What is the Global Market Portfolio?

The Global Market Portfolio is the investors starting point, the base reference and the central allocation

The main advantages of the Global Market Portfolio

What is the current Global Market Portfolio and how do you obtain it?

The evolution of the Global Market Portfolio over the years

What are the operational investments aligned with the global market portfolio?

How to adjust it to our personal case?

How can we replicate it and how much does it cost us?

What is the Global Market Portfolio?

The Global Market Portfolio is an approximation of the value, composition and distribution of the weights of the various major classes and subclasses or segments of financial assets in the world capital markets.

This portfolio reflects the current market value or capitalization of global financial assets. It is the investment portfolio of the average investor, the statistical financial or the economic and rational being.

It is the aggregate portfolio of all investors, where the portfolio weights indicate the constitution of the average portfolio.

The Global Market Portfolio is the investors starting point, the base reference and the central allocation

The multi-asset global market portfolio contains important information for strategic asset allocation purposes.

This portfolio shows the relative value of all asset classes according to the global financial investment community, which could be interpreted as a natural reference for financial investors.

To the extent that it represents the global market portfolio, it is the logical and rational starting point for the allocation of investment portfolios of any investor wishing to have a diversified portfolio.

It is on this market reference basis that the investor’s personal restrictions, constraints or ambitions are taken into account that will result in modifications or adjustments to such allocation, namely:

- In individual investors, the consideration of their objectives (interests and needs), as well as their risk profile (financial situation and capacity and risk tolerance);

- In institutional investors, the consideration of regulatory standards and rules, management strategy, business policy, investment methodologies or techniques, such as the risk-based investment strategy and capital consumption weighted returns on banks, solvency ratios and limits on technical reserves in insurance, investment policies mutual funds, or strategies or techniques followed by hedge funds;

In other words, we can consider that the shifts in the allocation of our portfolio to the allocation implicit in the global portfolio of markets have to be explained and justified by some of those reasons or fundamentals.

The main advantages of the Global Market Portfolio

The biggest advantage is to be the central reference, the starting point, the North, the lighthouse for all investors, for which any significant deviations must be explained for strategic or tactical, rational or emotional reasons.

In these terms, it can serve as a reference for the strategic allocation of investors’ assets. As Sharpe (2010) argues, the market portfolio can also be used as a starting point for the construction of portfolios.

One of its other great advantages and source of interest about this portfolio is that, despite the complexity of accurately quantifying these assets in real time, the Global Market Portfolio can be built quite simply using few index funds or investmet products accessible to all investors.

We could always make it much more complex for the purpose of making it more accurate, but simplification has a lot of value when it comes to investing.

In next posts we will address precisely the most relevant indices and the indexed investment products in the financial market.

What is the current Global Market Portfolio and how do you obtain it?

There are several authors who regularly publish studies in which they calculate the global market portfolio.

The best known study was that conducted by Doeswijk, Lam and Swinkels in 2014, updated in 2017 and revised in 2019.

These authors constructed the investable global market portfolio for the period 1990-2012, estimating the market capitalization for the eight asset classes: stocks, sovereign bonds, inflation-indexed bonds, bonds with a speculative rating bonds, emerging market bonds, real estate and venture capital.

For the main classes or asset categories – stocks, government debt, corporate (non-governmental) debt and real estate extended the period to 1959-2012.

They were the first authors to publish this global market portfolio with this level of detail.

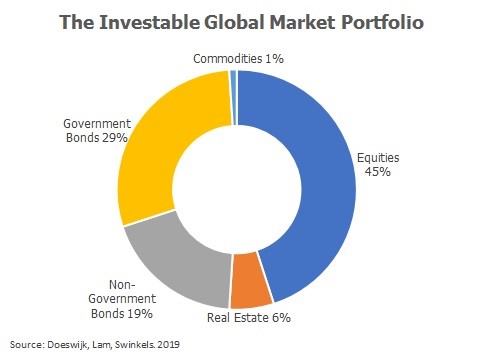

According to the most recent study conducted in 2019, the global market portfolio had the following composition in terms of large asset classes:

The global market portfolio in its most synthetic version, comprising only the main asset classes, consists of 45% of shares, 29% of government bonds, 19% of non-governmental bonds, 6% of real estate and 1% of commodities

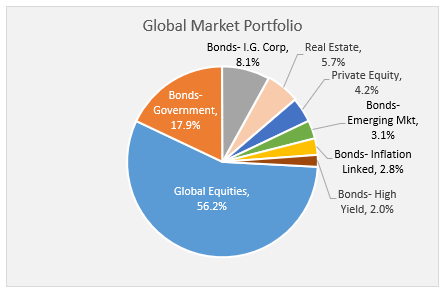

In the same study, the results extended to the main asset subclasses are:

In its more detailed version, which incorporates the various assets subclasses, this portfolio consists of 56% of stocks, 18% of public debt, 8% of bonds with investment rating, 6% of real estate, 4% of venture capital, 3% of market bonds 3% of inflation-indexed bonds and 2% of bonds with speculative rating.

The evolution of the Global Market Portfolio over the years

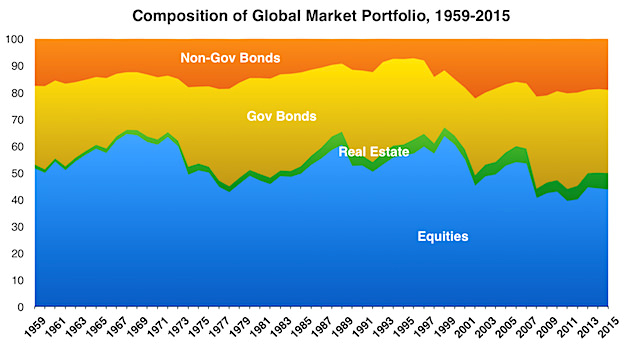

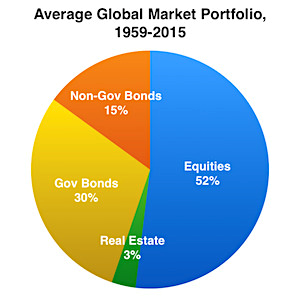

n order to avoid errors and deviations from the focus in a single year and arising from cyclical asset performances and misaligned with the long-term average, it is relevant to take into account allocation over a long period of time and the respective average.

The global market portfolio evolved as follows between 1959 and 2015:

In this period, the average allocation of the global market portfolio was as follows:

What are the operational investments aligned with the global market portfolio?

From this high level of distribution composition by the main asset subclasses we can deepen and develop their unfolding fundamentally in relation to the most representative subclasses, i.e., stocks and sovereign and non-governmental investment rating bonds.

This level of detail allows operationalizing the investments to be made.

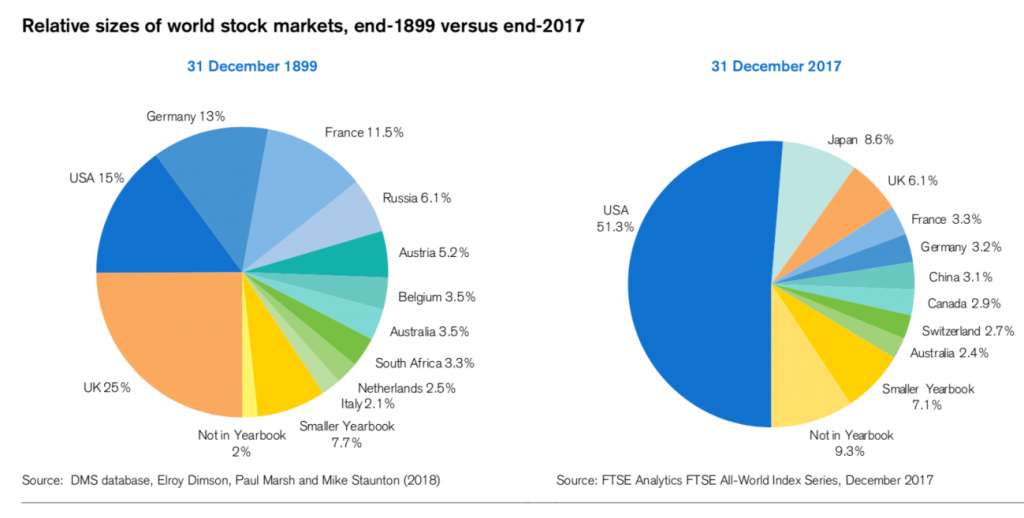

For this purpose, in terms of the stock markets, it is important to know their composition in geographical terms.

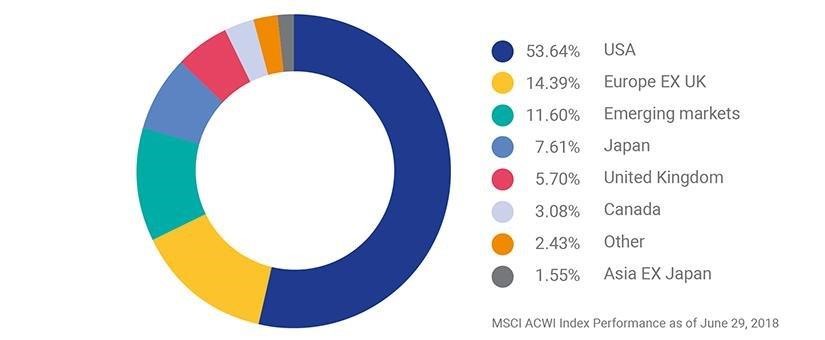

The best references are those updated annually by Credit Suisse in its Global Investment Returns Yearbook (GIRY) and the composition of the main index of the global stock market, the MSCI ACWI (All Country World Index):

Regarding stocks, the MSCI ACWI (All Country Word Index) world index has the following geographical composition:

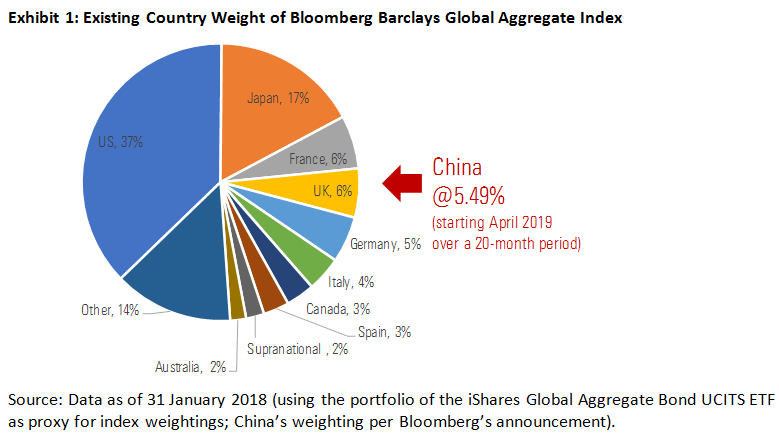

Regarding bonds, the Barclays Global Aggregate global index shows the composition of public and private investment rating debt securities:

How to adjust it to our personal case?

The adjustments of the allocation of the global market portfolio to our personal case are those that result from tuning the investment term of the objectives and the risk profile:

- The longer the investment period the higher may be the composition of assets with higher risk, but also higher returns, i.e. increased weight of stocks by reducing bond yields;

- The allocation of an average investor represents a balanced profile, the central between the common distribution of 5 profiles: conservative, moderate, balanced, dynamic, aggressive. If we are more risk-averse or intolerant, we need to reduce exposure to stocks by increasing bonds, and vice versa if we are less risk-averse or more risk tolerant.

How can we replicate it and how much does it cost us?

As we have seen, one of the advantages of this portfolio is that we can replicate it exactly or with the adjustments arising from our preferences with investments in index products.

We reaffirm that in next posts we will cover the main indexes.