Today we can easily invest as the largest Sovereign Wealth Fund in the world, the Norges Oil Fund, an example of successful diversification and capital appreciation, by investing in the main stock and bond market indices in line with the composition of Global Market Portfolio

The allocation is also very aligned with the composition of some of the world’s major indices

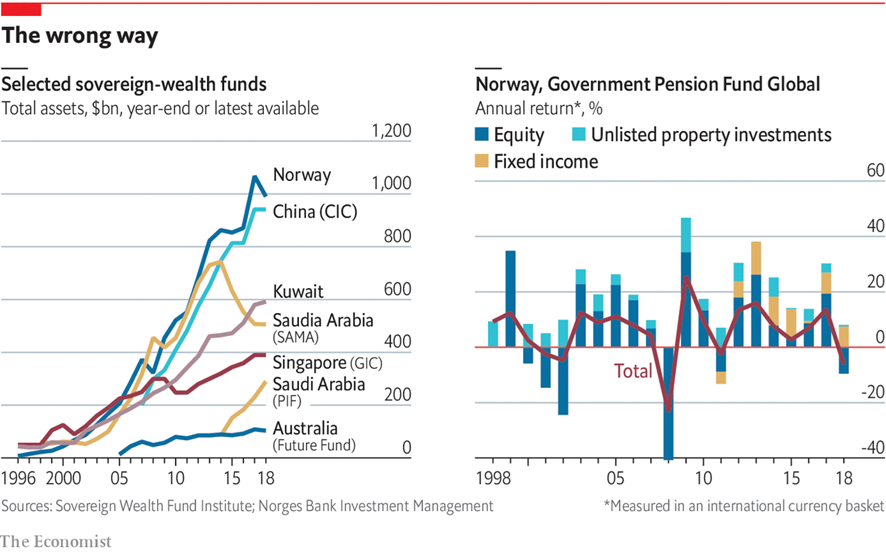

Norges Oil Fund (NOF) is the world’s largest sovereign wealth fund, with assets under management more than €1Trillion

The Government Pension Fund Global, also known as Norges Oil Fund (NOF), was created in 1990 to invest surplus revenues from the Norwegian oil sector.

It has more than $1 trillion in assets, including 1.4 percent of global equities, being the world’s largest sovereign wealth fund.

The objective of the fund is to ensure responsible and long-term management so that the wealth created benefits current and future generations.

The fund is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on behalf of the Ministry of Finance.

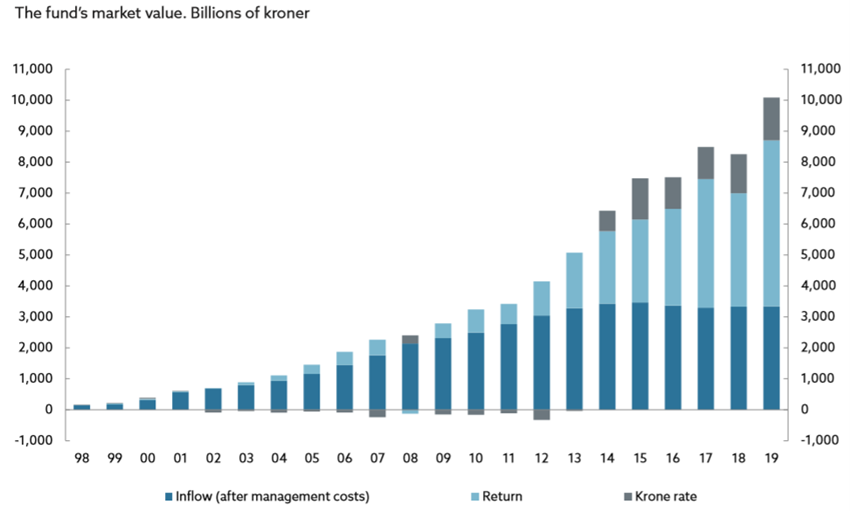

The growth of the Norges Fund has been extraordinary over the past 20 years, benefiting from a medium- and long-term investment strategy based on income compounding and broad diversification

Although revenue stemming from oil and gas production is transferred to the fund, these inflows represent less than half of the fund’s value.

This result is due to a medium-term investment strategy that benefits from income compounding over time.

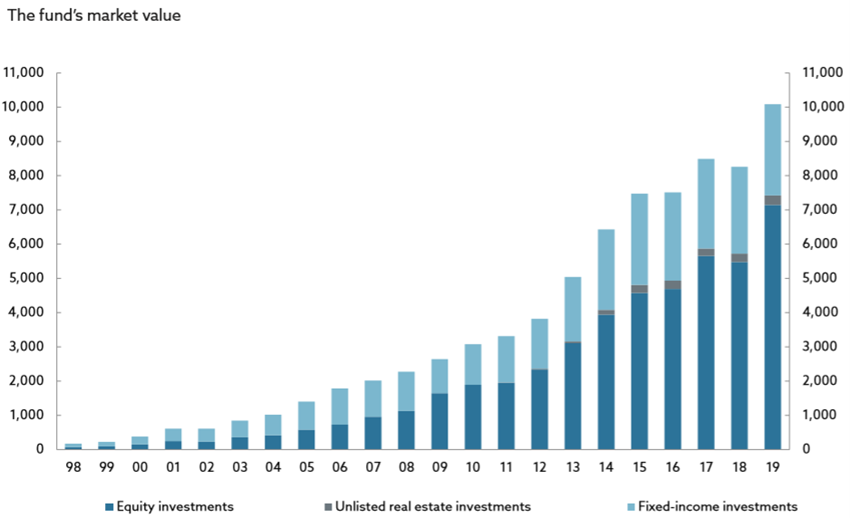

Most of the growth was achieved through financial investments in stocks, bonds, and real estate.

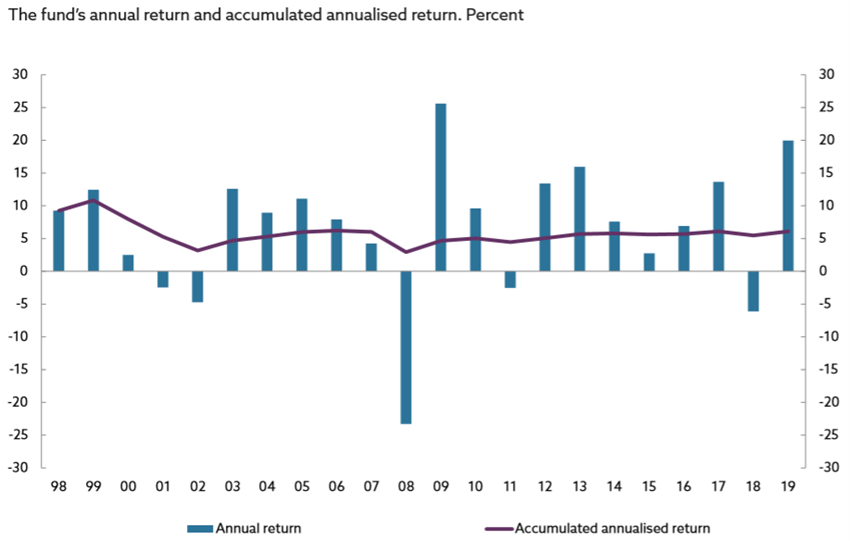

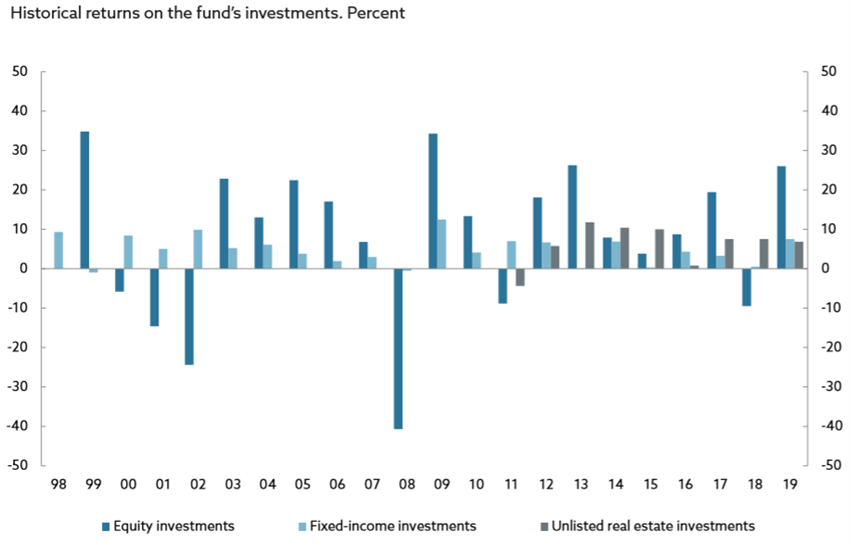

Norges’ profitability over the years has been very interesting, and aligned with the medium and long-term returns of the 3 large asset classes in which it invests

Norges has achieved annual returns in line with the valuations of global financial markets.

Annual returns fluctuate according to markets, and cumulative annualized returns over time are between 5% and 10%, even in a period of two financial crises: the tech bubble and the major financial crisis.

Annual returns are like those of global stock and bond markets.

The returns of investment in the stock markets have been the highest in average terms, around 10% per year, but subject to greater volatility especially in periods of crisis or economic cycle reversal (with annual devaluations reaching 40% in 2008). Average returns on investment in bond markets are more moderate, around 5% per year, but rarely negative (only in 1999).

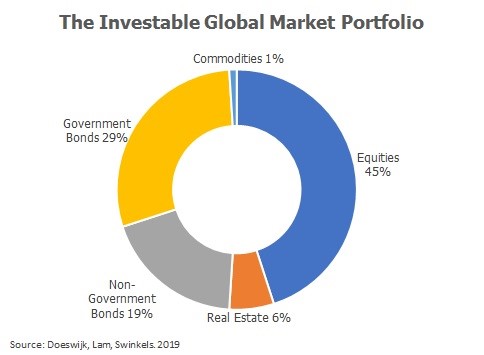

The Fund’s investment policy is quite detailed, being an example of financial diversification, and being very aligned with the Global Market Portfolio

Norges makes broad diversification the basis of its investment policy, as stated on its website:

“The fund is one of the largest funds in the world, owning almost 1.5 percent of all shares of listed companies in the world. This means that we have stakes in about 9,000 companies worldwide, which entitles us to a small portion of their profits each year. In addition, the fund has hundreds of buildings in some of the world’s major cities, which generate income for us. The fund also receives a steady stream of loan income to countries and companies. By spreading our investments widely, we reduce the risk of the fund losing money.”

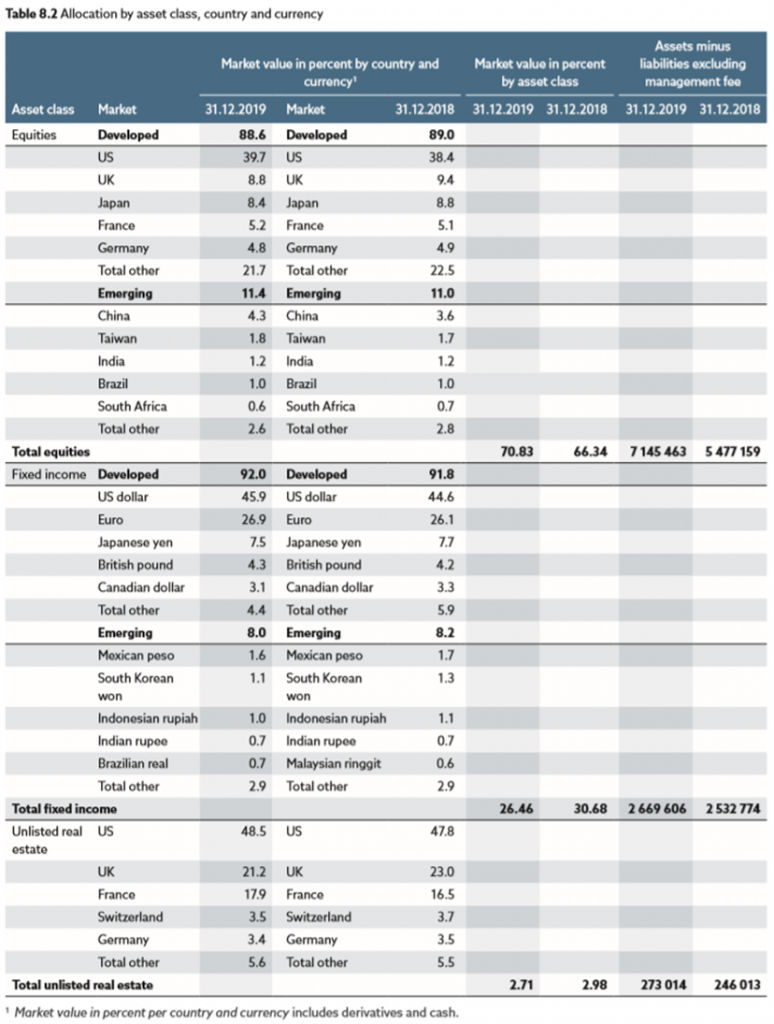

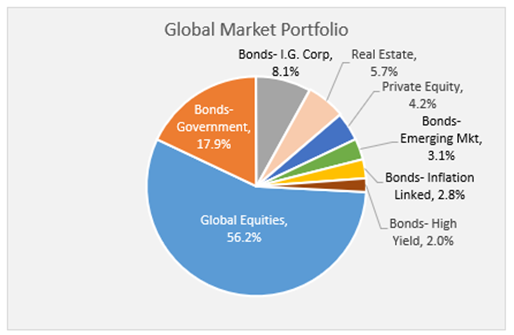

The allocation by asset class and the diversification of investments are very aligned with the Global Market Portfolio.

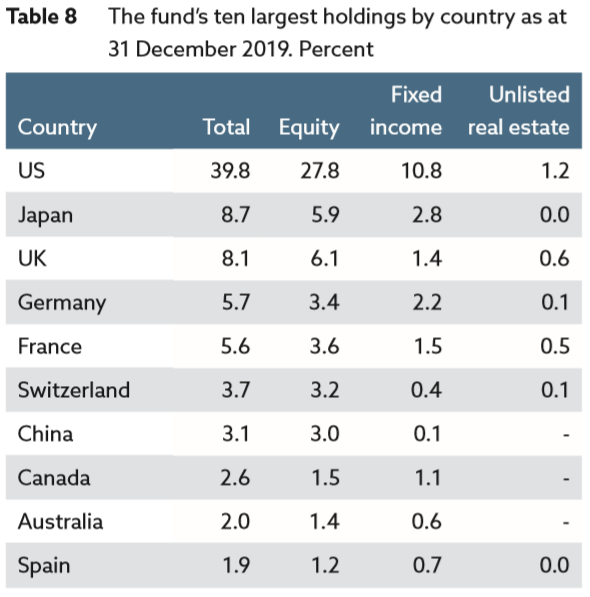

This reality is summarised in the Fund’s top 10 investment positions:

Como também na alocação por classe de ativos mais detalhada:

We can prove that the composition of Norges’ asset allocation is very much aligned with the latest in the Global Market Portfolio, either in its most general version:

And also, in its most detailed version:

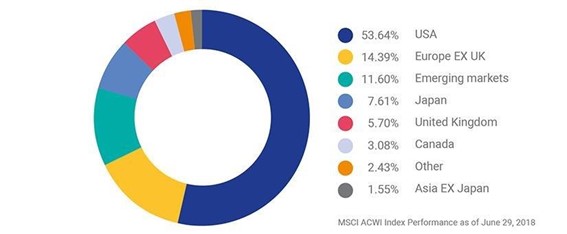

The allocation is also very aligned with the composition of some of the world’s major indices

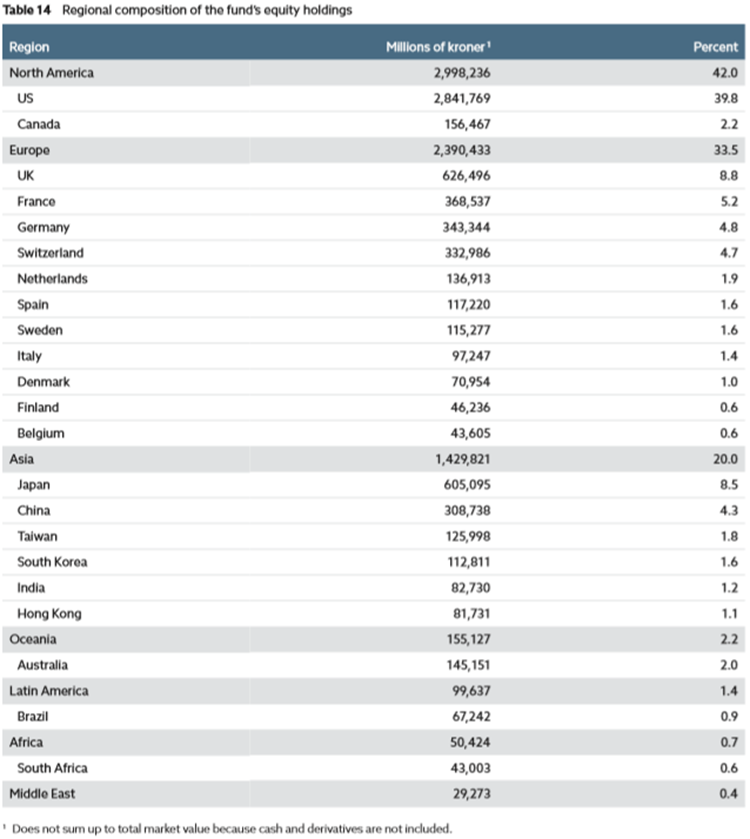

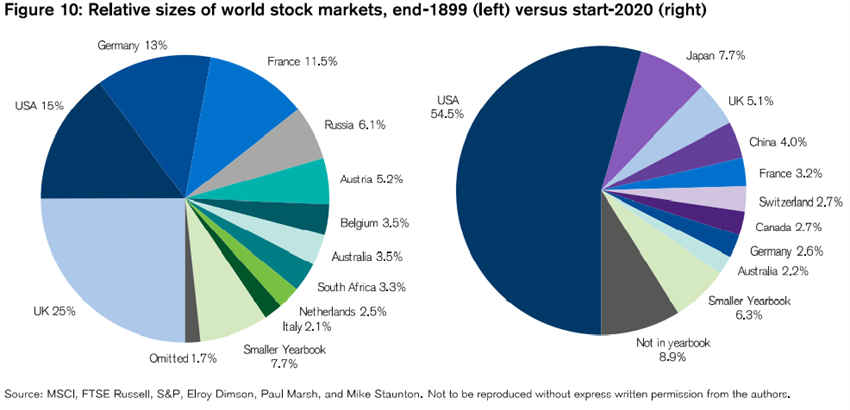

In addition, Norges’ investment allocation by asset class is also closely aligned with the geographic weight of each market in world markets.

For equities their distribution of investments is as follows:

Which is not much different from the composition of global stock markets, or one of the major indices of global stock markets, the MSCI ACWI (All Country World Index):

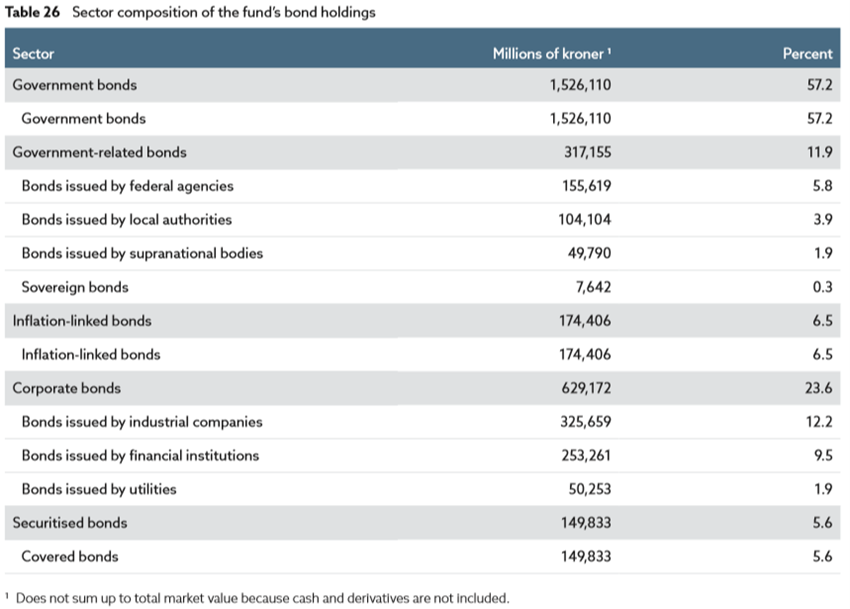

For investments in bond markets the distribution is as follows in terms of the nature of the issuer or type of issue:

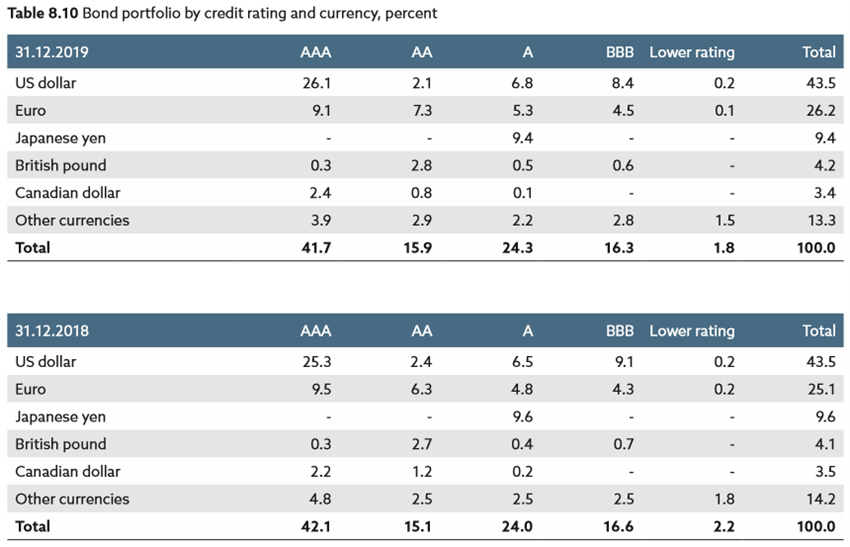

And the following in terms of credit rating and currency:

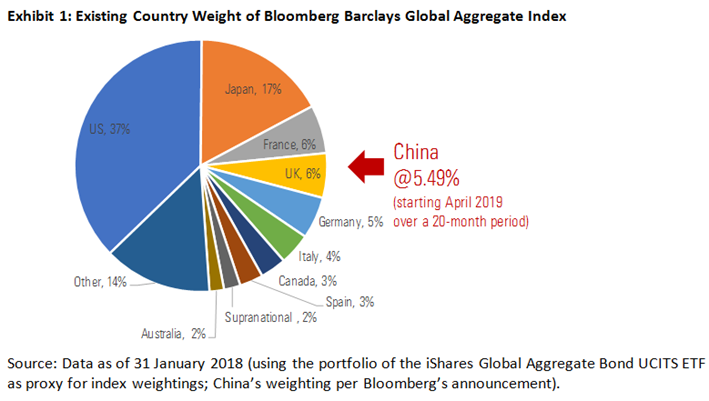

This distribution of investments is also not much different from that of one of the world’s major bond market indices, the Bloomberg Barclays Global Aggregate Bond:

Today, individual investors are already able to replicate the Fund’s investments very simply and with few investments. So, what are we waiting for?

Moral of the story: Norges is a successful case of appreciation of invested capital and an excellent example of medium and long-term investment methodology or process, in terms of asset and market allocation and investment diversification. The best thing about this case is that today we have at our disposal the funds or indexed investment products that allow us to adopt and replicate Norges’ investments.