Several studies indicate that the financial advisor has a value between 1.5% and 4% per year

The three major areas of value creation by the financial advisor are portfolio building, financial planning and emotional support and monitoring

Before we show the studies’ results, it is important to frame this matter in all the services provided.

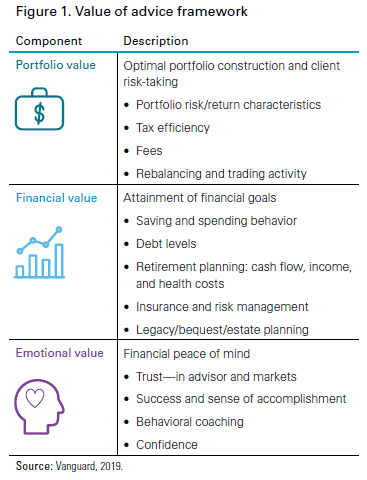

According to Vanguard there are three main areas of value creation by the financial advisor:

- Portfolio building value associated with the construction of an optimal portfolio aligned with the risk preferences of clients (including the risk and return characteristics of the portfolio, tax efficiency, commissions, rebalancing and rotation).

- Financial planning value directly linked to the ability to achieve financial objectives (including savings and spending behaviours, debt levels, retirement planning in terms of cash flows, income and health costs, insurance and risk management and inheritance planning).

- Emotional value measured by behavioural management resulting from trust in the consultant and in the markets, in the success and sense of achievement, behavioural training and self-confidence.

Several studies indicate that the financial advisor has a value between 1.5% and 4% per year

There are several studies that indicate that the financial advisor can add between 1.5% and 4% to the annual returns of investment portfolios in the long term.

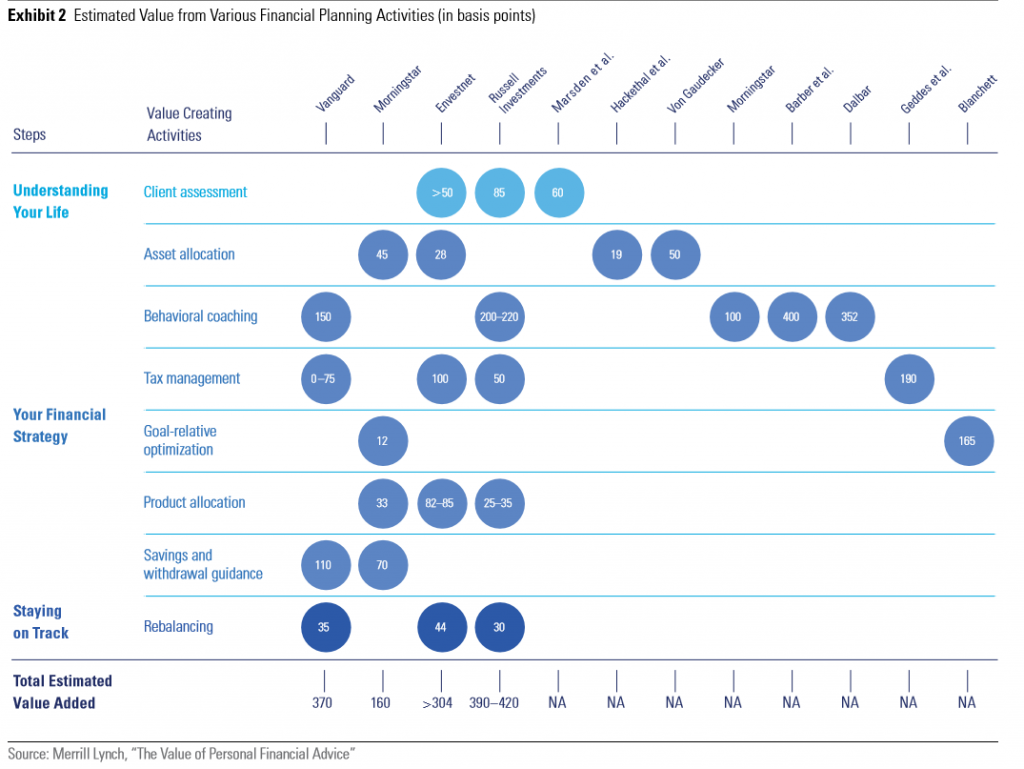

In 2016, Merrill Lynch published a document summarising the analyses made by various entities on this matter, decomposing the various activities or services provided:

The sources were diverse, used various methodologies and reached the following conclusions:

- Envestnet, Capital Sigma, The Return on Advice, 2016, estimates advisor value add at an average of 3% per year.

- Russell Investments, Envestnet, Capital Sigma, The Advisor Advantage, 2019, estimates advisor value add at an average of 3% per year).

- Value of a Financial Advisor Update, 2017, estimates value add at more than 4% per year).

- Vanguard, Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha® 2016, estimates lifetime value add at an average of 3%.

- Morningstar Investment Management, The Value of a Gamma-Efficient Portfolio, 2017, estimates value add for a subset of the service identified in this paper at an average of 1.5% per year.

This report shows that the value of the financial advisor’s service ranges from 1.6% per year calculated by Morningstar to the 3.9% to 4.2% estimated by Russell Investments.

According to those studies, the activities in which the financial advisor brings more value in terms of annual returns are:

- The behavioural coaching and advice ranging from Morningstar’s 1% to Barber’s 4%.

- The personalised client assessment varies between Envestnet’s > 0.5% and Blanchett’s 1.65% in objective optimization.

- Savings and withdrawal guidance, between 0.7% and 1.5%.

- Tax management, between Vanguard’s 0.375% and Envestnet’s 1%.

- Asset allocation, between 0.2% and 0.5%.

- Product allocation, between 0.25% and 0.85%.

- Rebalancing from 0.3% to 0.44%.

All 3 areas or activities are important, but the one with the greatest contribution is unquestionably emotional support and monitoring with about 1.5% per year

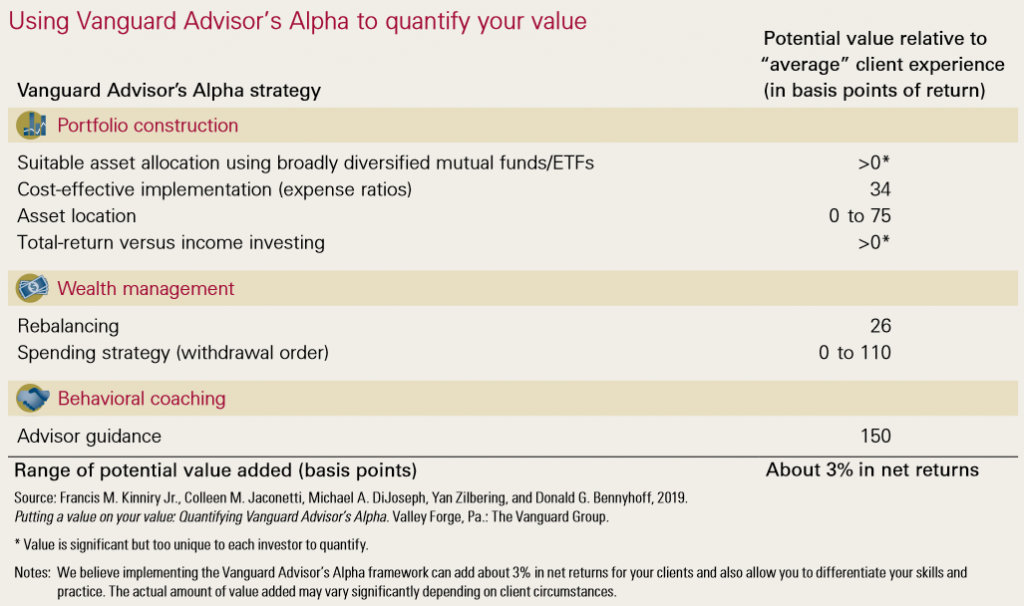

Let’s see in more detail the Vanguard study done in 2019:

This study concludes that the advisor contribution has a value of about 3% per annum, distributed in:

- Up to 1.18% for portfolio construction activities (excluding adequacy of asset allocation and management between total gains and income).

- Up to 1.26% for spending management and rebalancing.

- And 1.50% for behaviour coaching and guidance.

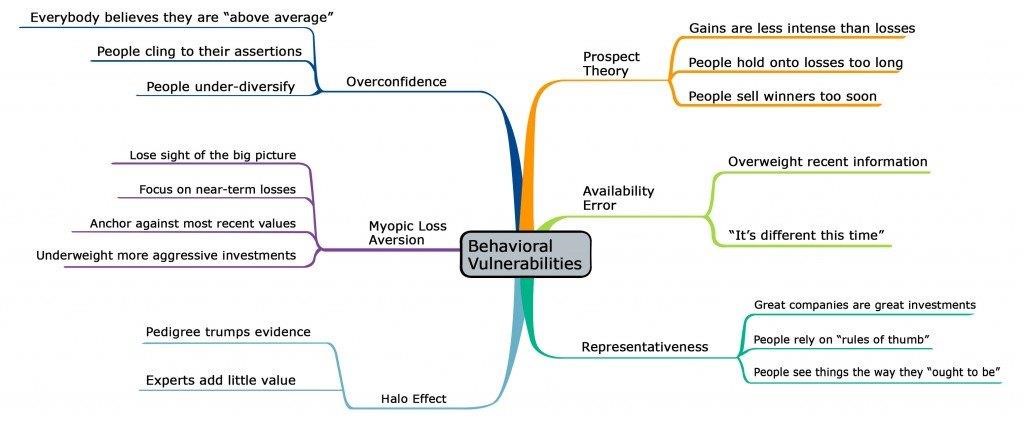

This last aspect of correcting our vulnerabilities and behavioural biases is often disregarded, but as we see it is the most important thing.

We are subject to a lot of information that can instil impulsive attitudes that cost us dearly and that we can only overcome or fight for our benefit with the help of a third party, expert and trusted, and no one is better than the financial advisor:

As we have seen in other posts our main behavioural vulnerabilities are overconfidence, myopia of aversion to loss, ego and wanting to do everything alone, rapid gains and deferred losses, exposure to short-term information or memory, and prejudices of intuition and representativeness.

https://www.cfainstitute.org/-/media/documents/survey/cfa_investor_trust_global_report.pdf