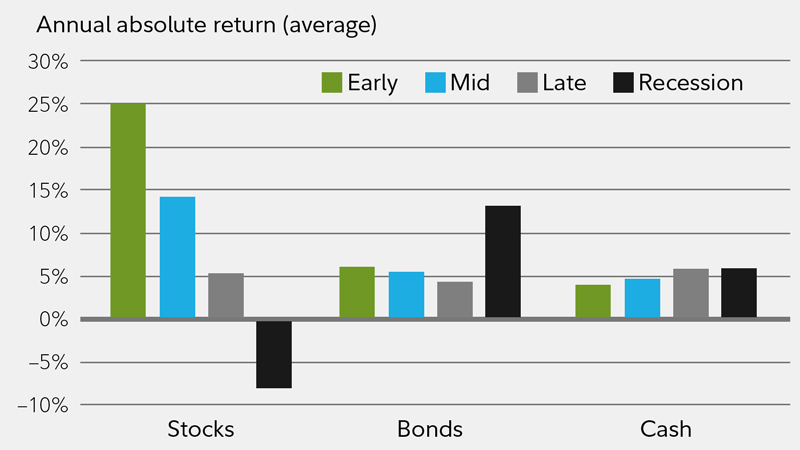

The rates of return of the main assets are quite different at each stage of the

Fidelity conducted a study of the profitability of the three main assets over these four phases for the US between 1962 and 2014 concluding:

In the recovery, stocks are the outstandingly higher asset, with average annual returns of 25%, compared to 6% of bonds and 4% of liquidity.

In recession, the best asset is bonds with returns of almost 12% per year, followed by liquidity, with stocks performing negatively between 5% and 10%.

In the intermediate phases of the cycle, stocks are better in the middle of the cycle and liquidity is more profitable before the recession.

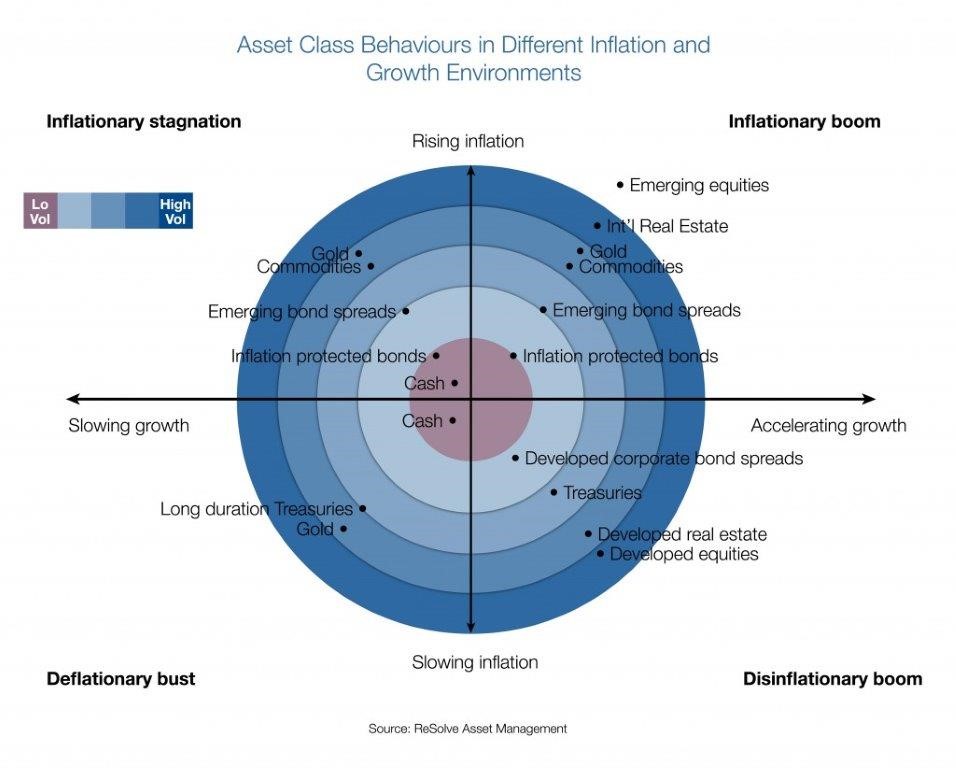

And the same is true for the main asset subclasses

Further deepening the most favored investments in each of these 4 phases, looking from the center to the periphery are (underlining that the quadrants are positioned differently from the previous graph):

During overheating (1st quadrant), the investments that normally perform best are, in addition to commodities and raw materials, inflation-indexed bonds and emerging economies’ bonds.

In the stifle phase (4th quadrant), in addition to liquidity, the most profitable investments are bonds in general and real estate.

Over the course of deflation (3rd quadrant), the investments with the highest profitability are long bonds, along side liquidity.

In the recovery (2nd quadrant), the investments with the best performance are bonds, stocks and real estate.

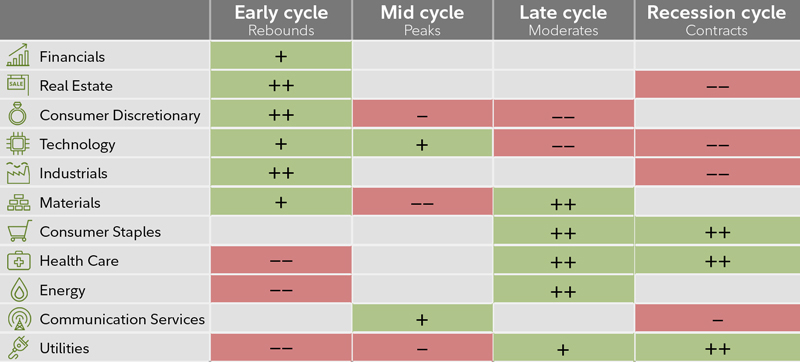

With regard to the stock market, the sectors also have different behaviours

In the same Fidelity study mentioned above, we also investigated which sectors of the best performing actions in each phase:

In the recovery the sectors with the highest profitability are real estate, durable consumer goods and industry, then followed, financial, technology and raw materials.

The worst performing sectors are health, energy and utilities.

During the recession the most protected sectors are consumer goods, health and public services, while the hardest hit are real estate, technology and telecommunications.

The end-of-cycle phase is not much different from the recession that precedes it.

In the middle phase of the cycle, the highest returns are in technology and telecommunications and the lowest in raw materials, durable consumer goods and utilities.

Differentiation that is also evident in terms of factors or styles of investment in the stock market

In a recent study, Russell Investments looked at the profitability of investment factors or styles throughout the various phases of the economic cycle between 1957 and 2020.

The phases are determined by the combination of two factors, the economic growth measured by the ism level above 45 and growing or not, and the average rate of inflation assessed by its quarterly value compared to the previous 3 years:

The results were as follows:

Of course, the best performing investment factors are momentum in the acceleration and expansion phase, and quality and value factors in the deceleration and recession phases.

It should be noted that in the most recent period the value factor lost weight in recessive phases, especially quality.

The market or beta factor is positive at all stages of the cycle except in the recession, and especially in recovery or recovery.