Economic crossroads: growth recovers, inflation falls, interest rates fall, employment resists, but inflation is proving to be stiffer than expected, and tightening may last longer.

Markets crossroads: Stocks and bonds appreciate, with long-term interest rates falling, S&P 500 trades at resistance in narrowband of 3,600 and 4,100 points since October.

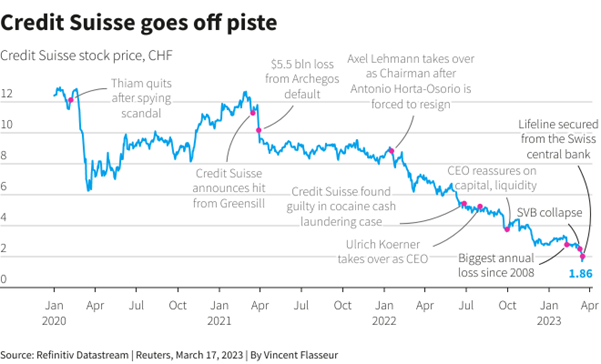

More risks emerge from the financial excesses of the recent past, such as the bank failures in the US and the rescue of Credit Suisse, which will have a disinflationary effect through the contraction of credit, and others will emerge, because there are still some pockets of exaggeration in the markets.

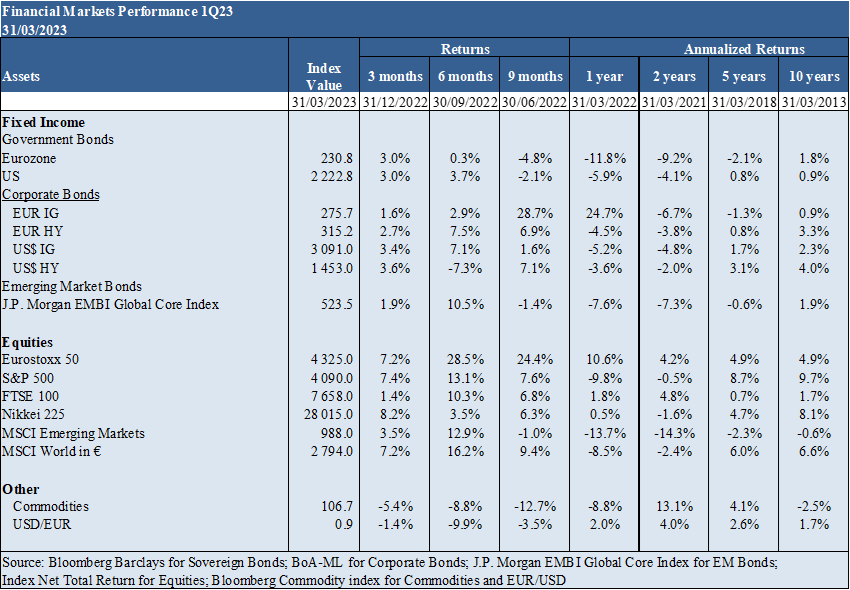

Markets Performance 1Q23: Equity markets rebounded between 7% and 10% in the quarter, led by growth and technology. Bond markets benefit from falling interest rates, and spreads on high-yield bonds are widening, associated with bankruptcies in U.S. banks and the rescue of Credit Suisse

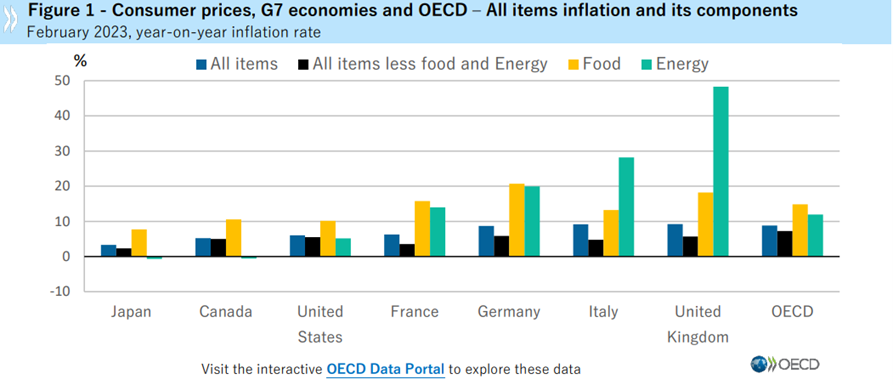

Macro Context: Improved economic growth due to China’s reopening and some inflation. Inflation falls around the world, in a differentiated way, but it is more rigid than predicted by the authorities

Micro Context: Key Instant and Advanced Economic Indicators Improve Worldwide

Economic policies:Restrictive monetary policies of central banks around the world continue with official interest rates rising at a slower pace

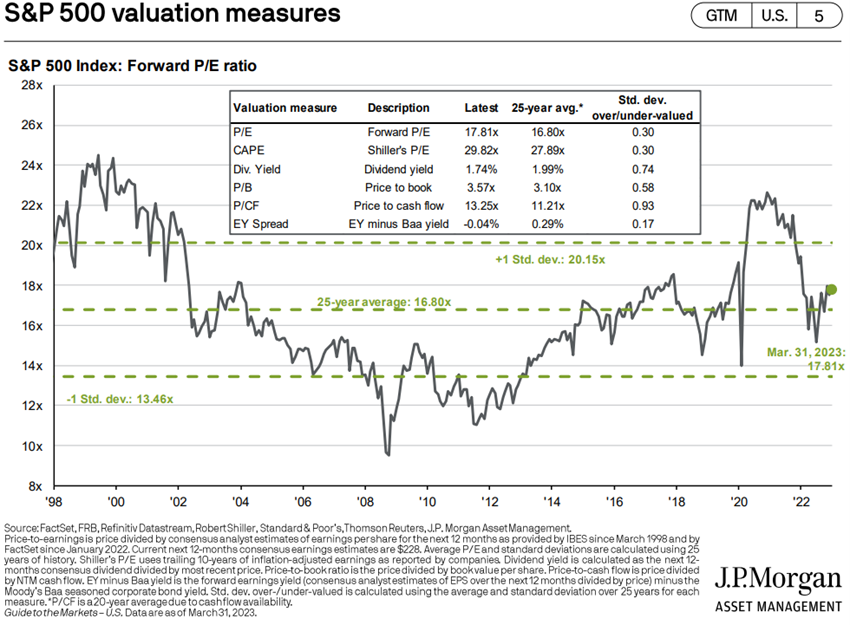

Equity markets: Equity markets rebound between 5% and 10% in the quarter, with the S&P 500 trading in a narrow band of 3,700 to 4,100 points since last October; valuations are still above the level appropriate to the current context of economic slowdown, inflation and interest rates

Bond markets: Bonds benefit from falling interest rates in the U.S. and Europe, but are impacted by an increase in credit risk spreads due to the failures of U.S. banks and Credit Suisse

Key opportunities: Less uncertainty, lower commodity prices, and job resilience and growth in the U.S.

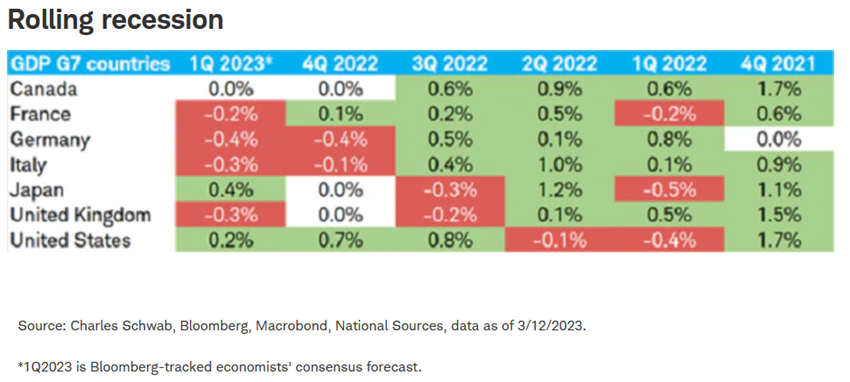

Main risks: Possibility of economic recession in Europe, and emergence of more risks from past excesses, such as bank failures

This phase of changes in the economic cycle and monetary policy privileges the protection of financial assets and defensive investments, in value or dividends stocks, and in medium- and long-term government bonds. Exposure to low-quality rated debt should continue to be avoided.

Financial market performance 1Q23

Equity markets rebounded between 7% and 10% in the quarter. U.S. bond markets benefit from falling interest rates, but spreads are widening in general, especially on high-yield bonds, associated with U.S. bank bankruptcies and the rescue of Credit Suisse

Stock and bond markets recover with falling inflation, China’s reopening, economic resilience in the U.S. and the prospect of an end to rising interest rates.

They improve the prospects for the US to be able to control inflation by avoiding an economic recession.

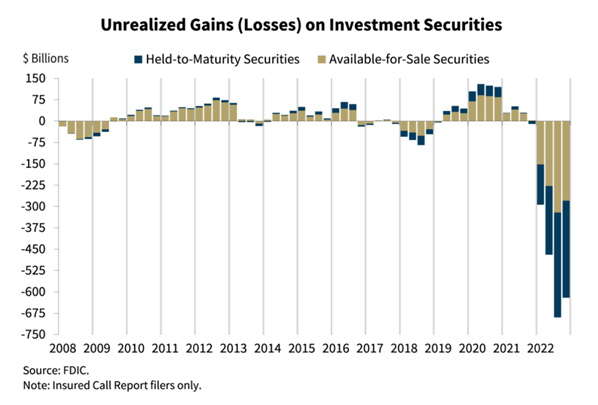

The bankruptcies of Silicon Valley Bank and Signature Bank in the US and the rescue of Credit Suisse in Europe are consequences of the financial excesses of the past and are an example of the vulnerabilities that still exist in the market.

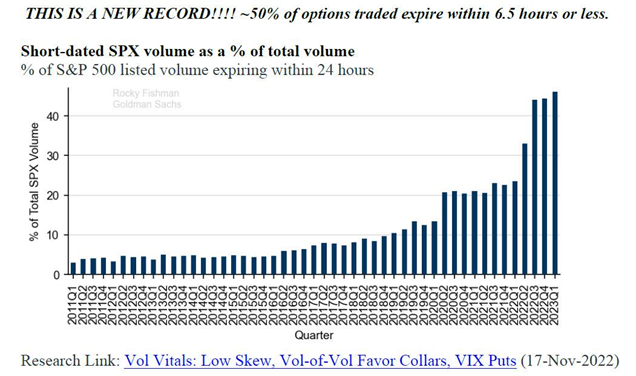

Other recent examples have been the bankruptcy of FTX, the immediate effects of Trusseconomics on sterling and British government bonds, meme stocks, the volume of trading of high-risk or zero-dated options.

Strong rise in the prices of cryptocurrencies, whose prices seem to evolve in counter-cycle with the risks of the financial system.

Macroeconomic context

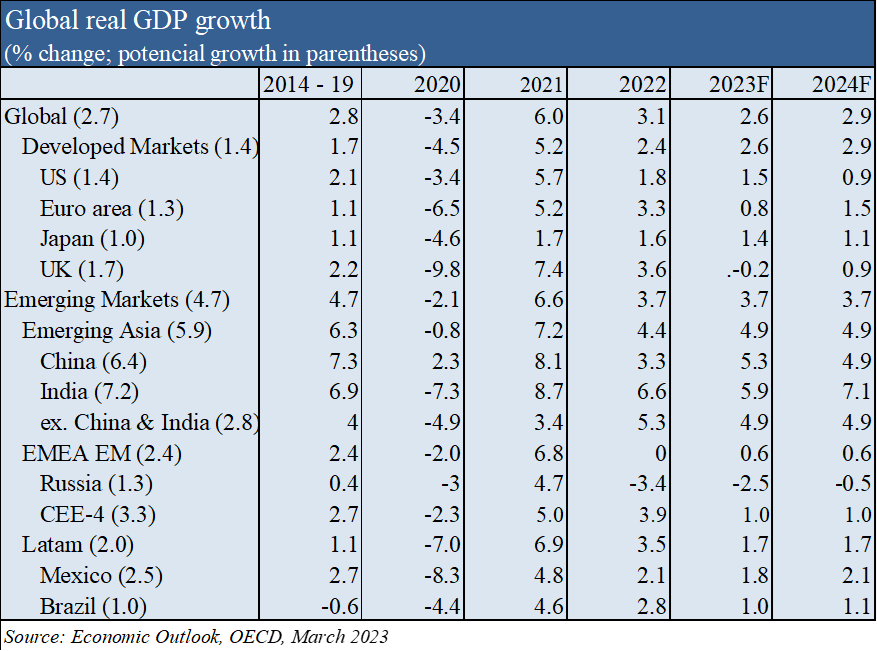

Improved overall economic growth forecasts to 2.6% in 2023 and 2.9% in 2024, and from 1.5% and 0.9% in the US, from 0.8% and 1.5% in the Eurozone, and 5.3% and 4.9% in China in 2022 and 2023 respectively, due to the lower impact on incomes of lower inflation.

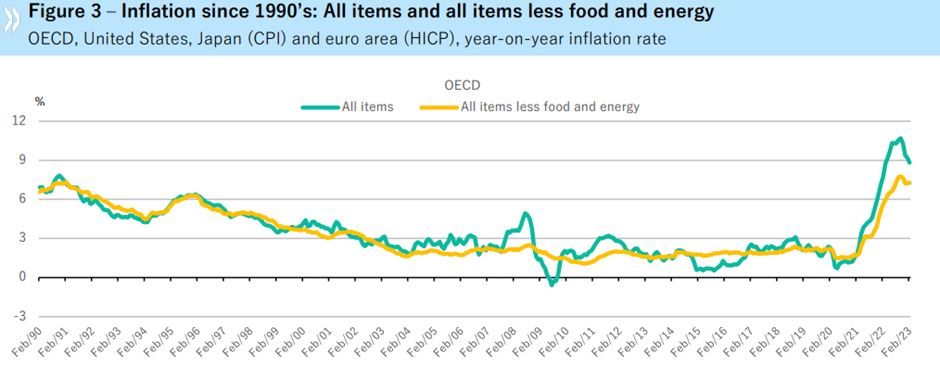

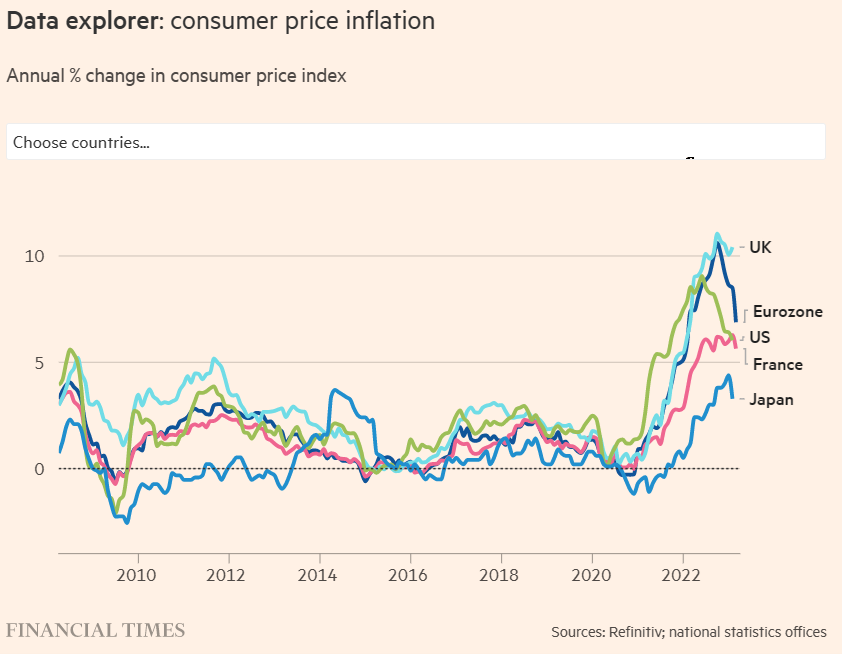

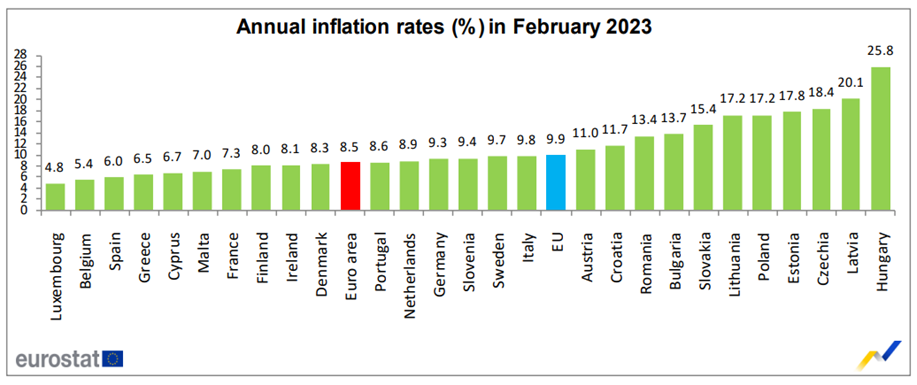

Inflation begins to fall gradually in developed countries, by reducing the price of energy and other goods.

However, core inflation remains high and tighter than expected by the authorities due to service prices, high margins in some sectors and labour market pressure.

According to the OECD, inflation is projected to decline from 8.1% in 2022 to 4.5% in 2024 in advanced countries, with core inflation at 4.0% in 2023 and 2.5% in 2024.

Micro-economic context

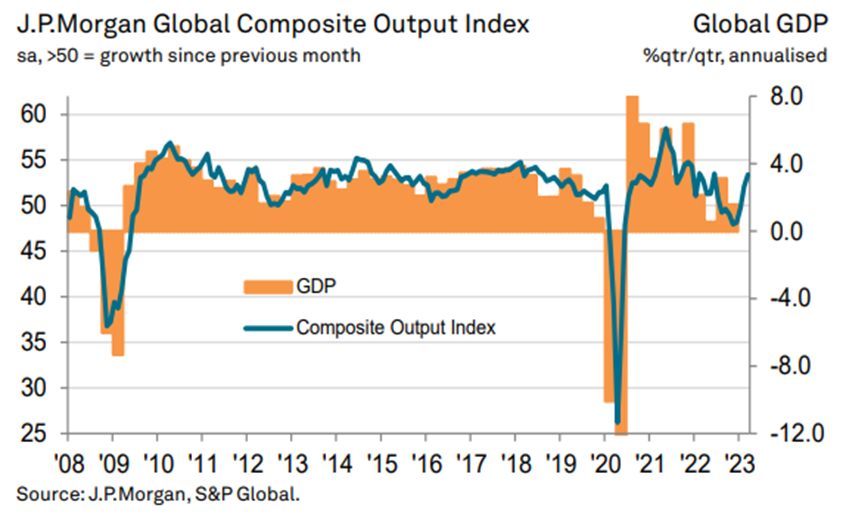

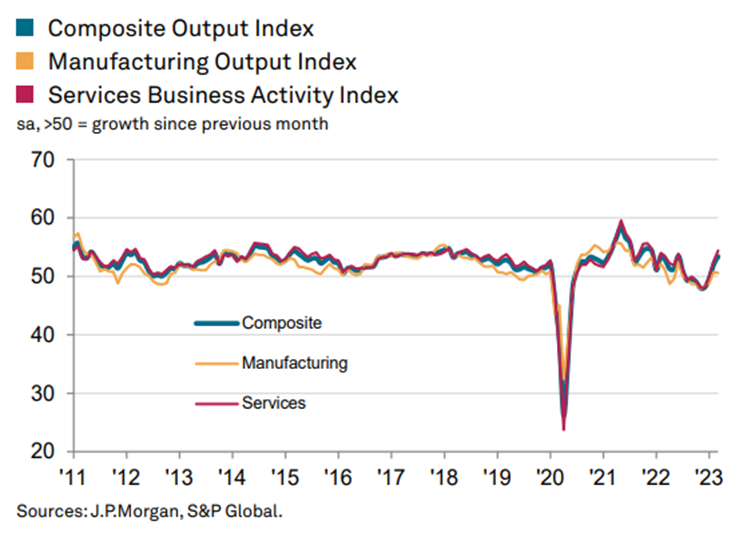

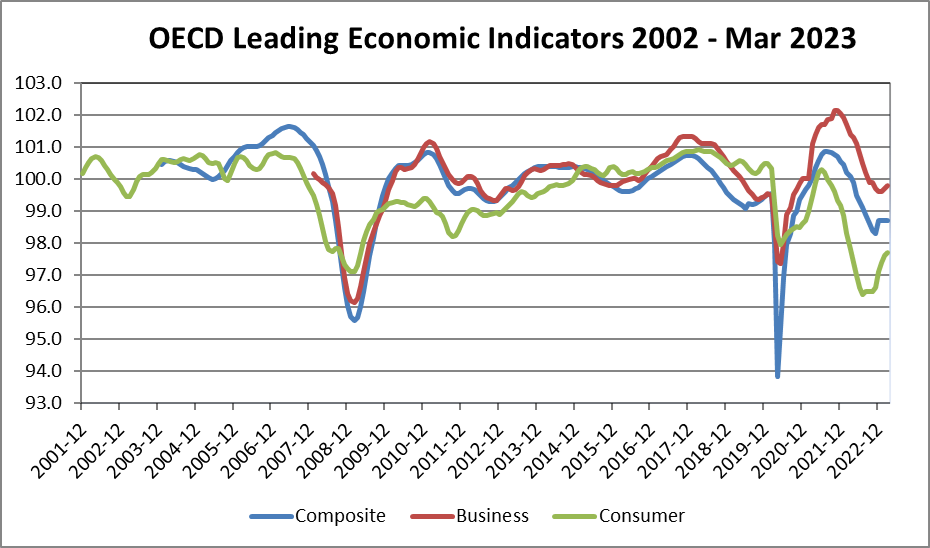

Key Instant and advanced economic indicators improve worldwide

The J.P. Morgan Global Composite Output Index advanced 53.4 in March, higher than February’s 52.1, and the best level in the last 9 months.

This indicator was driven by services, which reached the level of 54.4, the highest in the last 15 months, while the industry remained weak.

India, China, Russia, Spain and Italy recorded above-average growth in economic activity. Japan and the U.S. were below average but hit the highest level in the last 9 months.

The unemployment rate in the U.S. stands at 3.6 percent, levels very close to the lows.

Business and consumer confidence in OECD countries has also improved.

Economic policies

Central banks are determined to fight inflation that is stiffer than expected.

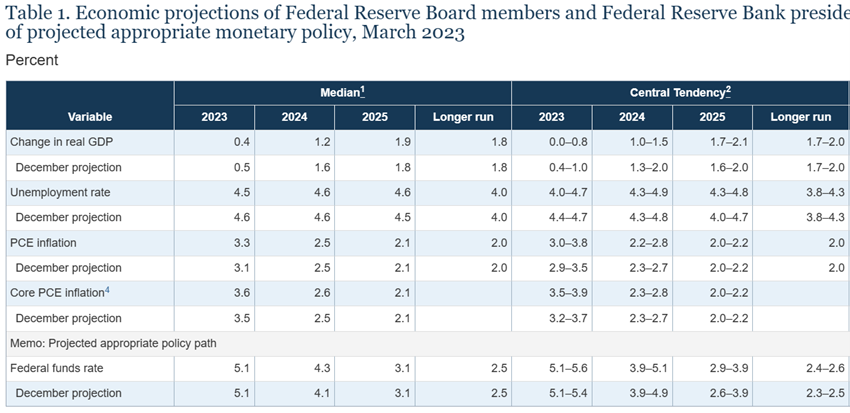

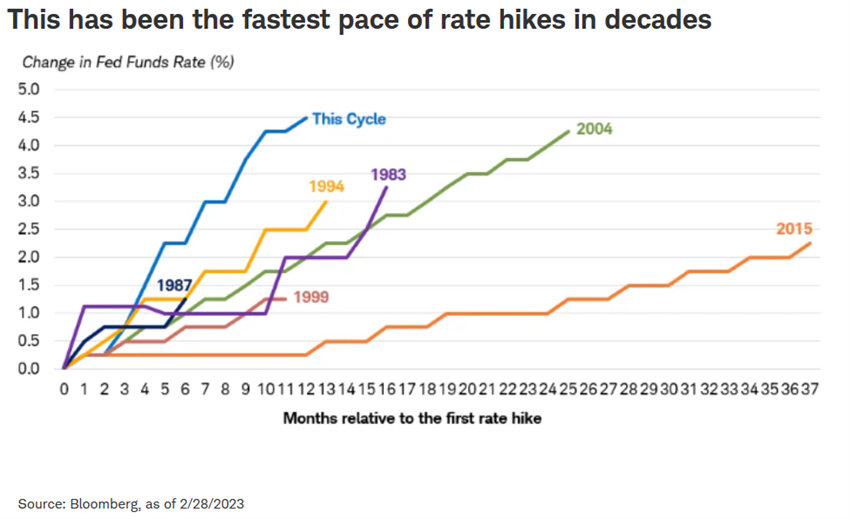

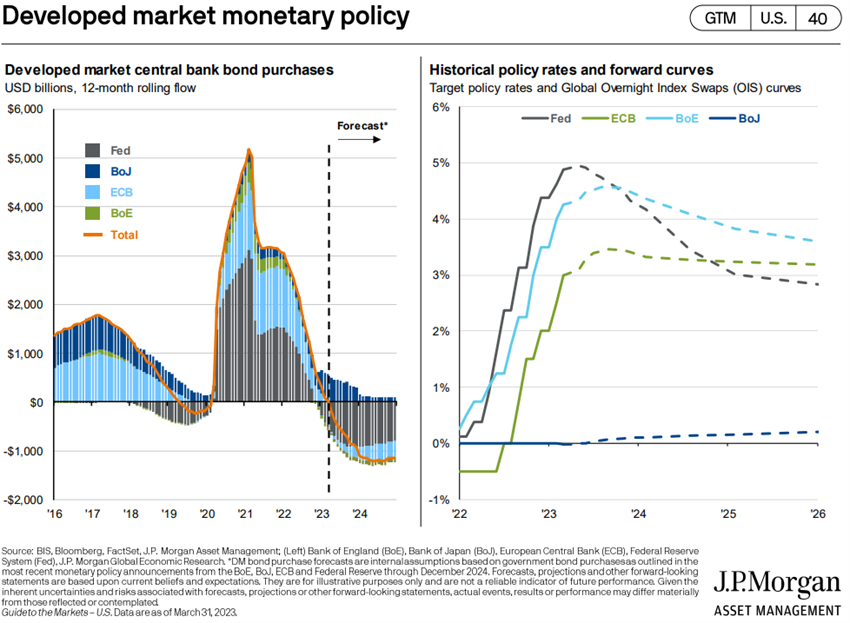

The Fed raised the official interest rate by 0.25% in March, setting it at 4.75%-5.0%, the fastest increase in living memory.

It reaffirmed his firmness in this strategy, contrary to the opinion of many analysts who believe that a pause (or even an inflection) would be more appropriate to safeguard the stability of the financial system and react to the expected disinflationary effect resulting from the contraction of credit.

The Fed’s projections point to this rate rising to 5.1% at the end of 2023, 4.1% in 2024, 3.1% in 2025, and 2.5% longer-term. It admits that unemployment could reach 4.4%.

The Bank of England raised the official interest rate to 4.25%.

The ECB raised the official rate by 0.5% to 3%-3.5% and decided not to reinvest €15 billion per month in bonds due by June. It forecasts inflation of 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

Financial conditions have improved in developed countries and emerging economies

Global financial conditions improved with falling interest rates and market appreciation, and volatility eased.

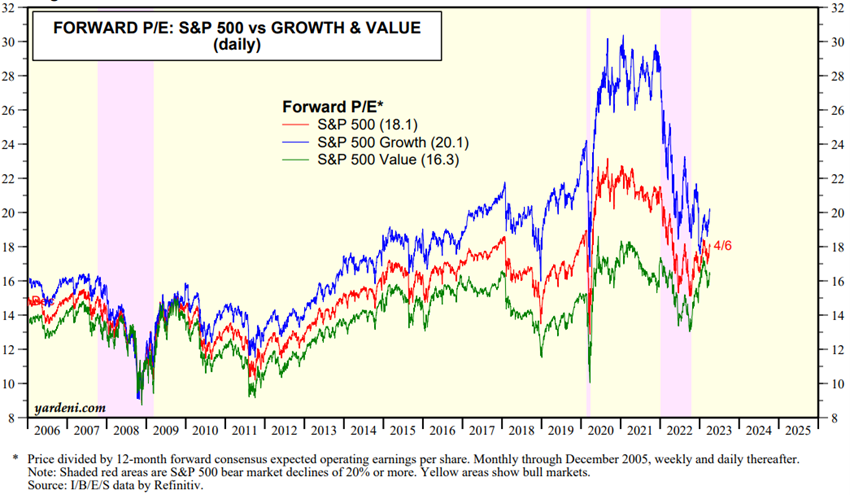

Equity markets valuation

Equity markets rebounded 5% to 10% in the quarter, the second consecutive rise, sending them out of the bear market.

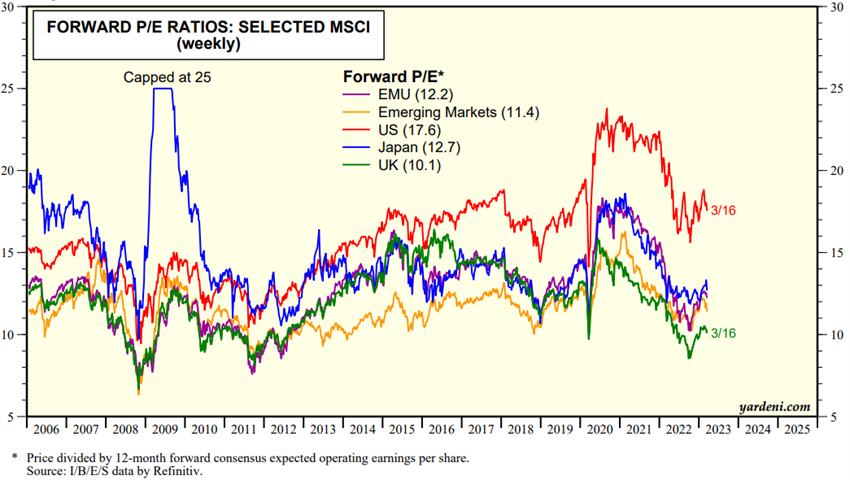

The 17.6x forward PER to the U.S. is above the long-term average.

PERs in the remaining regions fell to 12.2x in the Eurozone, 12.7x in Japan, 10.1x in the UK and 11.4x in emerging markets, below the historical average.

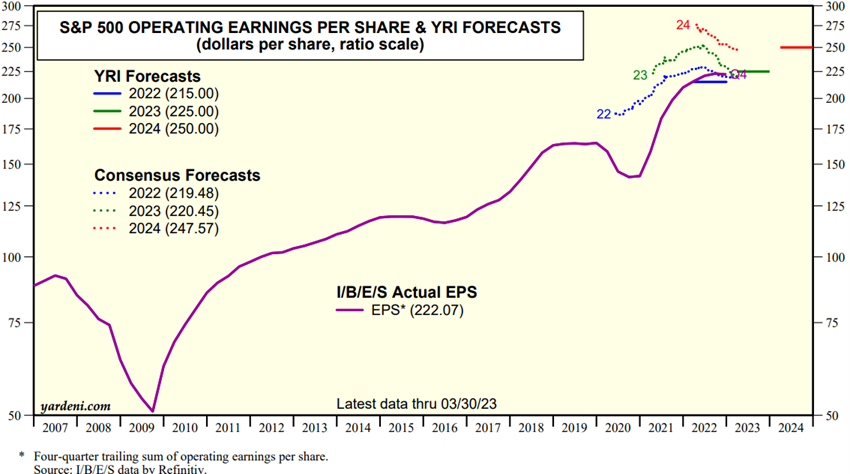

Companies and analysts continue to revise earnings forecasts for the end of the year downward.

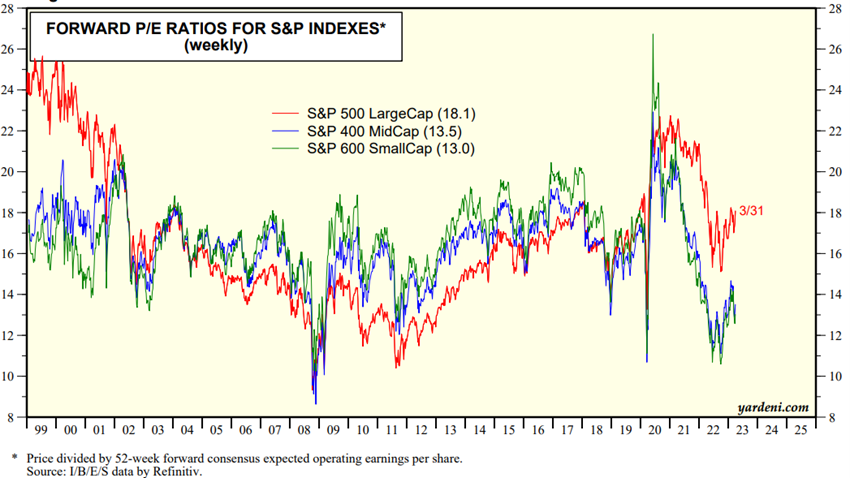

The PER of small- and mid-cap U.S. stocks is about 13.5x to 13x, below the long-term average, while the 28x of mega-caps is far above it.

The PER of U.S. growth stocks is at 20.2x and value at 16.5x, above the long-term average.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, April, 7, 2023

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, April, 3, 2023

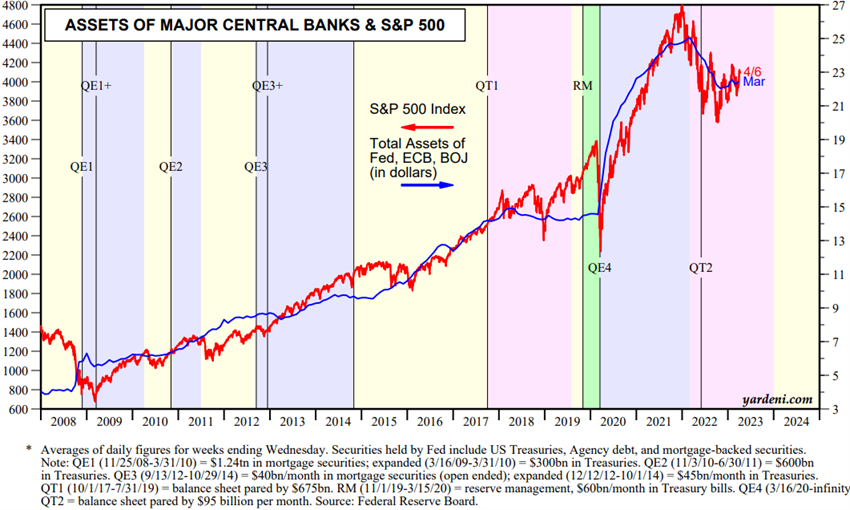

Source: Major Central Bank Total Assets, Yardeni Research, April, 7, 2023

Source: Style Guide: LargeCaps vs SMidCaps, Yardeni Research, April, 4, 2023

Source: Style Guide: Style Guide: S&P 500 Growth vs Value, Yardeni Research, April, 7, 2023

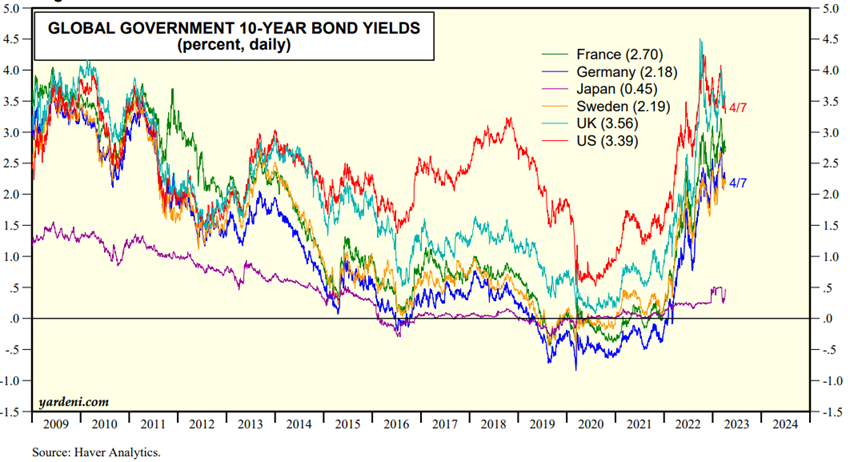

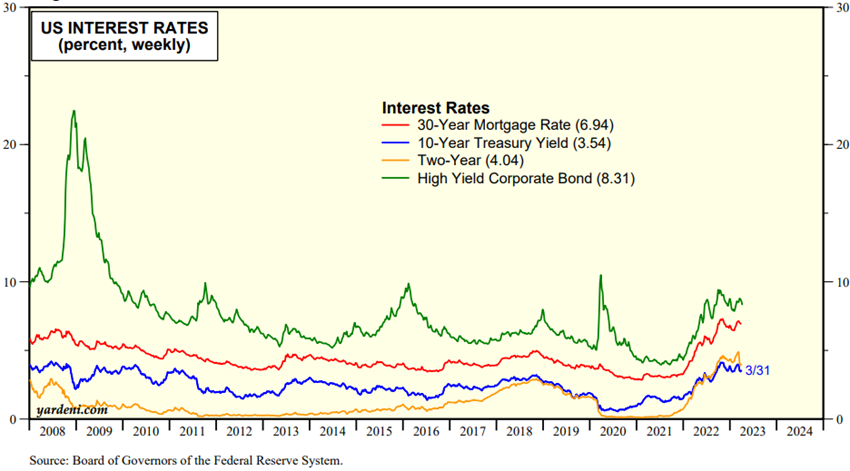

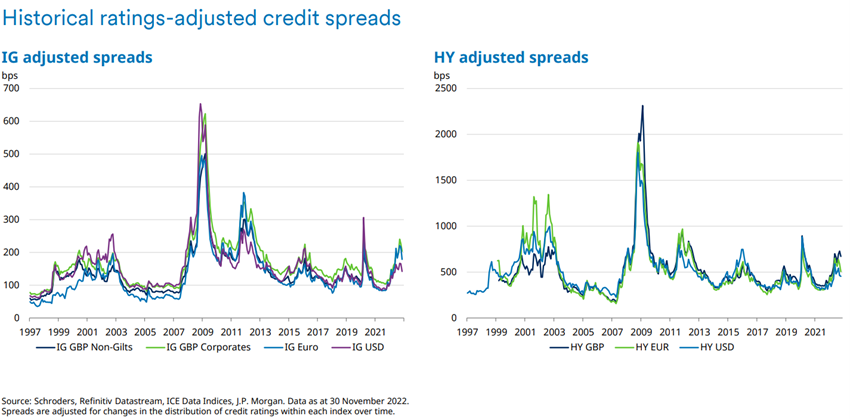

Bond markets valuation

Bonds benefit from falling interest rates in the U.S. and Europe, but are impacted by an increase in credit risk spreads due to the bankruptcies of U.S. banks and Credit Suisse.

Interest rates without long-term risk have fallen sharply in the United States, the United Kingdom and the eurozone, valuing bonds.

U.S. 10-year Treasuries fell from 4.2% in November to 3.3% today (and the 2-year from 5.1% to 3.8%), and more than 0.5% in the largest European countries.

Credit spreads widened mainly on the worst quality risks, namely high yields, due to the bankruptcies of banks in the US and the rescue of Credit Suisse.

European investment-quality bonds are starting to trade at interesting levels, keeping pace with what we predicted for the U.S. last September.

The less liquid segments of the credit market continue to show vulnerability.

Source: Market Briefing: Global Interest Rates, Yardeni Research, April, 7, 2023

Source: Market Briefing: US Bond Yields, Yardeni Research, April, 7, 2023

Source: Schroders Credit Lens, December 2022

Main opportunities

Europe avoids recession and world resumes sustained growth

The eventuality of a negotiated term in the war in Ukraine, with low probability, would obviously be a very positive surprise factor for the markets.

Main risks

High inflation may persist longer than anticipated, causing a loss of disposable income and a decrease in economic growth, or recession, at least in Europe.

Generally speaking, markets have been discounting the end of the rate hike and even its inflection at the end of the first half, which probably won’t happen.

Financial markets show signs of vulnerabilities associated with excesses of the recent past of cheap money and that, from one moment to the next, can turn into risks of significant impact.

Recent examples are many.

The failures of banks in the U.S. due to losses in forced sales of portfolios of bonds for liquidity.

The Credit Suisse situation referred to in another Outlook and that led to his rescue.

The euphoria of cryptocurrencies that we also mentioned in another article, and we had the bankruptcies of FTX and others.

The bubble in meme stocks, and the subsequent bankruptcy of Bed Bath and Beyond, etc., also anticipated.

Markets are correcting some of these excesses, but others remain.

There are several examples. The growing volume of options on high-risk or “zero-dated” stocks, and the speed of deposit withdrawals from banks in the U.S. driven by social networks are revealing of the vulnerabilities and risks of the market.

We can see other regional or even global banks in difficulty, problems in the residential and commercial real estate market, bankruptcies of highly indebted “zombie” companies, worsening of the situation of countries in difficulty (high inflation in Argentina, Turkey, etc.), in a context of high interest rates and inflation, public indebtedness and high trade deficits, and inability of timely reaction of the authorities.

And usually, the most unexpected risks are the most serious.